Nvidia’s monumental run eclipsed a new milestone, with the company achieving the title of the most valuable publicly traded company at the end of June 18th, according to FactSet data. The fever surrounding Nvidia may draw parallels to the Nasdaq’s ‘DotCom’ run in the late 1990s, but the differences between 2024 and the 1990s may be even more important than the perceived similarities. The DotCom era was riddled with low margin, low revenue companies valuing themselves based on clicks. But Nvidia surpasses comparisons against even the DotCom eras most deserving champions.

Cisco, which provided infrastructure critical to the internet’s foundation, was perhaps the most notable DotCom era leader whose growth was accompanied by profitability. Cisco was briefly the world’s largest publicly traded company too, but only towards the end of its run. News headlines from the period tell the story of the stock’s remarkable six-year run from $1.04 (split adjusted) in July 1994 to its $82 peak during March 2000. But behind the headlines Cisco also had strong fundamentals. So far, Nvidia’s have been even stronger.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

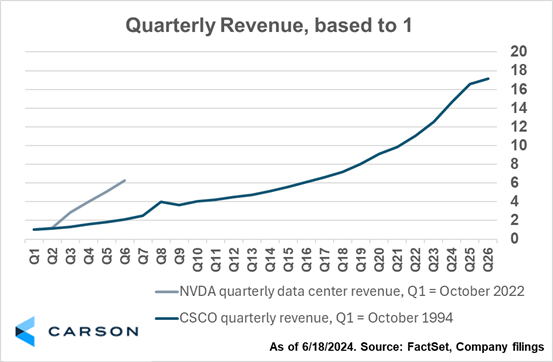

Cisco’s rise was spurred by an impressive 17x growth in the company’s quarterly sales. Revenue grew to $6,748 million in the January 2001 quarter from under $400 million in October 1994. Investors in Nvidia may take solace that revenue from the company’s Data Center segment has ‘only’ increased roughly 5x from the company’s October 2022 report, just before the AI buildout began.

But that’s in less than two years. In the first five quarters of Cisco’s DotCom run, revenue had grown ‘merely’ 110%. AI-fueled demand has sent Nvidia on a quicker growth path thus far! The chart below compares the revenue of the two as they entered their growth phase. While no outcome is guaranteed based on historical comparisons, the chart does help to contextualize the exponential growth possible for generation-defining technologies.

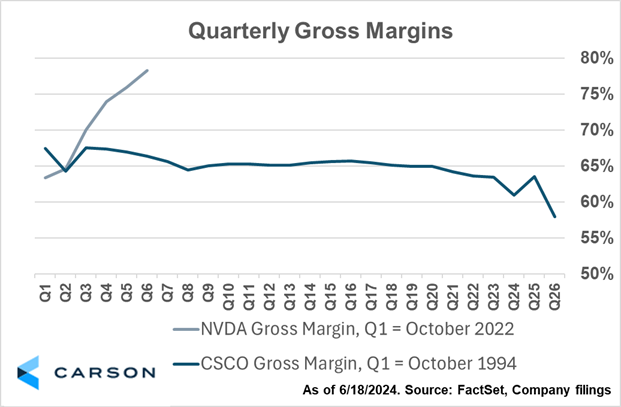

Industry dynamics, such as pricing power and competitive barriers, also matter. One of the best metrics, in our opinion, is gross margin. It helps quantify how much value a company adds to raw materials, with higher gross margins signaling, among other factors, a higher willingness to pay. It can also suggest competitive advantage. Here too there’s an important difference between Nvidia and Cisco. Nvidia’s gross margin has materially expanded in the last five quarters, whereas Cisco’s showed a decline over the same timeframe of its early growth phase. While competitive pressures can change overnight, Nvidia thus far has proven its value over competition.

There’s an old quip that history doesn’t repeat but it often rhymes, and for all their similarities, Nvidia appears to be singing a sweeter tune than Cisco did during its rise. Comparing Cisco’s DotCom run to Nvidia’s AI growth is fair given the headlines, but investors should acknowledge that Nvidia’s fundamentals may actually be even better. Revenue growth is off to a quicker start, and expanding margins may tell us that there are fewer viable competitors thus far. We know Nvidia’s rise has been rapid, but we think investors should remain cautiously optimistic, recognizing both the immense potential and the inherent risks of investing in a rapidly evolving technology sector.

02292427-0624-A