“We’re going streaking! We’re going up the quad and to the gymnasium.” -Frank the Tank in Old School

The fears of two weeks ago have significantly calmed down and stocks are now streaking. Unlike watching Frank the Tank, we all want to see these streaks.

The S&P 500 was higher all five days of the week last week, last seen in November of last year, something we call a perfect week. But what stood out was stocks saw big gains during the win streak as well, up nearly 4% for the best week of the year. The last two times we had a perfect week, and stocks were up close to 4% for the week? February 2021 and November 2023, which saw the S&P 500 higher six months later 14.1% and 19.0%, respectively.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Even more impressive though is stocks saw their second 7-day win streak of the year, which is quite rare. I found 12 other years that had multiple 7-day win streaks and on average the year gained 18.2%.

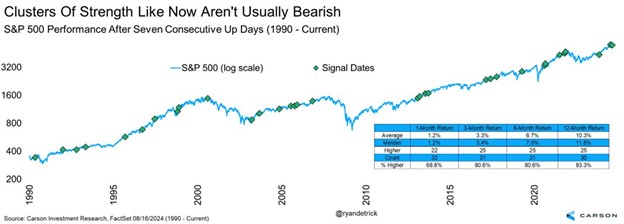

What does a 7-day win streak mean? The bottom line is they rarely happen in bear markets and are another clue we are in a bull market. Going back to 1990 we found this was the 33rd 7-day win streak. The near-term returns could suggest things are a tad stretched, but longer-term above average gains are likely, up a median of nearly 12% a year later and higher 83% of the time, both well above the at-any-time 12 month returns.

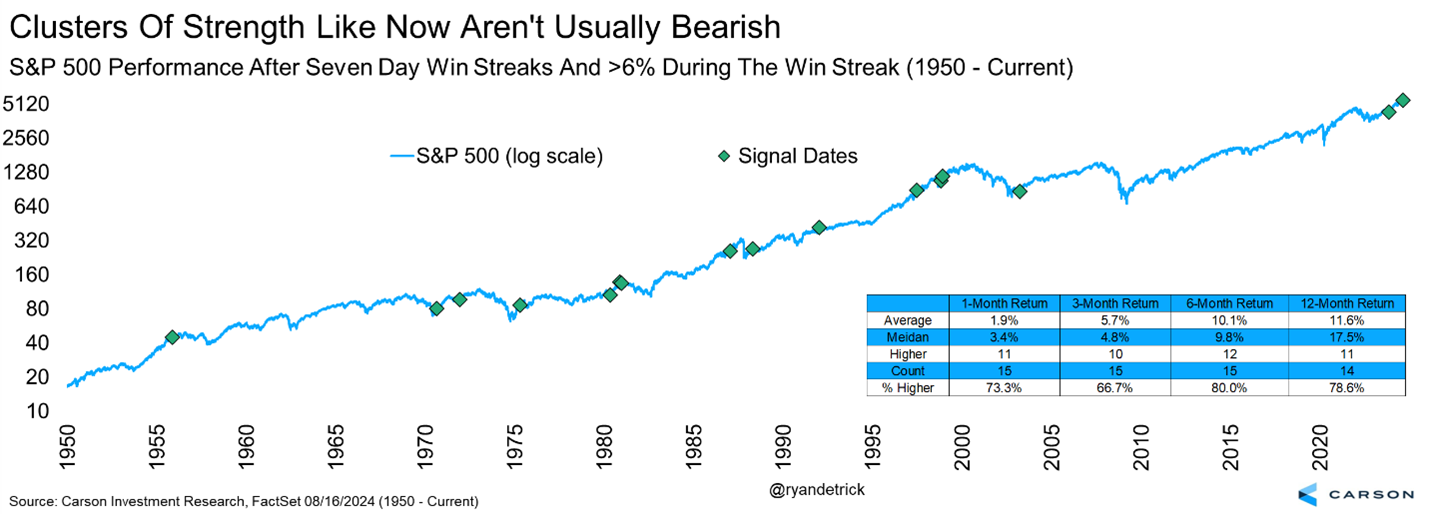

What stood out about this 7-day rally though was how strong it was. There have been plenty of 7-day rallies with small gains the whole time, whereas this one gained nearly 7% during the win streak. In fact, this was the best 7-day win streak return (6.8%) since March 2003 and the start of that bull market!

Looking at previous 7-day win streaks that gained at least 6% or more showed again better than average future returns. Up 5.7% on average three months later, up more than 10% six months later and up a median of 17.5% a year later. Once again, moves like this don’t happen in bear markets historically and they rarely mark the end of the bull market.

I’m writing this blog on Monday afternoon, but it appears stocks indeed did close higher once again on Monday, running the win streak to an incredible 8 days in a row. This rare feat was last accomplished in 2021. What investors need to know is previous years this happened those years saw substantial gains during the calendar year, again suggesting we are in a bull market.

I’ll leave you with two things to think about. First off, this year looks a lot like last year, like a lot. If this continues we aren’t out of the woods just yet. My take is to be aware we have the seasonally weak September and October coming up, along with the election, so more volatility and scary headlines would be perfectly normal.

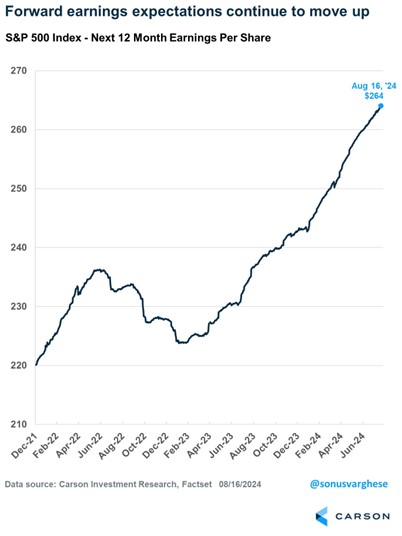

Inverted yield curves, uninverted yield curves, weak LEIs, weak manufacturing purchasing manager surveys, weak consumer confidence, the Sahm Rule triggering, the Federal Reserve (Fed) behind the curve in cutting, a weakening labor market, the yen carry trade unwinding, and more have all been in the headlines the past few weeks. Yet stocks are a few good days away from new highs, how is this possible? Earnings, it is all about earnings. We are wrapping up another solid earnings season and future 12-month expected earnings are at another record. Yes, this could change at any time, but we continue to expect upside surprises, as the economy is likely only in a midcycle slowdown currently and could expand going forward, thus avoiding a recession.

I joined Seana Smith and Brad Smith on Yahoo! Finance on Friday to discuss many of these concepts and ideas. You can watch the full five minute interview here.

For more content by Ryan Detrick, Chief Market Strategist click here.

02373432-0824-A