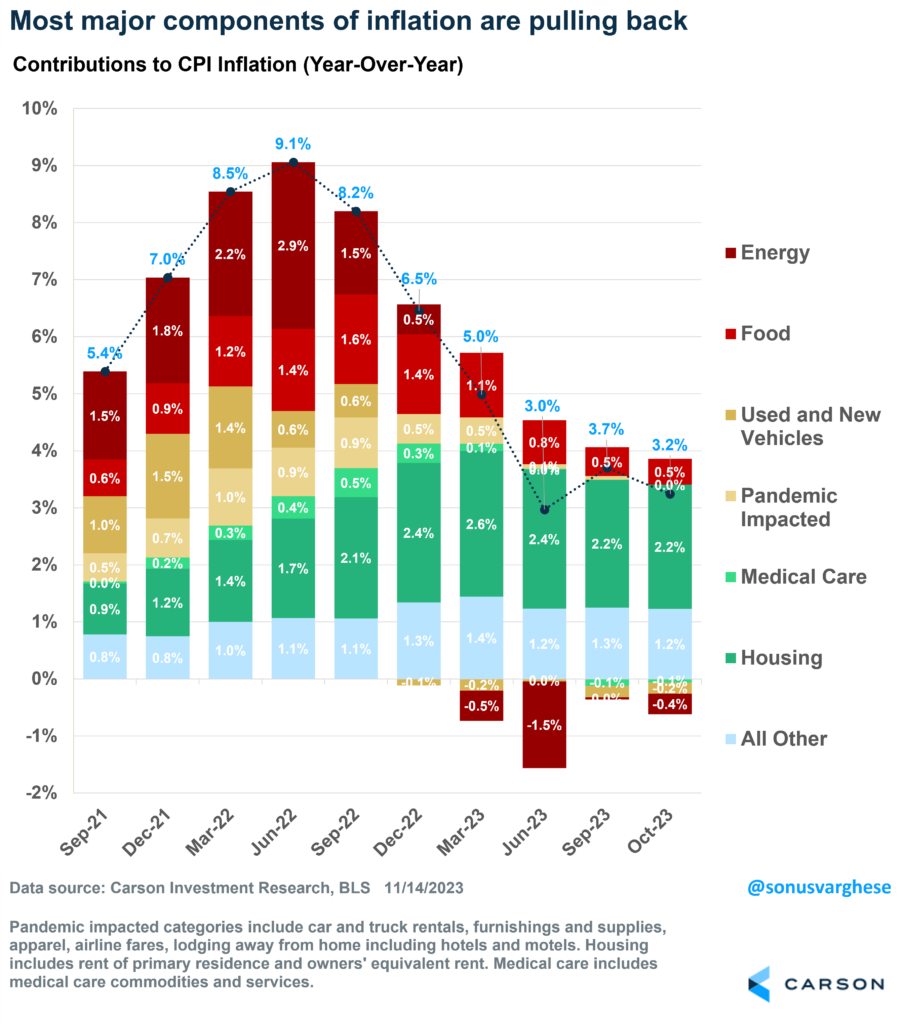

The October Consumer Price Index (CPI) report was chockful of good news. Headline inflation was flat in October, below expectations for a 0.1% increase. The October “surprise” came on the back of lower gasoline prices, which fell 5%. But that counts, and even more so because it means households have more income – keeping consumption and the economy humming. Headline inflation has pulled back from 9% year over year in June 2022 to 3.2% in October. The big decline came on the back of lower energy prices, but as you can see below, all the other bars are shrinking too.

The Federal Reserve (Fed) prefers to look at inflation stripped of food and energy (since these are volatile). “Core” inflation rose just 0.2% in October, translating to a 2.8% annualized pace. Over the last 6 months, core CPI has run at a 3.2% annualized pace – well below peak levels of 6-7% we were staring at a year ago and getting ever so close to the Fed’s 2% target. Core CPI was averaging about 2.3% before the pandemic.

The good news from the October CPI report is that we’re seeing broad disinflation. And there’s more to come. This is why this report will likely put an end to any further rate hike expectations and could go even beyond that – expectations for rate cuts in the first six months of 2024 will increase.

Let’s look at the three big key pieces that matter.

Prices for core goods, excluding food and energy, have been falling for five months in a row now, and are down almost 1% over the last six months (annualized). A lot of this is because of supply-chain healing, and we expect there’s more to come over the next several months, especially as auto production continues to ramp up and inventories increase, which will push vehicle prices lower.

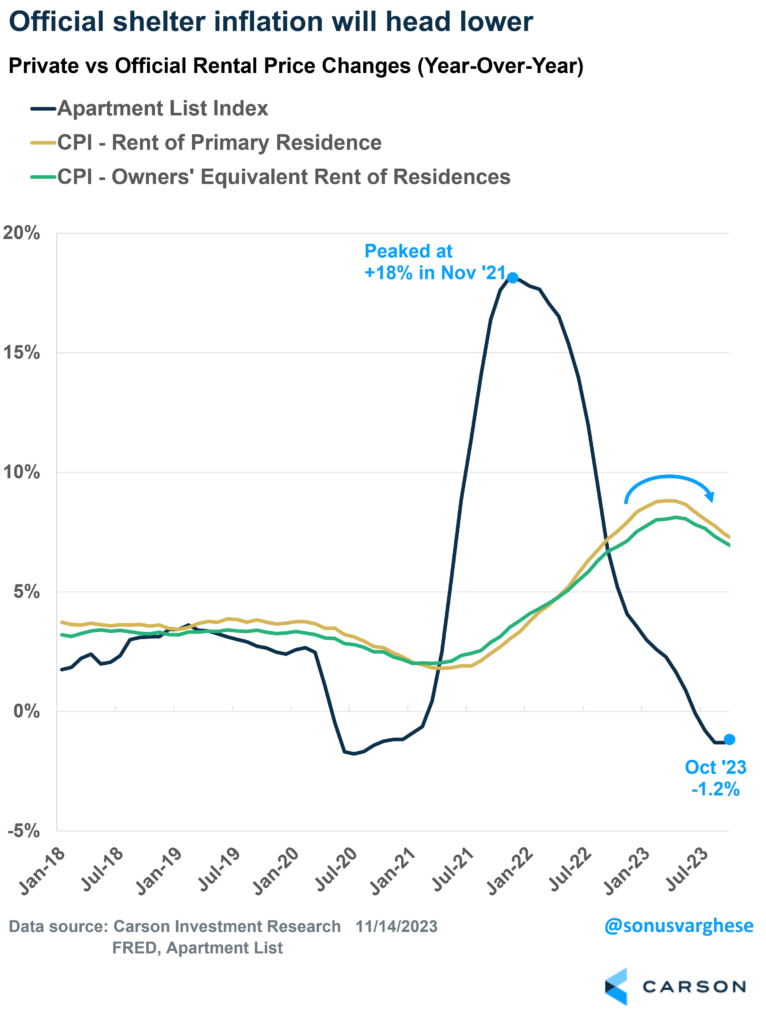

Housing disinflation has been on the cards for a while now, with falling market rents indicating that official data will follow. We got a brief spike in September, but the downtrend resumed in October, with housing inflation running at close to a 5% annualized pace – the slowest pace since December 2021. We’re likely to see more disinflation, as private market data indicates that rents continue to fall.

Then we have core services excluding housing, which is worth a deeper look as it matters a lot for how the Fed thinks about inflation, the labor market, and the economy.

The “Last Mile” of Inflation

Fed Chair Jerome Powell recently said that the decline in inflation over the past year is welcome. We’ve yet to get October data for the Fed’s preferred metric, which is the Personal Consumption Expenditures Index (PCE), but core PCE has declined from 5.5% a year ago to 3.7% as of September. However, Powell wants to see more evidence of disinflation.

Powell noted that the big pullback in inflation has come about due to the improvement in supply chains. For core inflation to decline from above 3.5% to the Fed’s target of 2%, he believes we will need to see demand moderate, which basically means the economy must slow down to below trend. The unemployment rate may also have to go up a bit. He doesn’t think there needs to be a recession, but that a slowdown is required to get through the “last mile” of inflation.

The Fed has talked about “core services excluding housing” inflation being key to get inflation back to target, which they believe is dependent on the employment situation. For example, restaurant and bar sales, hotel accommodations, live entertainment, dry cleaning, air travel, etc. could perhaps be impacted by labor market dynamics, i.e. a strong labor market results in higher incomes, which could push demand for these services up, and send prices higher.

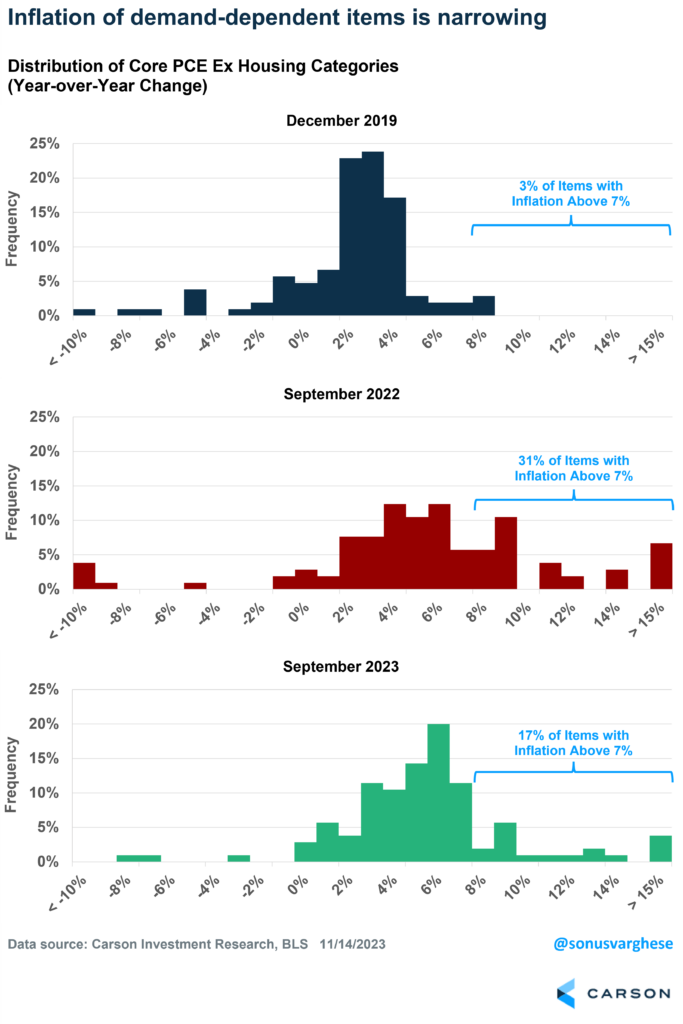

The good news is that we’re seeing disinflation even in these “core services ex housing” categories. That’s happened even as the economy has accelerated above trend the past year and the unemployment rate has remained under 4%. I looked at all the items that make up “core services ex housing” – there are about 105 of them in the PCE data – and calculated the distribution of year-over-year price increases for all of them in 3 periods:

- December 2019; before the pandemic

- September 2023; a year ago, and near peak inflation

- September 2023; the most recent data

The chart below shows how the distribution has evolved. You’ll immediately notice that inflation really broadened out for these items by September 2022. In fact, 31% of these items saw inflation rates of above 7%.

The good news is that things have pulled back over the last year, and there’s movement towards where we were before the pandemic. Only 17% of the items are running above 7% inflation. This means there’s some ways to go to get to where we were pre-pandemic, but the movement is a positive sign.

We believe this is evidence that a significant slowdown of economic growth may not be necessary to get core inflation moving towards the Fed’s target. Combine that with the fact that we’re seeing housing inflation ease, in line with private market data, and all signs point to inflation easing in 2024. As a result, the Fed does not have to raise rates again, and in fact, by Spring of 2024, they could even start thinking about rate cuts. If inflation is on a sustainable path lower, there’s no need to keep policy rates as restrictive as they are, especially when there’s a risk of breaking the economy, and Powell’s recent comments suggest they’re increasingly unwilling to do that.

Ryan and I discussed the Fed in the latest episode of Facts vs Feelings. Take a listen below.

1981466-1123-A