Nvidia released its latest earnings report after market close on Wednesday, delivering results that largely met expectations. Despite increased volatility in the stock recently, which included a record one-day market cap loss, the company’s fundamentals appear strong, customer demand remains robust. While investors can never know with certainty how the future unfolds, Nvidia’s latest results reinforce the strength of its offerings.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

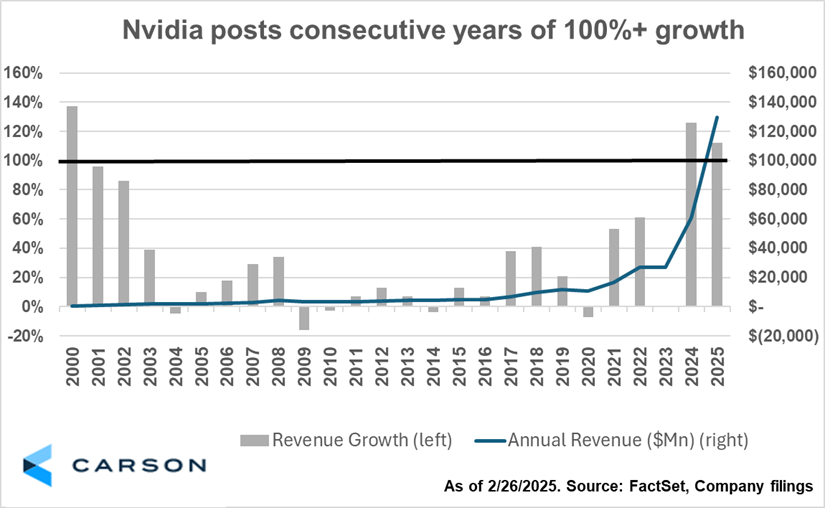

For the quarter, Nvidia reported revenue of $39.3 billion, marking an astonishing 78% year-over-year growth rate and surpassing analysts’ expectations. Non-GAAP earnings per share (“EPS”) came in at $0.89, also exceeding expectations (both according to analysts polled by FactSet). This quarterly result caps another phenomenal year for the company. For the first time this millennium, Nvidia grew revenue greater than 100% in consecutive fiscal years, as shown below, a feat it was unable to achieve even when its annual revenue base was a fraction of the $130 billion it just recorded. It has been a historic surge in revenue for the company at the heart of the AI boom.

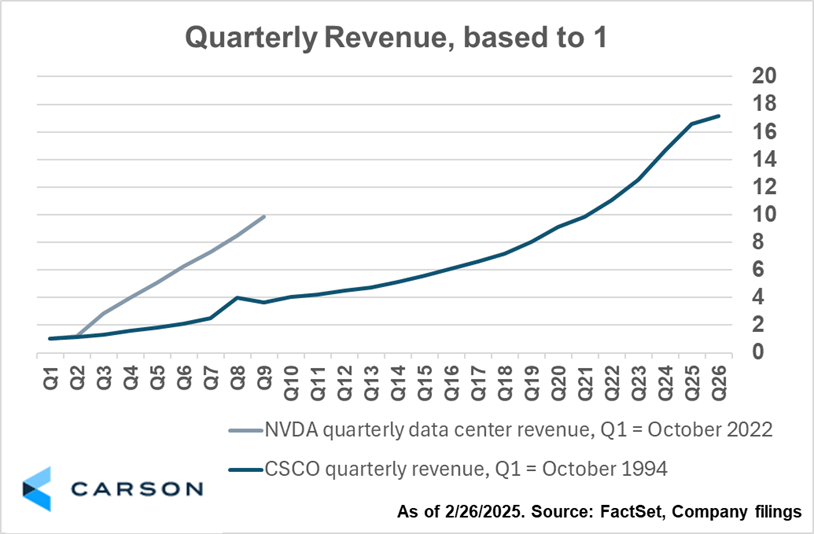

Nvidia’s financial trajectory continues to outpace that of Cisco’s run during the DotCom era. While skeptics have questioned the sustainability of the AI boom, including heightened ‘DeepSeek’ fears recently induced, Nvidia’s financials remain best in class. The company’s quarterly data center revenue has now grown nearly ninefold since the AI revolution began in the fall of 2022. By comparison, nine quarters into the DotCom boom, Cisco’s quarterly revenue had ‘only’ grown by 2.7x. This unprecedented demand underscores both how critical Nvidia’s chips are to AI development and how large the market may be.

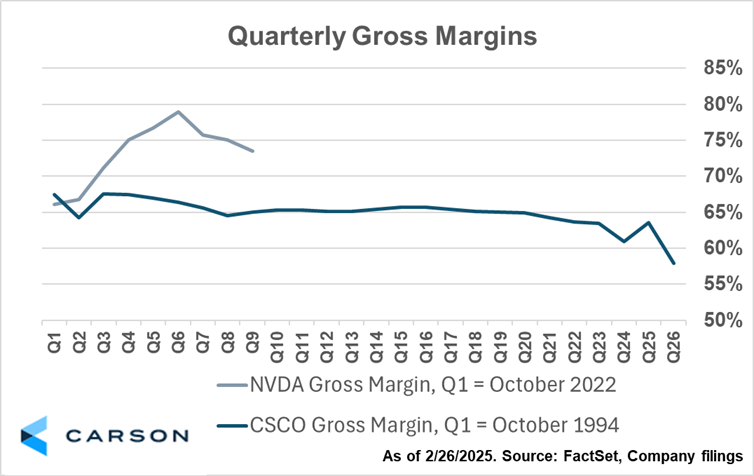

However, two data points may warrant closer investor scrutiny. Gross margin, which may be an investors’ indication of pricing power and demand, declined for a second consecutive quarter. Nvidia reported a 73.5% gross margin this quarter, down from 75.0% last quarter, with guidance for 71.0% next quarter. This result and guidance may indicate that the company is losing the pristine pricing power it previously experienced. Additionally, Nvidia’s reported inventory grew to $10 billion, up 31% from last quarter’s $7.6 billion figure. Traditional semiconductor investors may interpret lower gross margins and higher inventory as early signs of oversupply. But Nvidia may not be a traditional semiconductor company. CEO Jensen Huang has previously stated that these results may simply reflect a few quarters of less-than-pristine financial results between upgrade cycles. The company may be incurring high start-up costs for its latest Blackwell generation and holding some additional inventory to soothe a strained supply chain. If Nvidia can instill confidence that this is the case, investors may look favorably towards the future.

Forward looking commentary from Nvidia and its major customers remains strong. While Nvidia only provides firm financial guidance on a quarterly basis, CEO Jensen Huang on the company’s earnings call noted “The next phase of AI is coming…[these applications] are barely off the ground,” suggesting that the company’s best days may be ahead of it. The transition from training large language models to scaling agentic AI offerings may be in its early stages. Microsoft, one of Nvidia’s largest customers, echoes this sentiment on its latest earnings call, with CEO Satya Nadella noting “[our] AI growth rate is actually better than what we expected…and some of the workloads are scaling well.” While uncertainty abounds, forward looking commentary suggests that customers remain eager to get their hands on Nvidia’s product and build the applications of tomorrow.

Taken as a whole, Nvidia’s earnings report met expectations, with revenue and EPS growth among the highest in the market. While certain financial metrics, such as gross margin and inventory levels, may raise concerns, investors could view these as temporary growing pains associated with a generational transition to a new chip architecture. Meanwhile, Nvidia’s strong forward-looking commentary – supported by key customers like Microsoft – suggests that AI application development and scaling continue at a rapid pace, potentially signaling further growth ahead.

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.

7684012-0225-A