“It’s tough to make predictions, especially about the future.” Yogi Berra, Yankee great and Hall of Fame catcher

It is official, Donald J. Trump will become the 47th President of the United States. This of course is the second time he did it, joining Grover Cleveland as the only people to ever become President twice, but not in consecutive terms.

Barry Gilbert, VP Asset Allocation Strategist, wrote this excellent blog on 10 Quick Election Takeaways that I suggest you read (after you read my blog first of course 😉). In today’s blog I wanted to build on what Barry wrote, sharing what I found to be interesting these first few days after the election.

Don’t Mix Politics and Investing

We are aware that this decision likely is about as polarizing as could be for many of you. Half the country is thrilled, while the other half is angry and disappointed. I’ll keep this part fairly simple. As a steward of assets our job isn’t to get worked up over the election, but to do the best thing for our clients and the money we run for them.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

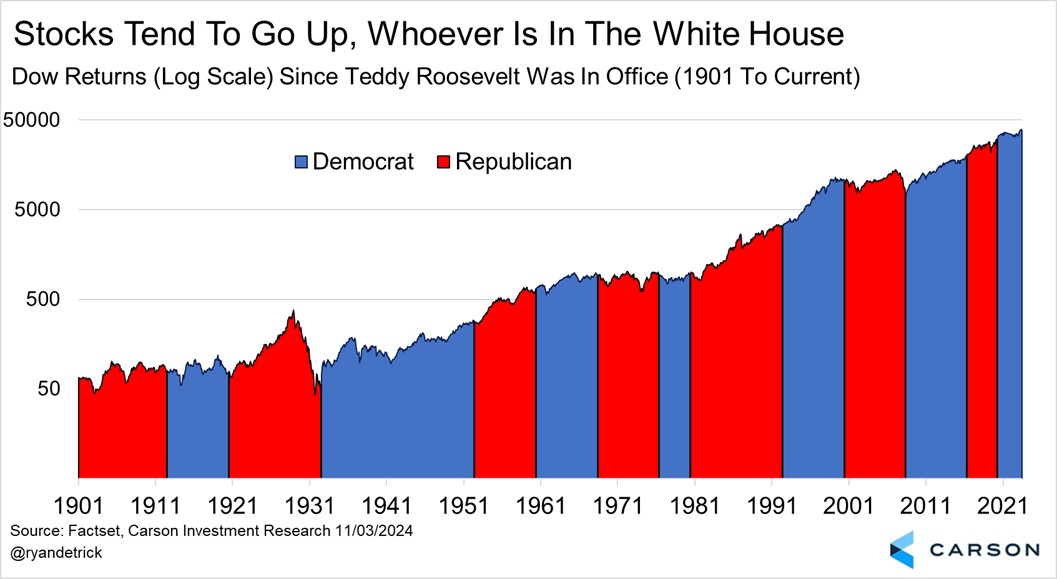

And doing this shows that who is in the White House has virtually no link to how the stock market will do. Yes, technically returns are a tad better under Democratic Presidents than Republicans, but the flipside to this is stocks do much better when Republicans control both chambers of Congress compared to when both chambers are blue. Look at the past few Presidents for example. A lot of people didn’t like President Obama and stocks did great. Many didn’t like President Trump and missed out on big gains. Then many didn’t like President Biden and stocks have been on 🔥 the past two years.

Here’s a neat chart that goes back to 1900 showing that stocks tend to go higher, regardless of who is in the White House.

What Happened?

Safe to say the majority of the pollsters out there were way off, yet again. We had a pollster saying Iowa (Iowa!) could go to Vice President Harris?! That one didn’t make any sense to me then and it sure doesn’t now.

Go read the Yogi quote up top one more time to see how hard it can be to predict the future, as virtually no one had Trump winning like he did. Many noted how the 2022 midterms came in much closer to expectations and maybe this time so would the presidential election, but this is yet another election involving President Trump that saw his eventual numbers come in better than expected, similar to 2016 and 2020.

President Trump is projected to win 312 electoral votes compared with Vice President Harris’s 226. This is more than the 304 he won in 2016 and more than the 306 President Biden won in 2020. It is the most for a Republican President since 1988, but it trails the 365 (2008) and 332 (2012) President Obama won in his two elections.

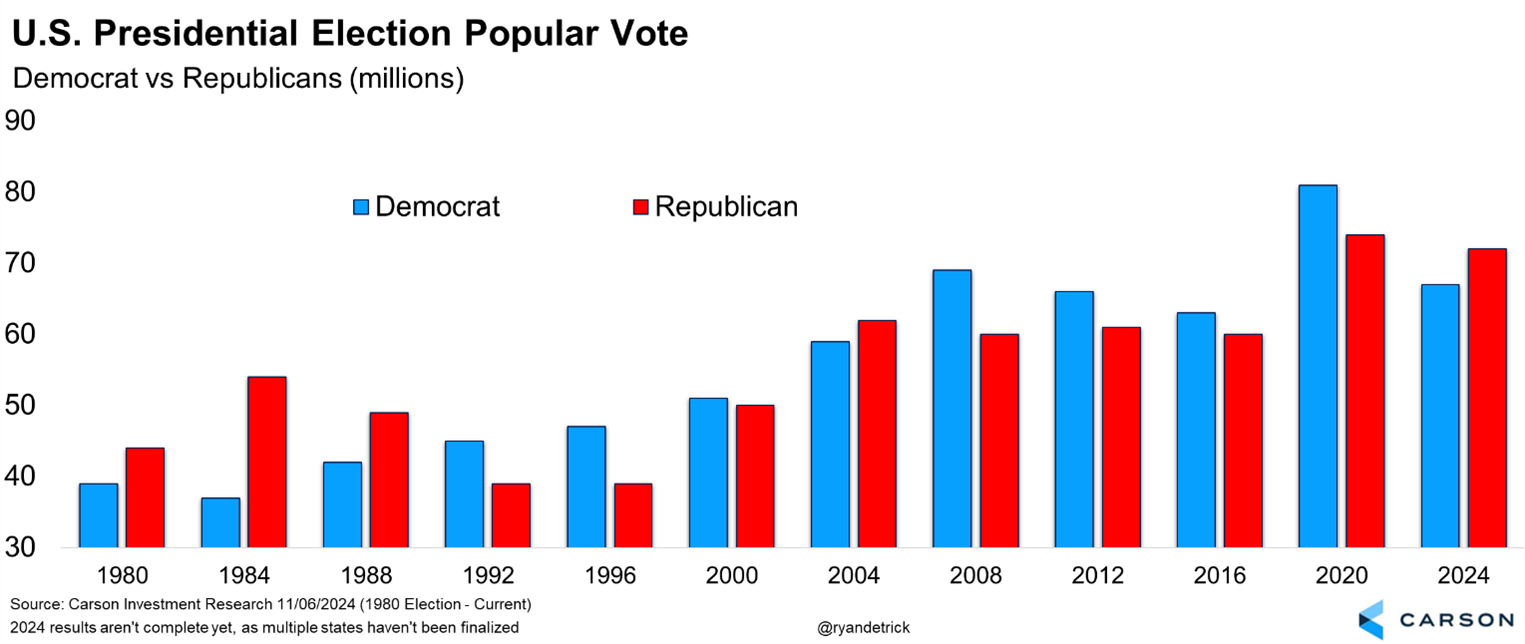

The big surprise though was Trump won the popular vote as well, the first Republican to do this since 2004. He is up to more than 72 million votes, which will go higher once Arizona and Nevada become official. Interestingly, Democratic votes dropped from a record 81 million four years ago to 67 million this go around, although complete California results should increase that a little.

Why Did It Happen?

There were seven swing states that were going to decide the election and President Trump won every single one of them. Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin all voted Republican.

Without being too obvious, President Trump received a lot more votes than expected. But looking at the exit polls it is clear that one group where he did much better than expected was married woman, which came in at 51% voting for President Trump. While Hispanic and Black men also voted at a much higher clip for President Trump than in the past.

Stocks Loved the News

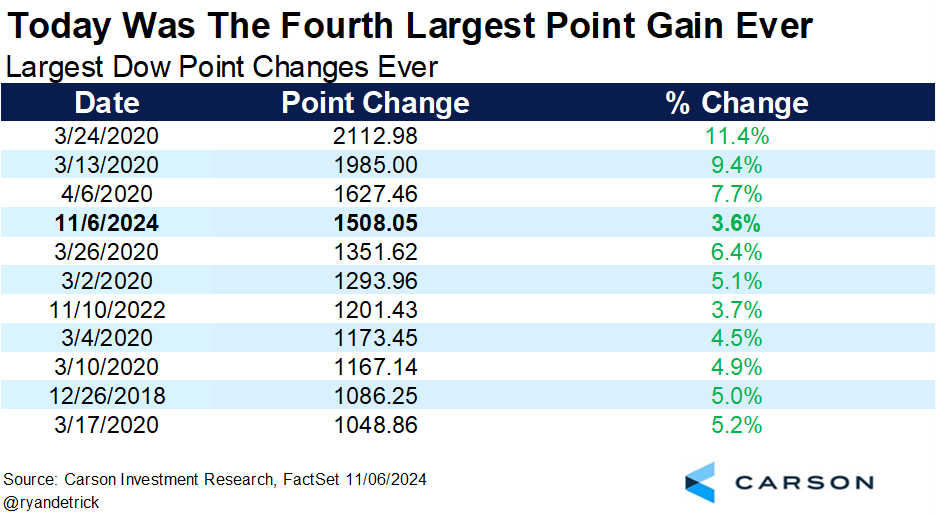

Optimism over lower taxes, deregulation, animal spirits, and improved small business confidence all sparked a huge stock rally, with the Dow up more than 1,500 points for the fourth largest point gain ever, while the 3.6% gain was the best in exactly two years.

The S&P 500 soared 2.5% the day after the election, which was the best post-election day ever. Be aware though, it also jumped 2.2% when President Biden won in 2020. The last eight elections stocks moved at least 1% the day after the election, so post-election day volatility is normal.

Small caps were the big winner on the day though, as the Russell 2000 gained nearly 6%, for its best day since November 2022. This was interesting, as yields soared and the past few years have seen higher yields as a negative for small caps, but optimism over lower taxes sparked the rally. As longtime readers and followers of our team might know, we’ve been bullish on small and midcaps all year and this very well could be just the start to a much better period for these names.

There Was No Post-Election Uncertainty

Another reason stocks soared yesterday was there was no long and drawn out drama around who would win. Here’s something that took me many years to learn. Stocks can take good news, they can even take bad news, but they can’t take uncertainty.

Many of the same polling experts were telling us it might take many days (or even weeks) to get the results. Instead, it was clear President Trump was going to win and as a result stocks gained as another potential black cloud was lifted.

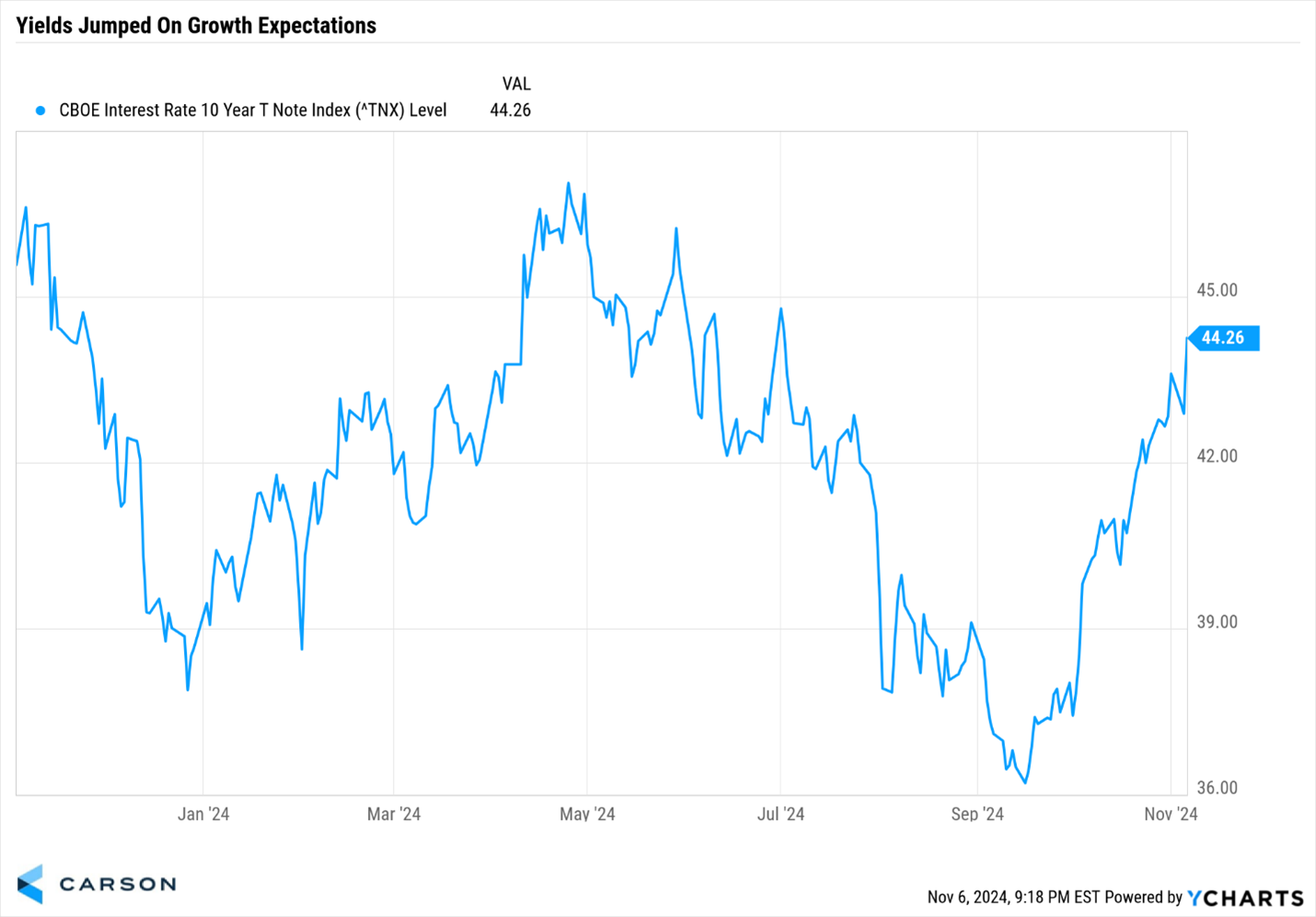

Yields Soared

The 10-year yield continued to move higher, just as it has done since the Fed cut rates in September. In the end, the 10-year yield added 0.14 points to close at 4.43%, the highest level since July. This sent bonds tumbling, as remember that higher yields hurt bond prices and vice versa.

Potential higher deficits, more spending, better economic growth, and tariffs (which are potentially inflationary) were all cited as reasons for the move higher. Perfect world, you don’t want yields to continue to move much higher, as it would hurt the housing market and potentially small companies as well.

The bottom line is yields have moved drastically higher since the Fed cut rates in September and we think there’s a good chance this move has gone too far and lower yields could be coming over the coming months.

So What Really Matters?

Of course, who is in the White House matters, but there are things that matter a lot more for investors. How the economy is doing, Fed policy, inflation, valuations, and overall market trends potentially matter much more.

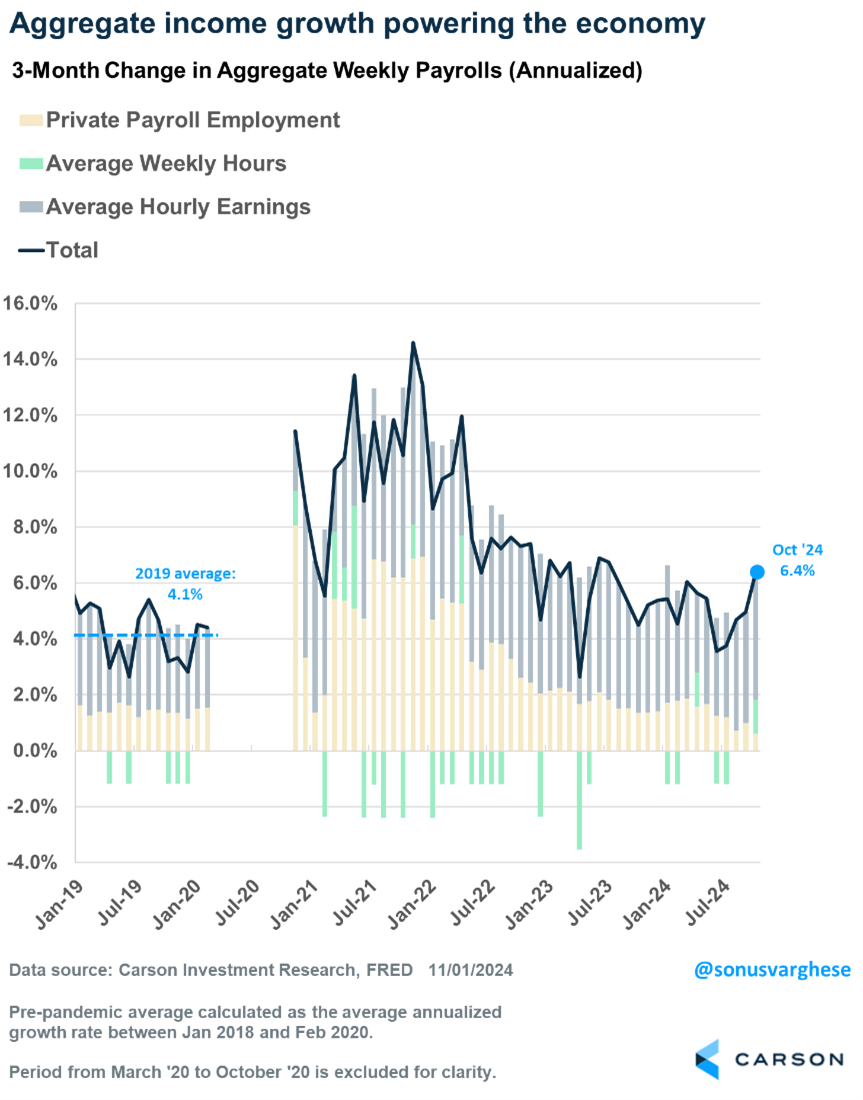

Right now we are looking at an economy that is outperforming and showing no signs of slowing down. Productivity is at some of the best levels since the late ‘90s. We have a stable, but slowing, labor force. Earnings are at record levels. The services sector (which make up more than 60% of our economy) is very strong. And not to be ignored, the Fed is quite dovish. When you combine all of these factors, you can see why we’ve been so bullish the past two years, and why we remain bullish currently.

Lastly, aggregate income growth is running at a 6.4% annualized pace over the past three months. That’s well above the 4.1% pace we saw pre-pandemic. When people are employed and their income is growing well above inflation, you have a big driver for continued solid economic growth.

The Podcast Election

This was likely the first election where people consumed much of their information on the candidates from places other than traditional media. It is appeared that the majority of headlines about President Trump were negative while the majority for Vice President Harris leaned positive, yet more than 70 million people voted for President Trump. How in the world did this happen? The simple answer is people stopped listening to traditional media and instead got to know the candidates in long form podcasts. Millions listened to President Trump for three hours on Joe Rogan and may have decided they liked his demeanor and his take on what was needed to help our country. Vice President Harris had the opportunity to also join the world’s most popular podcast with Joe Rogan but decided against it. I personally think this was a huge missed opportunity. On election night one reason offered for why she did poorly was the country just didn’t get to know her yet. Four years as the VP you’d hope people knew her, but there’s some truth there and more unscripted, long form discussions could have really helped, in my opinion.

In four years we will still have traditional debates, but who’s to say Joe Rogan (or whoever the next big podcaster is) doesn’t have both candidates sit down for a multi-hour podcast with no scripts? I think it is closer to happening than many think and I’d be all for it.

Now What?

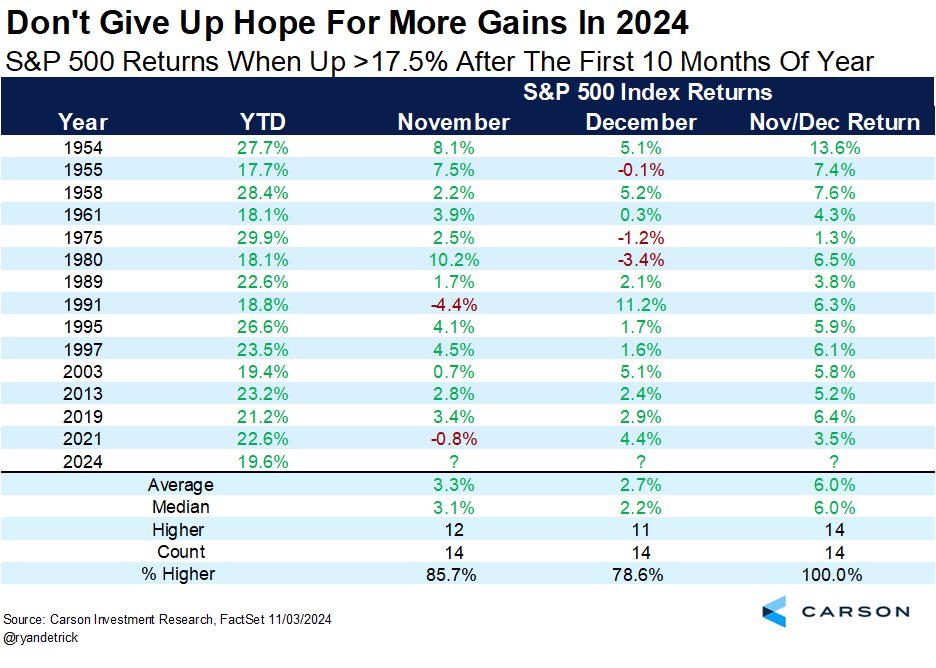

We continue to expect a year-end rally, as the truth is many have been underinvested (and too heavy into cash and bonds) and have missed much of this historic rally. Could there be a chase into the end of the year? Yes, we think there sure could be.

In fact, previous years that were up at least 17.5% heading into the final two months NEVER saw those final two months lower, higher 14 out of 14 times, with November up 12 times and December up 11 times. The bull might have a few more tricks up his sleeves.

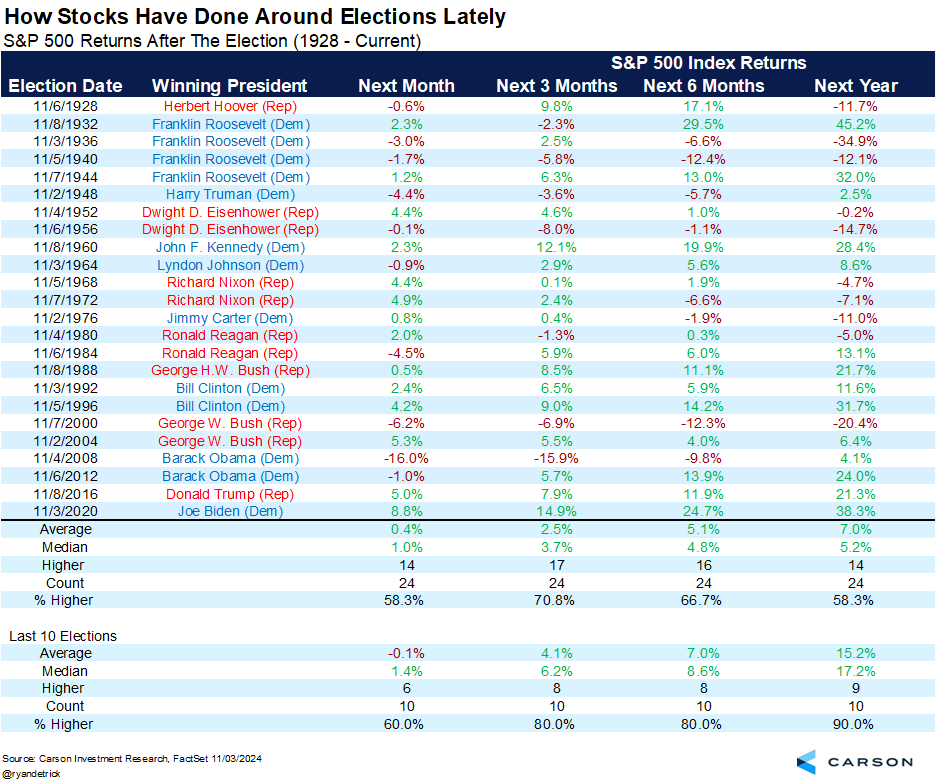

Looking at the past 10 elections we found that stocks were higher a year later after nine of them, and up more than 15% on average. Rallies after elections have been quite common the past 40 years and we think this time will likely follow this same pattern.

Our Hope

Our country is divided and raw right now. Although hope isn’t a strategy, we hope those differences can be mended over the coming months. In the end, we really aren’t that different and we need to get back to that. Being passionate about politics is important, but so is enjoying your life. So many people are miserable all the time over politics and I’d like to think the only people who should be miserable all the time are Chicago Bears fans (that is just a cursed team). If your candidate won, stay humble and know people are hurting. If your candidate lost, know those that voted against you did so because they believed in a change and it wasn’t because they were racist or ignorant.

I was able to join Scott Wapner on CNBC’s Closing Bell on Monday to discuss why a post-election rally was likely and why small caps would probably lead the way. Not a bad start 😉. Enjoy!

For more content by Ryan Detrick, Chief Market Strategist click here.

02498298-1124-A