Mid-Cap stocks have had a strong start to 2025. The iShares Russell Mid-Cap Growth ETF (trading under IWP) has outperformed both the S&P 500 and the Nasdaq 100 ETFs so far this year. In fact, the recent surge in this index is reaching historical levels, with concentration in the index at a decade-high. This heightened concentration is driven by a handful of explosive companies in the index.

The Mid-Cap Growth Index (proxied by IWP) has outpaced broader market indices so far in 2025. Through February 20th, according to FactSet data, IWP has returned just over 6%, compared to a 5% return for the Nasdaq 100 ETF (QQQ) and 4% for the S&P 500 ETF (SPY). Prior to a decline on February 20, IWP had posted even stronger gains, with more than five percentage points of outperformance leading into last week.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The recent increase in the index’s volatility may be partly attributed to its historic concentration. Due to the index’s annual rebalance in June, its more volatile constituents can drive significant price swings between rebalancing dates. Currently, the three largest holdings in the index account for 9.94% of its total weight (as of 1/31/2025, FactSet data)! That represents the highest index concentration, by this measure, in the last 10 years, and nearly three times the 2015 – 2023 average of 3.8%. This marks a historic surge for some of the index’s top constituents.

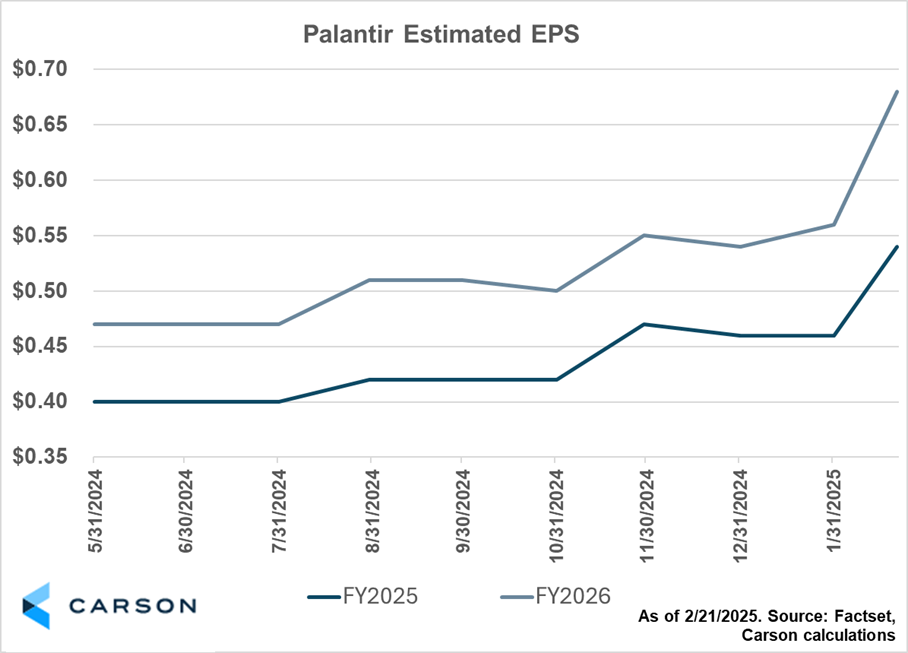

Powering the index’s recent move are Palantir (PLTR) and AppLovin (APP), currently the two largest stocks in the index. Palantir, best known for its data analytics software, delivered a strong earnings beat in its February 3rd report, sending the stock soaring nearly 24% the following day. While Palantir may trade at a high valuation, stock price movements often reflect a “better or worse” dynamic rather than a simple “good or bad” assessment. In that sense, Palantir’s recent large upward revision in earnings estimates signal a significantly better outlook than previously expected. Since June 2024, Palantir’s 2025 earnings per share expectations have increased by 35%, while 2026 estimates have increased by 45%, according to FactSet consensus estimates.

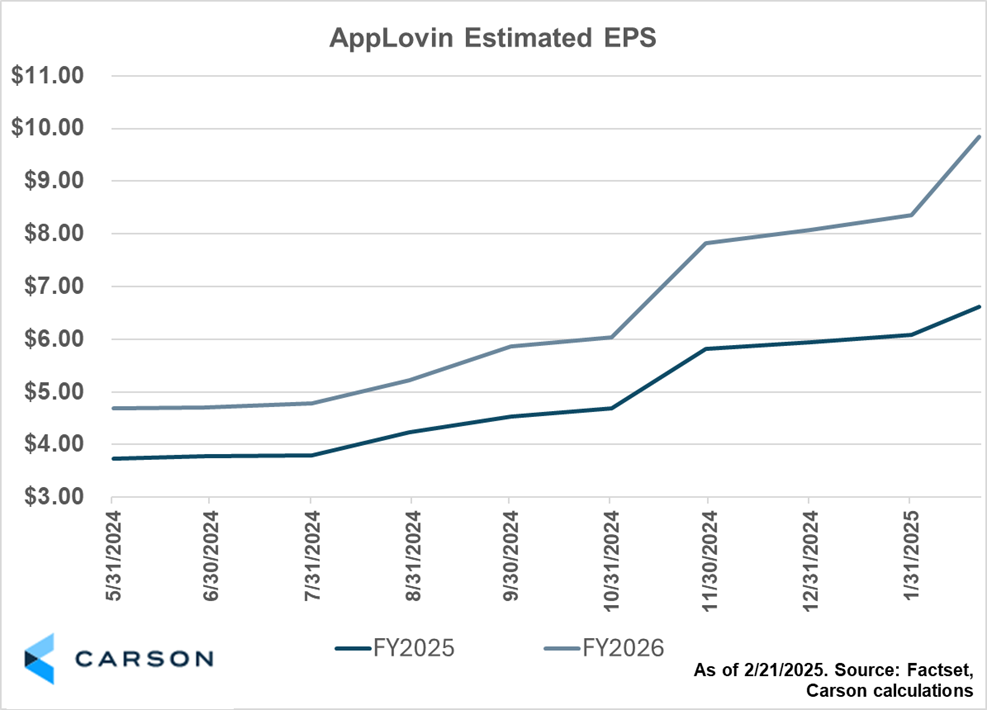

AppLovin has experienced a similar surge. The company, known for its mobile gaming advertising business, has thrived following Apple’s IDFA tracking changes. The company’s 2025 earnings per share expectations have increased 77% since June 2024, with 2026 expectations soaring by 110%, according to FactSet consensus estimates. Both companies demonstrate the potentially higher earnings growth that investors look for when investing outside of larger market indices.

The Mid-Cap Growth Index’s recent outperformance has been fueled by high-growth stories. With index concentration at its highest level in a decade, investors may benefit from understanding the growth drivers behind its largest constituents. Palantir and AppLovin have powered much of the index’s gain, and their rising earnings expectations appear to be a key catalyst. With the index’s annual rebalancing scheduled for June, the Mighty Mid-Caps may remain volatile until the reshuffling occurs.

For more content by Blake Anderson, Senior Analyst, Investment click here.

7667468-0225-A