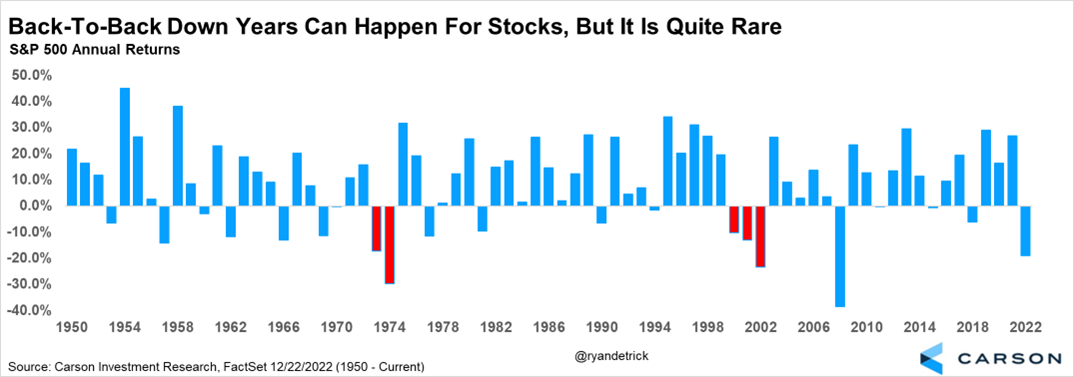

As bad as 2022 has been for investors, there is a silver lining: back-to-back declines in the S&P 500 are rarer than you may think.

If you go all the way back to 1950, the only times that stocks fell in back-to-back years were during the vicious recession of 1973/1974 and then three years in a row during the tech bubble implosion of the early 2000s. Fortunately, we don’t see similar scenarios within the current environment, so I think the odds could favor a snapback in 2023.

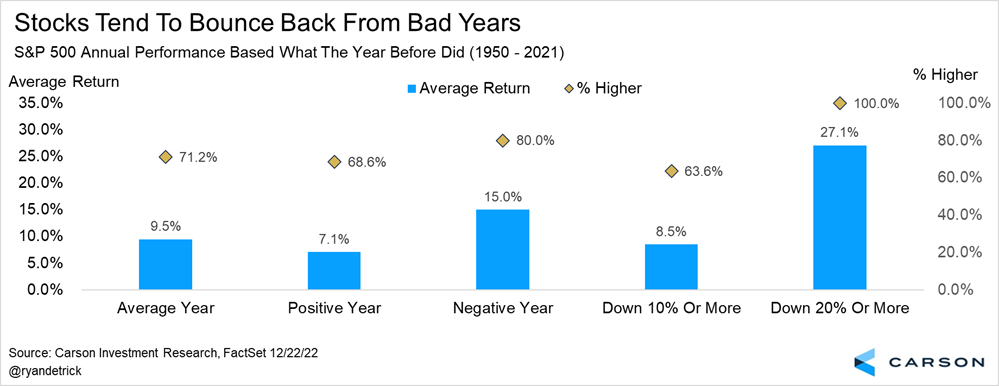

Taking a closer look into the data, we found:

- The year after, a negative return saw the S&P 500 up 15% on average and higher 80% of the time.

- A 10% (or greater) loss showed the following year up only 8.5% on average and higher 63.6% of the time.

- Out of the 20 negative years, only three times did returns get worse the following year (in 1974, 2001, and 2002).

- However, the following year, significant losses were rewarded as 20% or more declines saw the next year higher all three times and up 27.1% on average (in 1975, 2003, and 2009).

- Somewhat surprising to me is the year after a positive year, the returns were only 7.1% on average and higher 68.6% of the time. Take note that the average year since 1950 gained 9.5% and was higher 71.2% of the time.

As we head into 2023, we are putting the finishing touches on our Outlook 2023, be on the lookout for it early next year. And if we don’t talk to you until next year, have a great New Year (and go Buckeyes)!