It’s been a cliché to say interest rates are going to be higher for longer, especially with markets pulling back expectations for rates cuts quite significantly over the last 4 months, thanks to hotter than expected inflation data. Our team had always been in the camp that we were unlikely to see more than 0.75%-points of cuts in 2025, as we believed growth would remain strong even as inflation continued to ease. The disinflationary process has been bumpy, but as I’ve written, there’s good reason to believe it will continue.

However, it’s one thing to say we don’t expect too many rate cuts in the near future, versus not expecting a lot of rate cuts further out as well. In other words, we believe interest rates will stay higher for much, much longer. As my colleague, Barry Gilbert, wrote recently, we’re optimistic about economic growth over the next several years. We think we may be entering an extended stage of above-trend productivity growth that can improve the overall growth trajectory (relative to the last 15 years). At the same time, an economy that is running near capacity means we could see more inflationary pressure. As Barry discussed, that implies interest rates are likely to remain on the higher side longer run, perhaps around 3.5%, with a mild bias to the upside. That’s above the Federal Reserve’s own long-run estimate of 2.6%, which reflects some inertia of having been in a low growth, low inflation environment over the past decade.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Traditional Portfolio Diversification May Not Work in a High Rate Environment

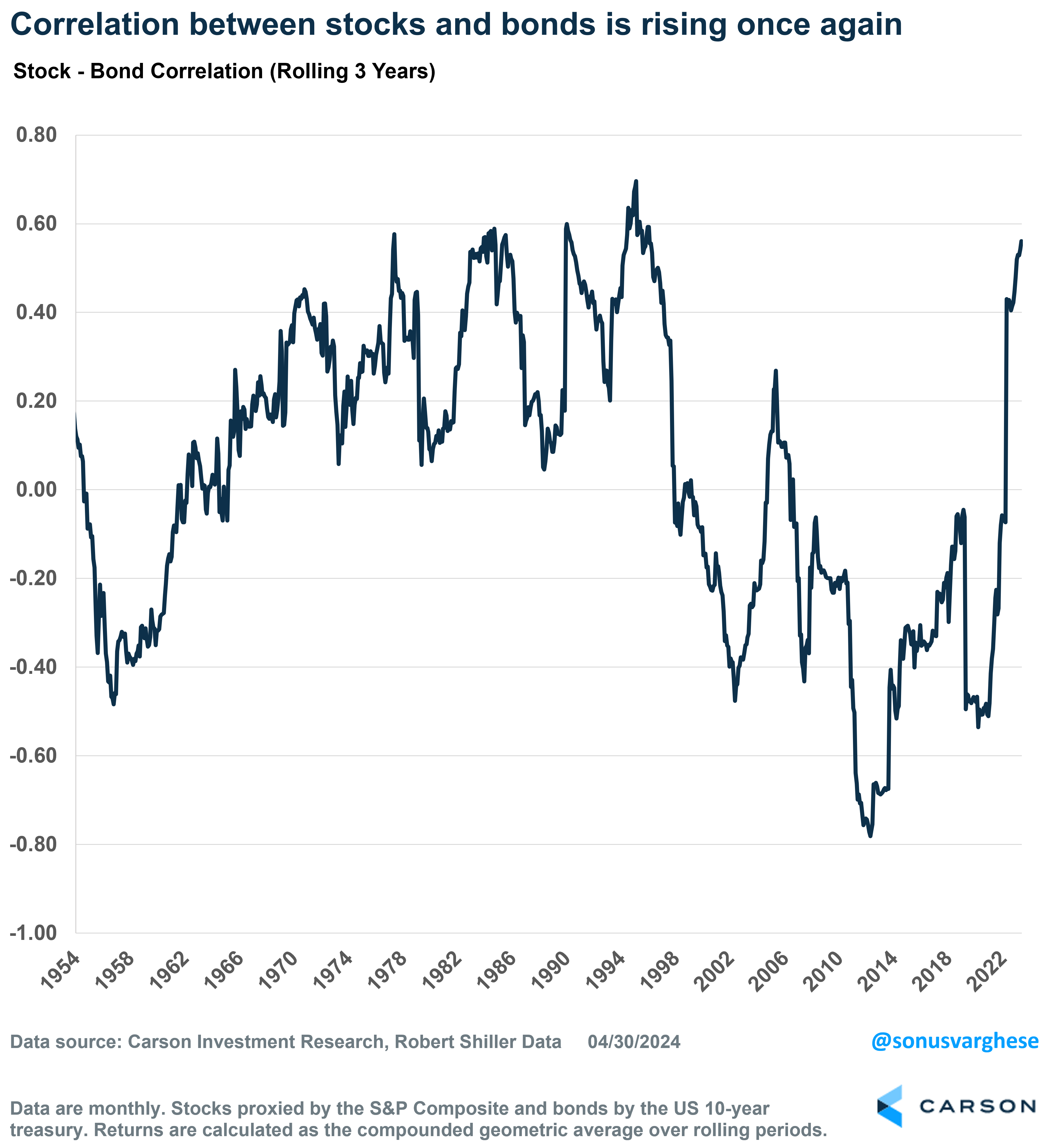

One thing that we’ve seen historically is that when inflationary pressures are high, and inflation volatility is high, stock-bond correlations rise. In such environments, bonds are not great diversifiers for stocks, i.e. bonds may not zig when stocks zag. The stocks-bonds correlation has been rising recently – over the last three years, it’s up to 0.56, a big contrast from the -0.28 average between 2000 and 2019. The correlation will likely fall from its current high level, but it could very well settle between 0.2 and 0.4. Of course, a positive correlation between stocks and bonds is what we saw from the late 1960s through the 1990s, and so in some ways, a return to positive correlations would not be unusual. However, that’s not great news for diversification.

What Do High Rates Imply for Asset Class Returns

I should stress that while we think interest rates over the next several years will be higher than what we saw over the past decade, we’re not talking about a rising rate environment. The fed funds rate is probably at its peak for this cycle, and it’s very unlikely the Fed will raise rates further.

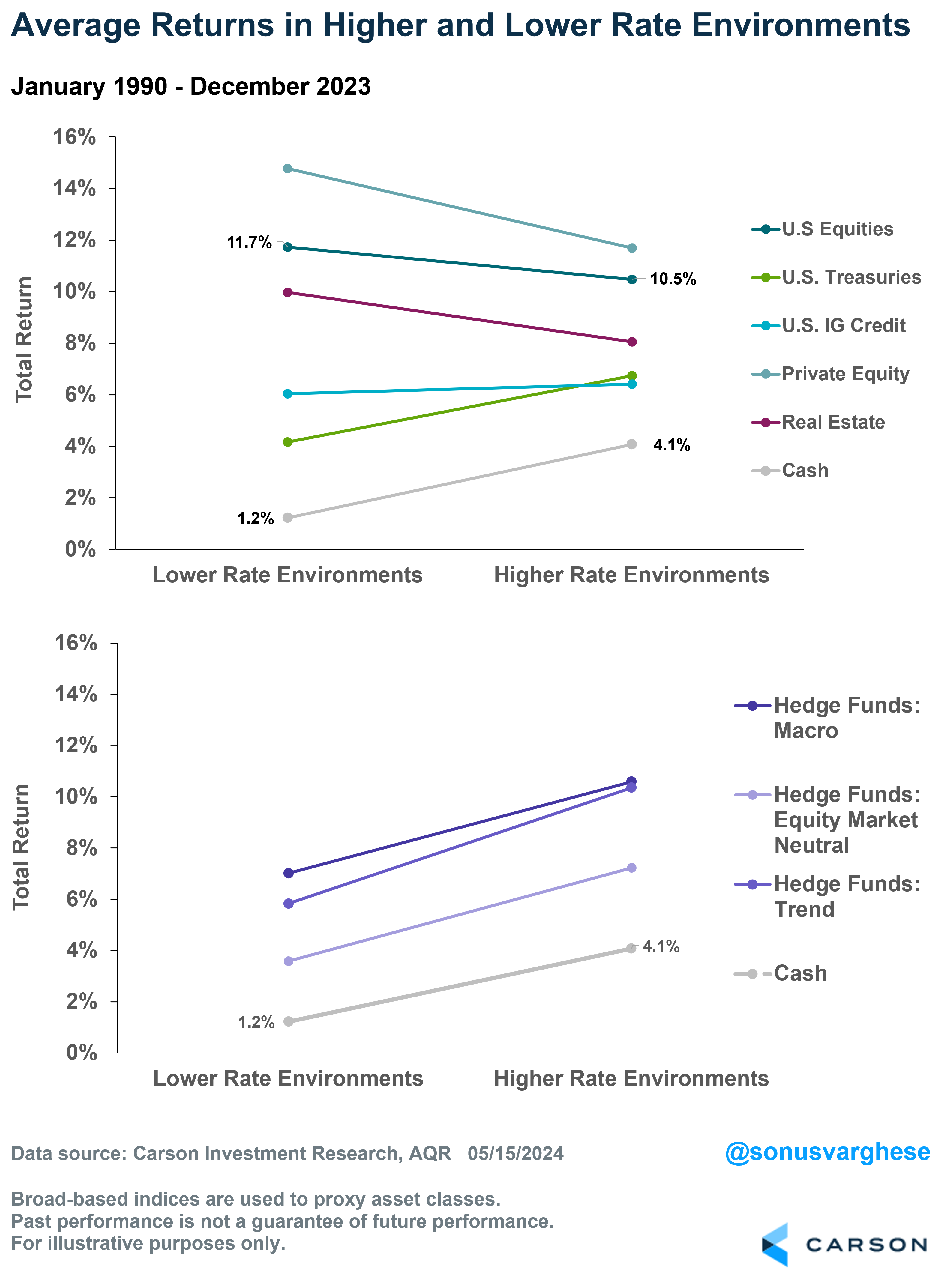

Obviously, if rates are high, that’s great if you have a lot of cash. In fact, forward-looking bond returns are likely to be higher if current rates are on the high side (since the best predictor for future bond returns is current yields). However, the bad news is that returns for most other traditional asset classes, and even for private equity, are relatively lower during high-rate environments compared to what you see when rates are very low. In contrast, alternative asset classes have relatively higher returns in high-rate environments, for example, trend following, global macro, and market neutral strategies.

Note that average returns for stocks are still relatively higher than bonds – so the equity risk premium still exists when rates are high.

So What’s Next For Portfolio Positioning

Here’s a quick recap of our views before we get into portfolio positioning:

- We expect higher economic growth over the next few years (compared to the last decade). This is on the back of a strong labor market and investment spending driving productivity gains above what we saw over the prior 15-20 years.

- We think this will also be accompanied by higher inflationary pressures. So, interest rates will likely be relatively higher than what we were used to in the 2010s. At the same time, we do think the Fed will cut rates from their current high level of almost 5.5%.

- We also believe rising deficits and a constructive corporate tax regime will be supportive of economic growth and profits no matter who wins the election.

It’s important to point out that we expect higher rates due to strong growth and more inflation volatility. That’s very different from a stagflationary environment, one with weak growth (including high unemployment) and rising inflation.

From a portfolio perspective, that implies:

- Overweight equities – If nominal GDP growth is strong, profit growth is likely to be strong as well. Within equities we prefer the US as we believe economic growth will be stronger in the US. We are also overweighting cyclical sectors and mid and small cap stocks (which also have relatively attractive valuations).

- Underweight bonds – Bonds may have less diversification potential than they had from the mid-90s through 2020. We wouldn’t get rid of bonds altogether, especially Treasuries, since they’re likely to still diversify in the event of a crisis or an unexpected deflationary recession that results in sharp rate cuts.

- Overweight alternatives – Alternatives may act as better diversifiers than bonds. This includes managed futures, but also assets like gold in our tactical portfolios.

Interestingly, our strategic and tactical positioning are fairly well aligned at the moment. Mostly because our longer-term views are downstream of our short-term views – like a strong labor market, and higher productivity growth as a result. The high likelihood of a mixed government is likely to be positive for stocks over the short-term, but also means corporate taxes are unlikely to rise.

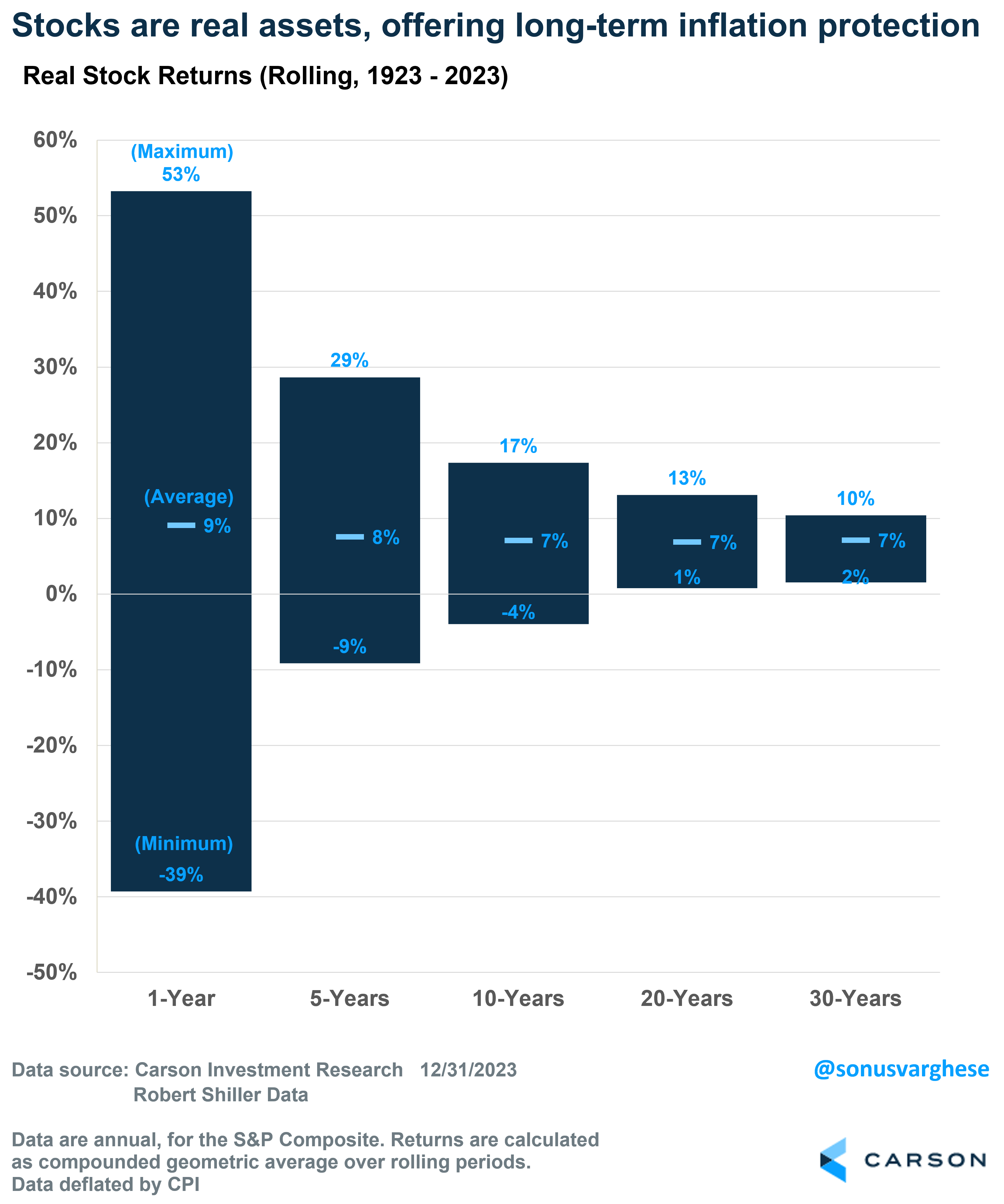

It may seem curious that we’re overweighting equities given possible inflation pressures. But that’s where alternative asset classes like managed futures and commodities come in. These can act as inflation hedges and help diversify portfolios during inflationary surges (which typically occur due to a spike in commodity prices). However, over the long term you also need inflation “protection,” and the best defense for that is strong real returns. It turns out stocks are the best real asset, since corporate earnings move higher with inflation as companies can pass rising input costs to customers. Pricing power is evident by the fact that long-term earnings and dividend growth has outpaced inflation, even during the 1970s and 1980s when inflation was high.

Stocks are “stable” assets over the long run, since time diversifies risk, but that’s true even after adjusting for inflation. Real (inflation-adjusted) returns are variable over short-time horizons (one to five years), but the dispersion tends to narrow as you expand the time horizon further.

From 1994 to 2023, the CPI Index rose 110%, translating to average annual inflation of 2.5%. An item that cost $1 at the end of 1993 would have cost $2.10 in 2023. At the same time, stocks (S&P composite) gained 1,662%, translating to an annualized return of 10%. In inflation-adjusted terms, the real return for stocks was 7.5%, which is very close to its average long-term real return.

In short, stocks work well for long-term inflation protection, something to keep in mind when constructing portfolios for long term inflation-adjusted growth.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02244924-0524-A