“It’s not supposed to be easy. Anyone who finds it easy is stupid.” -Charlie Munger, Vice Chairman at Berkshire Hathaway

Before we get into today’s blog, I wanted to take a second and give thanks to Charlie Munger, who passed away Tuesday, and all he has done to make this world a better place. There have been so many amazing tributes to an incredible man, I couldn’t possibly add anything new. I’ll just say this, he was unlike nearly anyone else and there never will be another one like him. Rest in peace, Charles Thomas Munger.

Let’s now get into it and first things first. The best month of the year is sure living up to that name, as the S&P 500 is up more than 8% in November with one day to go, making this the best November since 2020 (10.8%) and 1980 before that. We wrote why we expected better times in November one month ago, but even we have to admit we are surprised by just how strong things have been.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

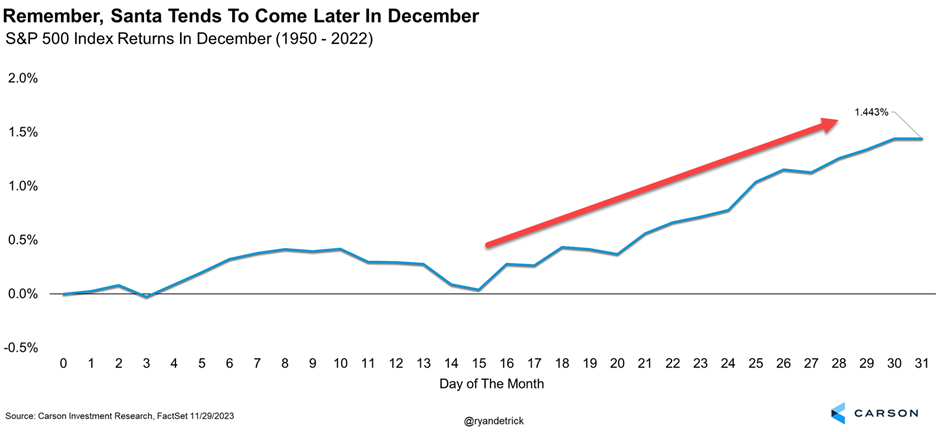

Looking ahead, December indeed is a strong month historically for stocks and we don’t expect this year to be any different. One month ago right now nearly everyone was bearish and the truth is many money managers have been drastically underweight stocks this year and they need to add to their positions, so we expect a lot of performance chasing into the end of the year. Should we see any early December weakness, we’d expect buyers to step in quickly. In fact, early December weakness isn’t out of the ordinary, it is later in the month when Santa tends to come.

Speaking of Santa, you will hear a lot about the well-known Santa Claus Rally (SCR) very soon. This simply is when we tend to see stocks do well to end the year and it playfully is called the SCR. Here’s the catch. It isn’t the whole month, or from late November until year end. It is the last five days of the year and first two days of the following year. Believe me, I will write about it a lot later in December, but by the true definition of the SCR, it won’t happen for many more weeks.

With Santa out of the way, let’s look at December in general and why we expect to see more gains before ’23 is over.

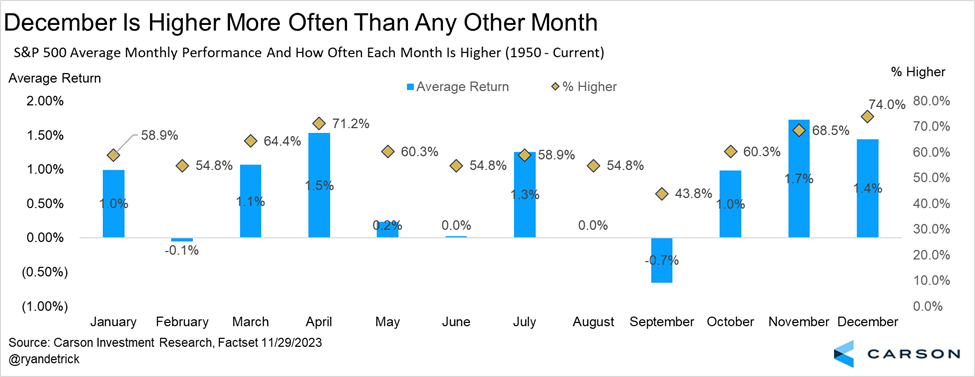

First up, no month of the year is more likely to be higher, with stocks higher 74.0% of the time in the last month of the year. In fact, only once in history has December been the worst month of the year and that was in 2018 (we can thank the Fed for that policy mistake back then). Fortunately, the Fed is likely done hiking and we don’t expect to see a similar policy mistake this time around.

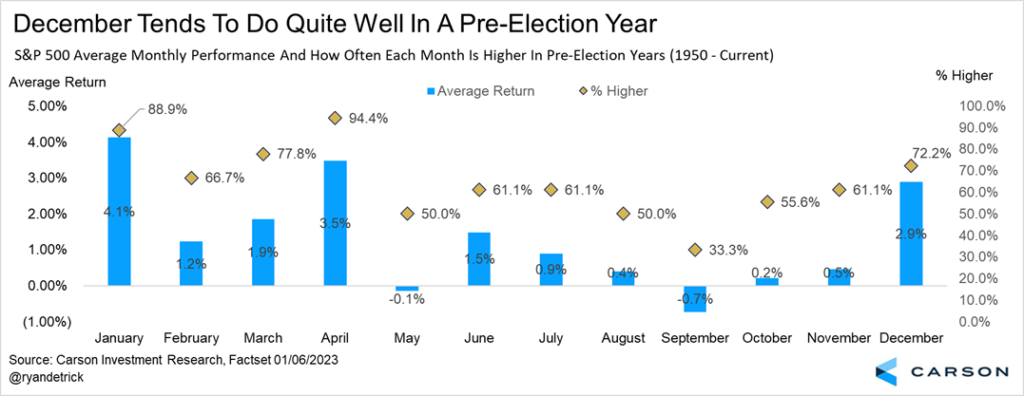

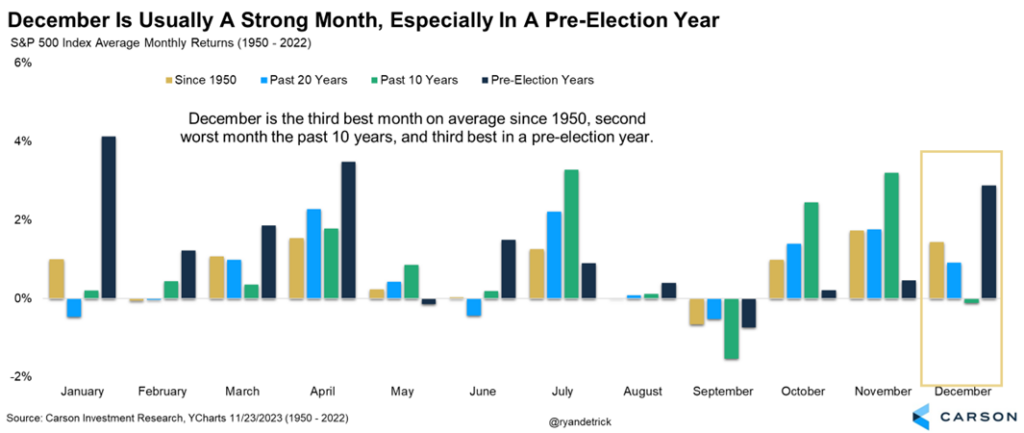

December is actually the third best month on average at 1.4%, with only April and November better. But what stands out to us is pre-election years tend to see even more strength, up 2.9% on average, another reason to expect higher prices before the ball drops on New Year’s Eve.

Here’s a chart we’ve shared all year that breaks down all 12 months based on various timeframes. Well, overall December is pretty solid, but it doesn’t rank very well if you look at only the past decade. But that is mainly due to the 9.2% drop in 2018 and the 5.9% drop last year. Here’s an interesting stat: Stocks haven’t been down more than 1% in December two years in a row since 1980 and 1981. Another reason to expect better times in December.

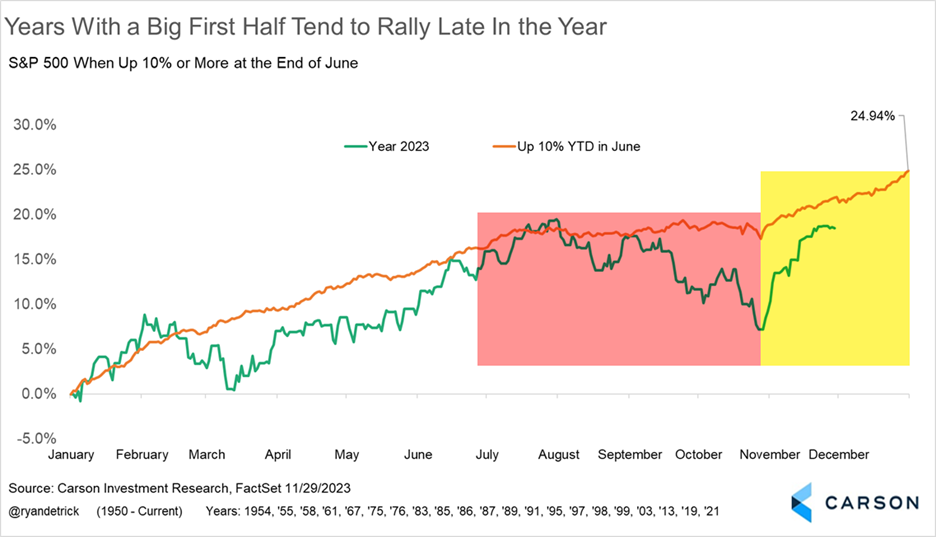

Some more reasons we expect a strong end-of-year rally? We’ve shared this chart a lot lately (because it has played out nearly perfectly) and it showed that years that were up double digits at the middle of the year tended to see weakness around the third quarter, but a late October low and vicious rally to end the year. This has played out well so far and we expect it to continue in December.

Speaking of the market being up a lot heading into December, we found that when the S&P 500 was up at least 10% for the year heading into December, the final month of the year has been higher 17 of the past 20 years and 12 of the past 13. Taking that a step further, if a pre-election year was higher by at least 10% going into the final month, the past five times December has been higher each time and up a very impressive 5.3% on average.

What about if November was up a lot? One would think a big November might steal some gains from December, right? There’s some truth to that, as we found when November was up 5% or more then December was up only 0.6% on average.

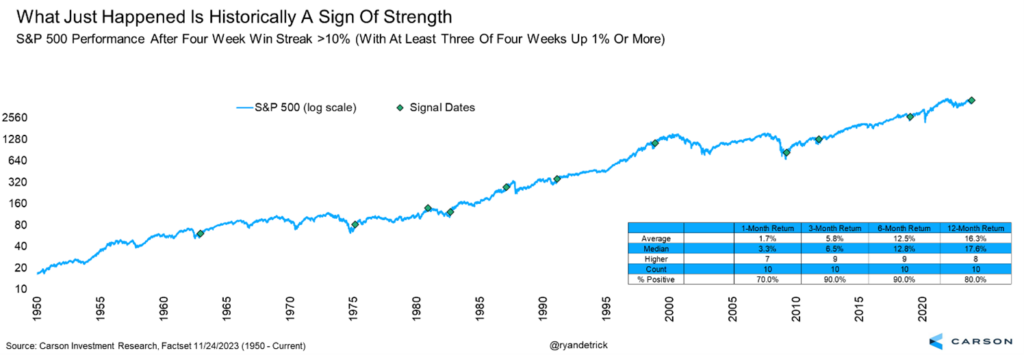

Lastly, we will leave you on this bigger picture bullish development. The S&P 500 has finished higher four consecutive weeks and gained more than 10% over the win streak. But what impressed me was each week gained at least 1%. In other words, there was persistent buying, not just one huge week and nothing outside that. So, I looked at previous times we saw a similar development and sure enough, the future returns have been quite impressive. The S&P 500 was higher a year later eight out of 10 times and up a median of 17.6%, which could have a lot of bulls smiling this time next year.

I was in New York City this week and had the honor to discuss many of our market thoughts with both Bloomberg and Yahoo! Finance. You can watch the interviews here and here.

Lastly, for more of our thoughts on the year end rally, be sure to listen to (or watch below) our latest Facts vs Feelings podcast, as Sonu and I break down why we still expect higher prices in ’23.

For more of Ryan’s thoughts click here.

2003607-1123-A