“Any company that has an economist certainly has one employee too many.” Warren Buffett

Another bear issued a mea culpa last week. This time it was David Rosenberg of Rosenberg Research. Rosie, as he is affectionately known, has been steadfastly in the camp that any data has been bad, will lead to trouble, and a recession would be right around the corner. After more than a decade plus of saying this (he was ‘right’ for two months when we shut the economy down for two months in 2020) he has issued an apology. Here’s an excerpt from a great article on MarketWatch:

“It’s high time for me to stop pontificating on all the reasons why the U.S. stock market is crazily overvalued and all the reasons to be bearish based on all the variables I have relied on in the past — from valuation, to sentiment, to overcrowded positioning. So, what I am going to start doing is assessing what it is the market is saying, because the market can certainly move to excesses in both directions and make faulty assumptions, but the market is not stupid,” he said in a piece he titled, “Lament of a Bear.”

“What I clearly underestimated was the dramatic impact this was going to exert on market psychology and the powerful upward shift in investors’ long-term earnings expectations that were the primary drivers of valuations this past year. And I have gained a greater appreciation that it is going to take a whole lot to upset this apple cart and trigger a fundamental re-evaluation of what AI will exert on productivity growth and profitability in the future,” he says.

As readers of this blog know, for more than two years we’ve been looking at the same data and we’ve come to a drastically different opinion. So what does it mean?

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For starters, this isn’t a major sign of the top, as Morgan Stanley and JPMorgan were both well-known bears during this huge bull market, but changed their tunes this year. I’ve long said that you need bulls for a bull market, but there are some other signs things could be getting near-term frothy:

- Put/call ratios near their lows of this year, suggesting option markets are complacent

- The VIX was sub 13 last week

- Huge flows into equity ETFs

- Various sentiment surveys showing excessive bulls

Then I also saw that Paul Krugman, economist/writer at the New York Times, retired. He is famous for being wrong more often than just about anyone else. He compared the internet to the fax machine, said the market would never recover after Trump won in 2016, didn’t expect inflation in 2022, missed the housing bubble, and I’m sure there are more but those are the easy ones you can find with a quick search.

Let me point out that I’ve been wrong many times before and I’ll be wrong many times in the future. But I’ll put what our team has said the past two years up against anyone and when the data changes we too will change our views.

The bottom line? We are in a bull market and it is alive and well, but some of this froth needs to be worked off eventually. Here are three more reasons this bull market isn’t done yet.

Not an Old Bull Market

We’ve noted week after week this year why we thought stocks would likely rally and fortunately that’s what we’ve seen happen. The S&P 500 is up more than 27% in 2024, which would go down as the best election year return ever, and it has made 56 new all-time highs, among the most ever as well.

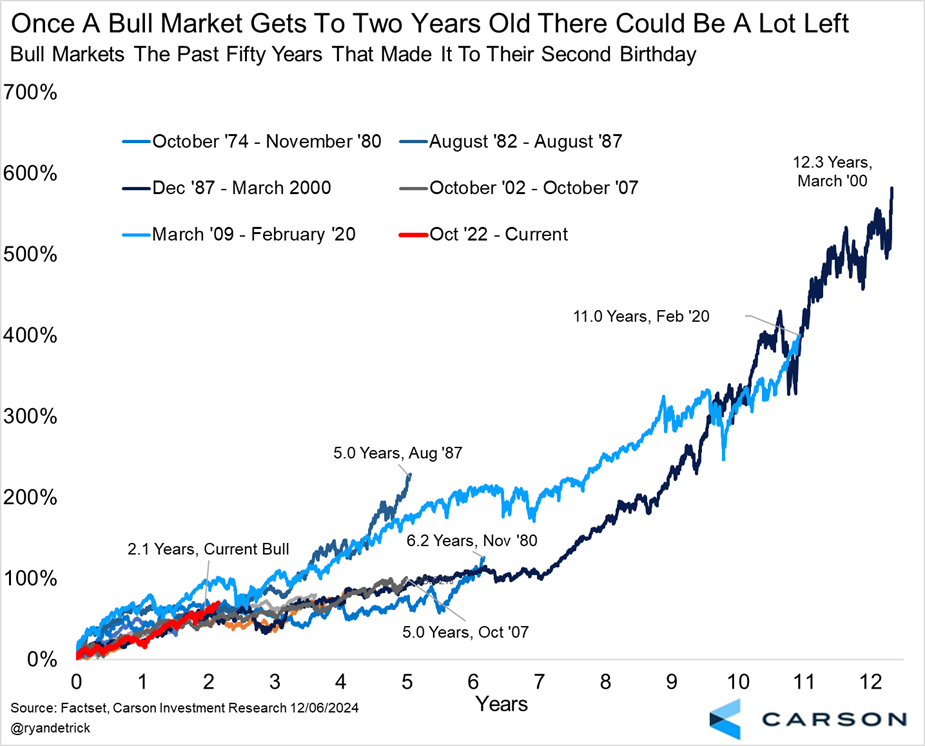

Stocks are looking at back-to-back 20% gains for the first time since the late 1990s, bringing many to worry this bull market could be about to end. Looking at the evidence, we don’t think so. This current bull market is nearly 26 months old and is now up more than 70% from the mid-October 2022 lows. But the good news for investors is that once previous bull markets got to this point there were many more years of gains left.

That’s right, going back 50 years, we found five other bull markets that had lasted at least this long and the shortest any of them lasted was five total years. Think of it like a cruise ship — once it gets moving, it can be quite hard to stop. As you can see here, not only could there be a lot of time left, but there could be more impressive gains as well.

Major Milestones All Over

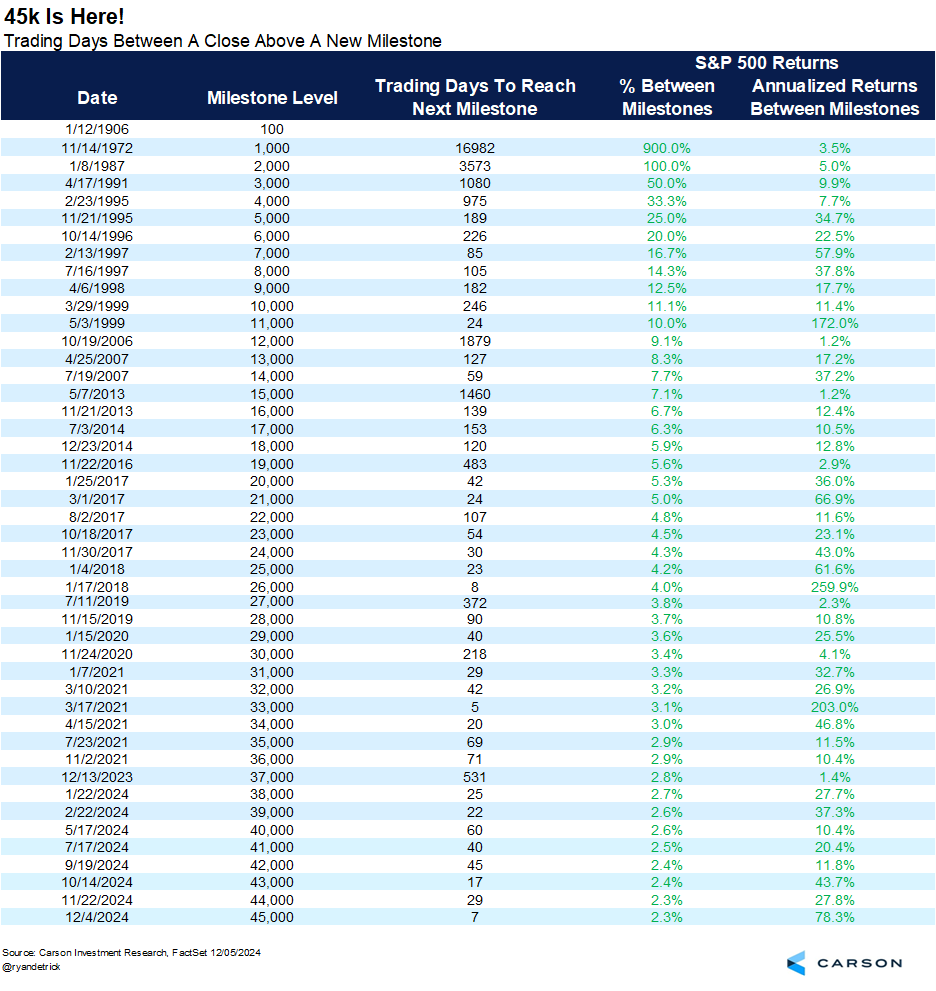

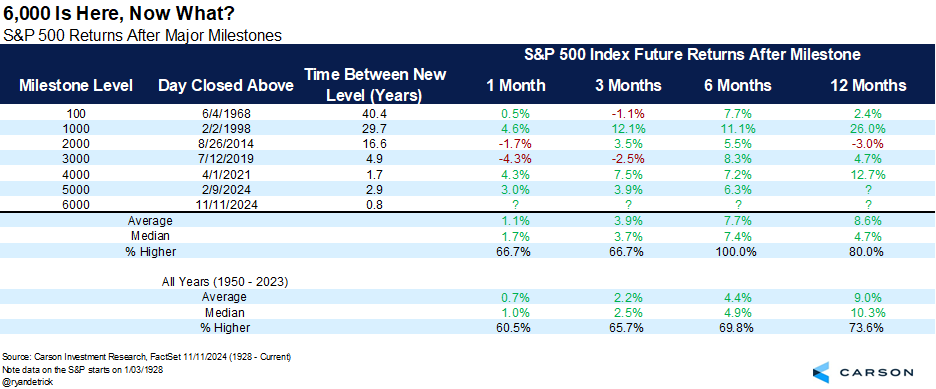

The Dow recently closed above 45,000 while the S&P 500 hit 6,000 for the first time ever. We are aware as stocks go higher, these 1,000 point milestones are easier to hit, as the percentage gain needed to achieve the milestone gets smaller. Still, this year will go down in the record books as a year that saw a lot of major milestones.

The Dow hit a record eight 1,000 point milestones this year and with a few more weeks to go, more could possibly be coming. In fact, it took only seven trading days to go from 44,000 to 45,000, the second fastest 1,000 point milestone ever.

Turning to the S&P 500 at 6,000, it appears that these 1000 point milestone levels can be a good sign, as stocks have never been lower six months later. We’ve discussed before that new highs tend to be bullish and these milestones are by definition new highs, so strong results over the ensuing six months makes sense.

One More Bit of Good News

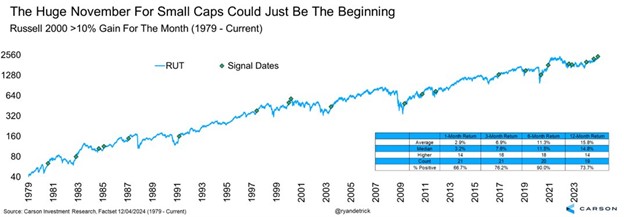

November was a huge month for stocks, but the big winner was small caps, with the Russell 2000 up an amazing 10.9%. Optimism over lower taxes, a stronger economy, animal spirits, and strong earnings all were likely reasons for the surge.

We found 22 other times the Russell 2000 gained at least double digits in a month and six months later it has been higher 90% of the time and a year later up a very solid 15% on average. The bottom line is strength like we just saw isn’t the hallmark of the end of bull markets, but more likely the beginning.

For more content by Ryan Detrick, Chief Market Strategist click here.

02544999-1224-A