Last month we were talking about a potential deterioration in the labor market, as the unemployment rate rose to 3.9%. It was as low as 3.4% in the Spring. That increase was definitely something to worry about, as a rising unemployment rate usually signals that there’s more to come – which is the essence of what’s captured in the Sahm rule. (Ryan and I talked to the author of that rule, Claudia Sahm, a few weeks ago on Facts vs Feelings for more perspective on that.)

Well, we now have really good news, because the unemployment rate fell back to 3.7% in November, the lowest since July. Of course, that is just one month, but the directional shift is welcome. More importantly, it hides some underlying labor market strength, because it came on the back of more than 500,000 people coming back into the labor force.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In short, more people came back into the labor force, and they found jobs – both of which happen only in a strong, resilient labor market.

Job Growth Is Still Strong, and Layoffs Are Running Low

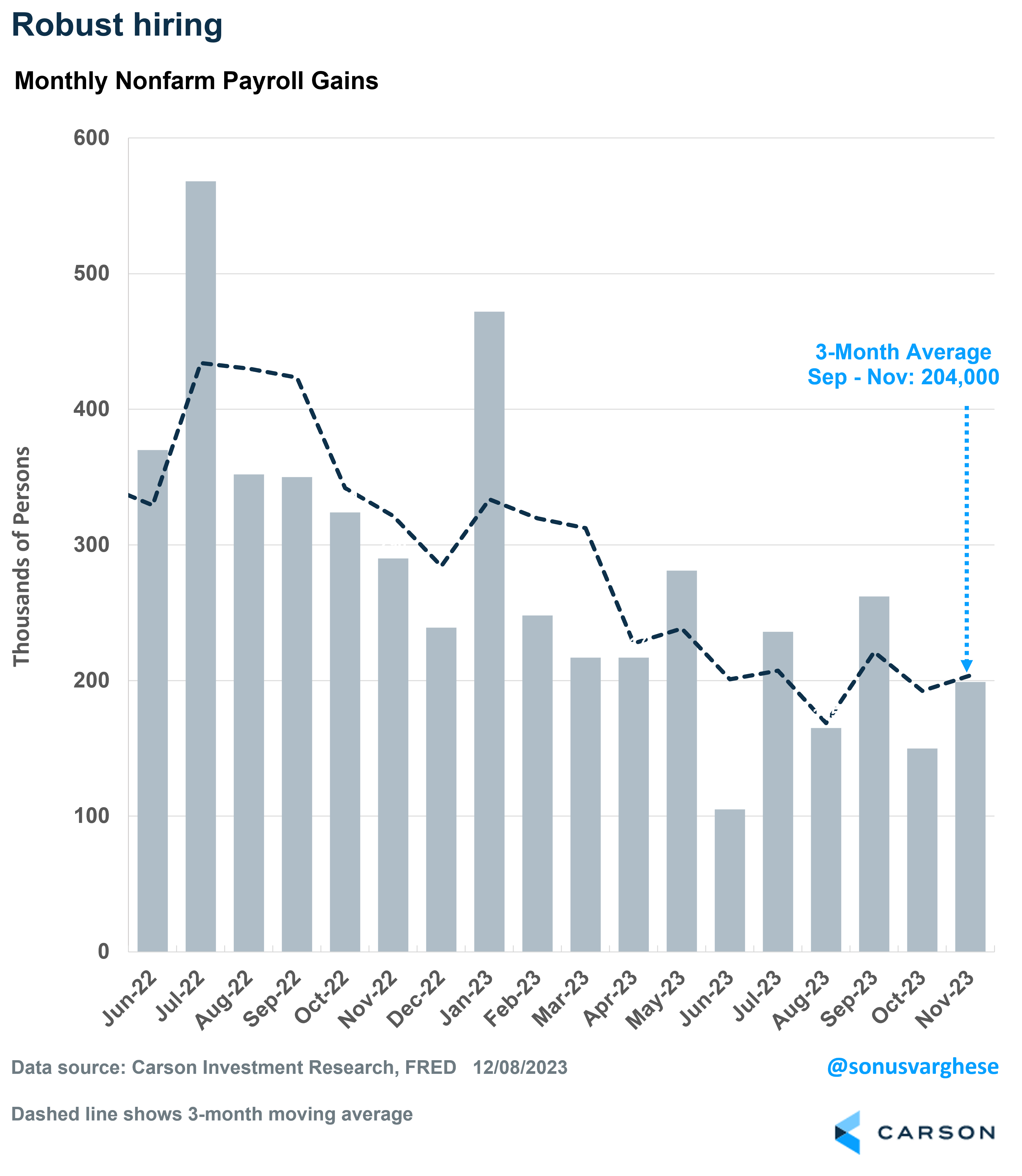

Payroll growth rose 199,000 in November, above expectations for closer to 180,000 jobs added. There’s been a boost from workers returning after the end of the autoworkers and Hollywood strikes, but that’s why the 3-month average is helpful, and that’s running at 204,000. For perspective, job growth averaged 163,000 a month in 2019. Note that we need about 100,000 – 125,000 net new jobs a month to keep up with population growth.

We also got the comprehensive Job Openings and Labor Turnover Survey (JOLTS) data this week, which showed that layoffs continue to run extremely low. The “layoff rate,” which is layoffs as a percent of the employed workforce, is running at 1.0%, well below the 1.2-1.3% range we saw before the pandemic.

Goldilocks = Strong Wage Growth + Falling Inflation

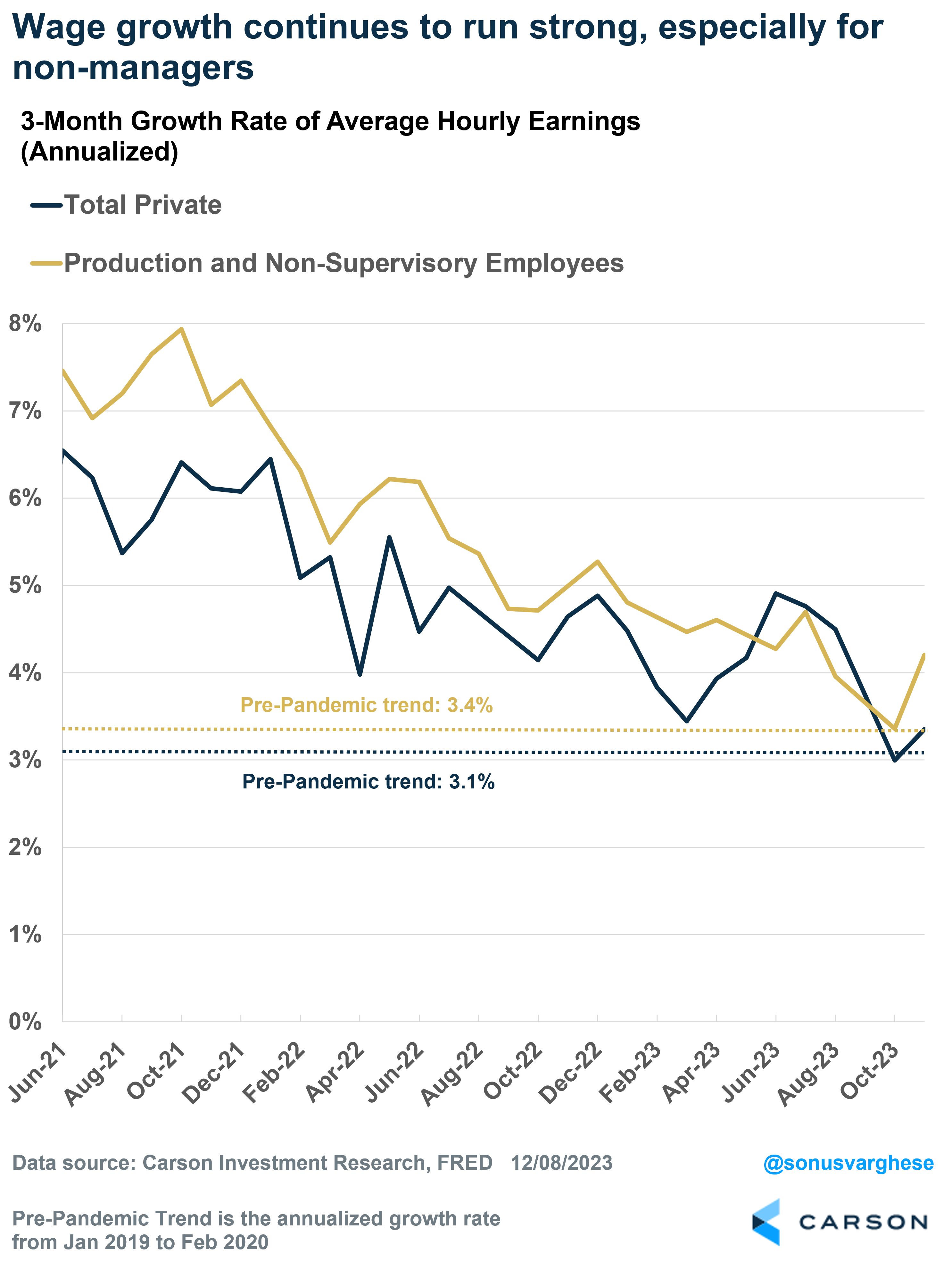

Wage growth continues to run strong, with average hourly earnings for private workers rising at an annual rate of 3.4% over the last three months. It’s even better for non-managers, whose wage growth is running at 4.2%. These are running slightly above what we saw before the pandemic.

Under normal circumstances, these wage growth numbers would lead the Federal Reserve (Fed) to worry about an economy that’s running too hot. But even they can rest easy since inflation is falling. As I pointed out last week, their preferred inflation metric, the personal consumption expenditures index excluding food and energy, is running at an annual pace of 2.4% over the last three months and 2.5% over the past six months. And the only reason those numbers remain above the Fed’s target of 2% is that the official rental inflation data severely lags the disinflation we’re actually seeing on the ground. So, there’s quite a bit more disinflation to come in the official data.

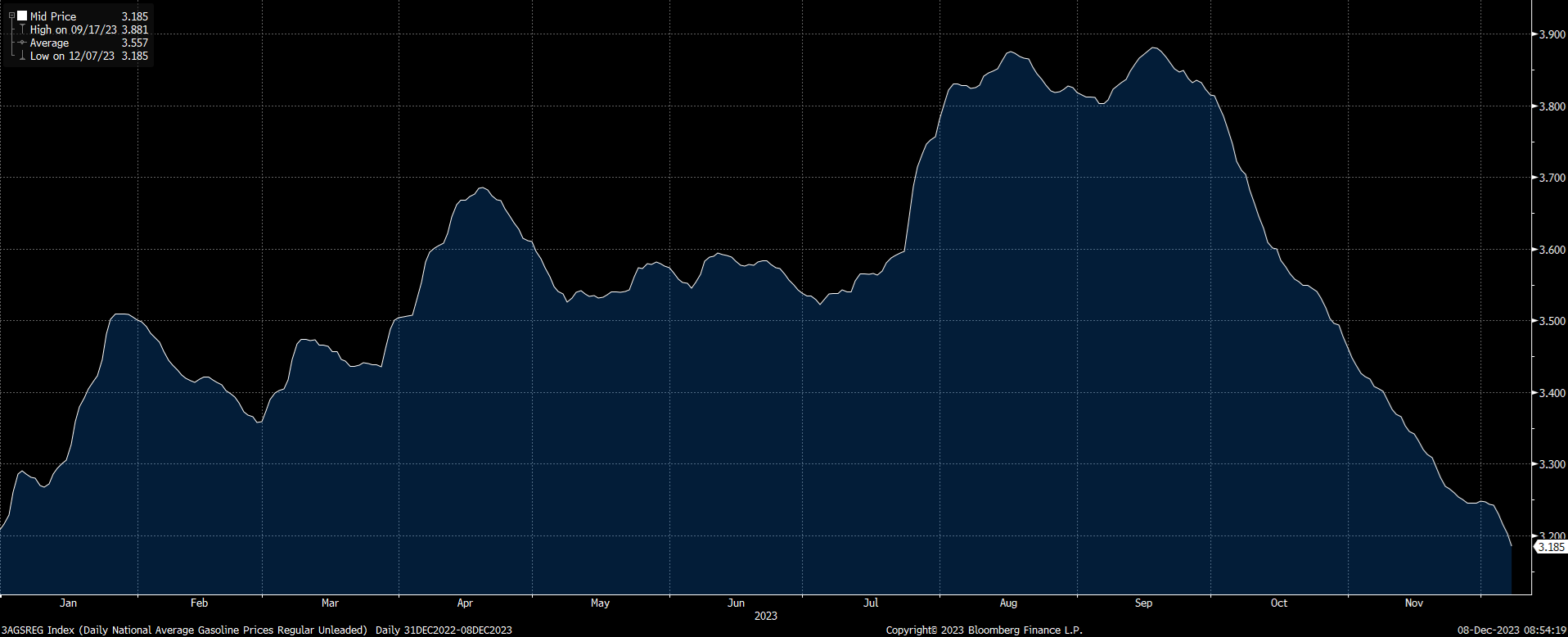

Beyond the Fed, American households are also catching a break from falling energy prices. Nationwide average gas prices are now below $3.20/gallon, which is the lowest this year (as you can see in the chart below). The good news is that it’s likely to head even lower.

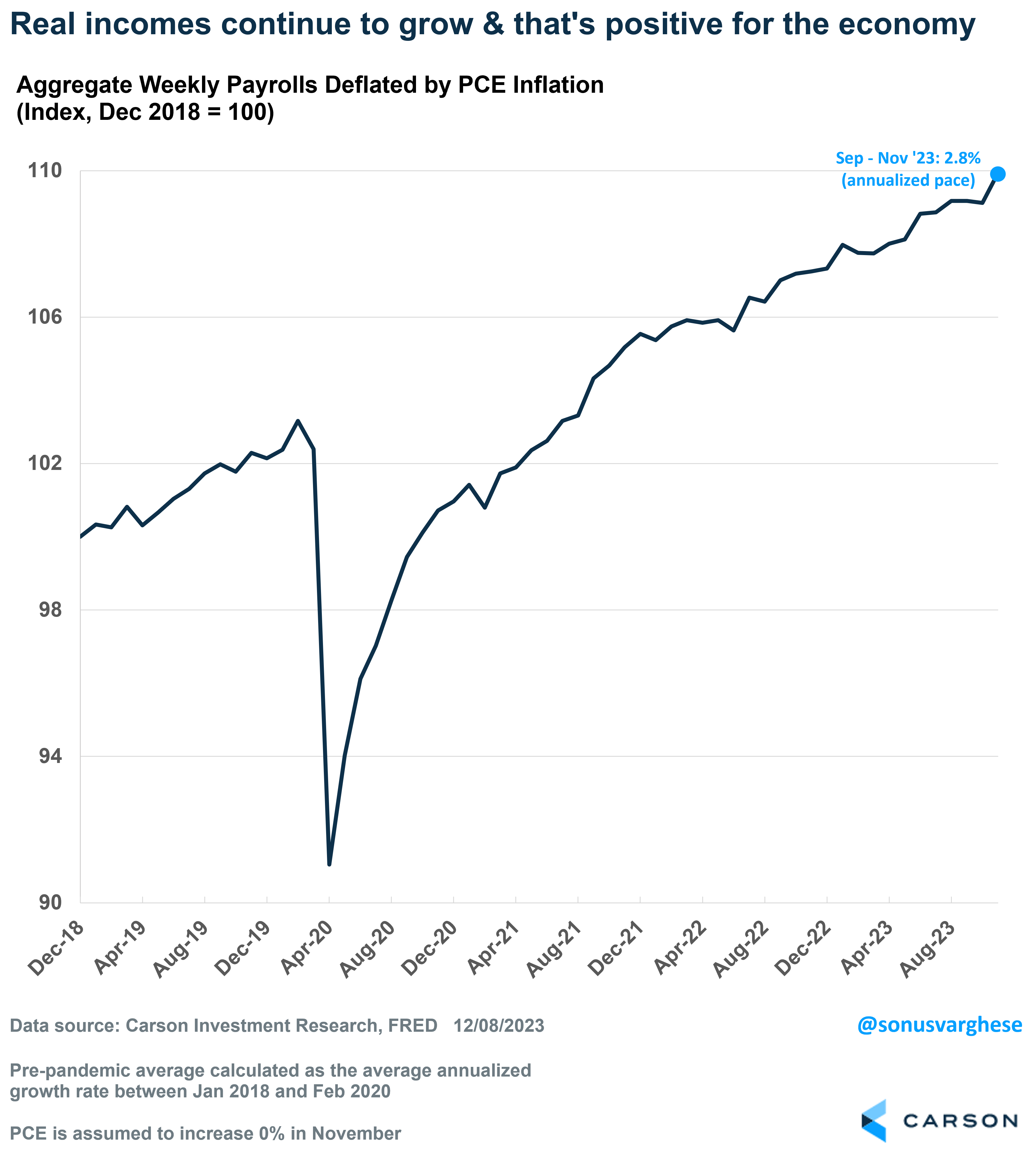

All in all, we have

- Strong employment growth

- Strong wage growth

- Falling inflation

All of which means inflation-adjusted incomes are rising at a pace of 2.5-3.0%.

That’s good for consumption, which means the economy is on a solid footing with a still upbeat outlook for profits.

For more of Sonu’s thoughts click here.

2016929-1223-A