Investors digested Nvidia’s second quarter results last week. The company fell short of high expectations with the stock trading -6% the day after. However, it’s results are still best in class with revenue growing 122% year over year and adjusted EPS growing 153% year over year, according to company data.

Heading into the release of the results, investors were pursuing answers around the rumored delays of Nvidia’s next generation chip, known as Blackwell. Nvidia estimates this new chip can deliver performance that is multiples better than the current chips and should help sales grow in the future. CEO Jensen Huang commented that “demand for Blackwell is well above supply and will continue into next year,” though investors were left with questions about the exact timing of revenue from these new products.

Stepping back to assess the big picture, it may be helpful to contextualize Nvidia’s run in the history of technology investing. In a recent blog post, I wrote about the comparison between Nvidia’s current run and Cisco’s rise in the late 1990’s. Nvidia briefly held the status as the world’s largest company on June 18th, 2024, with a market capitalization of $3.335 trillion (according to FactSet data). Cisco too achieved this title on March 23, 2000, though it marked nearly the peak of the DotCom run.1

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Weary investors may see today’s tech stocks as a simple repeat of the 2000’s, with high-valued technology companies unable to live up to high expectations. The fervor of this era’s AI-run may also compare to the sentiment of the DotCom bubble, with Nvidia’s returns echoing Cisco’s. But the similarities of the two companies may end there.

Nvidia has put up financial results that have far exceed Cisco’s performance during the DotCom boom, and those results were bolstered with the company’s most recent report.

Revenue of $26.3B during the quarter in Nvidia’s Data Center segment has grown substantially from the $3.6B of revenue reported in the quarter ended October 2022. This was the last quarter before the release of ChatGPT. This result represents 630% growth in revenue in this segment in just the 7th quarter since the AI revolution began.

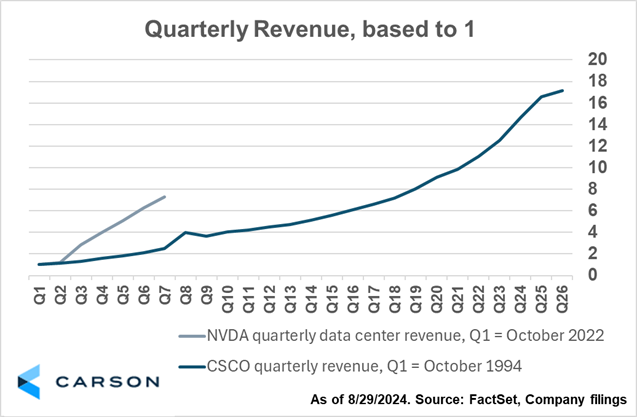

Investors may find it useful to compare this result to Cisco’s 7th quarter of revenue during the ‘DotCom’ boom in the summer of 1996. Cisco’s results show quarterly revenue had grown 150% from the start of the internet’s buildout, marked by the release of Netscape Navigator. Nvidia’s revenue growth has outpaced Cisco’s growth during the late 1990’s. Pictured below is a comparative chart of each company’s respective quarterly revenue during the chosen timeframes.

The chart also speaks to how long technology cycles can last. If growth investors believe the analogy that the AI revolution has just begun and follows a similar cadence to the DotCom boom, we may be only 7 of 26 quarters into today’s buildout.

Investors were left with more questions than answers in the wake of Nvidia’s earnings report. The company continues to post, and has guided for, robust growth and signaled that customer demand remains strong. While precise details about future revenue growth were unclear, the company is marching forward to its next generation of products. During these rocky times, I find it helpful to draw analogs to previous technology cycles, notably Cisco’s rise during the 1990’s. When comparing the two periods of financial performance, it appears that investors may be missing the forest from the trees if the growth is to continue.

For more content by Blake Anderson, Senior Analyst, Investments click here.

02393846-0924-A