Financial advisors create awareness about their business and strengthen their reputation through brand building, where your goal is to inform potential clients that you can provide financial advice and that the services you provide are valuable. But the next step to brand building is turning that awareness into an audience you can actually contact and provide services to.

Lead generation for financial advisors is a critical component of a successful growth strategy, aiming to gather information about potential clients who need your services now. Lead generation strategies come in many forms, including digital advertising, event networking, connecting with centers of influence and more.

Think about it like a funnel: if your funnel is too narrow at the top because your target audience doesn’t have awareness of your business, you aren’t going to be able to rapidly grow your business. In turn, if you aren’t targeted and thoughtful enough at the bottom of the funnel, you are going to be wasting time with prospects who aren’t qualified or ready to work with your business. A well-developed marketing strategy incorporates both awareness and lead generation, based on the needs of the firm.

If you are like most financial advisors, you are always looking for more effective ways to get better qualified prospects to your door.

Let’s look in more detail at the different methods financial advisors use to generate new leads, how to take advantage of each source, and how to determine which strategy is right for your firm.

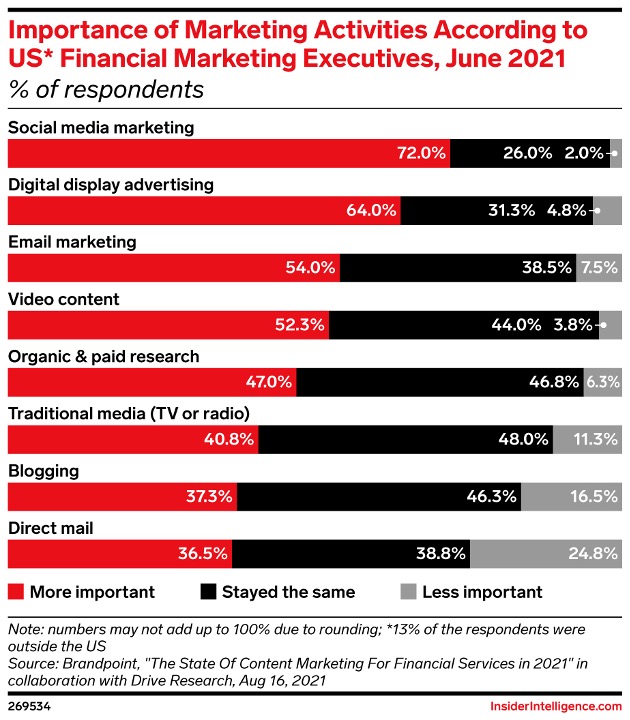

Source: InsiderIntelligence.com

Table of Contents

- Digital Advertising

- Downloadable Content

- Webinars

- Referrals

- COI Relationships

- Direct Mailing

- The Bottom Line

Digital Advertising

Digital advertising can serve as a main pillar for broader lead generation for financial advisors, as it offers significant opportunities to track data and metrics. Think of this category as including paid search, social media, display advertising, video ads, email and more – anytime you are promoting your business through a digital channel. For example, you can learn how many people view your ads and interact with your content as well as what percentage of your audience reaches out to your firm.

One effective approach for digital advertising is to work with a broad-scale platform such as Google or Amazon to buy media space across their network of sites targeting potential clients, such as people in a particular ZIP code who have expressed interest in getting financial advice. In addition, many financial advisors have found success in using digital ads to convert viewers into clients using aggregators like Smart Asset. These networks leverage their own content, including surveys about readers’ financial needs, to provide leads to financial advisor firms.

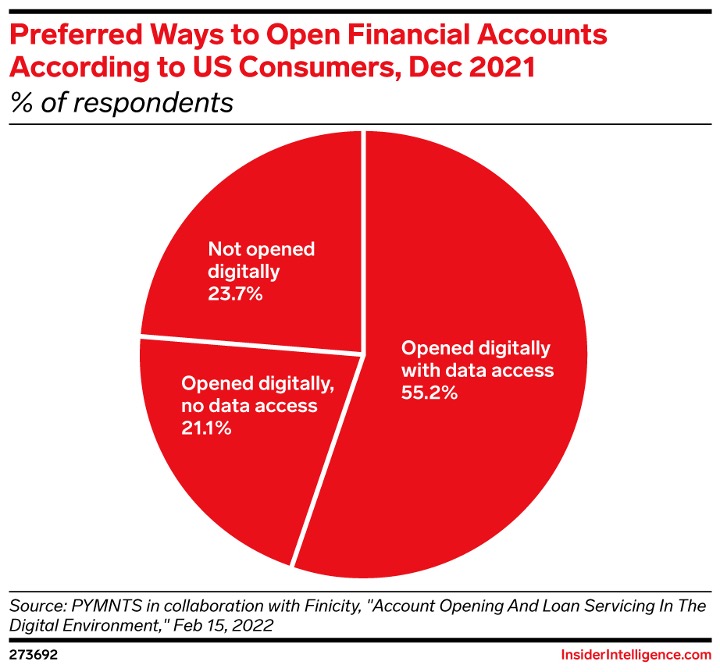

You can set a budget for digital advertising and then test how different ad strategies work for you. It’s no wonder that digital advertising channels continue to rise in popularity among financial advisors of all sizes – be it the measurability, the post-pandemic desire to perform financial activities online, or the availability of options for all budget levels, digital advertising can likely offer some value to your business.

Source: InsiderIntelligence.com

Downloadable Content

You’ve probably heard that “content is king.” You can establish your knowledge with unique, inspiring and thought-provoking material that engages readers. This type of content can successfully attract people who may be interested in working with you.

Then, offering relevant content in a downloadable form can open several opportunities for proactive lead generation for financial advisors. You can create a downloadable channel to help you better understand your readers’ goals. Simply publishing an article can drive volume, but when you make it downloadable, you can include a gateway that asks them for more information. For example, you can learn their name, ZIP code, email address or phone number. Then, you can nurture that lead by following up with more engaging material that highlights your thought leadership, which, in turn, could lead to them becoming a client.

Essentially, with downloadable content, you are asking for contact information while still respecting your readers’ privacy, because you are asking for the information in exchange for your content.

Webinars & Online Events

Webinars, or online seminars, can provide ample opportunity for lead generation for financial advisors through a distinct format. You’ll be able to identify potential clients with the list of attendees and produce content from the session to use in other formats to further engage with your target audience. For example, you could repurpose a webinar’s content on retirement savings tips as a topic for a downloadable article that can foster more leads.

When you host a webinar, you can record the event and then share the link through emails or offer it as a download in exchange for contact information from potential clients. In these ways, a webinar can provide lead generation value beyond just the live event itself.

Consider tracking the ratio of the number of your pre-registrations compared to your event attendance. This can help you adjust your topic, invite list and the amount of time you pour into developing the event. Monitor this data over time to ensure you’re seeing increases or at least maintaining a ratio that results in positive value for your firm, which may vary by firm according to your topic and target audience.

One other way to think about webinars is as a digital event or conference. In-person events and conferences can be expensive to host, labor-intensive to execute and limited in value if your goal is to drive leads ready to convert. However, deploying your event content through vehicles such as a webinar can provide a cost-effective path to connect with your target audience.

A word to the wise – today’s best digital events still struggle to create the “magic” of an in-person gathering, so maximizing digital experiences with personalized follow-up and interactions is critical.

Referrals

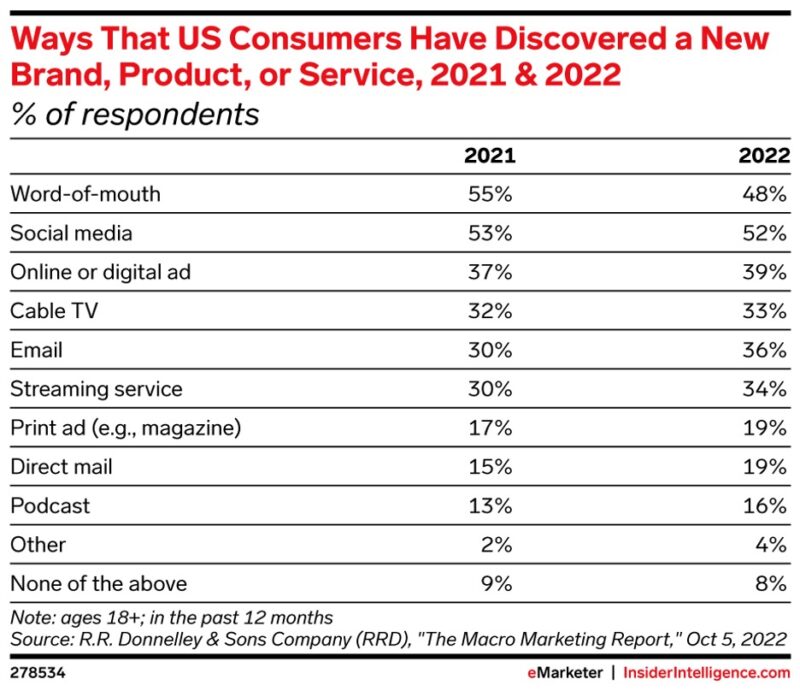

Referrals, also known as word-of-mouth advertising, is a traditional marketing tactic that continues to prove successful for lead generation for financial advisors and service providers broadly. Referrals are essentially generated by your network of clients. You’ll want to have the kind of interactions that inspire others to recommend your business and refer you to potential clients.

Source: InsiderIntelligence.com

Clients may provide referrals on their own, but often you’ll need to be proactive in requesting them. It can be difficult to take that extra step, but it can pay off if you do it appropriately. One challenge with referrals is determining when to ask for them without being perceived as “salesy.” Generally, it’s acceptable to ask for a referral from someone if you’ve recently provided value to them.

For example, if you’ve just helped a client with a financial problem or if you’ve just presented at a chamber of commerce event, it’s probably appropriate to mention that you are accepting new business. In contrast, sending a post to your entire LinkedIn network would be less appropriate because you likely haven’t provided value to all your contacts. The level of trust will be greater from those you’ve interacted with directly and more recently.

Many advisors have developed email templates to ask for referrals, to make it a more streamlined part of their regular process. A simple, personalized note asking someone if they appreciated your work to consider sharing the name and contact information of others that might benefit from your service is all it takes to get started.

COI Relationships

Centers of influence (COI) are people who have influence over your target audience, often by working with them in a different line of business, such as real estate agents or accountants, because they can refer business to you. Who is included as a COI will depend on your specific niche, but focusing on these relationships can be a successful lead generation strategy for financial advisors.

Identify the people who are working with your ideal clients and then work toward building a mutually beneficial relationship with them. For example, you can offer to refer any of your clients who are looking for a home to a real estate agent, and in return you can ask that real estate agent to refer their clients who are looking for financial services to you. CPAs, estate planning attorneys and investment bankers also make great COI relationships.

To meet COIs in your area, consider attending business events such as your local chamber of commerce networking events or economic development events. Other COI hotspots might include community service organizations, nonprofits or churches. You can turn to sources like LinkedIn to find professionals in your community whose skill sets fit your COI criteria. You could even host your own event to connect with a specific group of professionals in your area.

Direct Mail

Direct mail is another high-cost strategy of lead generation for financial advisors. Sending mailings to potential clients will entail costs such as postage and materials expenses, and the logistics will require significant planning time. However, direct mailing campaigns provide lucrative returns in certain scenarios, such as when firms target high net worth individuals who may be retiring soon. Because direct mail offers you the opportunity to provide greater detail about your service and philosophy while presenting a very tangible reminder, it can be a valuable tool for your business.

Direct mailings perform best when you can support multiple mailings over time, which can drain a firm’s resources, so this strategy may not be a good fit for firms that cannot commit to recurring mailings with different content. Consider what you want to get out of a direct marketing campaign, and then fully understand how the costs fit into your budget.

If you do use direct mailings, consider a call to action that doesn’t require recipients to turn to their computers, such as by providing a telephone number instead of a website address. If you do wish to use a digital call-to-action, consider that the recipient is going to have to type in the address manually, and leverage a simple vanity URL, or consider a QR code they can scan easily with their phone.

The Bottom Line

Lead generation for financial advisors works in coordination with brand awareness to connect you with clients who need your services.

Once potential clients know what you stand for, you’ll want to take action through lead generation to start a conversation about their financial needs. This initiative requires another set of tools beyond brand building and different ways of approaching conversations that will lead to a direct response. The right lead generation strategy for your firm will be unique and will depend on several factors about your business goals and operations.

For firms working with Carson Group, we also offer a Client Acquisition program that performs multi-channel awareness and lead generation to deliver highly qualified prospects to advisors. In other words, when you partner with Carson, we’ll plug you directly into proven digital campaigns, qualify potential clients and even schedule your introductory meeting.

To learn more about how partnership can help you rapidly grow your firm, schedule a time with our team today.