This week we dropped the 26th episode of our Facts vs. Feelings podcast, and it was a good one. We had Professor Jeremy Siegel on with Sonu and myself, and boy, did we have fun.

Here are some highlights from our discussion. I won’t give it all away, as we want you to watch it at the bottom of this blog.

- Why stocks for the long run? Professor Siegel wrote the first edition of his masterpiece Stocks for the Long Run in 1994. Over that time, we’ve had many crises, recessions, wars, and pandemics, yet stocks have done extremely well, much better than nearly all assets. By Sonu’s math to the tune of 9.5% annually since the first edition came out.

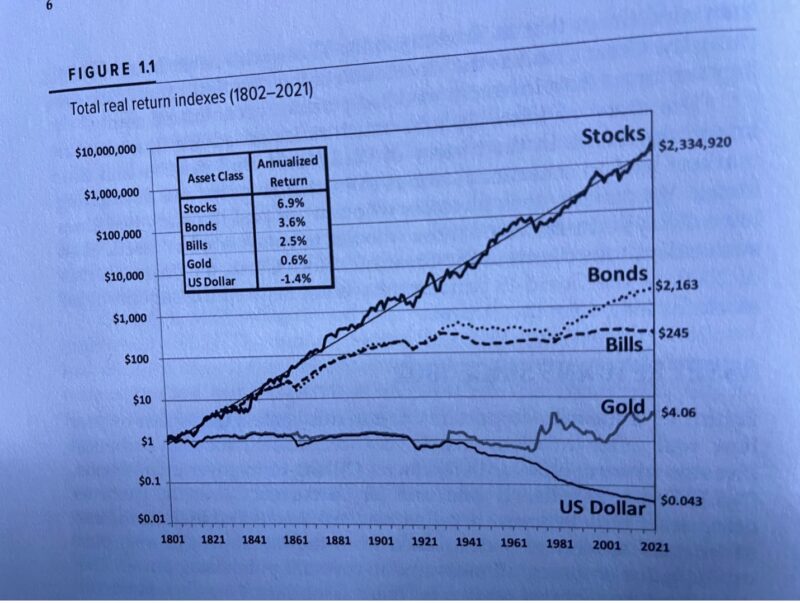

- But it isn’t just the past 30 years; here’s an image from his book that shows how stocks have done better than other assets since the early 1800s! It is what it is, stocks are one of the best ways to increase wealth over time, and we don’t expect that to end anytime soon. For this very reason, this is why in our longer-term strategic models, we remain overweight stocks.

- What has changed since the first edition of your book? ETFs are a huge part of investing now that simply wasn’t around back then. Also, electronic trading is new. Back then, the NYSE handled maybe 90% of all the trading volume. Now, it is closer to 10%. The final thing is that commissions have collapsed, while the minimum bid/ask spread was 1/8th of a point, whereas today, they are a penny or two.

- Is the Fed going too far now? Yes, yes, they are. Professor Siegel was one of the few voices in mid to late 2021 saying the Fed needed to raise interest rates as inflation was going to soar. Well, now we are on the other side of things, and they’ve likely hiked too much now in an effort to slam the brakes on. He pointed out the big drop in money supply recently, and how they should be going softer or they will create another crisis. Lastly, he’d pause now and start lowering rates, as he sees no inflation in commodities.

- Will we go into a recession? It is 50/50 right now and went up during the recent banking crisis. We did have two quarters of negative GDP last year, so what do we mean by a recession? If the Fed loosens up now, we can avoid it. Milton Friedman himself said it would take 12 to 18 months for monetary policy to have an impact on inflation. Given that the first hike was a year ago, it was always unrealistic to think we’d solve the problem in a year.

- What about credit creation? A lot of banks are looking at more questionable loans, and they might not give it anymore because what will the regulators say? It is almost like increasing the Fed Funds rate. Lending standards jumping up is almost like a de facto rate hike. What we saw with SVB was like two or three 25 basis point hikes.

- What about FDIC insurance? It is up to $250k insured now, but he thinks it should move up to $1 million. It has been stuck at $250k for about 15 years, and it has never been indexed to inflation. Additionally, payroll accounts should always be insured.

- One of the biggest mistakes investors make? Trying to time the market. They take money out at the bottom or put more in at the top. If you like to do that, take 10 or 15% to do that, but not with the bulk of your savings.

Be sure to check out the 6th edition of Stocks for the Long Run if you don’t own it yet, and please watch or listen to the entire interview below.