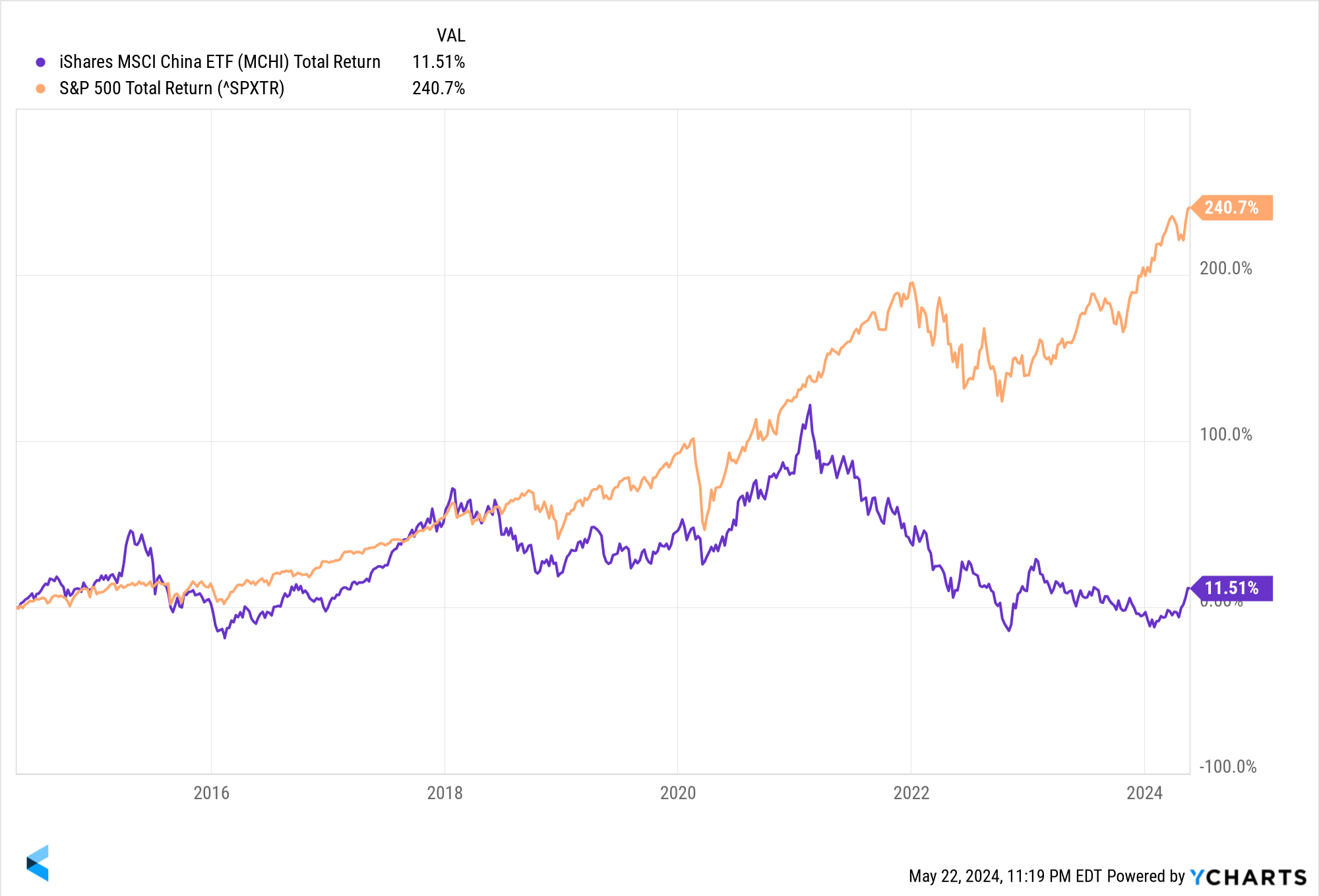

There’s been a lot of a chatter about China’s stock market recently, thanks to strong momentum. Chinese stocks (proxied by the iShares MSCI China ETF) are up over 18% over the past 5 weeks, versus a 5.5% return for the S&P 500. Of course, if you pull back the curtain to the last decade you see that Chinese stocks have significantly lagged their US counterpart. The China ETF is up just over 11% over the past decade versus a whopping 239% for the S&P 500 (including dividends).

Still, you can’t deny momentum – that’s something we like to follow as well, across asset classes. Ryan and I frequently talk about momentum being a positive on our Facts vs Feelings podcast (including in our latest episode, in which we discussed the Dow @ 40,000). Still, we remain underweight Chinese stocks (and Emerging Markets more broadly), as we believe there are better opportunities in the US – including in mid- and small-cap US stocks, which are also attractive from a valuation standpoint as my colleague Grant Engelbart recently discussed.

What’s Driving the Chinese Stock Market Rally

Beijing recently announced a series of measures to prop up the property sector, which has given investors renewed optimism. The property sector is a key part of the Chinese economy, with real estate and related activities accounting for 25-30% of GDP – which is double the peak level we saw in Japan in the 1980s. The problem is the property sector is tanking. The latest measures came after Chinese home prices saw the steepest declines in decades. New home prices fell 3.5% year-over-year and existing home prices fell 6.8%. The problem is a supply glut, with households worrying about

- Falling home prices, which is a big source of household wealth and security

- Unfinished apartments, which aren’t delivered

- Job security, amid a slowing economy

The measures seek to alleviate the supply issues. The central bank is giving loans to state companies to buy up completed but unsold inventory, which would then be converted to affordable housing (though it’s doubtful this will make a significant dent in excess inventory). Mortgage rules and down payment requirements have also been relaxed.

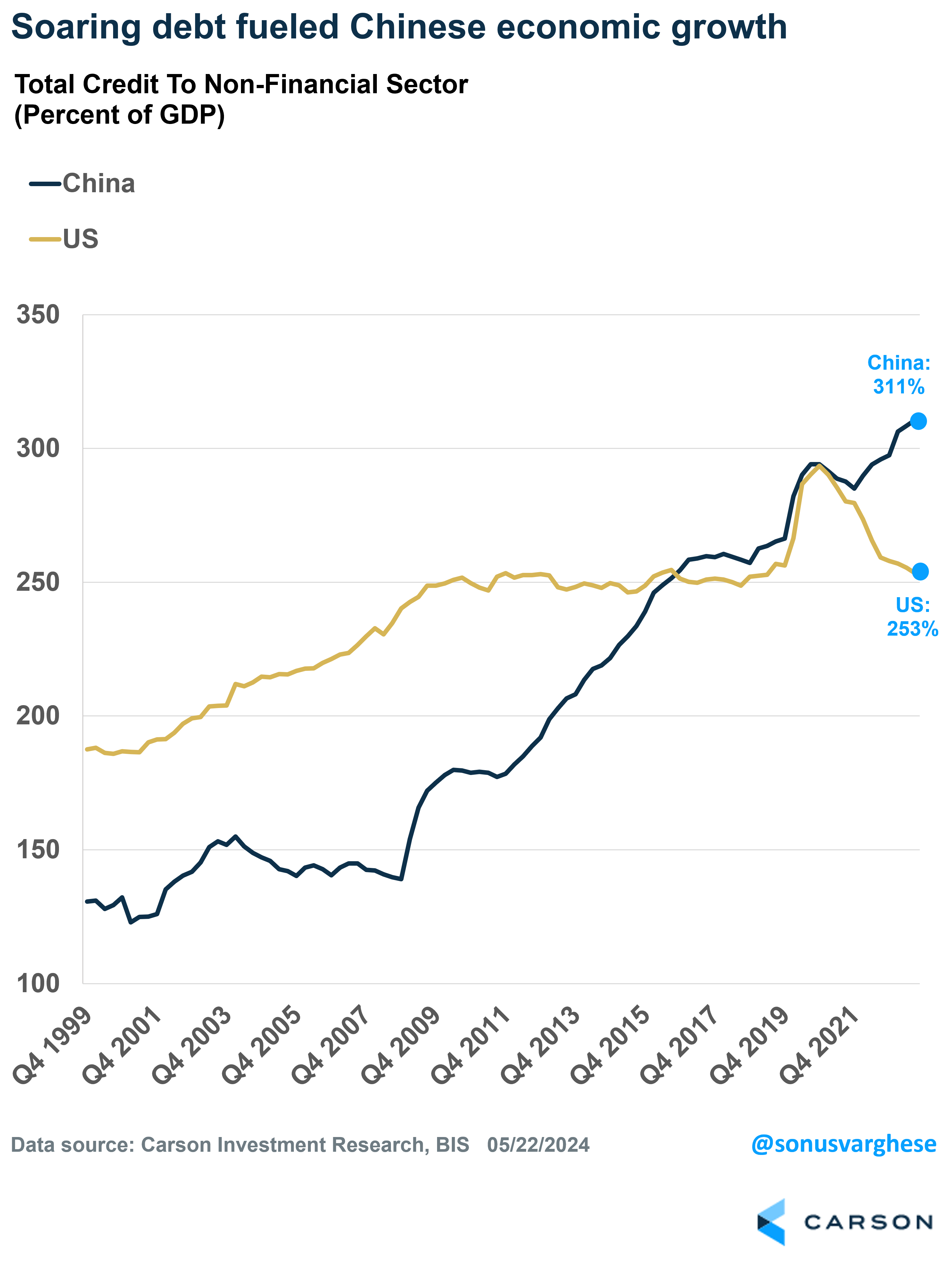

China’s Big Problem: Debt and Falling Investment

The issue is that ultimately China needs more real estate investment and development to return to prior levels of growth. In the past decade, that came on the back of lot of debt, but authorities are reluctant to pursue that strategy again as real estate developers ran into severe trouble over the last few years. Overall debt to the non-financial sector soared over the past decade, from about 140% of GDP at the end of 2008 to 311% of GDP last year. Contrast that to the US, where’s the same ratio has pulled back recently to just over 250% of GDP.

As a result, fixed asset investment has slowed recently, to a 4.2% year-over-year pace. That’s well below the pre-pandemic pace of 5-6% (it was over 10% up until 2015). Fixed asset investment is critical for the Chinese economy, as it makes up over 40% of GDP. In a nutshell, the slowdown in Chinese GDP growth is because of the slowdown in fixed asset investment. The main problem here is real estate: property investment is down almost 10% year-over-year as of April. In fact, the sale of new commercial buildings sold is down 31% over the first four months of 2024 compared to the same period last year.

Some Economic Momentum, but Still Below Trend

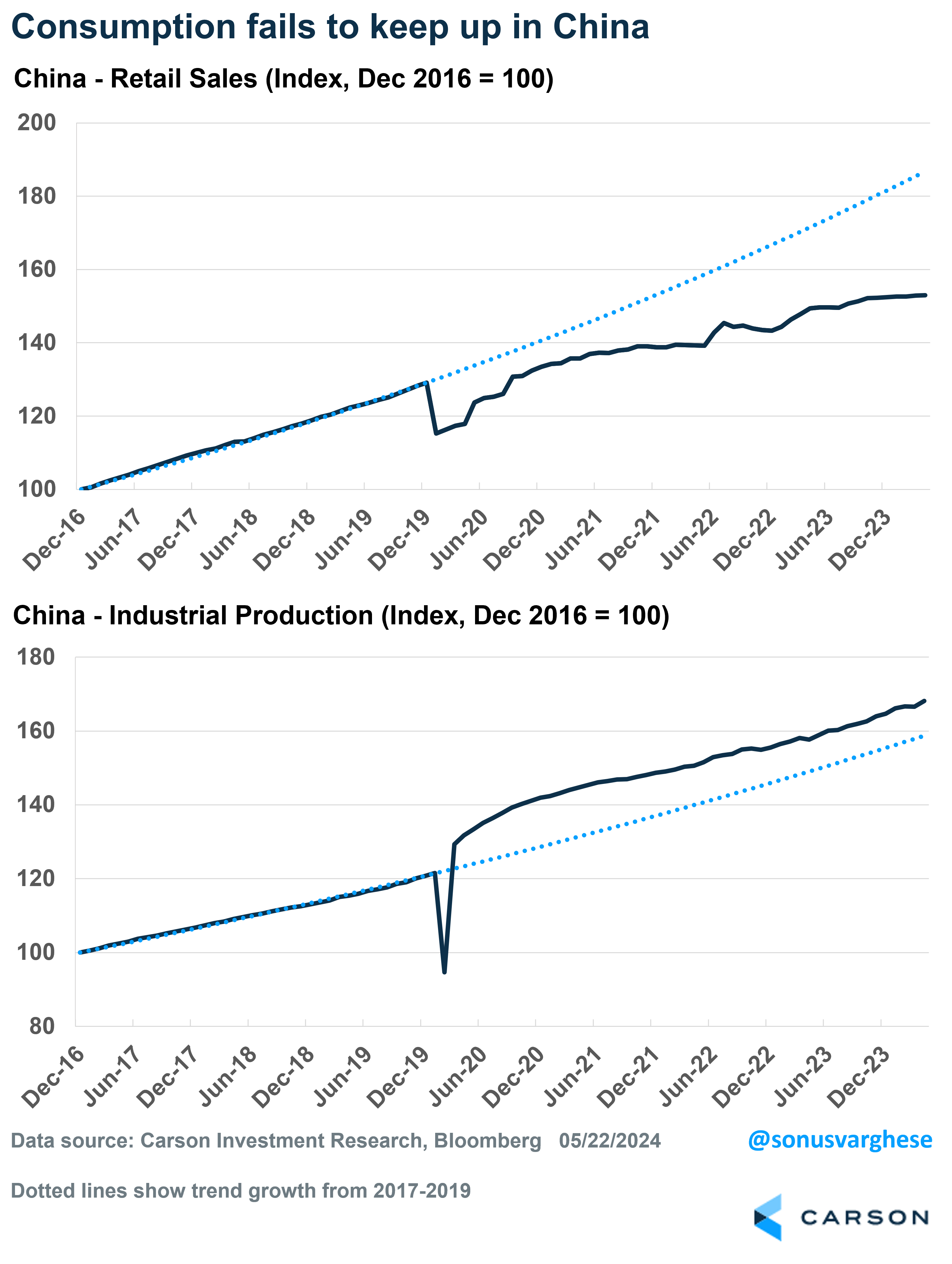

The best scenario for China is for household consumption to increase, making up for the slowdown in investment. However, that’s going in the opposite direction. Retail sales eased to 2.3% year-over-year in April, the slowest pace since 2022 and well below the pre-pandemic pace of about 8%. Consumption is running well below trend.

Where China is trying to make up is in the industrial sector. Even as investment in property plunges, investment in manufacturing rose 9.7% over the past year, and high-tech industry investment rose 11.1%. The downstream impact shows up in the industrial production data, which rose 6.7% year-over-year in April, in line with the pre-pandemic pace and running above trend.

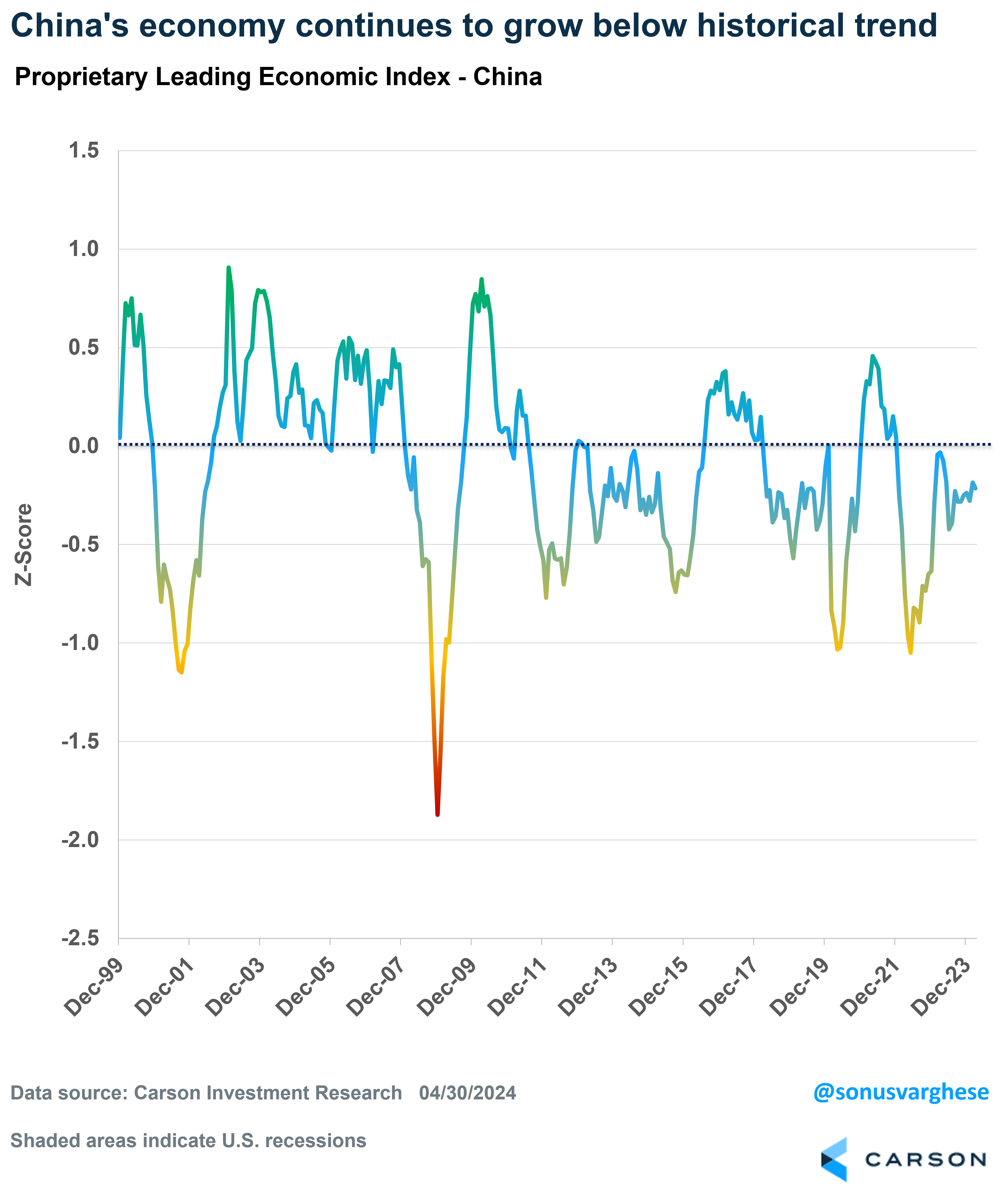

Our own proprietary leading economic index for China, which combines multiple economic data, shows some momentum over the past 6 months. However, activity remains below historical trend (a “z-score of zero indicates on trend growth). You can see how this has mostly been the case since 2012, in sharp contrast to the mid-2000s. A big reason why we’ve been underweight China for a decade now and remain so. But now there are more risks too.

What Are China’s Options?

From a fundamental perspective, things have gotten worse for China over the last decade. This is partly a recognition that things can’t continue the way they have

- With high debt spurring property investment, and the economy as a result

- The US being hostile to China is a game-changer as well

At this point, China must do some combination of the following:

- Accept lower growth (perhaps around 4%), but that brings higher unemployment. They have done a bit of this, which is why the GDP “target” is only 5%. GDP growth was running around a 6.5% annual pace before the pandemic.

- Juice growth by taking on more debt. But Chinese authorities seem reluctant to go down this road again.

- Export their way out of trouble. By keeping the currency week, and subsidizing industry (especially high-tech), both of which boost the manufacturing industry.

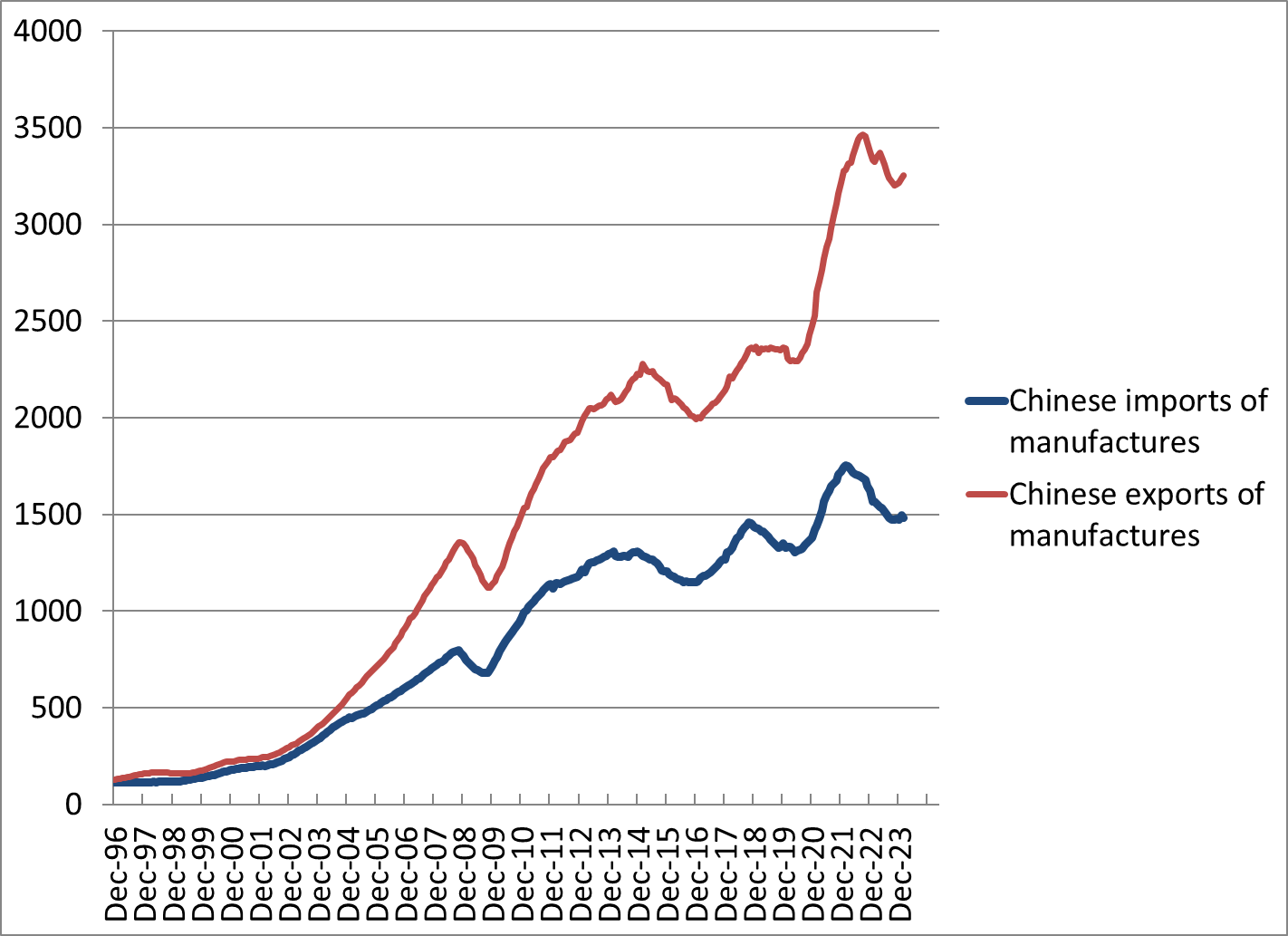

Recent data suggests they’re doing quite a lot of the third option I listed above. Brad Setser, an economist at the Council of Foreign Relations, shows how Chinese manufactured goods exports have surged since 2020, whereas imports haven’t increased anywhere to the same degree. A lot of this actually related to the Electric Vehicle (EV) industry, where Chinese exports have ballooned – mostly to Europe and other parts of the world, rather than the US. Of course, this also means manufacturers in these countries lose out.

But … The US is no Longer Playing Ball

US policy prior to 2016 was that “free trade is a good thing” (low inflation was a side benefit of this). Never mind the fact that China never played by the rules, i.e. they heavily subsidized their own industries, which meant companies in the West lost out. The attitude changed after President Trump was elected in 2016, who implemented tariffs on Chinese goods (and others). Interestingly, these policies were continued by President Biden and his administration, who ratcheted it up a notch. The bipartisan consensus on China resulted in the infrastructure and CHIPS Act, which along with the Inflation Reduction Act (IRA), started giving significant subsidies via grants and tax credits to US domestic. Similar to what China’s done (and continues to do).

In fact, the Biden administration just announced a slew of significant tariffs on China’s electric vehicle (EV) and parts industry. The tariff on Chinese EVs were quadrupled (from 25% to 100%). But this wasn’t just about EVs, since the US barely imports any Chinese EVs now. It’s about the entire ecosystem of EVs, including batteries and critical minerals. These are areas in which China is a powerhouse exported, controlling over 80% of large parts of the EV battery supply chain – note that some tariffs are slated to take effect only in 2026, to minimize supply-chain disruptions. This is to ensure that the US doesn’t lose to a rapidly growing Chinese EV manufacturing industry (though China has a big head start already).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Here’s the big picture: the US is starting to play the same game China’s played for a long time now. But that also means China’s options to boost the economy become even more limited. Which is why we’re still pessimistic about China’s growth prospects over the medium- and long-term. In our view, the fact that the US is looking to boost domestic industry also provides more opportunity in the US. Hence our overweight to stocks, and especially US stocks.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02252133-0524-A