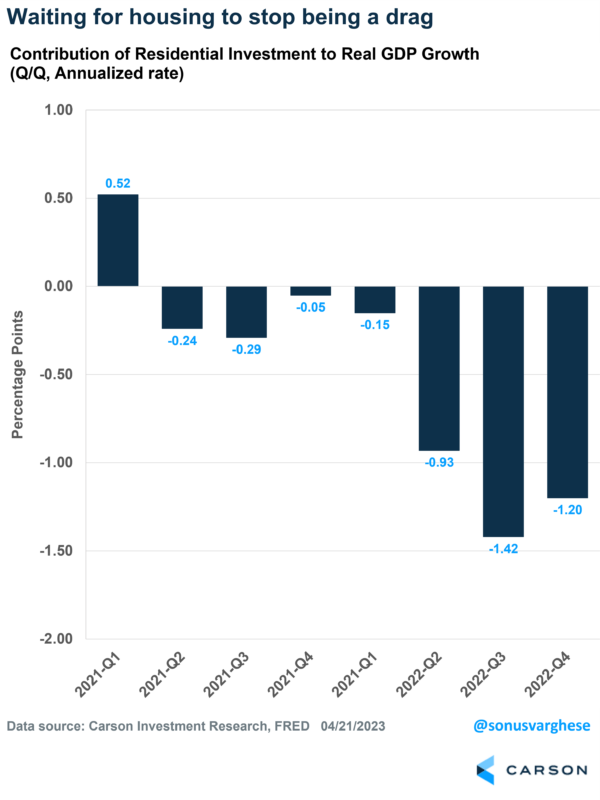

Housing was the biggest drag on economic growth last year. The economy grew by 2.1% in 2022, but that overcame a 0.93%-point drag from residential investment, i.e. housing. In fact, it’s been a drag on GDP growth for 7 straight quarters now (through the end of 2022). It got worse over the last 3 quarters of 2022 as mortgage rates surged from below 3% to just above 7% thanks to an aggressive Federal Reserve. Housing is likely to be a drag for the 8th quarter in a row in the first quarter of 2023.

But things may be looking up for the rest of 2023.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

People want houses but there aren’t many

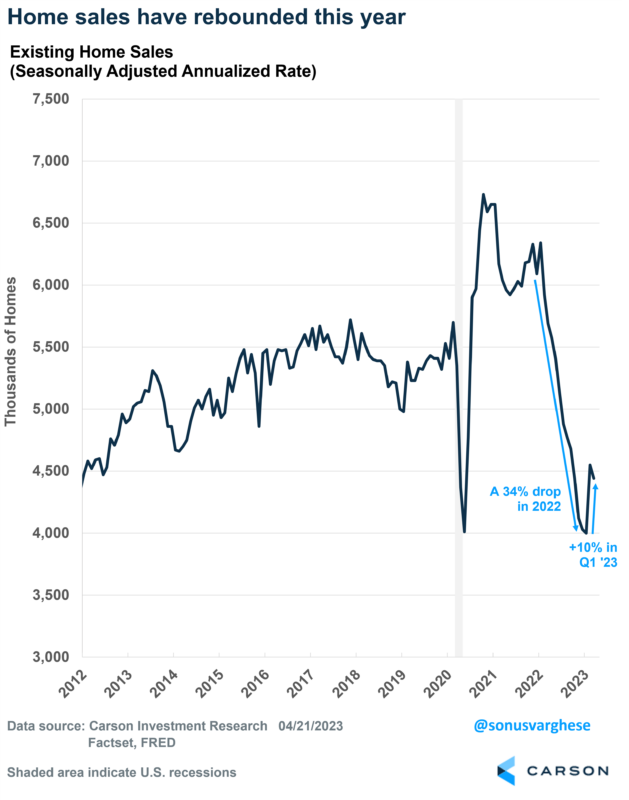

Existing home sales fell 34% in 2022 but are up 10% over the first three months of this year. Some of that is because mortgage rates have pulled back a bit from the peak level of 7%+ we saw last fall. However, rates are still high, and significantly higher than over a year ago when 30-year mortgage rates were around 3%.

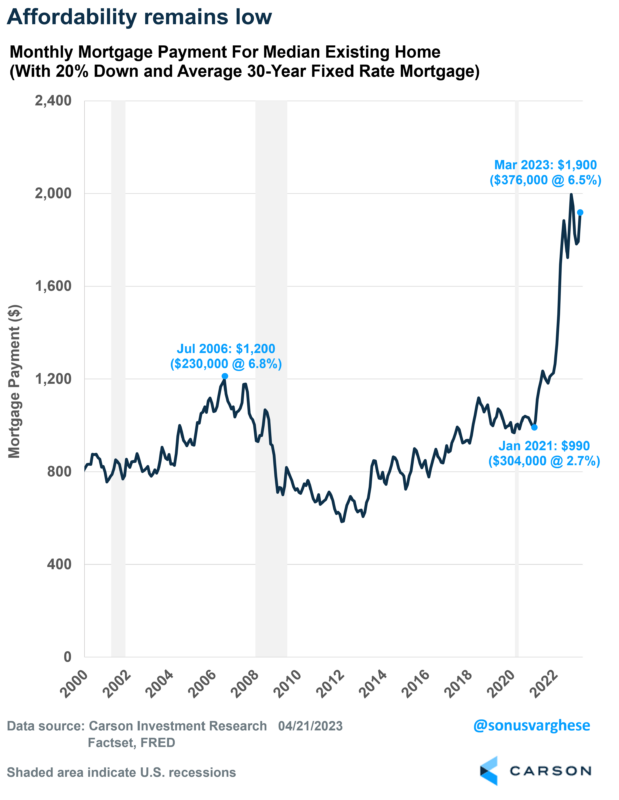

In fact, based on the median price of an existing home, and assuming a 20% down payment, the monthly mortgage payment has jumped from about $1,200 at the end of 2021 to $1,900 as of March. That’s not because of an increase in home prices – the median price increased about 5% to $376,000 during this period. It’s because the 30-year mortgage rate jumped from about 3.1% in December 2021 to 6.5% in March 2023! In short, affordability is truly low.

Nevertheless, as we saw from rebounding home sales, there’s still pent-up demand. A big factor is that there are a record number of people in the 25-34 year age cohort, which is prime-home-buying age. For perspective, the number of potential first-time homebuyers is up from 39.5 million in 2006 to 46.1 million today.

The problem is that there aren’t many homes for sale. Inventory of existing homes, in terms of months-of-supply at the current sales pace, is currently at 2.6 months. Well below a normal range of 4-6 months.

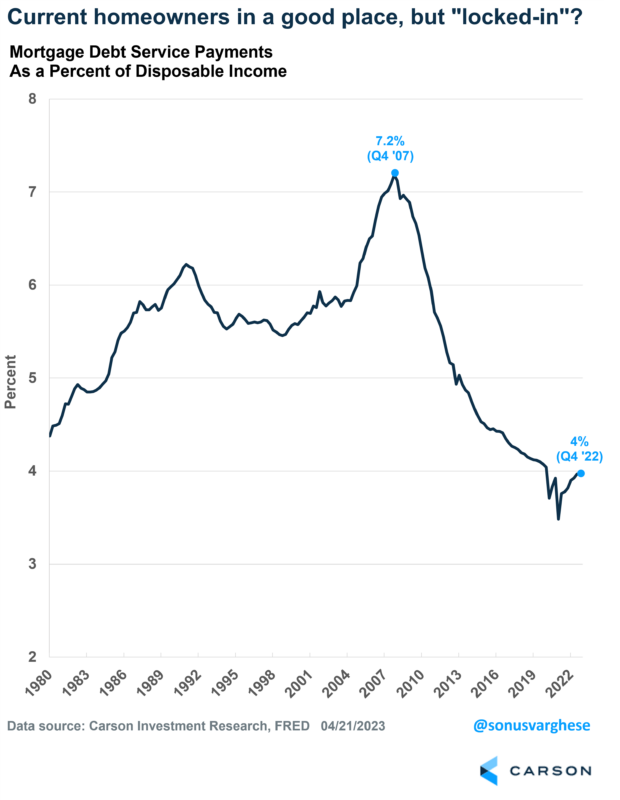

You can probably guess why inventory is low. Most homeowners are “locked-in” to their homes since they got their existing mortgage at ultra-low rates. As a percent of disposable income, mortgage debt service payments were just 4% at the end of 2022. That’s lower than it was pre-pandemic, and lower than at any point during the last four economic expansions. This is great from a consumption point of view, since it means households are less financially constrained. However, it also means a lot of homeowners are unlikely to move – who would want to sell and buy a new home at a mortgage rate of 6.5%?

Pent-up demand was evident in the latest existing home sales report. Properties typically remained on the market for 29 days in March, and 65% of homes sold in March were on the market for less than a month. So there clearly is demand despite high mortgage rates.

New buyers pushed to new homes

At the end of the day, if you have to buy a house, you go out and buy a house. And if there’s not much inventory in the existing home market, you look at the market for new houses. Which is why new home sales are up 16% from last September (through February). There’s relatively more inventory in this market, about 8-months of supply at the current sales pace. Though on an absolute basis, I do want to point out that the inventory of new homes is under 450,000, which is less than half that of existing homes (close to 1 million).

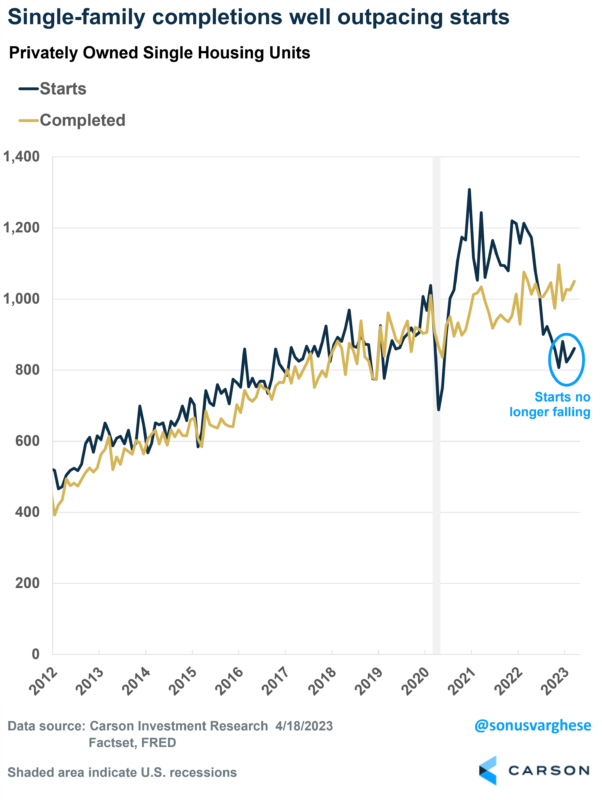

Also, the inventory of completed homes is rising while homes under construction are falling, as supply-chain issues fade. Homebuilders are also starting fewer homes than they are completing – this is not a problem now but that does mean supply next year is likely to be constrained. The good news is that new housing starts may have bottomed – starts are up 7% over the past 5 months through March.

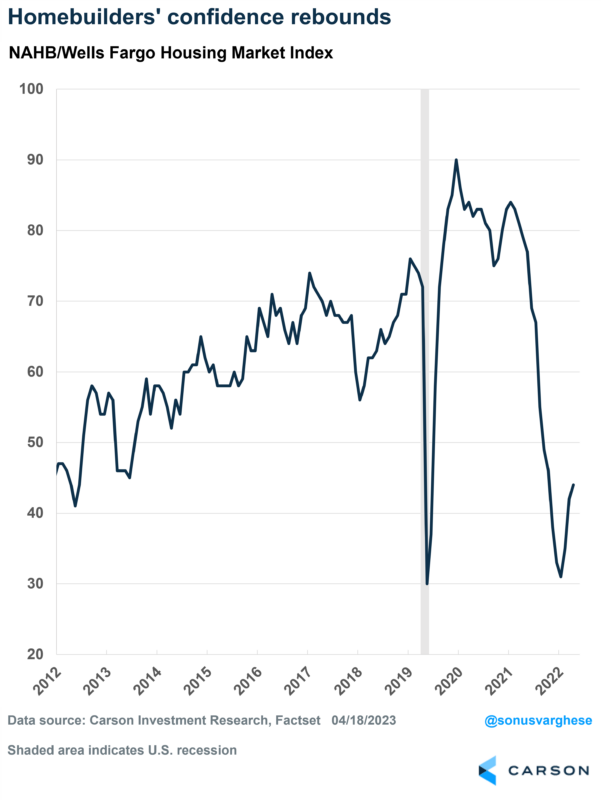

Homebuilders are feeling good, and the market likes that

Combine the high pent-up demand picture with relatively low supply, and builders are feeling good. As witnessed by a rebound in homebuilders’ confidence.

The market is sensing this as well. The SPDR S&P HomeBuilders ETF is up almost 16% year-to-date (through April 20th) versus 8.1% for the S&P 500. Since September 30th, the HomeBuilders ETF is up 28%, versus 16% for the S&P 500.

This was validated by D.R. Horton’s earnings report on April 20th. They beat revenue and earnings estimates by wide margins, sending the stock up by 5.6% over the day. But it was forward looking guidance that was especially positive: they see higher revenue in 2023 and expect to close on 77,000 to 80,000 new homes. Well above estimates for 71,000. Quoting management:

” Although higher interest rates and economic uncertainty may persist for some time, the supply of both new and existing homes at affordable price points remains limited, and demographics supporting housing demand remain favorable … Started less homes than they completed in the quarter, but do expect starts to increase each quarter.”

All of which is good for the economy. None of what you read above is what we’d be seeing if the economy was in a recession, or close to one. If households’ employment situation was looking shaky, we would expect housing demand to crater. The fact that the housing market, especially starts, appears to have found a floor, indicates that the labor market is expected to remain strong.

In fact, more activity in the new home market is even better for GDP growth. It involves activities like design and construction, as well large household appliance purchases – which is not the case for existing homes.

Single-family home construction makes up almost 40% of residential activity within GDP. And over the last 3 quarters of 2022, it crashed 23%, which is why housing was such a big drag on GDP last year.

The good news is that we may have seen the back of that, with single-family construction no longer sinking. That by itself would be a positive for the economy. And any rebound, if it happens, will be even better.

My colleague Ryan Detrick and I talk about all of this and more on our podcast each week. Take a listen. You can watch the full episode from our YouTube channel below or listen to it wherever you get your favorite podcast.

Apple Podcast | Google Podcast | Spotify