The second largest cryptocurrency by market cap, Ethereum, has now made its way into US-listed exchange-traded funds. Last Tuesday, the SEC greenlit 9 products (one conversion) to begin trading in a quiet and almost unexpected launch, especially relative to the craze seen earlier in the year surrounding Bitcoin ETFs.

Ethereum was the logical approval after Bitcoin for digital assets entering the ETF wrapper. Existing global instruments that hold Ethereum were valued at roughly $12 Billion prior to the launch of the ETFs. Ethereum’s market cap of nearly $400 Billion is more than 2x that of the next largest cryptocurrency, yet still pales in comparison to Bitcoin at more than $1.3 Trillion.

From an ETF structure and launch perspective, there are numerous similarities to Bitcoin ETFs. Structure, custodians, sponsor firms, fees – and even fee waivers – are nearly identical. The surface level structure is where some of the similarities stop, however, as Ethereum is a very different asset than Bitcoin despite often being lumped together.

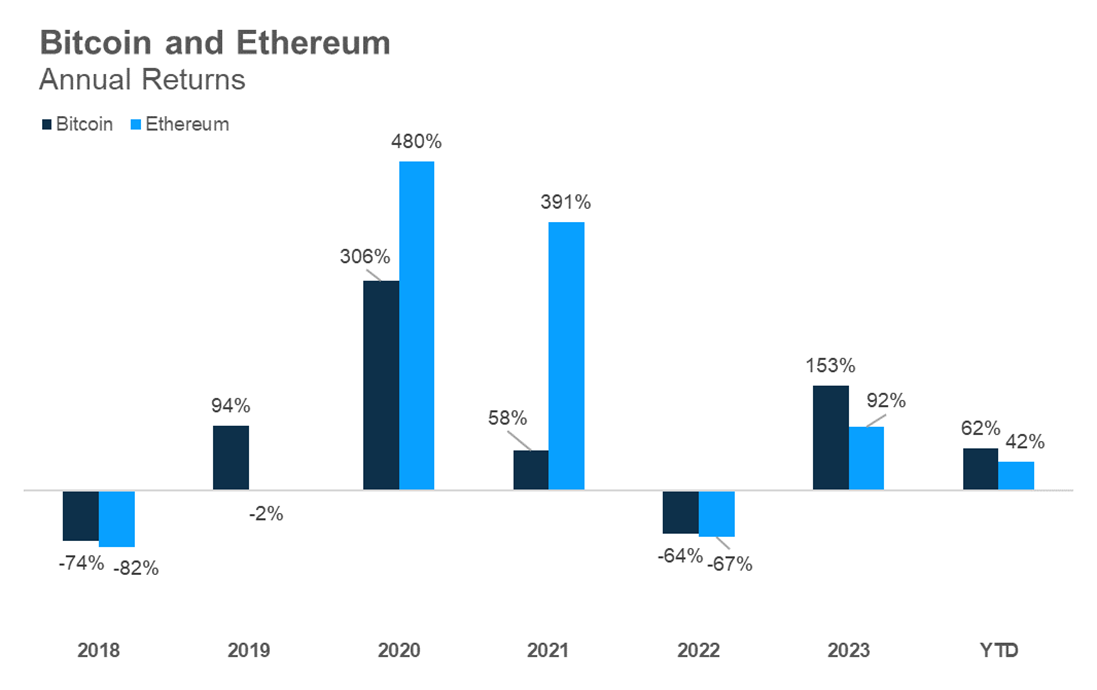

Ethereum and its underlying blockchain were designed to function as the base ‘layer’ of the digital economy. We focus here on the token itself, technically called “Ether”, as the way to invest in this universe, but there is much more to it than that. Without delving deep into a multi-page whitepaper, Ethereum is in many ways what most of the digital asset ecosystem is built on. Ethereum’s technology allows for ‘smart contracts’, which are protocols executed without the need for a central governing body. This programmability allows for the nearly 6,000 applications built on top of Ethereum to function, ranging from decentralized financial services, non-fungible tokens (NFTs), and even social media. There are also hundreds of thousands (yes, really) of other cryptocurrencies that use Ethereum to function. This makes Ethereum less of a store of value in the sense of Bitcoin, but more an investment in future technology. While Ethereum has not been around as long as Bitcoin, since the beginning of 2021, Ethereum has outperformed Bitcoin by nearly 3x!

Source: Morningstar 7/29/2024

The largest difference between holding Ethereum directly versus in an ETF is the concept of ‘staking’. Staking is the process to become a validator on the network, securing and processing transactions – and getting paid in the process. For sacrificing some liquidity, you can receive yields around 3% on your Ethereum holdings and still participate in market returns. This feature was explicitly excluded from the ETF wrapper for several reasons, but don’t doubt the financial services industry’s ability to engineer other ways to receive income on your Ethereum holdings.

Sources: Morningstar, Issuer websites. 7/31/2024 *Closed-end trust conversion

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Very similar to the Bitcoin ETF launches earlier in the year, nearly all the products that have come to market have a fee waiver for a period or certain asset threshold. Grayscale converted their existing ETHE product to an ETF (similar to Bitcoin). This time, however, they issued a special distribution of shares for existing holders into a new ‘mini’ trust, ETH, with a significantly lower fee and essentially seeding the product with around $1 billion.

We will continue to monitor the space and work closely with issuers as products grow, trade, and deal with various market environments. At Carson, we want to provide our advisors with the right tools to allocate and diversify client accounts. More to come soon on Ethereum ETFs, and please reach out with any questions.

For more content by Grant Engelbart, VP, Investment Strategist click here.

02347865-0802-A