The August payroll report was kind of ok on the face of it. Payrolls grew by 142,000 in August, below expectations for a 165,000 increase but these things are noisy. The unemployment rate also declined from 4.3% to 4.2%, which is welcome. However, read one step beyond headlines and it’s fairly clear the labor market is softening. That does not mean we’re in a recession, or one is imminent – it just means risks are rising, and the Federal Reserve (Fed) needs to act.

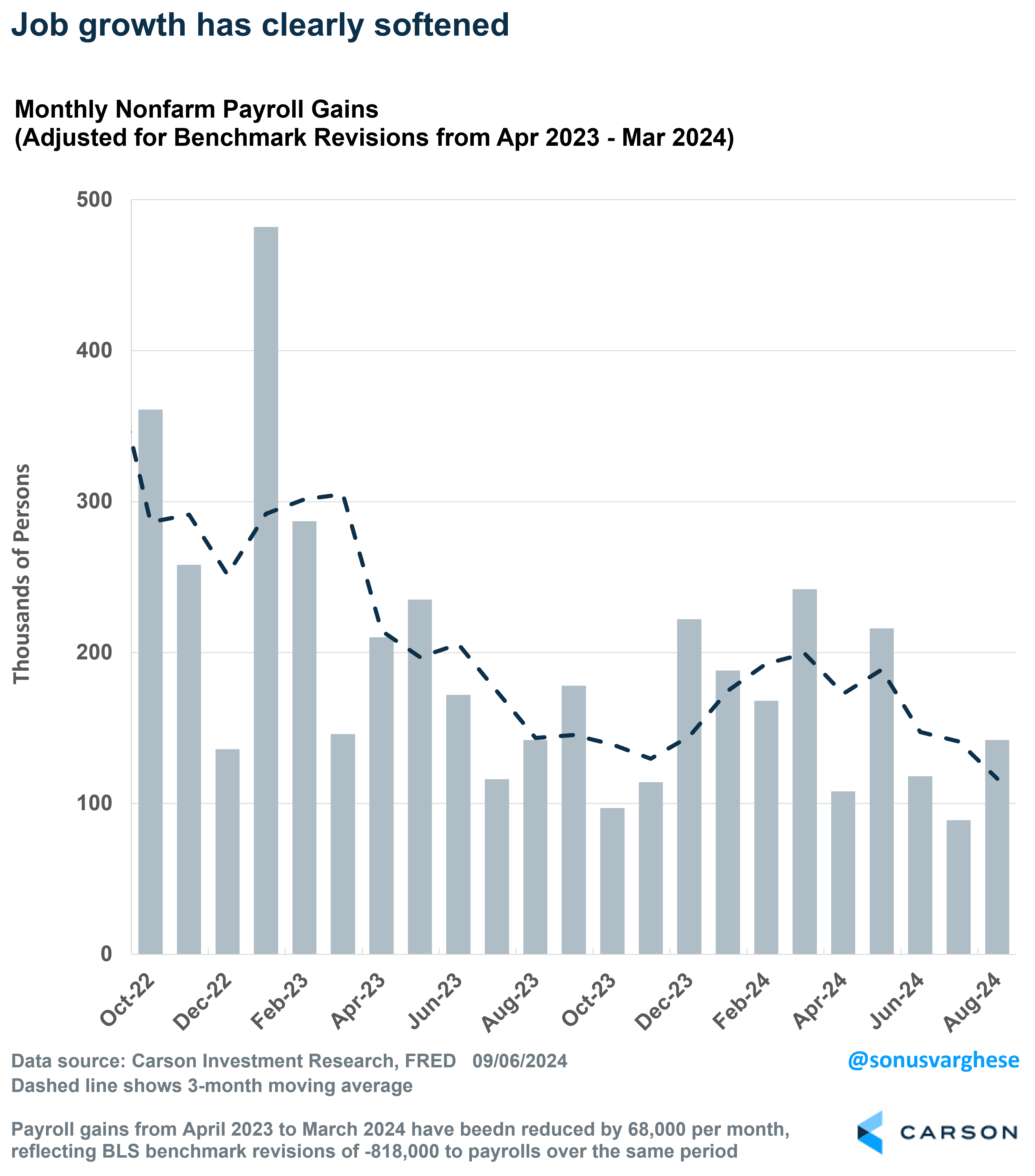

As I noted above, monthly payroll gains are noisy and so it helps to take an average. With revisions to June and July, monthly payroll gains have now averaged just 116,000 over the past three months. That’s barely enough to keep up with population growth, and a deterioration from earlier this year. The 3-month average was running around 199,000 back in March (after including recent benchmark revisions by the Bureau of Labor Statistics, which took April 2023-March 2024 payroll growth from 2.9 million to 2.1 million).

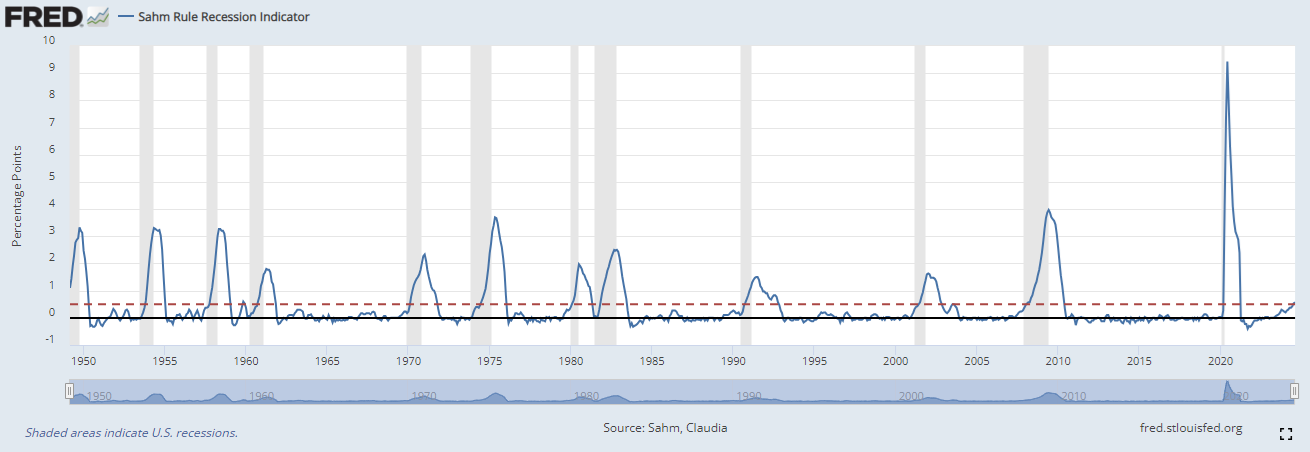

The unemployment rate has been rising as well – it was just 3.7% when we started 2024 and is now at 4.2% (unrounded, the unemployment rate fell from 4.25% in July to 4.22% in August). Historically, when the unemployment rises, it continues to rise. That leads to a negative feedback loop between hiring and spending (with lower incomes leading to lower spending), which ultimately results in a recession. This dynamic is neatly captured in the Sahm Rule, which says that when the 3-month average of the unemployment rate moves 0.50 or more percentage points above the lowest point of that average over the last 12 months, the economy is likely in the early months of a recession. It’s correctly indicated every recession since 1970. My colleague, VP, Asset Allocation Strategist, Barry Gilbert, wrote about this several weeks ago. The bad news is that the Sahm Rule triggered in July and remains triggered in August. The good news is that the preponderance of economic data clearly tells us we’re not in a recession right now. Claudia Sahm herself, the author of the rule, has suggested that the rule may be broken and things may be different this time. Instead of weak demand, the unemployment rate may be rising due to an increase inn the supply of workers (who can’t find jobs easily). The Sahm rule doesn’t distinguish between these two dynamics.

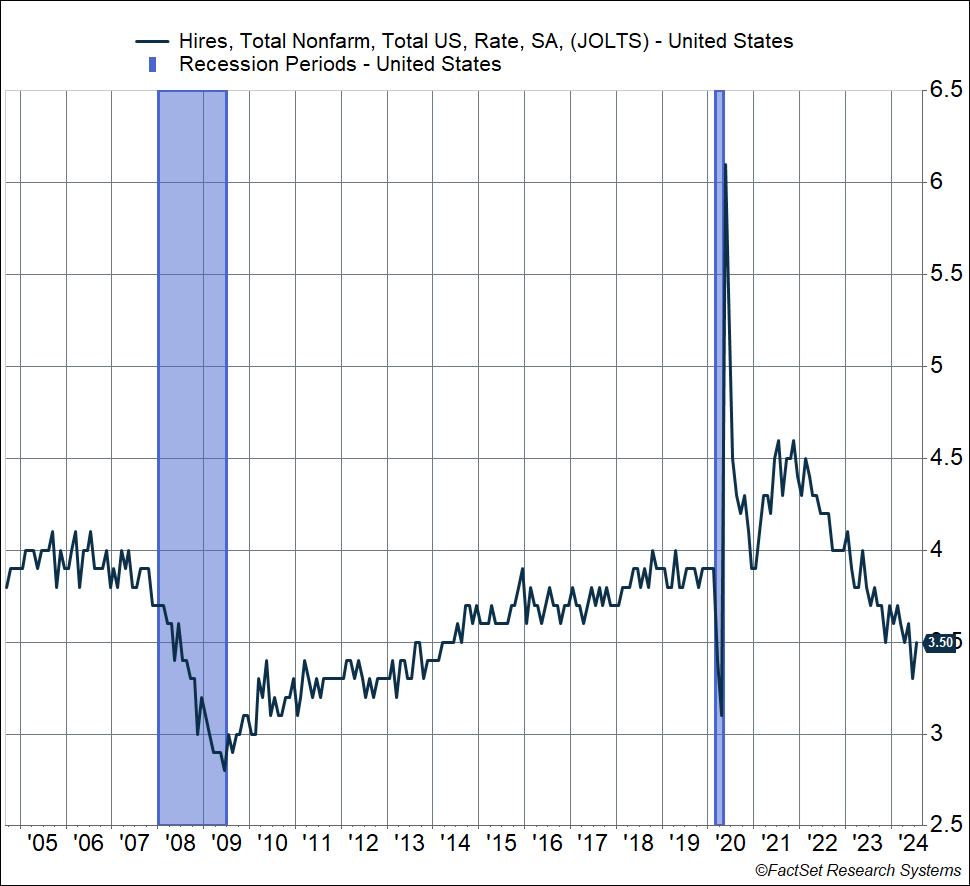

In any case, hiring has stalled. The hiring rate, which is hires as a percent of employment, has fallen to 3.4%. Other than during the heights of the pandemic, the last time hiring was at this level was in 2014. It’s unclear why employers have stopped hiring as much as they have. It could be uncertainty around future demand, policy expectations or uncertainty (from the Fed or Washington), or simply that employers hired too many people in 2021-2022 and have no need to increase payrolls immediately.

Risks Rising Doesn’t Mean Recession Is Here or Near

The only solace in the deteriorating trends I cited above is that that it’s very gradual. Plus, other labor market data suggest that the labor market is in a reasonable place right now. It’s just that the trend is in the wrong direction. But it’s worth highlighting the positive data points.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

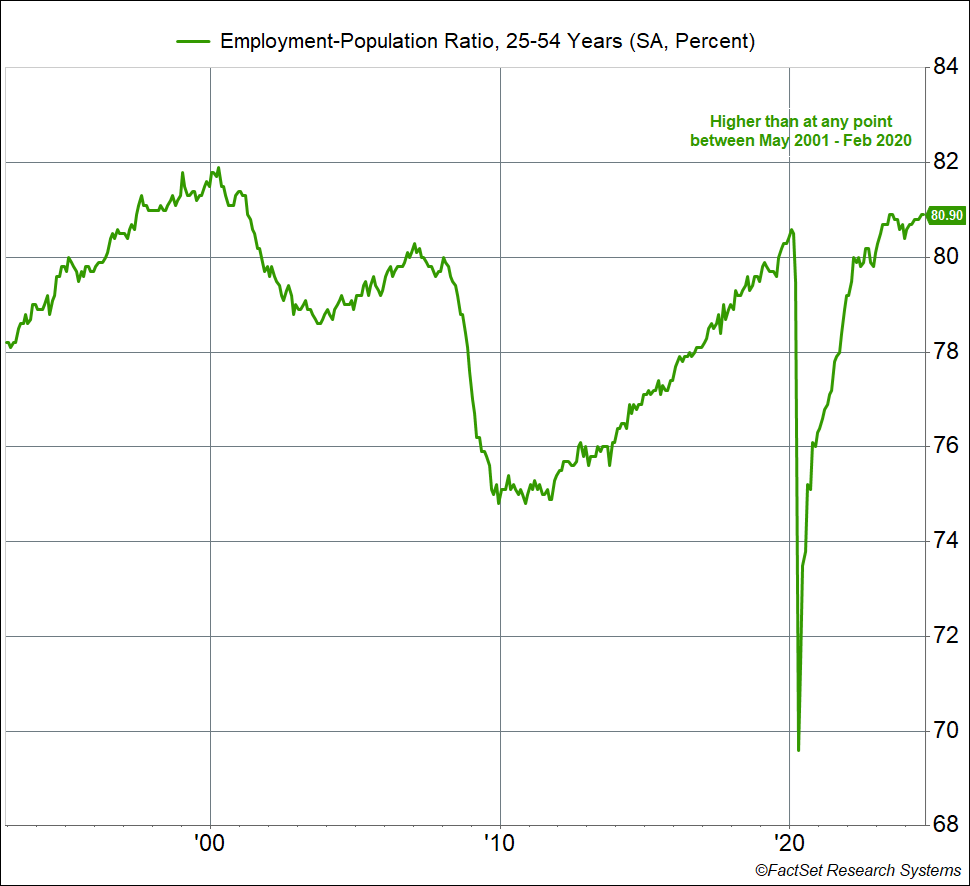

I’ve mentioned in previous blogs how I prefer looking at the “prime-age” (25-54 years) employment-population ratio, since it gets around definitional issues that crop up with the unemployment rate (someone is counted as being “unemployed” only if they’re “actively looking for a job”) or demographics (an aging population with more people retiring and leaving the labor force every day). The prime-age employment population ratio was unchanged at 80.9% in August. That’s higher than anything we saw between 2001 and 2019 (when it peaked at 80.4%). In fact, for women, this ratio is at 75.6%, only a tick below the highest we’ve seen (75.7% back in May). This by itself should tell you the labor market still quite healthy, with more people participating in it. This supports Claudia Sahm’s view that the Sahm Rule has triggered because of more workers coming into the labor force, rather than weak demand.

Layoffs are also low, which should also tell you we’re not in the middle of a recession or very close to one. The layoff rate, which is layoffs as a percent of employment, is running at 1.1%. That’s historically low. For perspective, it was running around 1.2-1.3% from 2017-2019, and around 1.3-1.6% from 2005-2007. Also, initial claims for unemployment benefits, which is one of the better leading economic indicators out there (if you had to pick one) still shows layoffs remain low, in line with what we saw in 2023 amid a strong labor market and even 2018-20019. The “insured unemployment rate,” which measures the number of unemployed people continuing to receive unemployment benefits as a percent of covered employment, is at 1.2% – above where it was pre-pandemic. All of this tells you that people aren’t at great risk of losing jobs, but finding a job has gotten harder (which is why continuing claims for benefits are higher).

So, as you can see, the labor market is still in a reasonably healthy place if the downtrend stops. The good news is that the downtrends can likely be arrested, or even reversed, if the Fed acts to cut off the risks that have clearly risen. As I wrote in a blog earlier this week, the Fed can act on Chair Powell’s recent comments that they do not “seek or welcome further cooling in labor market conditions” with a bigger-than-expected interest rate cut of 0.5%-points at their September meeting. Instead of opting for a more gradual approach that will clearly indicate institutional inertia in the face of rising risks. As Powell himself said, with the policy rate target currently at 5.25-5.50%, the Fed has ample room to respond to risks.

We know the labor market is trending down. The big question going forward is how quickly the Fed responds to get in front of that trend to potentially reverse it.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02399224-0924-A