The S&P 500 rallied 2.9% last week ahead of inauguration day, helped by some positive inflation news and a strong start to earnings season. The move pushed the index into positive territory for the year, although still 1.6% below the December 6, 2024 all-time high as of Friday.

Monday was inauguration day, a good moment to check back on what we have seen from markets since election day. We also can compare market performance to 2016, which saw prospects of a similar policy shift to what we are currently experiencing.

Before looking at the market’s early marks for President Trump, let’s give former President Biden his due. The S&P 500 Index grew at an annualized rate of 13.6% for the four calendar years of his term. That’s not as high as the 16.0% for President Trump’s first term, but it is still well above the historical average. The bond market over Biden’s term in office, however, was awful (for bonds), the Bloomberg US Aggregate Bond Index “growing” at an annual rate of -2.2% over his four years. The good news for savers was in short maturity Treasury returns. The Bloomberg 1-3 Month Treasury Bill Index provided an annual growth rate of 3.0% over Biden’s four years and was over 5% in 2023 and 2024. Those high rates have been a headwind for some important areas of the economy, but they did have their upside for savers.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Getting back to our newly inaugurated president, markets have looked differently at the lead-up to Trump’s second term than his first, but there are a couple of basic things they have in common. First, the S&P 500 has climbed higher. The period from election to inauguration has been a little lower this time around, +4.0% versus +6.6% in 2016 – 2017, but 4.0% in less than three months is still above average. Early on this has largely aligned with Carson Investment Research’s view in our Outlook 2025: Animal Spirits.

Second, bond markets haven’t been happy either time. The broad Bloomberg U.S. Aggregate Bond Index is down 0.8% since the election versus down 2.1% last time. The good news there is that bond yields have been rising in part because of higher growth expectations. (That was also true last time.) But inflation concerns are a piece of it too.

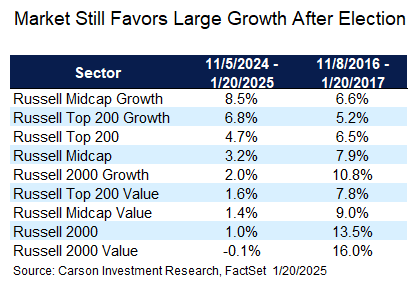

In addition to those similarities, there are also some important differences. In 2016 – 2017 Trump’s election was seen as a major boon to smaller businesses and cyclical sectors of the economy leading up to inauguration. As seen below, the small cap Russell 2000 Index soared post-election in 2016 and the Russell 2000 Value Index was the top style box performer. This election the market has focused more on larger technology-oriented stocks, although mid-cap growth has outperformed large cap growth using Russell indexes. Since that preference has been the primary trend anyway the last couple of years, it’s unlikely that has anything to do with the new occupant of the White House. Better to say the market’s view on technology didn’t change substantially from where it was before the election, but expectations have come down a lot for small caps compared to last time.

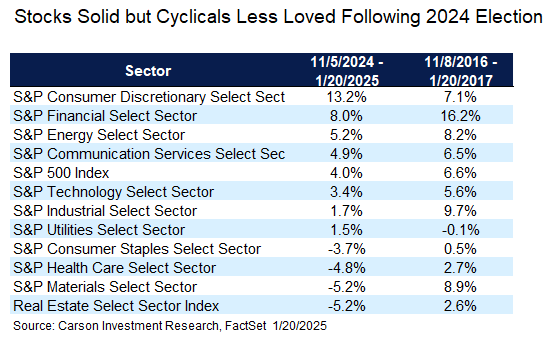

On the sector side, following both elections financials performed well, in part because they are potentially the largest beneficiary of deregulation. But, like small caps, investors have shown less interest in cyclical parts of the economy. The industrials sector and materials sector did well post-election in 2016, but have not seen the same lift this time.

The baseline overall takeaway here is positive. Economic expectations over the next year have lifted from where they were pre-election, although we’re likely to get slower real growth than the 3.0% we had over the last eight quarters. More importantly, between rate cuts and the expected policy shift, the perception of downside economic risk has improved.

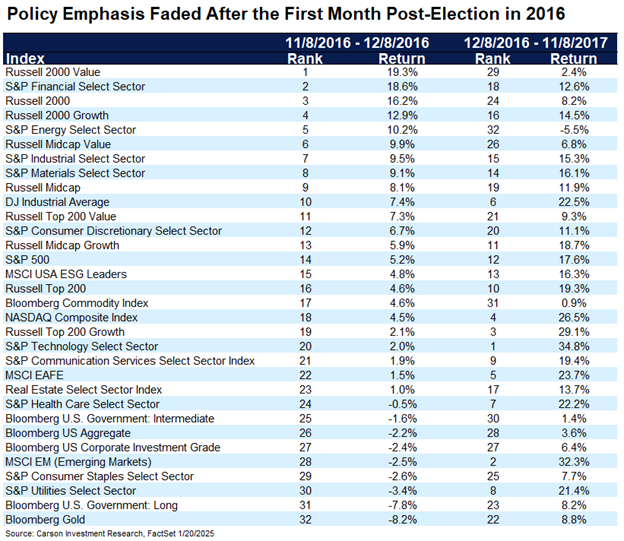

Finally, a caution. While we do see the current policy environment (including monetary policy) as one that may support the rise of animal spirits and economic confidence as it becomes easier to do business, the policy angle tends to quickly give way to macroeconomic fundamentals. As seen below, much of the policy reaction in 2016 was in the first month, but the picture was quite different over the next 11 months as macroeconomic forces came to dominate. From a market perspective, we are optimistic about the policy environment over the next year, but also see some risk of a policy mistake, whether from the White House, Congress, or the Federal Reserve. We’ve seen market’s reflecting similar concerns in some of the recent mild volatility, including yesterday’s positive reaction to the delay in tariffs. But until shown otherwise, we think the policy takeaway for markets will be to the upside.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

7554817-0125-A