We just got a bunch of data to round out the economic picture in the second quarter (Q2).

Long story short: Not only do we see no sign of recession, but it also doesn’t even look like the economy is looking for a “landing” at this point.

I realize this could change, but so far the data doesn’t indicate much weakness. Now, the monthly data can be volatile, and subject to revisions. So it helps to look at the last three months. Let’s walk through some of the highlights.

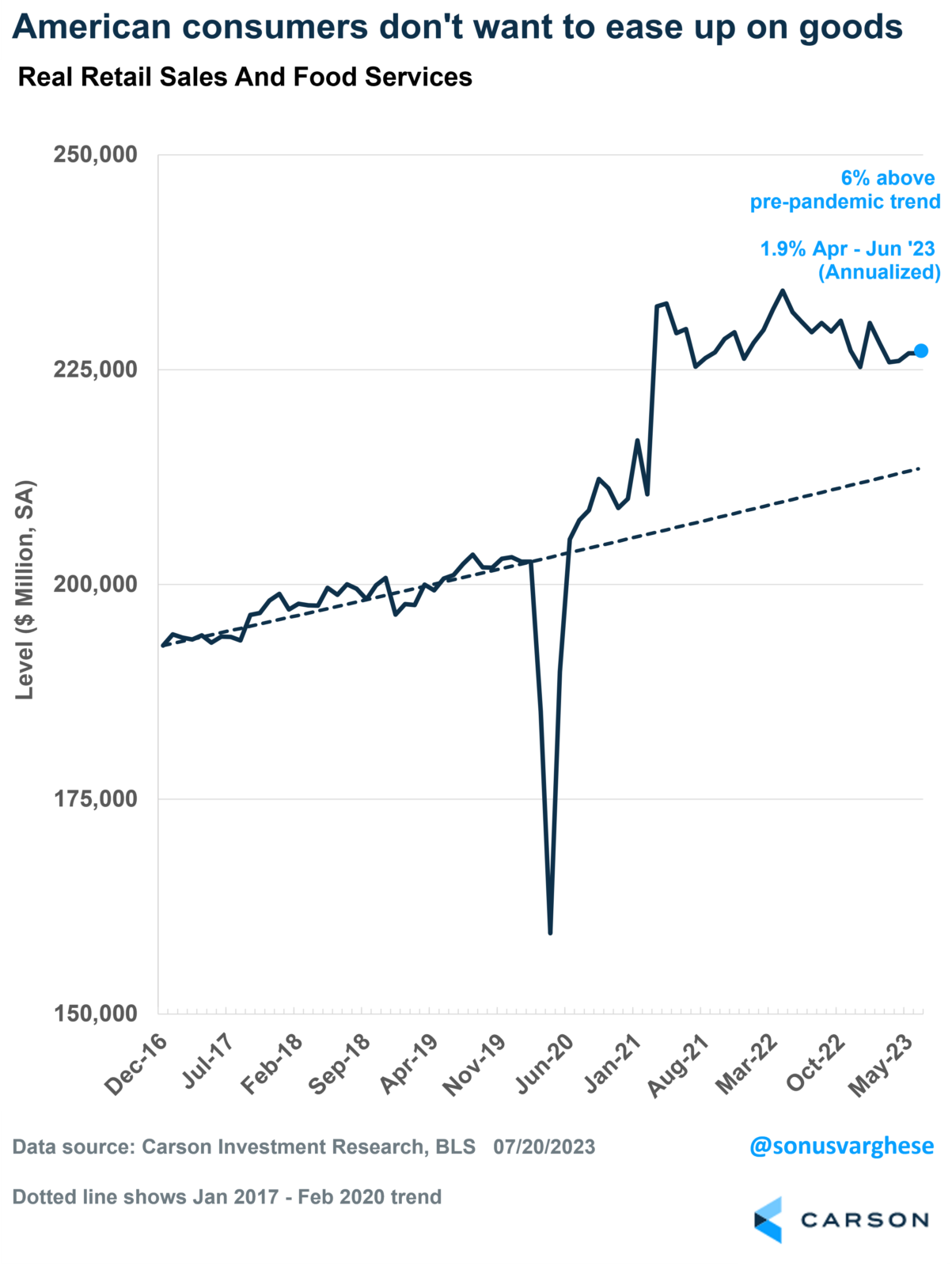

Consumption Was Strong

- Retail sales rose at a 4.7% annual pace in Q2.

- Core retail sales, excluding categories like vehicle and gas station sales, rose at a 6.3% annual pace.

- Even after adjusting for inflation, “real” retail sales rose at a 1.9% annual pace in Q2, and are currently running 6% above the pre-crisis trend!

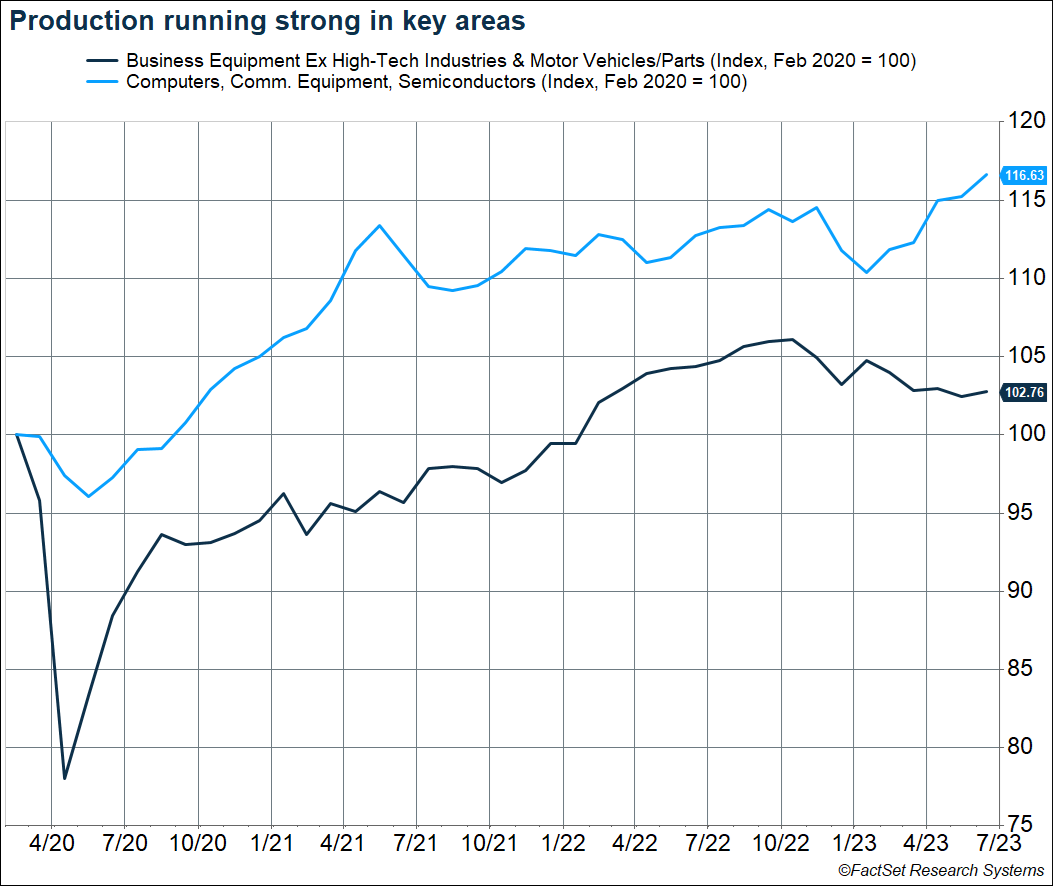

The Supply Side Is Coming Back

- Vehicle production rose 7.6% in Q2.

- Production within the aerospace industry rose 4.7% in Q2.

- High-tech industries are running hot, with production up 3.9%, and almost 17% above pre-pandemic levels.

- Production of business equipment outside of vehicles and high-tech also looks to have bottomed, which is a positive sign for capex.

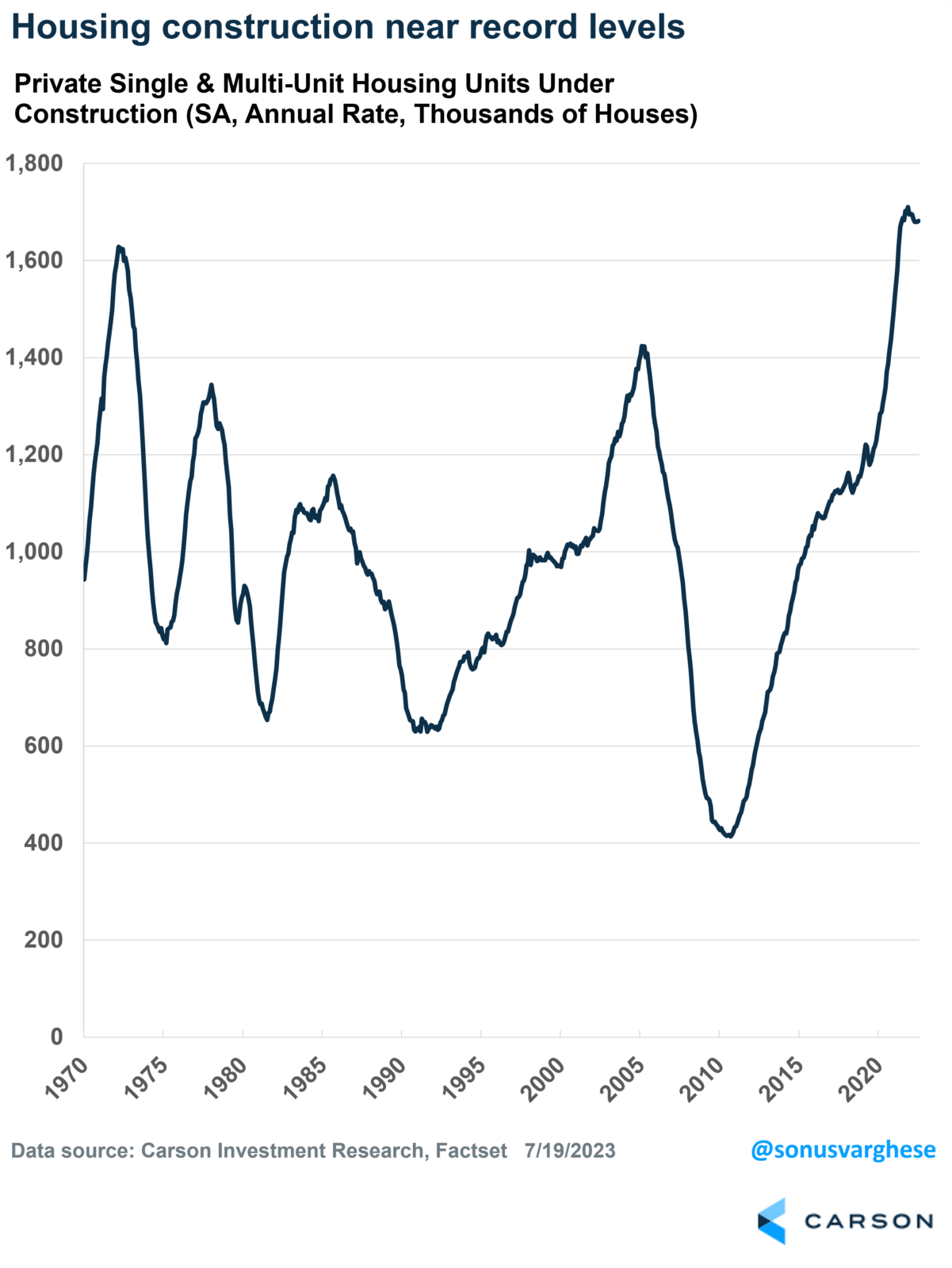

Construction is Booming

- Single-family housing permits and starts rose 11% in Q2.

- An index measuring homebuilder sentiment continues to move higher, indicating that builders are getting more positive about future demand.

- Meanwhile, total housing units under construction (single-family and multi-family) are near an all-time record.

- Combine that with a boom in manufacturing construction, and its not a surprise why construction payrolls have increased by 88,000 this year and are about 339,000 above pre-pandemic levels.

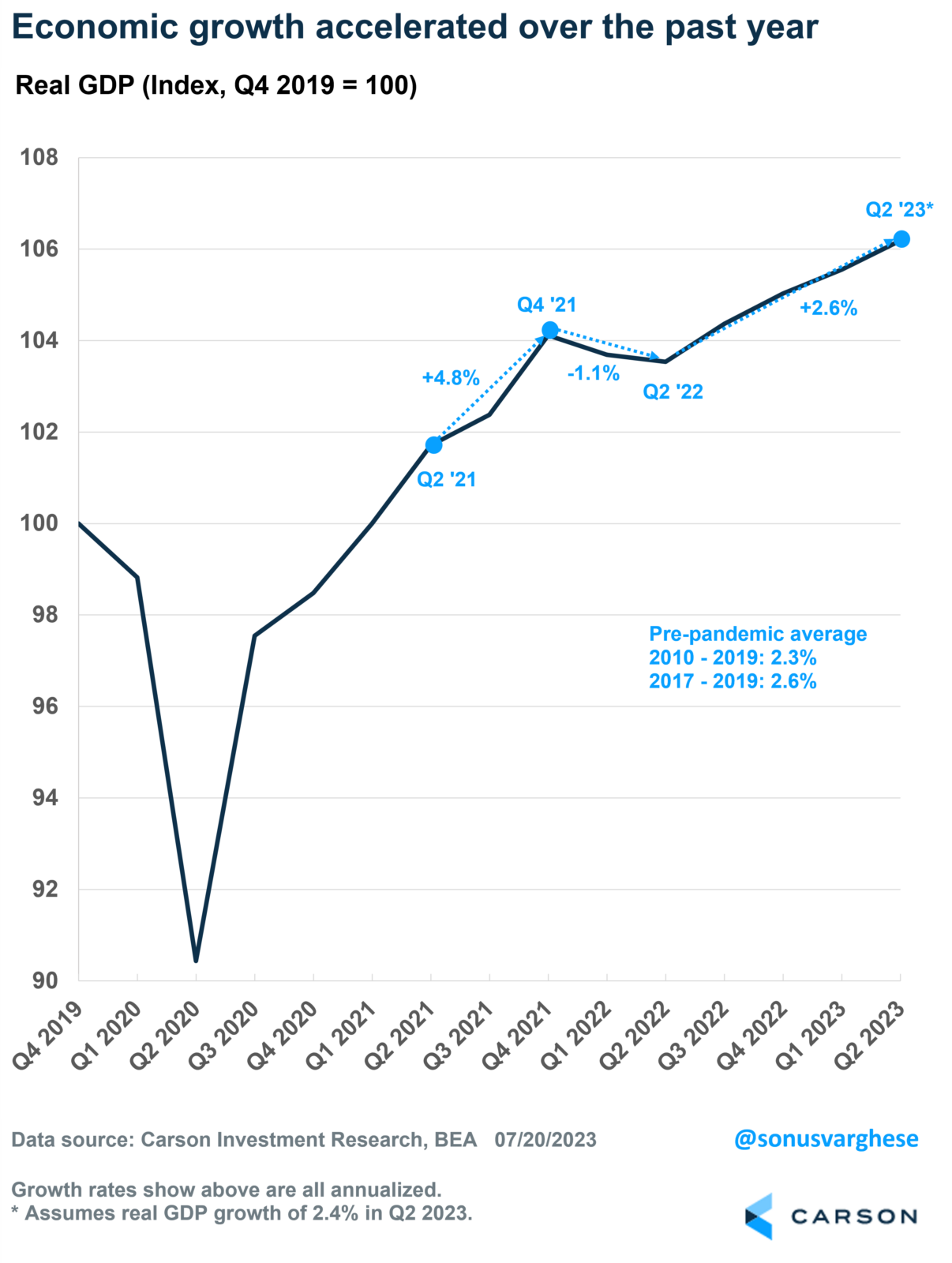

All These Points to Strong Economic Growth

The Atlanta Fed puts out a “nowcast” of quarterly real GDP growth that is updated with major economic data releases. Right now, it says the economy grew 2.4% in Q2, after adjusting for inflation.

If that is close to actual GDP growth in Q2, it would mean the economy grew 2.6% over the past year. That is not only stronger than the average 2.3% pace of growth between 2010 and 2019, but it also matches the pace of growth over the three years prior to the pandemic (2017-2019), when economic growth picked up.

What is amazing is that the economy accelerated after a poor first half of 2022 even as the Federal Reserve hiked rates aggressively, taking the federal funds rate from 0.25% to 5.25%.

Meanwhile, the unemployment rate remained steady at 3.6% over the past year, and headline inflation fell from 9% to 3%.

It really doesn’t get better than that. Perhaps more importantly, there is no reason to believe a major slowdown is in the cards at this point.

Ryan and I talked about all this while discussing our Mid-Year Outlook “Edging Closer to Normal” on a recent episode of our podcast, Facts vs Feelings. Take a listen below:

01840814-0723-A