In recent blogs we discussed the strength of household balance sheets and also how higher wages have been more than offsetting inflation, including for lower income workers. Today, we look at a third piece that helps explain consumer strength, the offsetting impact of higher rates on savers and borrowers. Consumers are penalized by higher rates by having to pay higher borrowing costs, but they are also rewarded by receiving higher interest on savings and fixed income investment. Combined, surprisingly, they probably even remain a benefit to consumers overall.

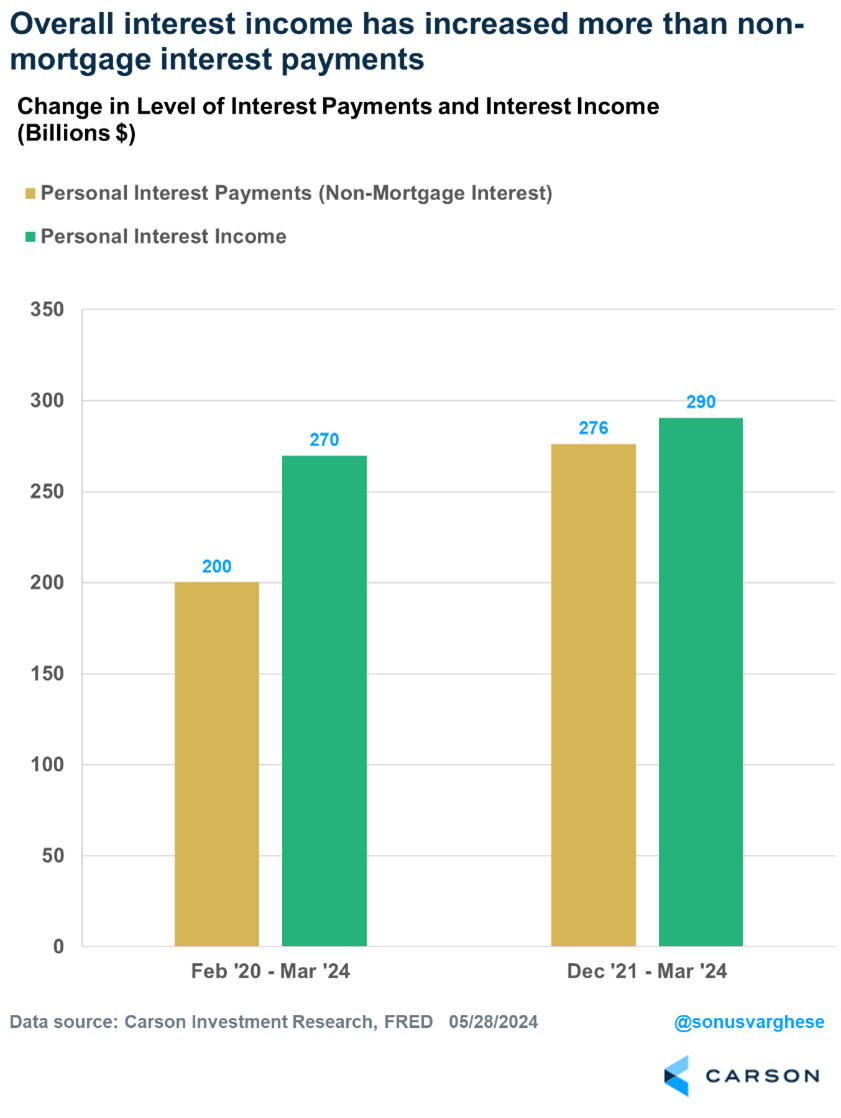

Part of this is because there can be an important timing difference in the impact of higher rates on savers and borrowers. The effect on savings takes place almost immediately as yields rise quickly on short-term instruments like savings accounts, short-term Treasuries, and certificates of deposit (CD) rise. The effect on borrowing happens more slowly as higher rates impact new borrowing but longer-term existing borrowing at a fixed rate still enjoys the lower rate. This is especially true with mortgages, which make up over 80% of household debt and are easily the dominant category.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Finally, while there is some impact from wealth (higher earners typically have more savings), we should always keep in mind that raw wealth data captures some important demographic differences that don’t tell the total wealth story. Over a lifetime, people generally achieve peak wealth at retirement, but that wealth needs to last them throughout their retirement years. Current wealth is high but earnings potential is very limited. Households that are younger often have weaker balance sheets, on the liability side from lower home equity or student loans, on the asset side from being early in their “accumulation” phase with less help from the impact of investment returns. At the same time, the future earnings potential for younger households is high and they are more likely to accumulate additional savings.

While current mortgage rates have stayed low for the average borrower (but are challenging for prospective new homeowners (as Sonu discussed yesterday), the spread between other interest paid and interest received has expanded. There is some impact here from increased aggregate wealth, but the point still stands that higher interest rates have had a larger positive impact for households across the economy than a negative impact. That’s not meant to ignore that many households struggle with higher rates, or that higher rates do pump the brakes on new borrowing, especially for housing. But overall consumer strength, which is what flows through to markets, depends on the overall effect.

If you look at all the recession calls in late 2022 and well into 2023 (with some prominent voices still saying it’s just around the corner), many pundits missed all the factors that continued to support consumer strength, including poorly estimating excess savings, the knock-on effects of fiscal stimulus, and the strength of the job market, but also the transmission mechanism for higher rates. The negative impact does become stronger as time passes, but with so much consumer and business debt locked into low long-term rates, the Fed was given a lot more time to guide the economy toward a soft landing. As disinflation continues, even with the recent slowdown, we think rate cuts toward the end of the year will be enough to support continued economic expansion. Good economic analysis is not well served by looking for the cloud in every silver lining and even when it comes to interest rates, there’s at least as much benefit for the average household as harm.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02266602-0624-A