January inflation data hit the nose on expectations. Headline CPI rose 0.5% and is up 6.4% year-over-year, while core CPI (ex-food and energy) rose 0.4% and is up 5.6% year-over-year. The fact that inflation is coming in at expectations is in and of itself a victory. That’s a sharp contrast to last year when inflation kept surprising to the upside.

With that, here’s the big picture:

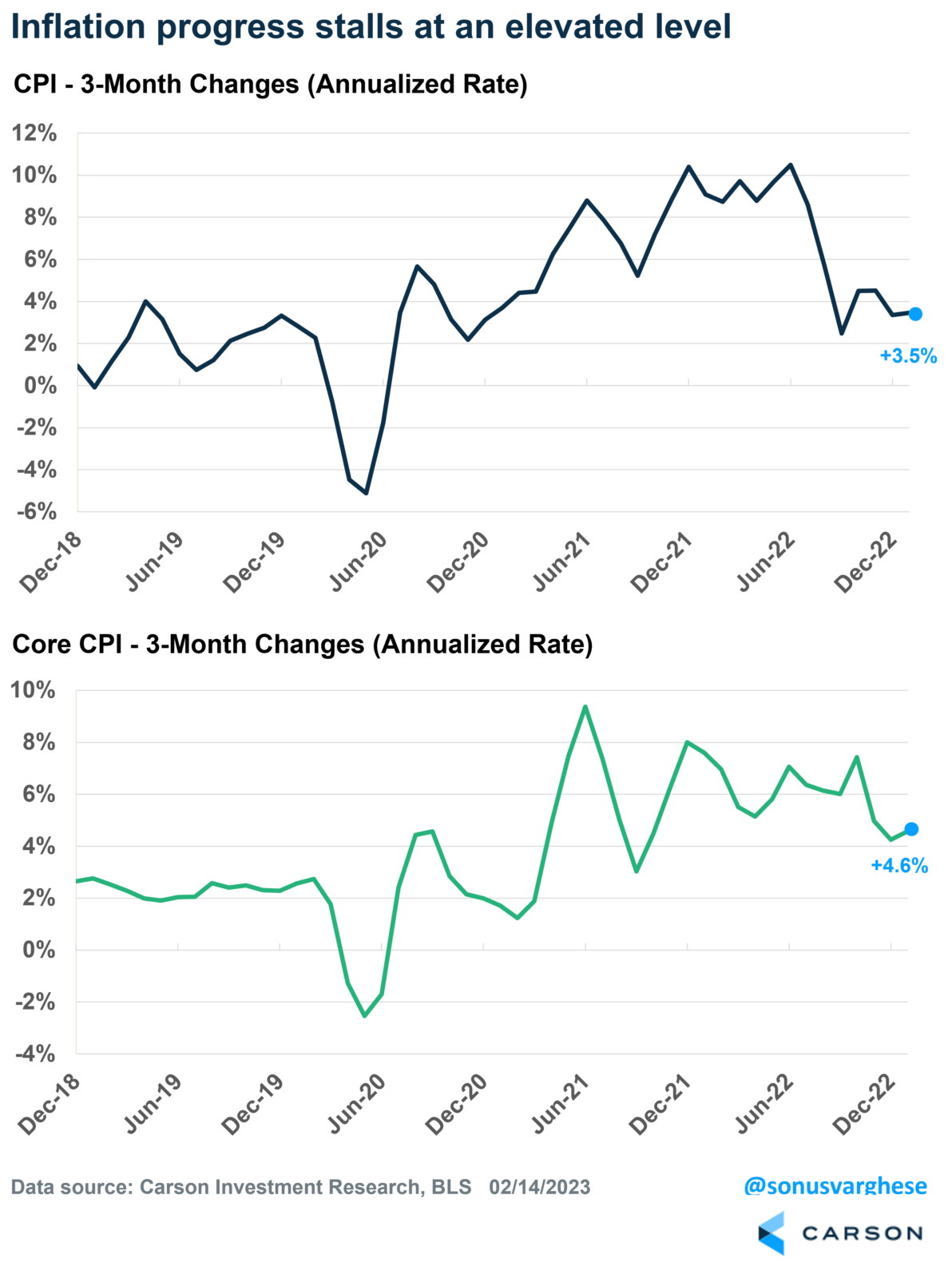

- Inflation’s much lower than it was last year. For example, over the 18 months from May ’21 through Oct ’22, headline CPI was running at 7.6% and core at 6.2%. Over the past three months, headline has slowed to 3.5% and core to 4.6% (annualized rates).

- Inflation is still elevated, and we’re not seeing further deceleration. Yet. hah

It’s worth understanding why the deceleration has seemingly stalled.

The devil’s in the details

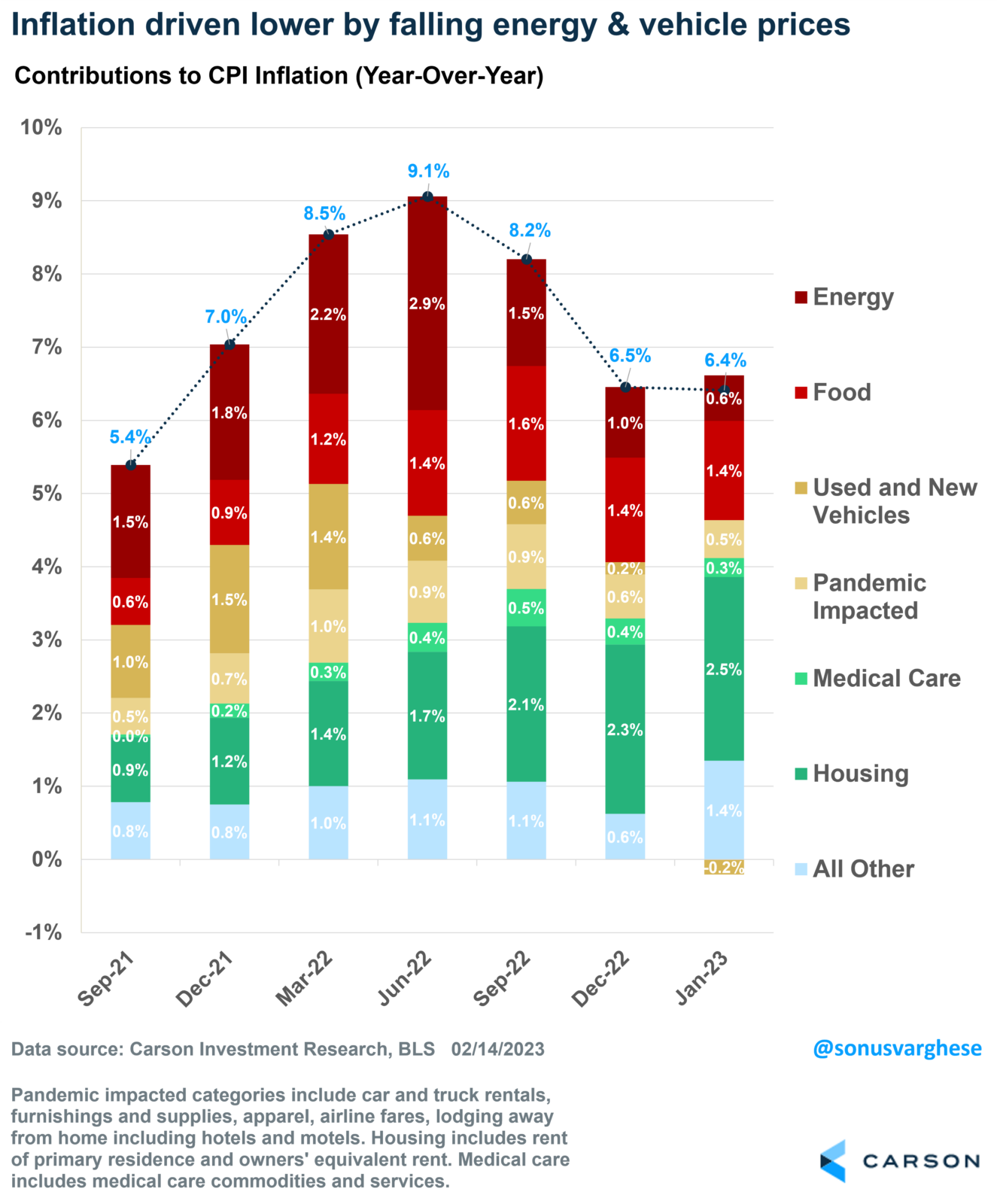

As the chart below shows, headline CPI slowed from 9.1% in June to 6.5% in December. And that came on the back of falling energy prices (dark red bars) and falling used car prices (dark yellow bars).

The problem is that we didn’t have either of those in January.

Energy prices rose 2%, with higher pump prices and surging utility prices. The big declines in pump prices are over for now, though we should see utility prices pull back (thanks to falling natural gas prices).

Used car prices fell 2%, which was positive. The problem is that the Bureau of Labor Statistics (BLS) reduced the weight of used cars in their latest update by almost a full percentage point to 2.7%. So, expect the disinflation drag from used cars to be modest from here on. If at all, since auction prices are rising again – the Manheim used car price index was up 2.5% in January.

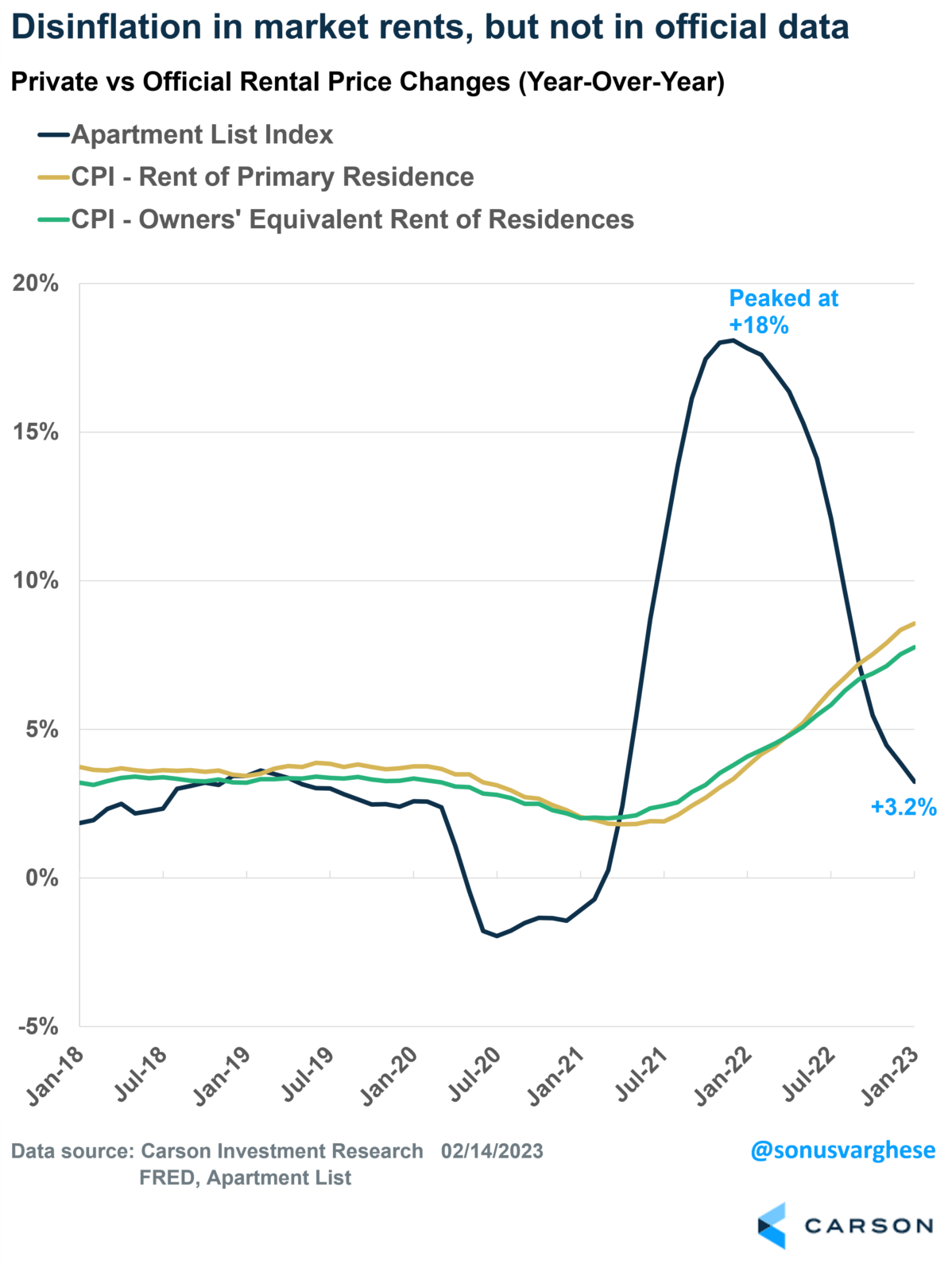

The single biggest driver of elevated inflation right now is rents – represented by the dark green bars in the previous chart. Rents have been running at an annualized pace of just under 10% over the past three months, while “Owner’s equivalent rents” (what homeowners “pay themselves”) are running close to 9%! These are massive numbers. On top of that, the BLS just increased the weight for “Shelter” by more than a percentage point to 33%.

So, you had items with falling prices getting a lower weight and items with high inflation getting a larger weight…

The good news is that shelter disinflation is in the pipeline. Market rents have decelerated significantly in recent months. The bad news, as we’ve written before, is that official data will not capture this dynamic for another eight months or so. It’s coming, but until that happens, core inflation will probably remain above 3%, perhaps closer to 4%.

A strong economy is putting upward pressure on prices

As the economy was recovering from Covid, there was an expectation that

- Consumers would pull back spending on core goods, like household stuff, apparel, etc

- And they would shift toward services, as they “revenge-spend” on everything they missed amid the lockdowns. But even that would be temporary, with consumption eventually normalizing to pre-pandemic trends.

Well, neither has happened. And that is a direct result of a stronger economy.

Or, more specifically, a strong employment market and strong wage growth. Combine that with falling inflation, and consumers are seeing “real incomes,” i.e., incomes adjusted for prices, rise once again. That’s a tailwind for consumption. We discussed this dynamic in our 2023 Outlook – one of the biggest reasons we believe the economy can avoid a recession this year.

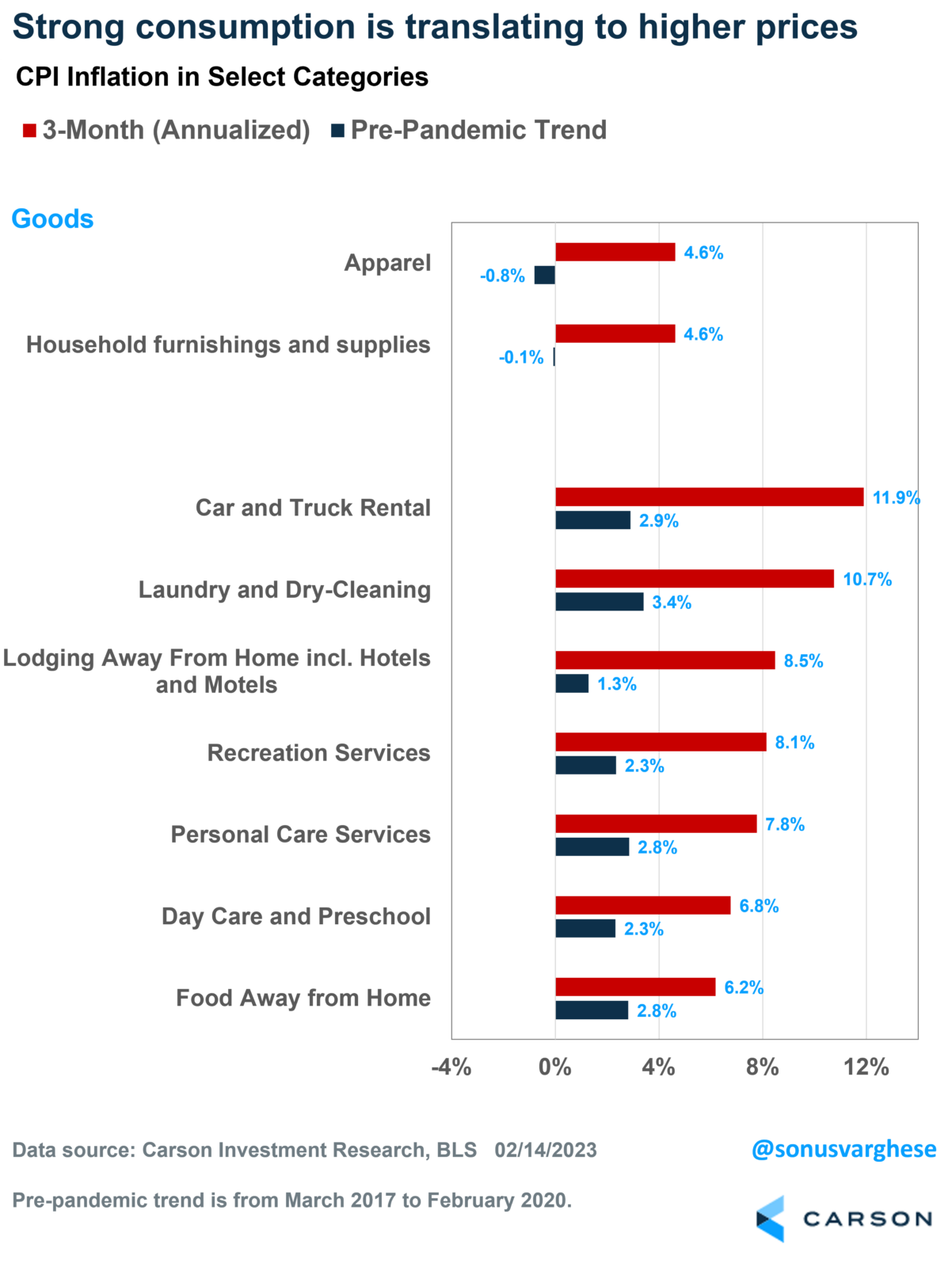

Now the other side of this is that there’s upward pressure on goods and services you’d expect consumers to spend more money on if they were feeling good about their finances. Including eating out, going to movies/concerts, recreational activities, buying clothes and household goods, spending more on personal care services (including dry-cleaning), and child care.

I’m “guilty” of engaging in some of this as recently as this past weekend, as my wife and I hired a babysitter to look after our 6-year-old twins while we went to watch Avatar (which was phenomenal). Avatar, by the way, has made more than $2 billion in sales – not something you’d expect in a weak economy! So that’s a lot of movie tickets, popcorn, and babysitters.

The chart below shows inflation over the past three months for several core goods and services categories. As you can see, they’re all running well above the pre-pandemic trend. The categories listed below comprise about 17% of the CPI basket. It’s not insignificant.

Strong consumption is good for an economy that is highly reliant on it. We believe consumption patterns will normalize as the year progresses, especially as wage growth decelerates – and there are strong signs of that, as we discussed after the latest employment data were released.