Another month, another slew of economic data that not only shows that the economy is resilient, but it may in fact be accelerating. Here’s a quick recap.

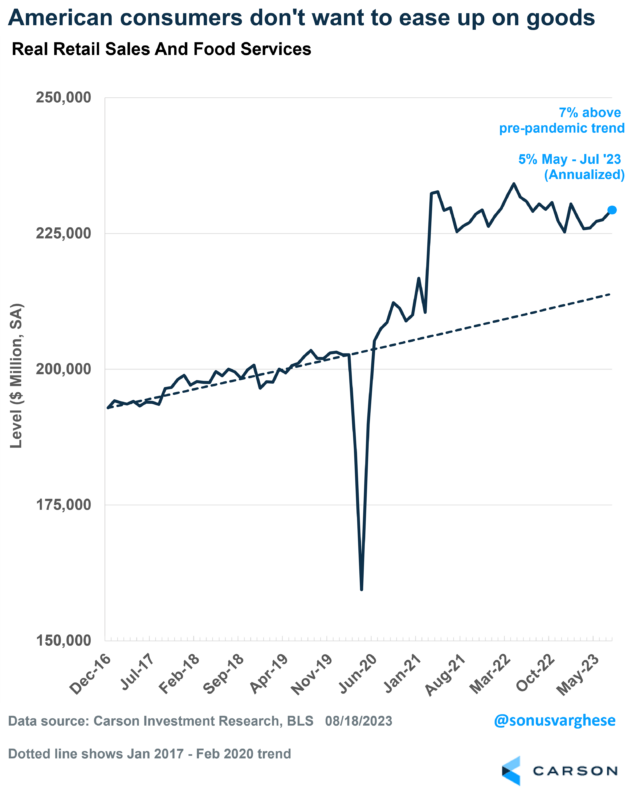

Retail sales and food services rose 0.7% in July. One month may be noisy, but even if you take a 3-month average, retail sales rose 7% at an annualized pace. By the way, inflation was up just 1.9% over this period. Which means inflation-adjusted retail sales rose at a 5% annualized pace and leaves it 7% above the pre-pandemic trend. That’s incredible and it tells you how strong households are.

There are four positive stories on the manufacturing front as well, all of which are tailwinds for the economy.

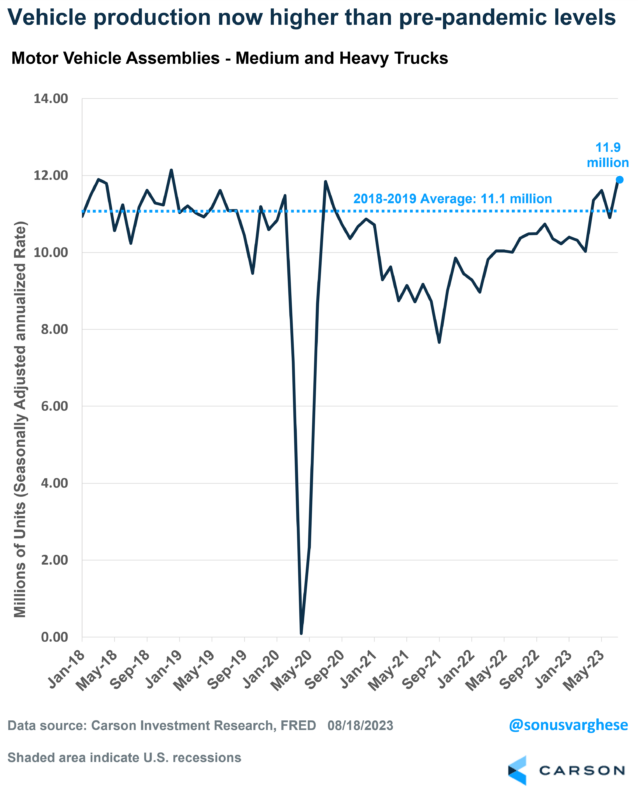

Vehicle production has rebounded to the highest level since 2018 (which means it’s even higher than at any point in 2019). Even with that, we’ve yet to make up for a cumulative shortfall of 5 million vehicles due to pandemic shutdowns, which means production is likely to remain strong.

Production of medium and heavy trucks is also moving up, rising 14% this year.

The aerospace industry is also seeing a boom, with production up 4% this year.

High tech equipment production (computers, communication equipment, semiconductors) is surging once again, rising more than 7% over the first seven months of this year, and up 20% since February 2020 (pre-pandemic).

Suffice to say, none of this is what we’d expect to be seeing if the economy was heading into a recession. These are all large investments companies have to make, and it tells you that they believe future demand is going to be strong.

Overall, this is positive for current activity and GDP growth near-term. But its also positive in two other important ways:

- Inflationary pressure may be reduced as supply increases

- Productivity may rise in the future on the back of investments made today

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

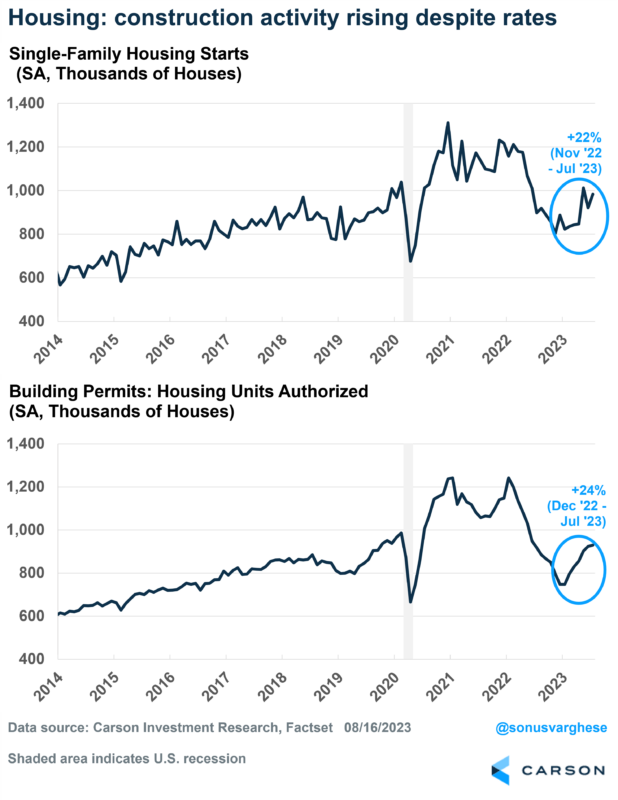

We also received data from the housing market that shows single-family construction continues to rebound. Housing starts rose almost 7% in July and are up 22% since last November. Building permits, which are a sign of future supply, rose just under 1% and are up 24% since December. It tells you how homebuilders are viewing potential demand, despite mortgage rate rising above 7%. This is another tailwind for GDP growth, as we wrote in our Mid-Year Outlook.

All this has sent the Atlanta Fed’s nowcast of Q3 GDP growth to a whopping 5.8%. A month and a half ago, the median expectation for Q3 growth was zero! Which meant half of the polled economists were expecting negative growth. It’s hard to believe GDP will rise close to 4%, let alone 6% (this is after adjusting for inflation) – and we do have a long way to go before the quarter closes out. But the direction should tell you a lot about how the economy is doing.

Higher Interest Rates for Longer, Much Longer

Equity markets have pulled back despite this run of strong economic data. Of course, this is a period that has historically been weak for equities, as Ryan has pointed out. It’s ironic that this is happening even as a lot of bearish analysts are throwing in the towel and switching their estimates to less bearish outcomes.

But it’s the bond market that has my attention.

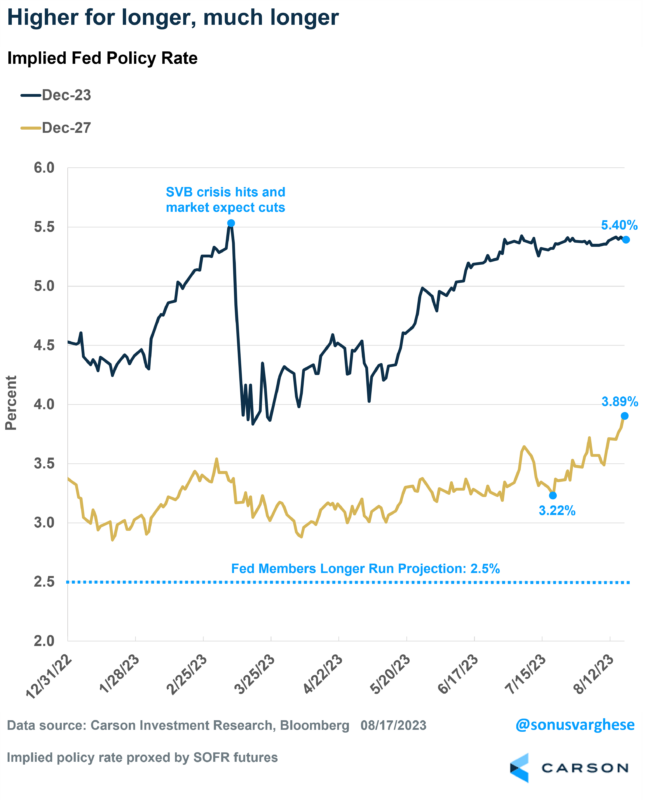

Investors are not expecting the Fed to raise rates any further despite the strong economic data. So, the fed funds rate is expected to peak around 5.4%. A 5.4% peak makes sense because inflation seems to be rolling over, and there’s potentially more disinflation in the pipeline, with vehicle and shelter inflation easing further.

What’s interesting, is that longer-term bond yields have been surging even as short-term rate remain steady. Some of this is because of a potentially increased supply of Treasuries, as the government looks to cover a rising deficit. But investors’ expectations of what may be coming has also changed.

Rising long-term yields mean investors expect the Fed to keep rates on the higher side long-term. The run of strong economic data, including employment, has surprised a lot of investors. As a result, expectations for future growth are shifting higher as the economy proves its resilience in the face of an aggressive Fed and higher interest rates.

Investors do expect the Fed to cut rates by about 1-1.25% in 2024, in the face of lower inflation. But not much more after that.

A month ago, they expected the Fed to keep rates around 3.2% into 2027. That’s now almost up to 4%, which is well above Fed officials’ own “long-run” forecast of 2.5%. This long-run expectation is similar to what the Fed expected over the last decade, and so they’re definitely anchored to that.

Yet, investors see it different. They’re saying that the economy is resilient, and its likely to remain that way. But it also means that interest rates will have to be higher than what we saw over the past decade.