Background: A Shifting Environment Focused on Aligning Investment and Values

The investment landscape is undergoing a paradigm shift, characterized by investors increasingly seeking to harmonize their financial portfolios with their deeply held beliefs and values. Thematic investing has emerged as a powerful avenue for clients to translate their convictions into tangible financial actions. This approach empowers investors to strategically target specific ideas or trends that they perceive as impactful or significant. By directing investments towards their priorities, investors can actively contribute to the realization of their personal beliefs and values.

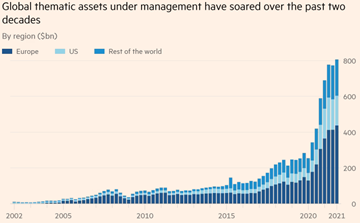

The trajectory of thematic investing’s popularity has been remarkable, as evidenced by data from Morningstar. The global landscape is being shaped and now contains an astonishing $800 billion of assets invested in equity-based thematic funds, constituting approximately 2.7% of the equity funds universe. Only a decade ago, a mere $71 billion, or 0.8% of equity funds, was dedicated to thematic strategies.1 This exponential growth underscores the profound desire among individuals and institutions to exert a positive influence through their financial decisions.

The surge in thematic investing highlights the increasing importance of Values-based investing and the desire to make a positive impact through financial choices. As more investors seek opportunities to support causes and trends that resonate with their values, the popularity of thematic investing is likely to continue its ascent. This approach not only allows investors to achieve potential financial gains but also empowers them to contribute actively to the advancement of ideas and trends they believe will shape a better future.

Beneath this investing phenomenon lies a significant shift in wealth dynamics, where women are emerging as a powerful and rapidly growing subset of wealth management. Over the rest of this decade, an unprecedented transfer of assets into the hands of American women will take place, potentially eclipsing $30 trillion.2 This seismic wealth transfer rivals the annual GDP of the United States. Demographics play a pivotal role in this. In the US, women live longer than their male counterparts by an average of five years. This, coupled with the tendency for women to marry partners who are two years older, implies women are expected to outlive their male spouse by seven years on average.2 Despite commanding an increasing share of household wealth, women remain underrepresented in the financial services industry. Only 15-20% of financial advisors are female.3 Understanding this shifting dynamic is crucial for wealth management firms to attract and retain female clientele. Polls have shown women are more concerned with investing in their values than men.4 Women have unique needs, preferences, and behaviors that differ distinctly from men when it comes to managing a financial relationship and finances.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

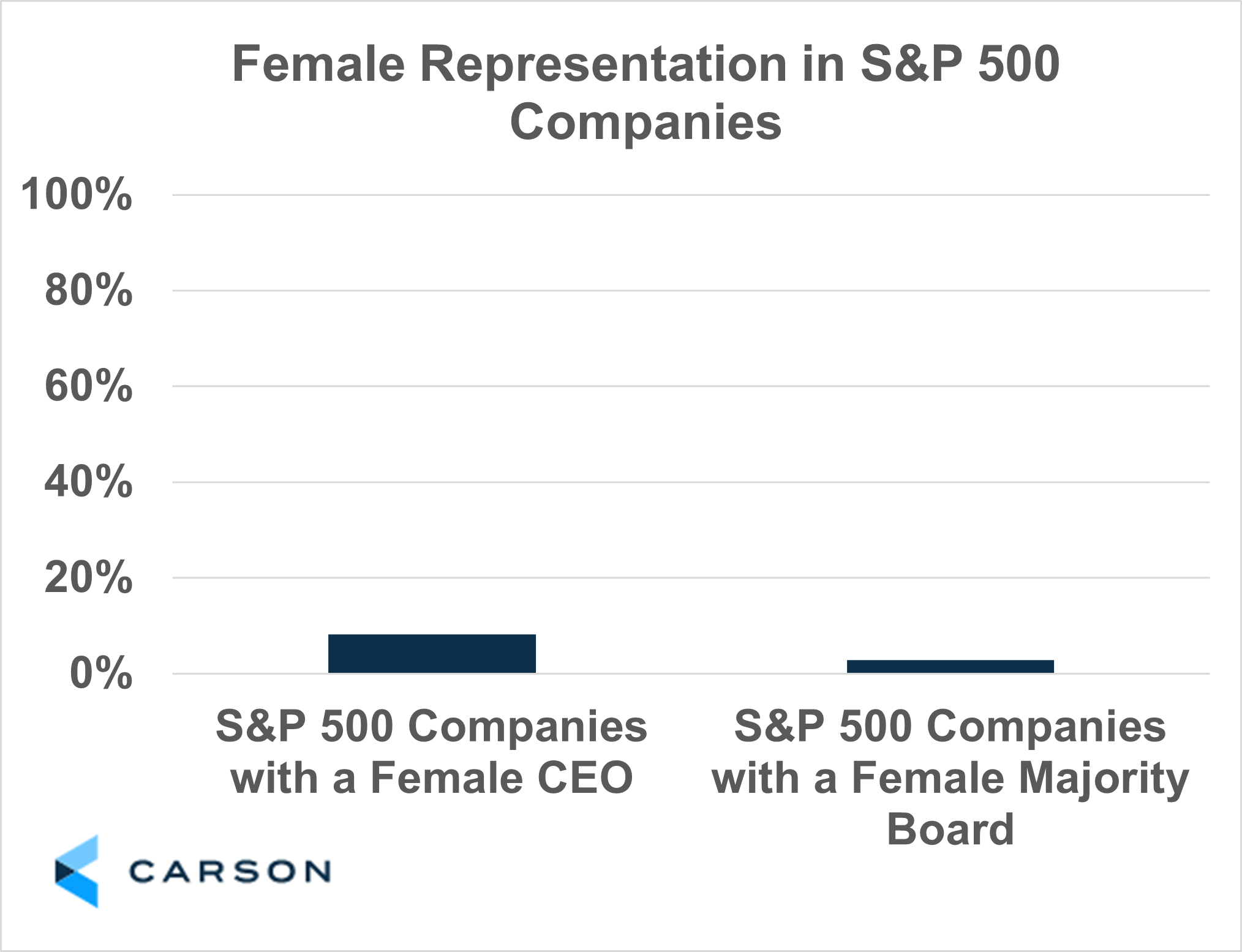

The underrepresentation of women is particularly pronounced in corporate boardrooms and C-Suites. As of 2023, only 8% of S&P 500 constituents had a female CEO and less than 3% of boards were majority women.5 These stark figures reflect a deeply entrenched gender gap in the upper echelons of corporations. Beyond a social concern, this gender imbalance represents a strategic imperative. As the business landscape evolves, it becomes increasingly important for organizations to capitalize on the full spectrum of talent and perspectives that diverse leadership can offer. The challenge of enhancing women’s representation in both CEO roles and board membership requires targeted initiatives to dismantle systemic barriers and foster an environment conducive to equitable opportunities.

Thematic Options Currently Promoting Women in Leadership

Within this dynamic landscape, a palpable desire emerges among both women and men to champion women’s leadership roles through thematic investing. However, the current options available to investors fall short of encompassing the depth and significance of this objective. Some progress has been made. The first female-leadership focused ETF launched in 2016. Other products have followed. Additional female-focused ETFs often blur the focus on women in leadership by striving to closely track a benchmark or by granting fund managers excessive discretion.

The challenge lies in striking a balance between thematic purity and active management. While funds that mirror benchmarks aim to reduce tracking error, they inadvertently dilute the thematic intention. Meanwhile, active management solutions occasionally diverge from the core objective due to too loose an interpretation of the target thematic exposure, a problem shared by many thematic products. In our view, to genuinely capture the desired gender representation, the definition should be both clear and substantive. While the exact definition is open to some interpretation, we believe equal representation should be straightforward: either women are equally represented, at fifty percent, or they are not.

We See an Opportunity for a More Authentic Thematic Fund Focused Purely on Women in Leadership

The MSCI USA Gender Diversity Select Index emerged against this backdrop. It selects companies that exhibit a commitment towards promoting and maintaining a high level of gender diversity across the different levels of an organization. Using a score-based ranking system, the index bases inclusion on female representation in leadership roles and diversity management programs the company has in place. It is an effective methodology to focus on companies that promote gender equality. However, the index subsequently reconstitutes the weighting based on sector weights and market cap weights of the applicable universe, which dilutes the focus on gender equality to reduce tracking error with the broader market.

While indices like Morningstar® Women’s Empowerment Index and Solactive Equileap US Select Gender Equality Index employ similar ranking methodologies that represent a step forward, we think a higher standard is feasible, that better expresses the intended values, and can contribute more strongly to continued progress. For instance, some parameters consider an executive board with one-third or more female representation as suitable for inclusion in a funds or indices that promote female equality. This assessment is made relative to the broader corporate landscape, where a board with such composition is seen as relatively diverse. While certainly a move forward, according to 2022 data from the US Census Bureau, women account for 50.4% of the total population and nearly 60% of the civilian labor force.6 While these indices are earnestly committed to advancing gender equality and elevating women in leadership, there is a place for a strategy that better reflects workplace demographics in the evolving landscape of modern business.

Active managers operating under the dual mandate of advancing gender equality while also striving to generate alpha are confronted with a complex set of decisions that carry the potential to inadvertently compromise the core values of the fund. For example, some funds incorporate discretionary policies, such as those stating that the inclusion of equities is based on the “advisor’s opinion” regarding the adoption of initiatives to attract, retain, and promote women. This approach, while aiming to strike a balance between impact and performance, could result in the inclusion of companies that merely meet a basic threshold of gender-related initiatives, diluting the authenticity of the fund’s mission.

As is often the case with thematic funds, the primary rationale for investment in a fund that promotes gender equality is to align financial capital with personal beliefs. A fund of this nature, unaltered by efforts to mimic more conventional equity benchmarks like the S&P 500, may not fit precisely in a traditional portfolio framework. Given the current lack of gender diversity amongst the largest 25 US companies, it is plausible that a fund genuinely dedicated to promoting women in leadership roles could lean toward value-style stocks and skew smaller than broader indices. By comprehending the underlying factor-based characteristics of the thematic fund, one could construct a portfolio that approaches the composition of a traditional portfolio built without incorporation of thematic funds.

Amid the dual narratives of thematic investing and supporting expanded female leadership, there is a compelling need for a fund that more robustly centers on women in leadership roles than current options. There is an opportunity for a solution that remains resolutely committed to promoting gender equality, ensuring that the representation of women in leadership stands as a stark, non-negotiable objective. The story that unfolds here transcends investment; it echoes the transformative potential of financial choices to create lasting societal impact. It underscores the need for a future where women’s leadership is not just a thematic concept, but an unwavering reality, achieved, in part, through dedicated financial strategies that mirror profound shifts taking place in our world.

Disclaimers:

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

Mutual Funds and Exchange-Traded Funds are sold only by prospectus. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the company or from your financial professional. The prospectus should be read carefully before investing or sending money.

Definitions:

The Morningstar Women’s Empowerment Index is designed to deliver exposure to large- and mid-cap U.S. companies that have strong gender diversity and equal opportunity employment policies embedded in their corporate culture, as measured by Equileap’s data and scoring methodology.

The Solactive Equileap U.S. Select Gender Equality Index is designed to deliver exposure to global companies that promote gender equality and are committed to women’s empowerment through equal compensation and gender balance in leadership and the workforce.

References:

1 https://www.ft.com/content/1db0f968-2175-4434-ba65-c57632b51e02

5 Carson Group Research

6 https://www.census.gov/quickfacts/fact/table/US/LFE046221

01879030-1123-C

The opinions contained in this material are those of the author, and not a recommendation or solicitation to buy or sell investment products.