Tomorrow, October 19, will mark the one-year anniversary of the peak in the 10-year Treasury yield. According to CBOE’s US Treasury Yield Index, the 10-year Treasury yield peaked at 4.99% on Thursday, October 19, 2023. Even with the recent backup in yields, that’s about 0.9%-points above the current level.

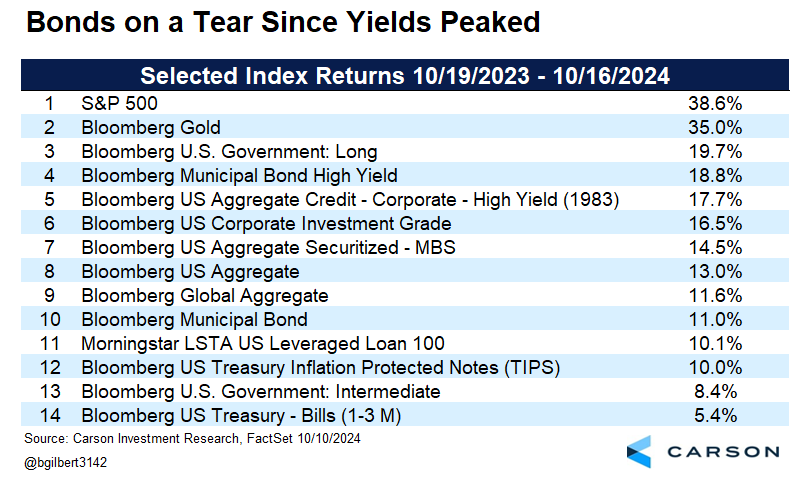

Bond returns over the last year aren’t in the same zip code as stock returns, or even gold, but they’ve been pretty good. The Bloomberg US Aggregate Bond Index (Agg) has returned 13% since the peak through Wednesday, more than double short-term Treasury bills (1-3 months). Long US government bonds, which are typically the most interest rate sensitive, have returned almost 20% over the same period.

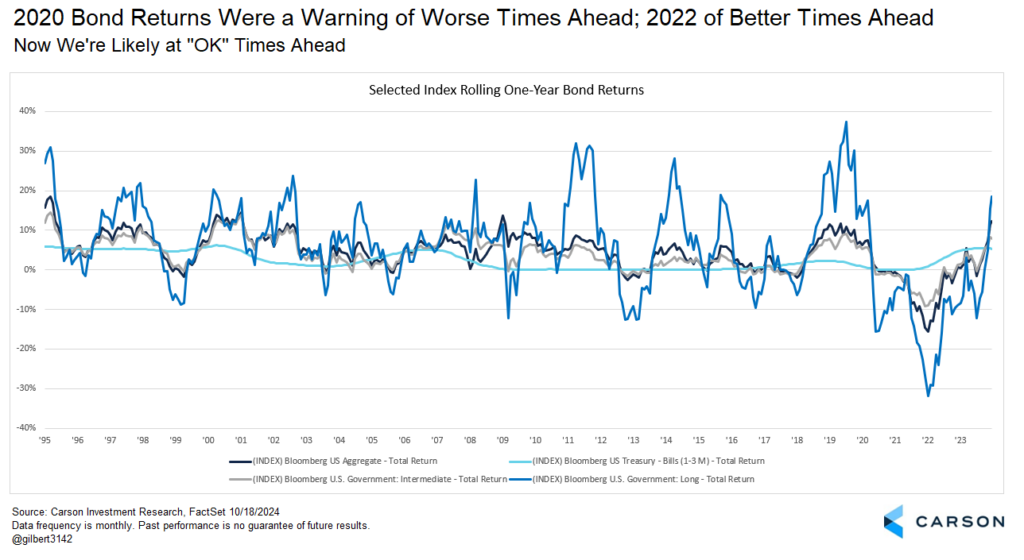

Those are fairly short-term returns and we don’t expect similar moving forward. The easiest money from falling yields has likely been made. At the same time, the risk of a 2022-like year for bonds is very low. One of the reasons is much higher starting yields. A high starting yield help insulate against bond losses in two ways: first, the level of interest income is higher and can offset larger losses; second, all else equal bond prices are less sensitive to changes in interest rates when yields are higher.

Many investment professionals seemed to forget basic bond math when the 10-year Treasury yield was below 0.60% in 2020. Bonds were very vulnerable to a drawdown due to low coupons barely insulating against capital losses and the increased rate sensitivity of prices. The bond math also means that yields are strongly predictive of longer-term expected returns.

But there is a strong tendency to look backwards instead of forwards with markets. In mid-2020 bonds had just had a terrific run, giving them an aura of invincibility even for some investment professionals. I remember even having great difficulty persuading colleagues at another firm of the risks. Instead, flush with bonds’ recent success, the team changed the portfolio management rules to create an unreasonable limit how far bond holdings were allowed to be underweight “duration,” a measure of interest rate sensitivity. One colleague even argued Treasuries are the best alternative asset. Cue 2022.

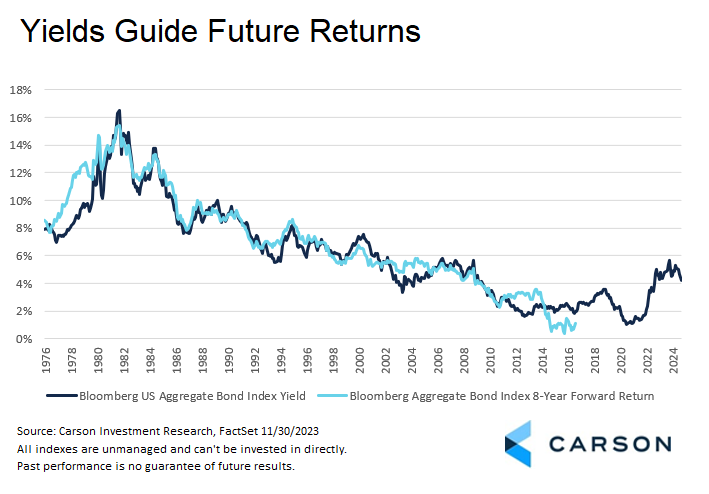

While we are unlikely to see a bond run similar to what we had over the last year, the good news is we believe starting yields remain supportive of bond returns at current levels. One way of looking at this is simply understanding that yields are a strong forward predictor of bond returns over the average maturity of the portfolio, since you know the price of a bond at maturity (assuming it doesn’t default), which is just its par value. You also know your coupon (interest payments). You put those together and you get the yield to maturity, the expected annual return of the bond from now until maturity. There are some things that can throw that off, but generally for a portfolio of high-quality bonds, it’s a pretty good estimate. Even if the bonds are systematically rolled (sold before maturity and longer maturity bonds bought), future returns will track the yield to maturity pretty closely.

As shown below, the historical data bears this out. The eight-year forward annualized return of the Agg has closely tracked its yield at the start of the period. In fact, it has been within one percentage point of the yield to maturity at the start of the period 73% of the time. (Imagine if you knew the return for stocks over the next eight years within a percentage point 70% of the time.) The cost of that added certainty is bonds’ lower typical expected return compared to equities.

Rethinking CREAM

It’s paid off (literally) to hold cash over the last two to three years, as opposed to longer maturity bonds. Hence, C.R.E.A.M. (Cash Rules Everything Around Me). It may be time to start rethinking that.

The yield-to-maturity for the Agg right now is 4.52%, and that’s a pretty good guess for the annual return of the Agg over the next eight years. That’s far from historical stock returns (about 9-10% annualized), but more attractive than what we saw in the 2010s. It’s true that you can get a higher yield in the near term from Treasury bills, but what the return of short maturity Treasuries will be over the next eight years is highly uncertain.

Why not hold onto the higher yielding, short maturity bonds until the rates do actually go down? One reason is that price fluctuations for longer maturity bonds mean returns can be much better (or worse) than the yield in the near term, depending on whether rates are rising or falling. That’s part of what happened over the last year (and 2022 on the other side) and is why most major bond sectors solidly outperformed Treasury bills over the last year despite a lower starting yield.

That’s not necessarily what we expect to happen again, or at least not at the same scale. We think it’s likely that the 10-year Treasury yield will see further declines from its current level by the end of 2025 as the Federal Reserve continues to cut rates, but our expectations for further declines are fairly modest. It wouldn’t take much for the Agg’s return expectation to match or top short maturity Treasury bills, but we may not get much more.

Looking more closely, the effective fed funds rate is currently inverted relative to the 10-year Treasury yield, sitting about 0.80%-points above it. Historically, during rate cut periods the 10-year Treasury yield falls about half the amount of the 3-month Treasury during its peak-to-trough decline, although it varies. (I discussed this in more depth here.) Right now, the 3-month Treasury is about 0.75%-points off peak with the 10-year down a little more. In other words, we’re ahead of pace for 10-year yield declines assuming the historical relationship. While we do expect the 10-year yield to fall, outside a recession (not at all our base case), we would expect those declines to be much smaller than the amount the Fed cuts rates over the same period. While there’s still a lot of uncertainty, that may make the center of gravity for the 10-year Treasury about 3.75% for year-end 2025.

Don’t Forget to Diversify, Even The Diversifiers

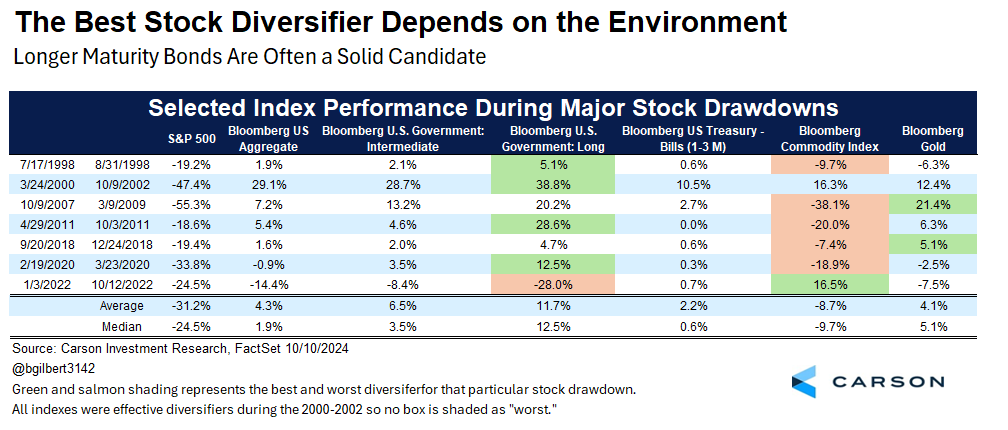

One final thought: 2022 was an important reminder that while bonds have a long history as an effective diversifier in general, there are environments where they are ineffective, primarily when inflation rises sharply and the Federal Reserve responds aggressively. While we continue to see a strong disinflationary trend, we do think inflation uncertainty, within a range, will remain more elevated going forward than what we experienced in the 2010s. As a result, we believe it remains important to “diversify diversifiers.”

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

As the table below shows, since the late 1990s (the period over which we have a broad range of index data), long maturity Treasuries have been the overall best diversifier during periods of market downturns. But keep in mind that this was in the middle of an extended bond bull market with generally low inflation. Even so, commodities (gold in two cases, broad commodities most recently) were the best diversifier from a return perspective in three of the seven major stock drawdowns since the late 1990s. Also keep in mind that while long Treasuries have been the best diversifier overall during major market drawdowns, they also can be quite volatile and do experience periods of meaningful drawdowns themselves, as you can see in the chart of rolling one-year returns above.

Our broad portfolio positioning guidance continues to emphasize overweighting equities, but within bond allocations we are comfortable holding more Agg-like interest rate sensitivity. At the same time, we think a portfolio that seeks some diversification beyond bonds to other areas of the market that usually has a low correlation with equities (such as gold, managed commodities exposure, or other alternative assets) will increase the odds of more robust portfolio behavior across a range of potential return environments.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02468804-1024-A