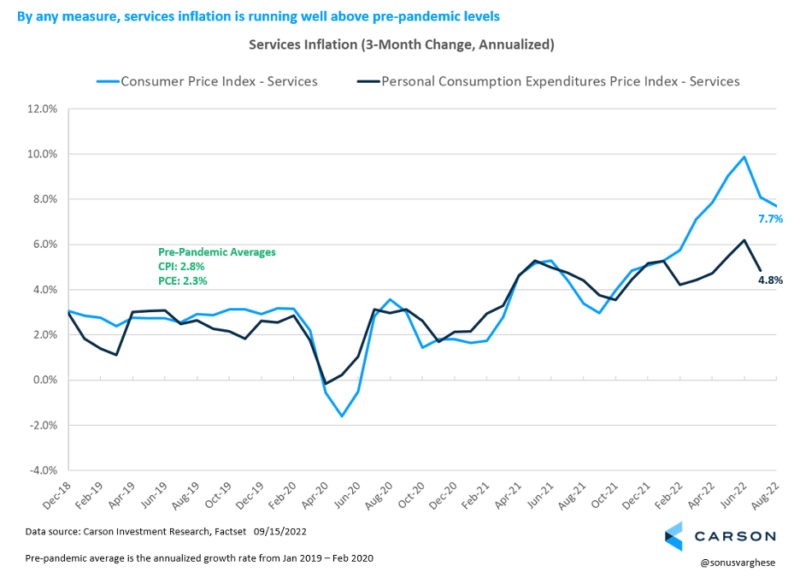

The August CPI report was a disappointing one, especially core inflation which strips out food and energy. As my colleague Ryan Detrick wrote, a lot of services costs, such as dental services, all came out hotter than expected. While there may be some noise in the month-to-month numbers, services inflation is running at a 7.7% annualized pace over the past three months (June-August). This is well above the pre-pandemic average pace of 2.8%. Even if you look at the Federal Reserve’s preferred inflation gauge, the personal consumption expenditure index, services inflation over the three months leading into July was running at a 4.8% annualized pace (we’ll get August data in two weeks) – it averaged 2.3% before the pandemic.

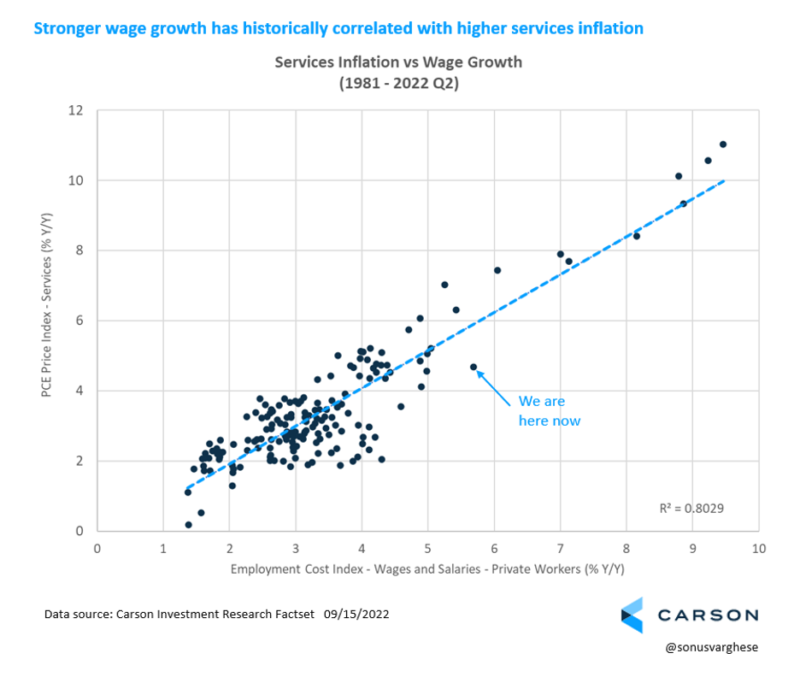

As I have written before, services inflation is tied to stronger incomes.

Which is why the Federal Reserve (Fed) wants to reduce the pace of wage growth. Raising interest rates will potentially cause economic activity, such as business spending, to slow down – thereby reducing demand for workers, and reducing the supply-demand imbalance in the labor market.

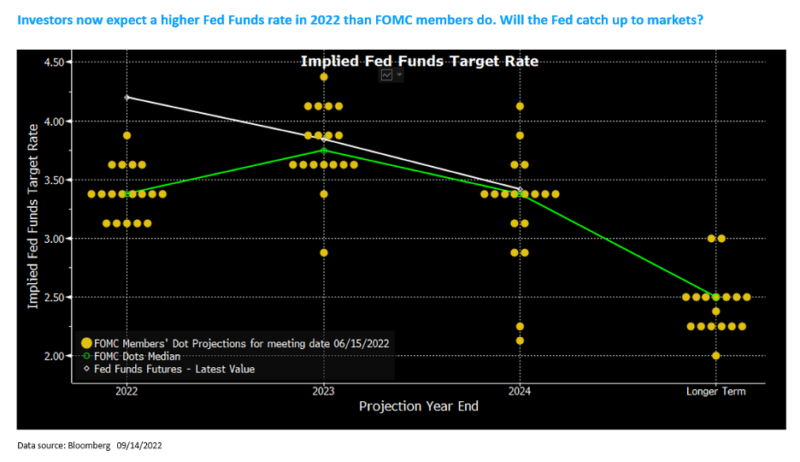

Wage growth appears to be cooling but not enough, and now after a hot inflation report, investors expect the Fed to continue raising rates at a furious pace. Investors currently anticipate the federal funds rate to be raised as high as 4.2%. The white line in the chart below shows investor expectations for the fed funds rate, while the green line shows the median of the dots, which represent each Fed member’s estimate for where the policy rate will be in 2022 and beyond.

As you can see, the green line for 2022 is well below the white line (investor expectations). The Fed has a meeting coming up next week and perhaps the most important thing we will be watching is how much higher they move their own estimates, and whether they get as far up as where the market is right now.

Our view is that the green line will shift higher, close to the 4% level or more. And that is why we’re still cautious on our outlook for interest rates, believing there’s still some room for rates across the spectrum to rise – on the back of higher policy rates.

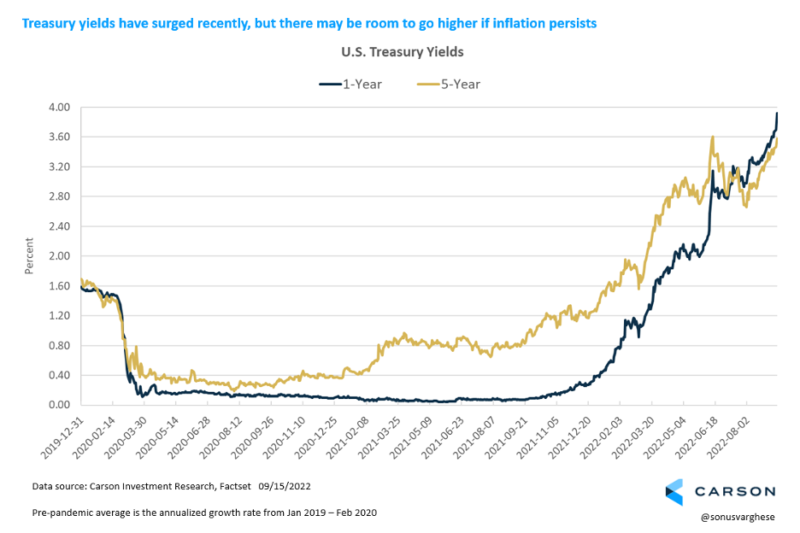

Short-term treasury interest rates, which are a good approximation of monetary policy, have surged this year, and are well above pre-crisis levels. After the August inflation report was released, 1-year rates rose from 3.70% to 3.92%, while slightly longer-term 5-year rates rose from 3.47% to 3.58%. So, they certainly are closer to where policy rates may get to, but not quite there yet.

The key is services inflation, and that gets back to wage growth. GDP growth in nominal terms (so not adjusted for inflation) was running at an annualized pace of almost 8% in the first half of the year. GDP basically measures spending and so the other side of this is incomes since spending should equal income. Gross domestic income – of which wages is a big part (in addition to things like corporate profits and rental income) – was running stronger than GDP in the first half, at an annualized pace of 10%.

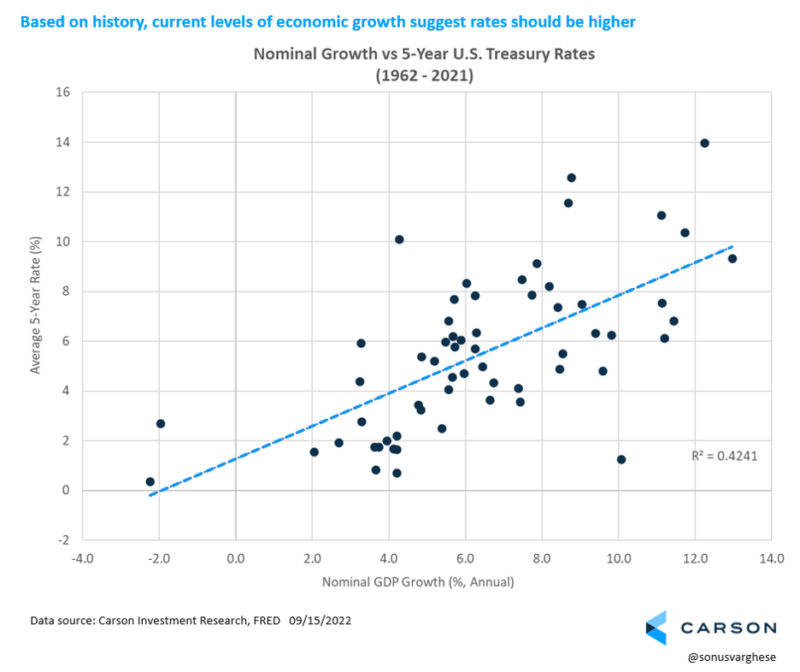

The pre-crisis average for nominal GDP was around 4% and 1-year rates averaged under 1.0% while 5-year rates averaged about 1.7%. We are clearly in a different environment now, and based on history, yields should be higher than what they are now.

By no means do we believe rates will go from around 3.5-4% to above 6%. There is still buying pressure from institutions who find a 3.5%+ yield attractive, especially on what is considered the safest asset in the world. Also, as financial markets have become more globalized, there is a more demand from foreign investors for US treasuries, both as a safe haven and a way to earn higher yields, much more so than yields in other Developed Markets in Europe and Japan.

We believe the Federal Reserve will raise their benchmark rate close to the 4% level over the next 6 months or so. Which means there will be further upward pressure on rates. So, from a portfolio perspective, we are underweight duration, or in other words, overweight cash and other ultra-short-term instruments. We believe the risk-reward ratio is skewed in favor of ultra-short term fixed income right now, more so because they yield more than longer term yields.

At the same time, an inverted yield curve (shorter-term rates higher than longer-term rates) means that there are risks to economic growth as the Fed tightens policy. The main risk is that they tighten too hard and too fast, pushing the economy into a recession. This is not our base case at this point, but we believe the probability of that scenario is around 30% over the next year. And so, we are not eliminating longer-term treasuries from our portfolios. They serve the important role of diversification, especially amidst a recession, when investors run for safety.