In my opinion, the June inflation report was picture perfect. The consumer price index (CPI) fell 0.1% in June, which was below expectations. Core CPI, which strips out the volatile food and energy components, rose just 0.1%. These were below expectations, and combined with April and May data, reverses the “heat” we saw in the first quarter inflation data.

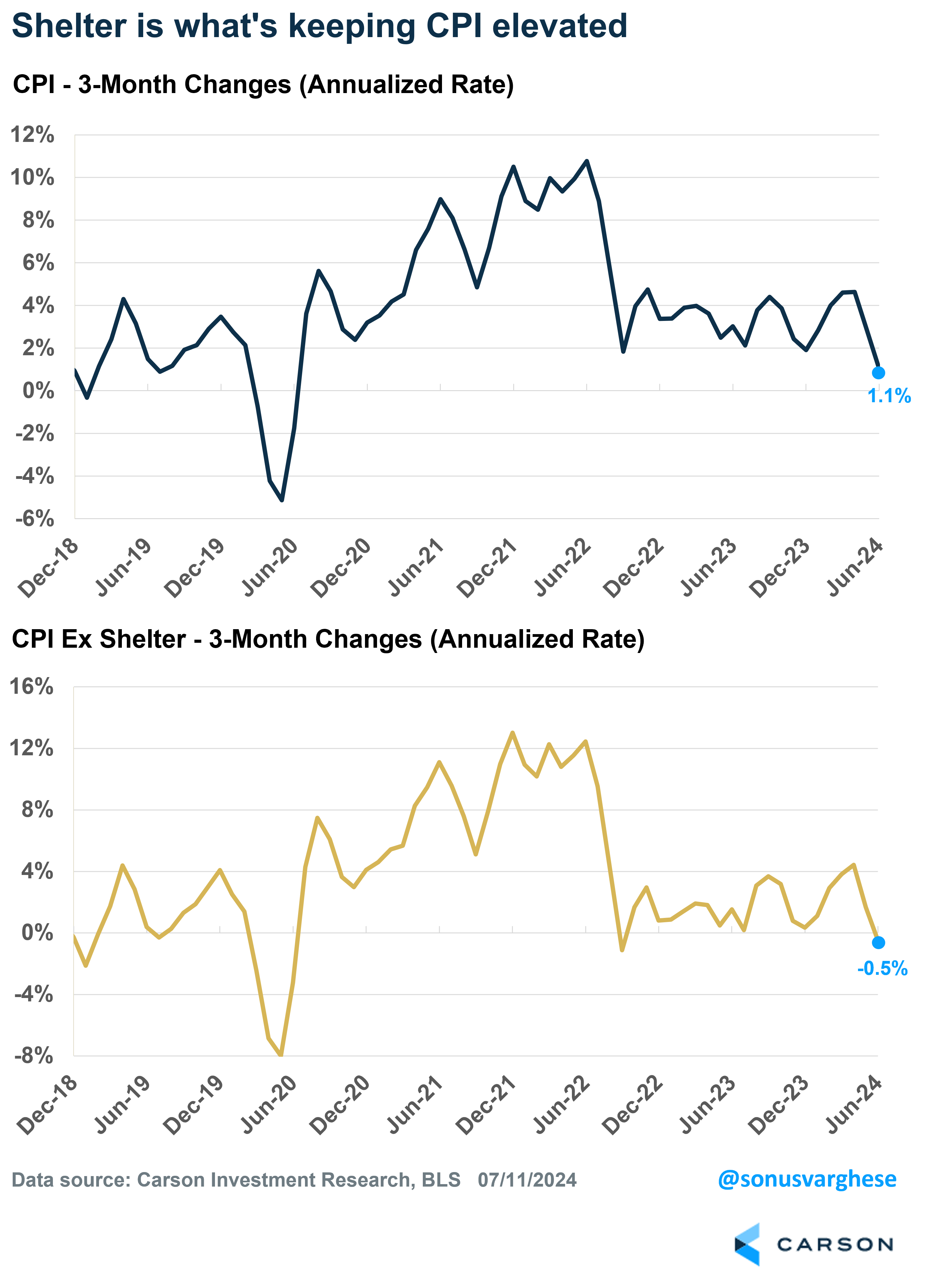

CPI ran at a 1.1% annualized pace in the second quarter (Q2), bringing its six-month pace to 2.8%. That’s still elevated relative to the Federal Reserve’s (Fed) target of 2%. But here’s the thing: 35% of CPI is shelter, and official shelter inflation runs with significant lags to what we see in actual rental markets. Strip out shelter and here’s what we have:

- CPI ex shelter ran at a -0.5% annualized pace over the last 3 months (Q2). The negative sign is not a typo.

- CPI ex shelter is up 1.6% annualized over the last 6 months, and 1.8% over the last 12.

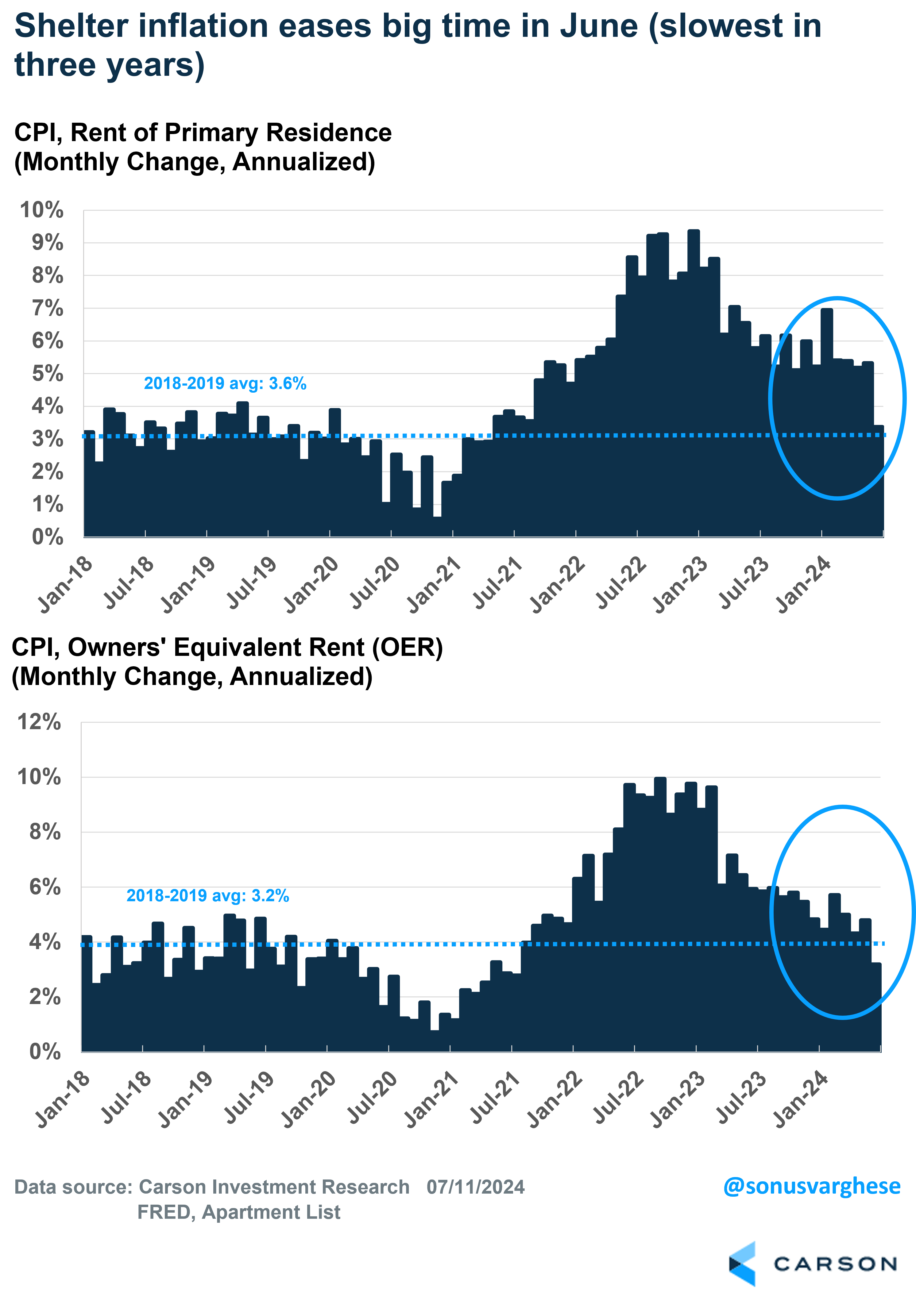

Official shelter data is also looking positive from the perspective of what may be coming ahead. Rents of primary residence account for 8%-points of that, while “owners’ equivalent rent” (OER) accounts for the other 27%-points. OER is the “implied rent” homeowners pay, and it’s based on market rents as opposed to home prices. In June, these ran at the slowest pace in three years, and close to the pre-pandemic trend. It’s easy to think of that as a blip, since it’s much lower than recent months. But there’s reason to believe that May data was skewed upwards for idiosyncratic reasons, which means the downtrend is smoother, and likely to continue.

We also got the producer price index data for June this morning, which along with CPI, serves as a partial input into the Fed’s preferred inflation metric, the Personal Consumption Expenditures Index (PCE). Core PCE is expected to be on the softer side as well in June, running between 0.1-0.2% for the month, going by estimates from Employ America.

As the title of this piece says: Inflation is last year’s problem.

Time For the Fed to Focus on Risks Other Than Inflation

As our friend at Ren Mac LLC, Neil Dutta, pointed out, all the stars aligned for the June inflation report. But most importantly, it shouldn’t have been a surprise since this was always coming. We’ve been talking about a disinflationary trend (and the problems with how shelter inflation is measured) on these pages since last year. Not to mention the Facts vs Feelings podcast Chief Market Strategist Ryan Detrick and I do weekly, and across 4 market outlooks (including our latest Midyear 2024 Outlook).

Yes, the inflation data was hotter than expected in Q1, but I wrote multiple blogs saying that this was more than likely a head fake. There was no other data, including wage growth, consumer inflation expectations, business expectations, and market expectations, that pointed to a renewed surge in inflation. And these would be the places to look if that were the case.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The good news is that the Fed is starting to acknowledge this reality. Fed Chair Powell was in front of Congress this week and said that the disinflationary trend was back on and that the risks to their “dual mandate” are double-sided. On the one hand, cutting interest rates too soon could undo the progress they made on inflation. On the other hand, cutting too late could unnecessarily undermine the expansion, and cause unemployment to continue to rise. This two-sided view of the risks is different from what he was saying a year ago and acknowledges that there are rising risks in the labor market. We would add that risks are likely more skewed to the labor market side, rather than inflation, but follow the Fed we must. It looks like they are unlikely to cut rates at their July meeting in two weeks, but we could very well see them start the rate cutting cycle in September. Not a moment too soon.

Stocks Loved This

As soon as the June CPI report was released, Treasury yields collapsed lower. The 1-year yield fell from 5% to 4.89%, and the 2-year yield fell from 4.62% to 4.51%. These are essentially market expectations for monetary policy rates over the next one and two years. And markets are saying, the Fed will cut (the current policy rate is 5.25-5.50%).

We’ve maintained across the past year (including in our 2024 Outlook and the Midyear Outlook that was released earlier this week) that disinflation is happening, and the Fed will respond to it with rate cuts. That’s going to help the stock market rally broaden out, beyond the recent gains we’ve seen for the largest technology companies in the world.

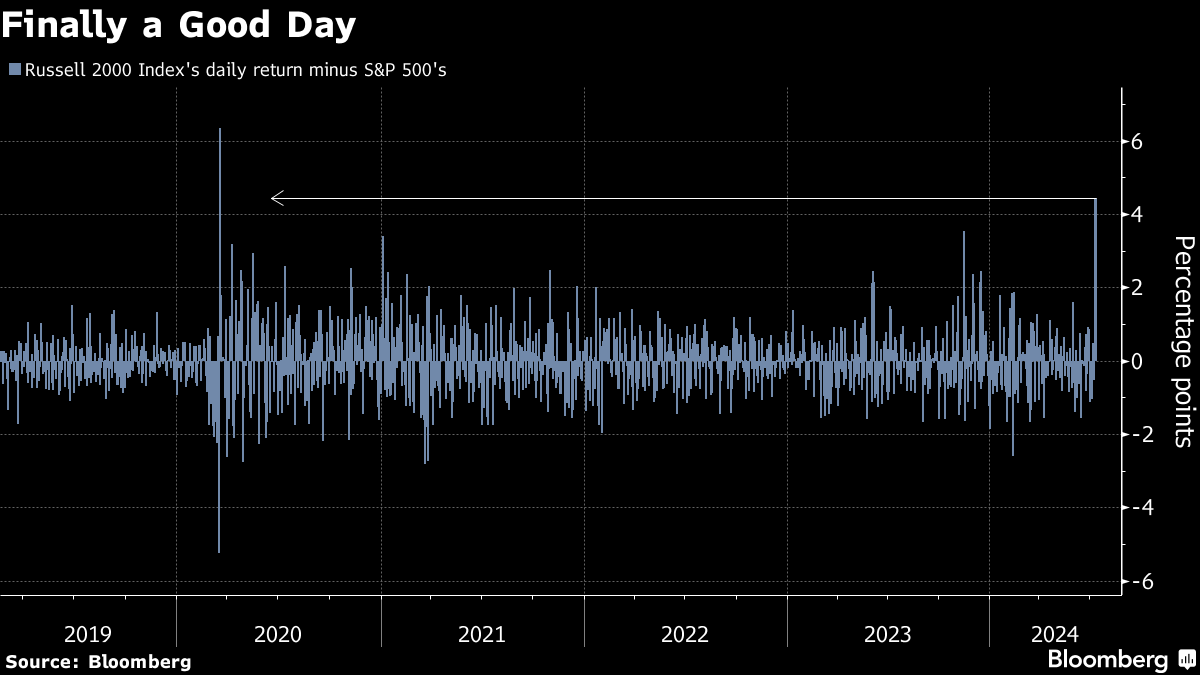

Market action after the CPI report release underlined this. Stocks overall, at least as measured by the broad S&P 500 Index, fell almost 1% on the day. Even the Dow rose under 0.1%. But it was a different story under the hood, with over 400 stocks gaining. The ones that lost the most ground were the big technology names that have been surging recently. That’s why the headline S&P 500 index fell (since large technology makes up over 30% of the index).

The Russell 2000 Index, a basket of small cap stocks, rose 3.6% on Thursday. It beat the S&P 500 by 4.5%-points, the most since March 2020. This is extreme, as you can see in the chart below, and not something we expect to see replicated going forward. However, we think it’s likely that we see the general theme of rotation – from large cap stocks to midcap and small cap stocks, and from technology stocks to other sectors – to play out over the reminder of the year.

A broader rally amongst stocks is one reason to have a diversified portfolio, even within your equity allocation, where you’re not betting on just one theme to play out.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02320662-0724-A