NVIDIA briefly overtook Microsoft last week to top the charts as the most valued company in the world measured by market capitalization. The stock has pulled back since then, but it was up 156% year to date through last Friday (June 21st). This amazing run comes on the heels of a 239% return in 2023, leading many to question whether the stock has stretched too far and drawing comparison to the dot-com bubble in the late 1990s (and subsequent crash). My colleague, Blake Anderson, Sr. Analyst, Investment, tackled this in his latest blog, highlighting how NVIDIA’s run is much more dependent on fundamentals than the dot-com era darling, Cisco.

We can break apart the price return of a stock (or index) into two components:

- Earnings growth – I use forward earnings expectations

- Valuation multiple growth – a measure of sentiment, telling us how much investors are willing to pay for a $1 of forward earnings

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

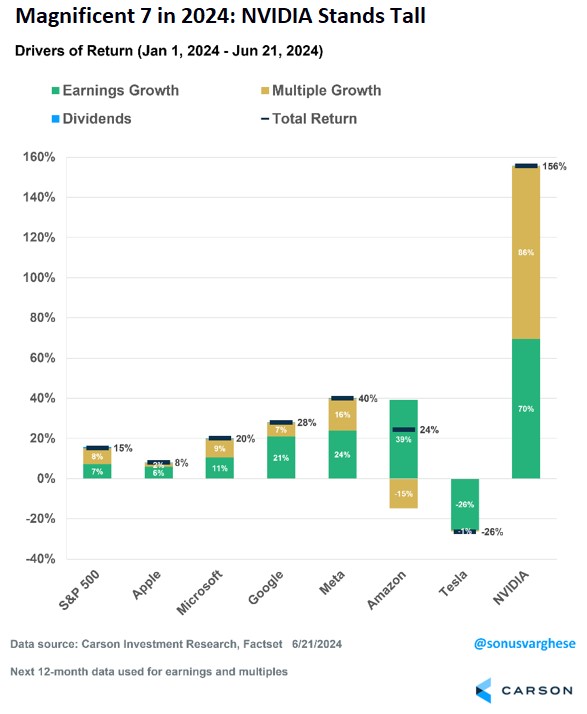

The chart below breaks down price returns for the Magnificent Seven (“Mag 7”) – Apple, Microsoft, Google, Meta, Amazon, Tesla, and NVIDIA. I included the S&P 500 as well for comparison. NVIDIA’s return of 156% is well above the others, including the not so shabby returns of 40% for Meta and 28% for Google. The S&P 500 is up a strong 15% year to date, split almost equally between earnings growth and multiple growth. NVIDIA’s return is driven by a hefty 86%-point contribution from multiple growth, but rising earnings growth has added another 70%-points to add up to 156%. Not quite “irrational exuberance.” In fact, for the rest of the Mag 7, excluding Tesla, the majority of the year-to-date returns have come mostly on the back of strong earnings growth.

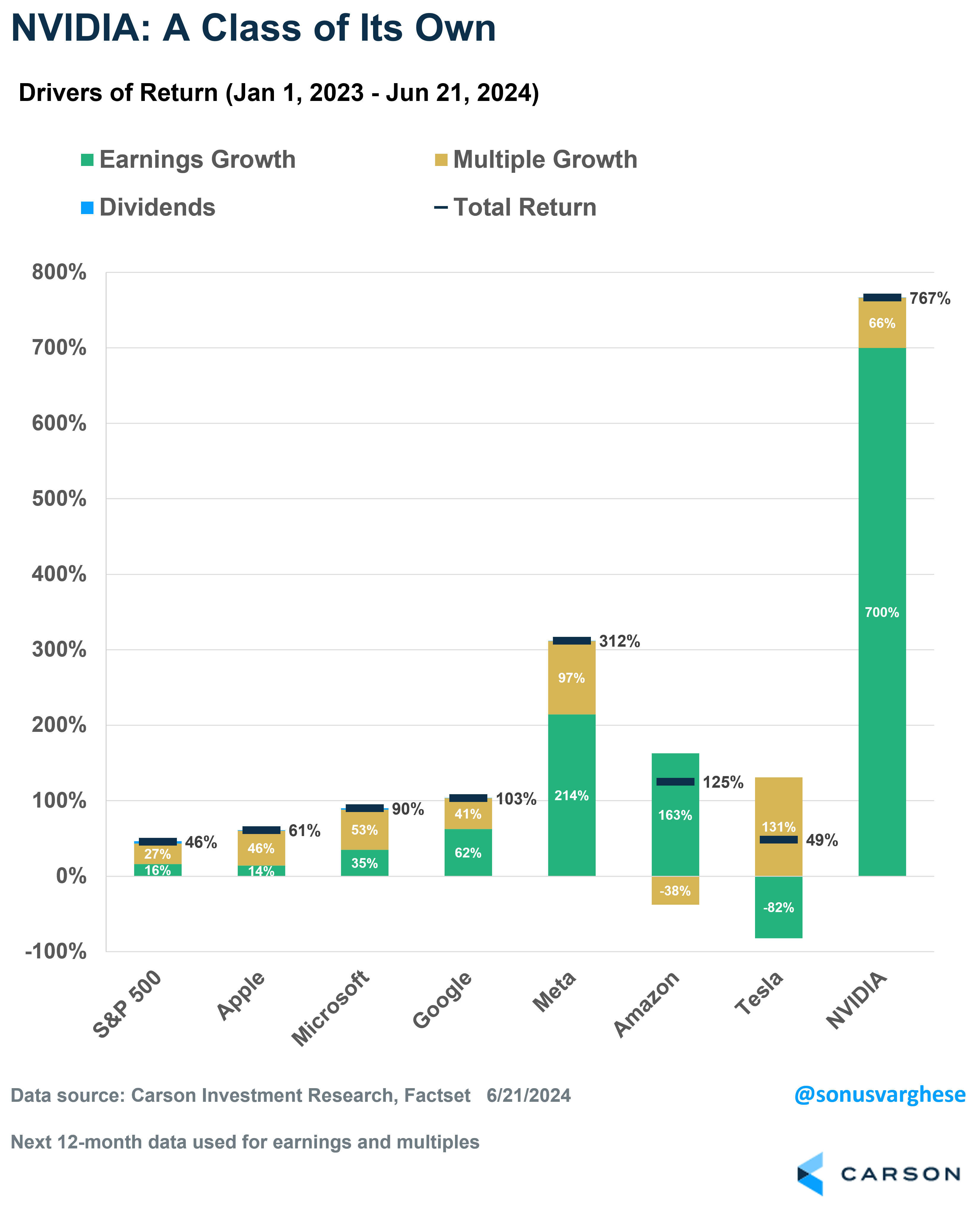

I thought it would be interesting to pull back the time period and look at the last 18 months of returns, going back to the beginning of 2023. NVIDIA is up a whopping 767% from Jan 1, 2023 through June 21, 2024. But here’s what is incredible: 700%-points of that has come on the back of earnings growth, while “only” 66%-points have come on the back of multiple growth. As the title of this post puts it, that’s an incredible profit growth story.

Another thing that comes out of the chart above is that NVIDIA’s mix of return drivers is not a complete exception. Three of the other six companies with 100%+ returns over the last 18 months – Meta, Amazon, and Google – have also been mostly driven by earnings growth. Multiple growth has been a relatively larger driver for Apple and Microsoft, as well as the broad S&P 500 index, though this is a rebound after the bear market in 2022, when multiples contracted amidst the big jump in interest rates.

I can’t say where NVIDIA’s stock price goes from here, but as incredible as recent returns have been, profit growth has been just as incredible, in my opinion. If anything, I’m surprised multiples haven’t stretched even further. NVIDIA’s forward P/E ratio is currently 42 – not exactly cheap, but a far cry from Cisco’s multiple of 200 in March-April 2000. And multiples for the rest of the Mag 7 are even lower than that of NVIDIA (save for Tesla). Profit growth has been a big part of the story for mega-cap technology companies, as well as the S&P 500. There may be exuberance, but it doesn’t seem irrational, yet.

We remain overweight equities but neutral on technology stocks in our Carson House View Tactical models. We don’t see a reason to underweight the technology sector given the strong profit growth story. At the same time, we don’t see the need to overweight the technology sector given that it is already the single largest sector position within the portfolio, parallel to technology’s role in broad US indexes.

Chief Market Strategist, Ryan Detrick and I discussed market momentum in our latest Facts vs Feelings podcast, as well as the short-term outlook for stocks and the potential risk posed by the Fed waiting too long to start lowering interest rates.