Nvidia delivered quarterly results largely in line with expectations. Quarterly revenue of $35.1 billion exceeded the $33.15 billion high end of guidance, earnings per share (“EPS”) of $0.81 exceeded FactSet consensus estimate of $0.75, and guidance for next quarter’s revenue of $36.8 – $38.3 billion bracketed FactSet consensus estimate of $37.1 billion. Many of these results, when compared to expectations, are about in line with recent history and likely why the stock is trading roughly flat since the report was released. Some of the nuances of the report still strike me as shocking.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

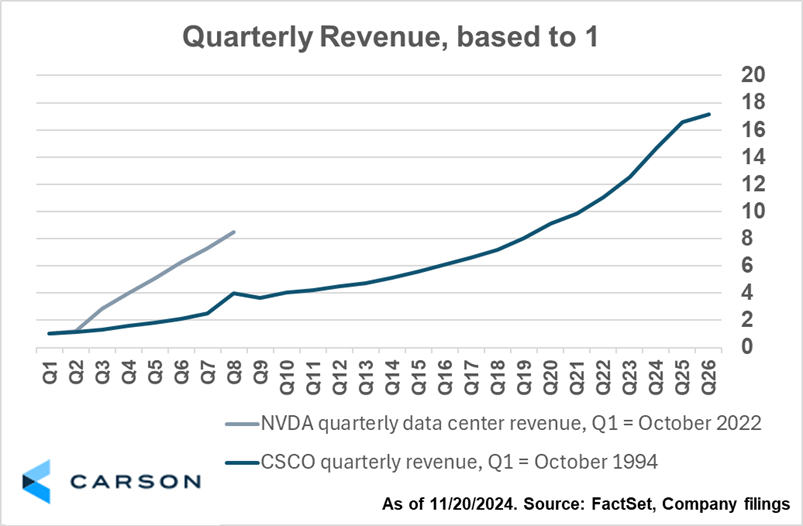

These latest results build on Nvidia’s historical growth trajectory. I wrote about why comparisons of Nvidia to Cisco’s DotCom run are erroneous previously, but it bears repeating: Nvidia is growing faster than Cisco did. This quarter added to its growth. Nvidia breaks out their Data Center revenue, which includes sales to customers such as Meta, Microsoft and Alphabet which help power ChatGPT and other AI-focused products. Revenues for this segment came in at an astonishing $30.8 billion which represents 7.5x growth in the segment since the ‘AI Boom’ began in late 2022. In Cisco’s 8th quarter of growth during the DotCom boom, revenue had ‘merely’ grown 3x.

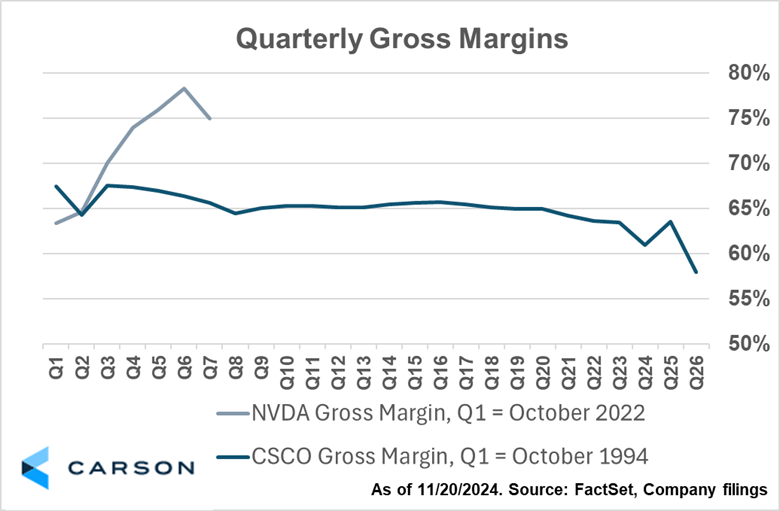

Investors may also take comfort in Nvidia’s gross margin results. Gross margin helps investors quantify how much value a company adds to raw materials. In my opinion, higher gross margins often signal competitive advantages and a higher willingness to pay, among other factors. It can be an early indicator that demand may not be as robust as it has been in the past if it begins to deteriorate. Nvidia’s reported non-GAAP gross margin of 75% this quarter remains consistent with recent results. The slight downtick can be attributed to startup costs for their new chip. And talk of gross margins potentially improving in the coming quarters as startup costs diminish should set investors at ease that pricing power remains intact for the time being.

What may get investors even more excited about Nvidia’s future is the next chip they’re bringing to market: Blackwell. Blackwell has been rumored to deliver roughly 2-3x the computing performance for only 30% more power consumption. It means that AI computing could very likely become 50%+ cheaper to access. Nvidia CEO Jensen Huang noted that “demand for Blackwell is expected to exceed supply for several quarters” as customers are eager to get their hands on the best chips. Advancements in these computing capabilities mean that AI applications can continue to creep into our lives in ways previously unimaginable.

Nvidia delivered a solid quarter with revenue, gross margins and EPS all remaining robust. And the company’s latest and greatest chip, Blackwell, may get investors excited for the future. The fervor of Nvidia’s stock price trajectory may mirror Cisco’s run, but the comparisons should end there – Nvidia has simply put up better results than previous ‘bubble stocks.’ While competitive dynamics can change overnight, this quarter’s report is not ringing any alarm bells.

For more content by Blake Anderson, Senior Analyst, Investments click here.

02520018-1124-A