Our good friend Captain Obvious tells us that attracting new clients is never a walk in the park. The current environment offers even more challenges and new wrinkles in this all-important activity. How can you be an effective business generator when the normal methods of connecting with clients and prospects are off the table? Well, I’ve got a solution for you.

The Two Types of Prospects to Go After During Market Volatility

In my regular conversations with advisors, seasoned veterans report that periods of extreme market volatility are primo prospecting opportunities, and many of them are posting huge wins in year-to-date asset flows.

As you know, there are two groups who especially need your help right now:

- People who work with an advisor who is missing in action. Some advisors are unsure of how to comment on current headlines, uncomfortable engaging with clients when they are stressed, or for some other reason simply not staying in touch with the people who rely on them for financial guidance and reassurance.

- The DIY crowd. It’s easy to roll your own in the middle of a ten-year bull run, but not so much when markets are bouncing all over the place and the economy is under extreme pressure. Some of these folks are recognizing that they shouldn’t be calling the shots themselves. They need what you’ve got.

And here’s the thing: Your clients know people in both buckets!

Landing New Clients While Social Distancing

But how do you canvass for new clients when you’re not able to visit with people in person? Of course you can’t ring up your top clients simply ask, “Hey, who do you know….” But if you’ve been doing the right things consistently – proactively reaching out to clients, being an empathetic listener, providing reassurance and refocusing clients on the underlying strength of their financial plan – then you have made substantial deposits in the Bank of Goodwill.

Now, it’s time to make a few select withdrawals.

How to Use the Two-Step Prospecting Technique

I’d like to share an approach I’ve seen advisors be successful with: The Prospecting Two-Step. The essence of this technique is using a distinct tool and process to leverage the goodwill you’ve engendered by being thoughtful, caring and proactive, and apply it toward your clients’ natural impulse to help the people they care about. Here’s how it works.

THE WARMUP

Create a list of your top clients whom you most want to replicate:

- Start with your A+, A and perhaps B+ clients.

- Remove from the list the people you don’t particularly enjoy working with – you know the names that put a scowl on your face when they pop up on your calendar.

- Remove from the list all those who are not “connectors.” From Malcolm Gladwell’s book “The Tipping Point,” connectors are people who derive a sense of satisfaction from introducing two people they believe can help each other. Non-connectors will be of little help to you in this exercise.

- The connectors who remain will serve as your call sheet for this prospecting initiative.

STEP ONE

When your warmup exercise is complete, you’re ready for step one: Pick up the phone. Reach out to every one of the clients on your call sheet with this agenda:

- Check in on how they are feeling and provide a brief update on the markets and current events – just as you have been doing.

- Then, with the two prospect types mentioned above in mind, engage them in a dialogue – a genuine, two-way conversation about people they care about who are not receiving the level of guidance and support they need and who crave an experienced voice of calm and reason.

- Use the power of the pause. Ask the relevant question and then, as hard as it might be, don’t say anything until they start talking. In order for the two-step technique to be as successful as possible, it’s critical to get your clients sharing honestly about the people they care about and the concerns they are voicing.

Keep in mind: It’s common for advisors to quickly hit on a number of ideas with clients during a typical meeting. But in order for this two-step idea to be effective, rather than briefly landing on this topic and then bouncing off to another one or ending the call, it’s imperative that you take it to a deeper level.

Move the discussion beyond “Hey, here’s another idea to think about” and make it concrete, definite and actionable. Remind them that given the circumstances, this is something many people need right now. Guide the conversation to the individuals your clients know who have expressed concern and need to hear the voice of a seasoned, confident and empathetic financial professional.

A Sample Call Script

Below is a script that can create a comfortable yet productive dialogue.

“Sounds like you have a pretty healthy perspective on this market volatility. Have I helped you to feel more comfortable with the dynamics of what is going on economically?”

Pause

“Has any of this come up in conversations with your friends, family or neighbors? What have they been saying?”

Pause

“I have done this with several friends of clients in the last few weeks and all of them have been very appreciative.”

STEP TWO

Now that clients are describing the comments they’ve heard from concerned friends, it’s time to pivot to step two: your formal second-opinion service.

We know that everyone, both clients and advisors, gets wiggy about referral conversations, so don’t use the word “referrals.” Instead, offer a second opinion. There’s just something more neutral and less invasive about this phrase. It’s asking for a referral without asking for a referral.

Clients will likely feel more inclined to act as your agent with a second opinion service, because this more analytical, solutions-oriented approach helps them feel like they have less on the line personally as compared to a formal introduction.

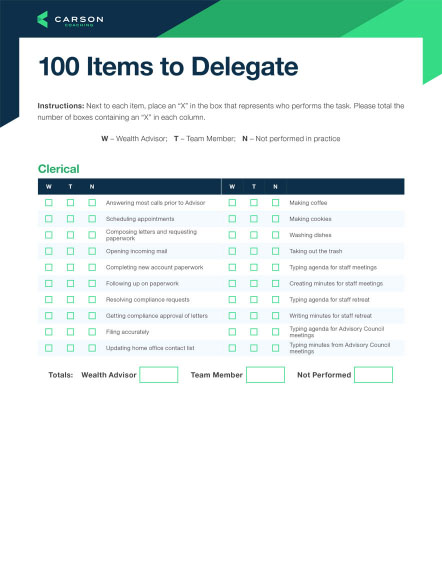

At this point in the conversation, refer to your professional-designed flyer that visually communicates your second opinion offering in a rich and compelling manner. Review it with them in real time, focusing on the benefits and how this service has helped associates of other clients.

The reason for reviewing the flyer together is to solidify the concept in the client’s mind. Help them digest its value and inspire them to take action. Ask them to forward it to the people they were just describing to you, and anyone else they believe would benefit from your support and counsel.

Finally, ask about the right way to get in touch. For example, would they be willing to set up a call or a Zoom meeting?

Why The Two-Step Prospecting Technique Works

The success of this technique is dependent upon the consistency and force of your intention. If you casually mention it here and there or at the end of the occasional review meeting, you shouldn’t expect it to move the needle appreciably. Simply adding verbiage to your website or creating a pretty flyer is not going to generate introductions. As is often said, sales is the transfer of confidence. So, exude confidence as you follow this path and offer to come to the aid of those who are underserved.

As Carson Group’s Founder and CEO Ron Carson points out, advisors must bring confidence, enthusiasm and conviction to their business development efforts. If you apply these attributes to this prospecting approach, I believe that you’ll reap the reward of not only growing your AUM, but also seeing the gratitude and admiration of new clients who have found peace and positivity in working with you.

Our coaches are experienced in referrals and ready to help you convert prospects into satisfied clients. Click here to schedule a complimentary consultation to learn how we can help you accelerate your firm’s growth.