Fake news alert: Saudi Arabia is not going to stop selling oil in US dollars (USD), and they’re not ending any petrodollar pact. In fact, there is no petrodollar pact, secret or otherwise. So, there’s nothing to renew (or not renew). Nor is there any “paradigm shift” shift in global finance.

The rather mundane truth behind this volcano of misinformation is that the US and Saudi Arabia put together a Joint Bilateral Commission on Economic Cooperation in the 1970s to strengthen US-Saudi relations. Oil prices surged in 1973-74 after the Arab oil embargo, sending inflation surging. Following this unpleasant episode, the US wanted to foster closer ties with the Saudis to avert another crisis. The best way to do that was to get the Saudi’s to invest the proceeds of their oil sales in the US by buying US assets. Note that this was already happening, with the Saudis starting to invest a lot of their oil wealth in the US. The goal was to continue and enhance this trend. The result of the bilateral commission was that the US would give technical assistance to the Saudis across multiple areas – defense, agriculture, labor, science and technology, industrialization – all of which the Saudis would fund using “petrodollars,” petrodollars simply being the dollars received for selling oil.

Crucially, this arrangement was not a formal deal or treaty.

The US built closer ties to a country that could prevent another oil shock. It clearly worked for the Saudis too, as they got 2 things:

- Development assistance from the US

- Assets in a currency (USD) that was liquid and freely convertible (so they could move it around as they liked)

Fast forwarding to the current day, and the irony behind the rumors is that the US and Saudi Arabia are on the verge of signing a historic security agreement, pulling the two countries even closer together from a defense perspective. Also, everything related to the global oil trading systems – financing, transportation, insurance, etc. – is all done in USD. That’s unlikely to change anytime soon, as the network effects are just too strong.

Finally, the US is now the largest oil producer in the world. Which means the biggest source of “petrodollars” right now is the US.

So What If the Saudis Don’t Sell Oil in USD ¯\_(ツ)_/¯

Back in the 1970s, the Saudis didn’t have a lot of other options when it came to selling oil. However, now it looks like they do. The Saudis could “diversify” and start selling oil to the Chinese in yuan and to the Indians in rupees. But what comes next? Once they receive Chinese yuan or Indian rupees, what do they do with it? Ideally, they’d buy Chinese or Indian assets with it, i.e. government bonds, stocks, and/or real estate. That may work, but only up to a certain point. There are a lot of constraints to “replacing the dollar.”

For one thing, US assets are a lot more attractive from a return perspective, especially relative to Chinese assets. Chinese and Indian assets are also not as liquid as US assets. There’s not even enough “T-bill” equivalents to park cash in, like the Saudis (or even you or I) can do with US Treasuries.

Just as important, their currencies are not “fully convertible” like the US dollar is. The dollar is easy to buy and sell on the foreign exchange market with few restrictions (the Japanese yen, euro, and pound are also fully convertible). China and India, by contrast, have strict capital controls, which is why their currencies are not easily convertible. The best way to think about this is that you can buy Chinese and Indian assets but selling them and moving money out of these countries is not easy. China and India are unlikely to loosen capital controls anytime soon. China in particular will likely see a flood of capital moving out of China if that happens, into more “safe” places (like the US).

More likely is this scenario: If the Saudis receive yuan or rupees for their oil, they’re likely to hand it over to someone else in exchange for USD (assuming they find takers for it, which may be quite hard to do at scale). And we’re back to the same place.

Here’s Why the Dollar Will Likely Remain Dominant

The USD is unlikely to be dethroned from its top status anytime soon (maybe not even in our lifetime). Three reasons why.

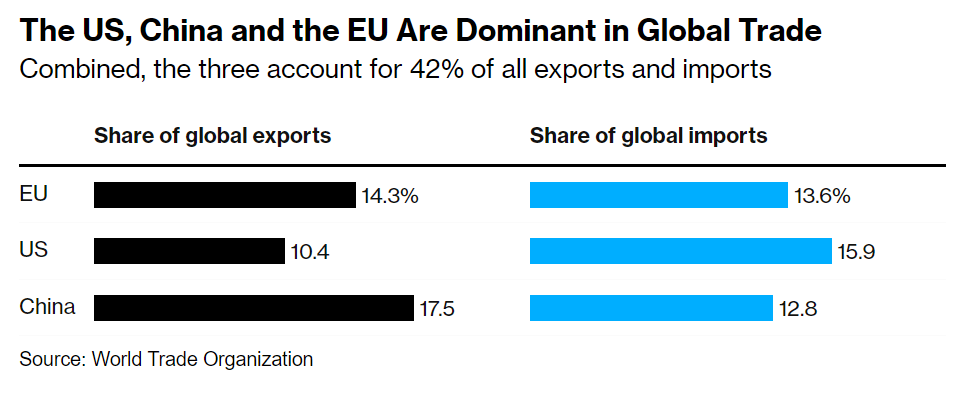

One, global trade is dominated by the US, China, and the EU. But it’s massively skewed, with the US importing much more than it exports. China is the dominant exporter, but even Europe exports more than it imports. All this means the rest of the world is awash in US dollars – which they receive in exchange for supplying Americans with goods. That’s actually a feature of how their economies work, which they rely on in many ways.

And what do they do with the USD they receive? They invest them in the most liquid and deepest capital market in the world, the United States of America.

This dynamic is not going to change unless countries like China start importing a lot more goods from America, which would be very good for American manufacturers and workers. But, for countries like China and Germany to start importing more, their households will have to start earning a larger share of national income. It also means their domestic manufacturers will lose some of their market share. However, the political dynamic in these countries is not going to allow for redistribution from domestic businesses to households.

If you really want to start “worrying” about the dollar’s premier status, a good time would be when the Chinese government implements something like Social Security and Medicare. That’s as good a signal as any that foreshadow the demise of the dollar.

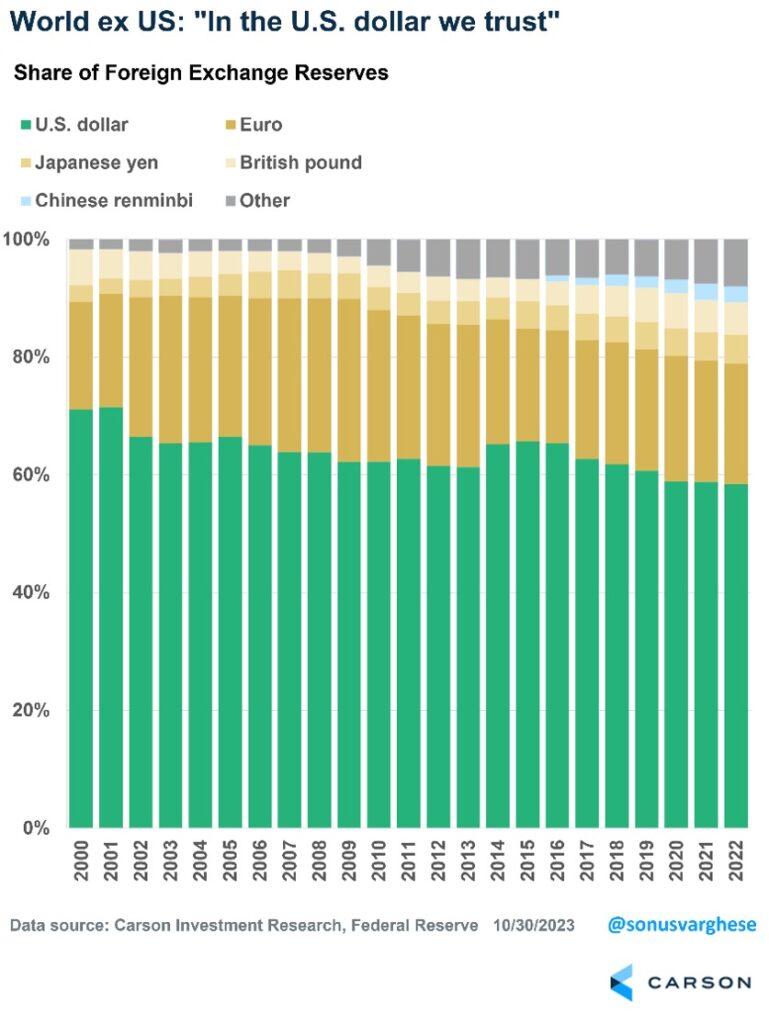

The second reason: The world has confidence in the US, and therefore the dollar. This is because the US has the deepest and most liquid financial markets, thanks to the size of the US economy, the strength of the US economy, open trade and capital flows with few restrictions, strong rule of law, property rights, and a history of enforcement. Despite the US making up 25% of the global economy, about 60% of global foreign currency reserves are in USD. It has fallen from 71% in 2000 but remains far ahead of other currencies as the decline in share has been spread across various currencies.

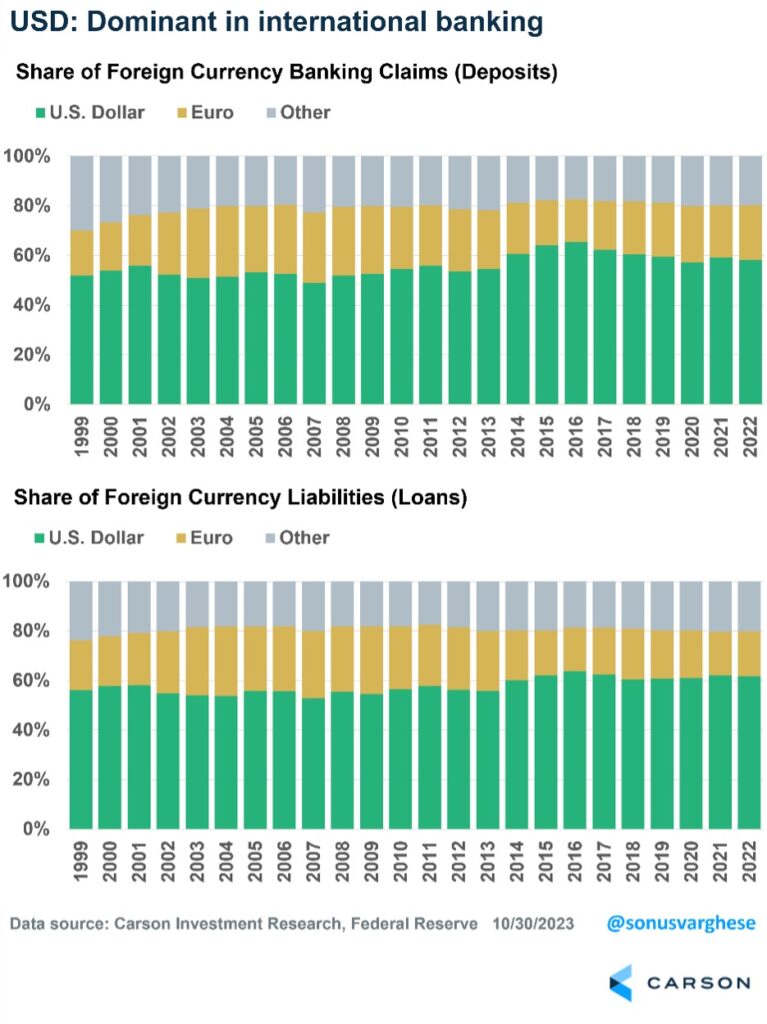

The third reason is that the USD is dominant in trade invoicing and international finance. Outside of Europe, more than 70% of exports are invoiced in US dollars. That’s unlikely to change anytime soon. Again, everyone wants USD because it’s liquid and “safe”. It also means the USD automatically becomes the dominant currency for international banking. Close to 60% of international foreign currency banking claims are in USD, including bank deposits denominated in foreign currency and loans taken out in a foreign currency. That’s been fairly stable since 2000, and actually increased over the past decade.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Foreigners like to borrow in dollars, thanks to stability. Of the total amount borrowed in foreign currency, USD-based borrowing accounts for 62%, up from 56% in 2012. This is all about network effects and they can be extremely hard to dislodge. It won’t be easy to convince people across the world that they have to move their assets from the USD to another currency, let alone face the risk of actually making the switch.

Could all of these things I laid out above change? Sure, but its likely to be a long and very slow process. Our advice: Ignore the viral advertising and trigger seed stories that have come up every few months really for decades that some triviality or plain made up news event is going to “crash” the dollar. The global economy is a complex system in which the dollar is deeply embedded. But that’s been an economic strength, as the dollar continues to play an important role facilitating trade, providing liquidity, and supporting economic stability.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02286272-0624-A