“Forget self-driving cars, AI is transforming every industry, and Nvidia is at the center of it all” – Venture Capitalist, TechCrunch

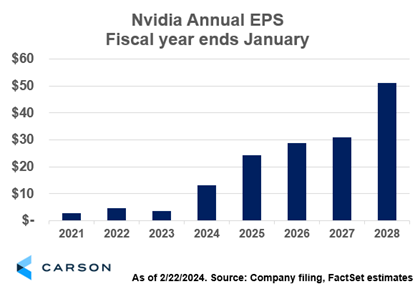

With bated breath, investors eagerly awaited the final earnings report of the “magnificent 7.” Among the seven, Nvidia’s report was perhaps the most hotly anticipated, given it’s the driving force behind accelerated computing and artificial intelligence. This tech darling, responsible for significant market gains over the past year and a half, carried the weight of the entire AI industry on its shoulders. An earnings beat was expected, though how large of a beat left investors wringing their hands. In the days leading up to the report, shares of Nvidia had fallen about 8% as investors took profits. It turns out, Nvidia beat fourth quarter earnings estimates by $0.57 (~12%) and raised guidance for the first quarter above expectations. Ultimately, shares climbed back to the level they were at before the nervous excitement began as AI chip demand continued to accelerate.

Generative AI has reached a tipping point and demand for artificial intelligence is exploding. In the fourth quarter, the company’s sales more than tripled and earnings increased nearly six-fold. Demand is extremely robust, and the company will be short supplied for the foreseeable future. Investors expect its earnings will double again in the upcoming year, as Nvidia extends its streak of shattering expectations. CEO Jensen Huang said, “Demand is surging worldwide across companies, industries, and nations.” Nvidia H100 accelerator chips serve as the backbone of artificial intelligence and companies like Amazon, Meta, Microsoft, and Alphabet are scrambling to acquire them.

Generative AI represents a technological leap that pushes past the boundaries of prior generations of computing. Until this breakthrough, computers relied on complex algorithms to crunch numbers, solve equations, and manipulate statistics at ever increasing speeds. Generative AI, however, has the ability to learn, adapt, and create, using not only calculations but also text, images, sounds, and other inputs. This is having a significant impact on various fields, from drug discovery to artistic creativity. Nvidia’s chips happen to be perfect for building and training artificial intelligence models because they are so adaptable. The company developed a software ecosystem over the past decade that makes it easy for developers to manipulate and optimize their chips, as opposed to competitor’s chips that are purpose built and less malleable. Nvidia is clearly in the dominant position for the initial wave of AI, though competitors like AMD and Intel are trying to catch up.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

It’s becoming increasingly clear that AI will become ubiquitous; it’s already being adopted at an alarming rate. Nvidia’s report reassured investors that AI’s prolific spread isn’t slowing down, but we’re hearing that from many other companies as well. UnitedHealth Group noted how it uses AI to improve customer service and employee productivity, Bank of New York Mellon is using it to do mundane or repetitive tasks. Nvidia noted that nearly every automotive company in the world is using AI, for design and efficiency, though many are also developing autonomous driving capabilities. Quest Diagnostics is using it to improve quality and JPMorgan is using it to improve fraud detection. AI is not just about Nvidia, or the Magnificent 7; it is already impacting companies across the world. As Nvidia’s earnings confirm, investments in AI aren’t slowing down for the foreseeable future, which is good news for the stock and the stock market.

For more of Jake’s thoughts click here.

02126104-0224-A