With both the Republican and Democratic party conventions over, it’s safe to say we’re in the home stretch of the Presidential election. In fact, early voting starts in 7 days in North Carolina, a key swing state. That also means campaign rhetoric is heating up, and promises are being made—some wild ones, too, but this is politics in the homestretch of an election and it’s not too surprising.

Campaign Promises Go Wild

Let’s look at some of the “policy” proposals that have hit headlines recently, from both candidates. I put policy in quotes because some of these seem rather off the cuff, without a lot of heft and practical implementation details behind them.

Here’s something former President Trump first proposed, and then Vice President Harris copied: making tips tax-free. As simple as it may sound, it becomes complicated after a little bit of thought. For one thing, tipped workers don’t earn much and so their incomes aren’t taxed a lot anyway. Then the question is whether tips will be exempt from Social Security and Medicare taxes—if so, that will actually reduce lifetime average earnings for tipped workers, which means they’ll receive fewer social security benefits. More practically, if someone earns $30,000 with half of that from tips, the question is why they should pay lower taxes than someone who earns $30,000 in straight-up income. Then of course, you could also have a situation in which a lawyer who bills $200/hour receives an additional $200/hour in “tips.”

Another proposal from Harris is that she’ll ban price gouging in the food and grocery industry. This has received a lot of attention, but it’s very unclear what exactly this entails. A lot of commentary has focused on it being implemented via price controls, but I think we can safely conclude that will never happen, in my opinion. You just have to go back and look at how former Defense Secretary Don Rumsfeld, and his then assistant, Dick Cheney, struggled to implement price controls under the Nixon administration in the early 1970s—an experiment that may likely never be tried again, with good reason. In this case, it looks like the Harris “ban” could take the form of existing bans against price gouging in 37 states, and similar to the one President Trump signed in March 2020 to prevent hoarding of health and medical resources. In any case, it’s unlikely to do much for food price inflation, and is a case where the “promise” runs far ahead of reality. For Trump’s part, he’s said he’ll direct all agency heads and Cabinet secretaries to “use every tool and authority at their disposal to defeat inflation”—not too many specifics there.

Trump has also said he’ll offer senior citizens massive relief by ending taxes on social security benefits (currently it’s not taxed on up to $25,000 for individuals, and 50% of benefits above that are not taxed). Technically, this will be lost revenue for the social security trust fund, but overall, it amounts to something like a $1.6-$1.8 trillion increase in the federal deficit over the next 10 years.

Both Harris and Trump have suggested enhancing child tax credits (CTC). Harris’s proposal would permanently increase it from $2,000 to $3,600—it was briefly at this level in 2021 but wasn’t extended due to its massive cost. In addition, she would also add a new CTC of up to $6,000 for middle- and lower-income families with children in their first year of life. Not to be outdone in the promises sweepstakes, Trump’s Vice Presidential nominee, J.D. Vance, floated an idea to increase the CTC to $5,000 for everyone. Think of what all of these, or any of these, would do to the deficit.

Let’s Get Real: Control of Congress Matters

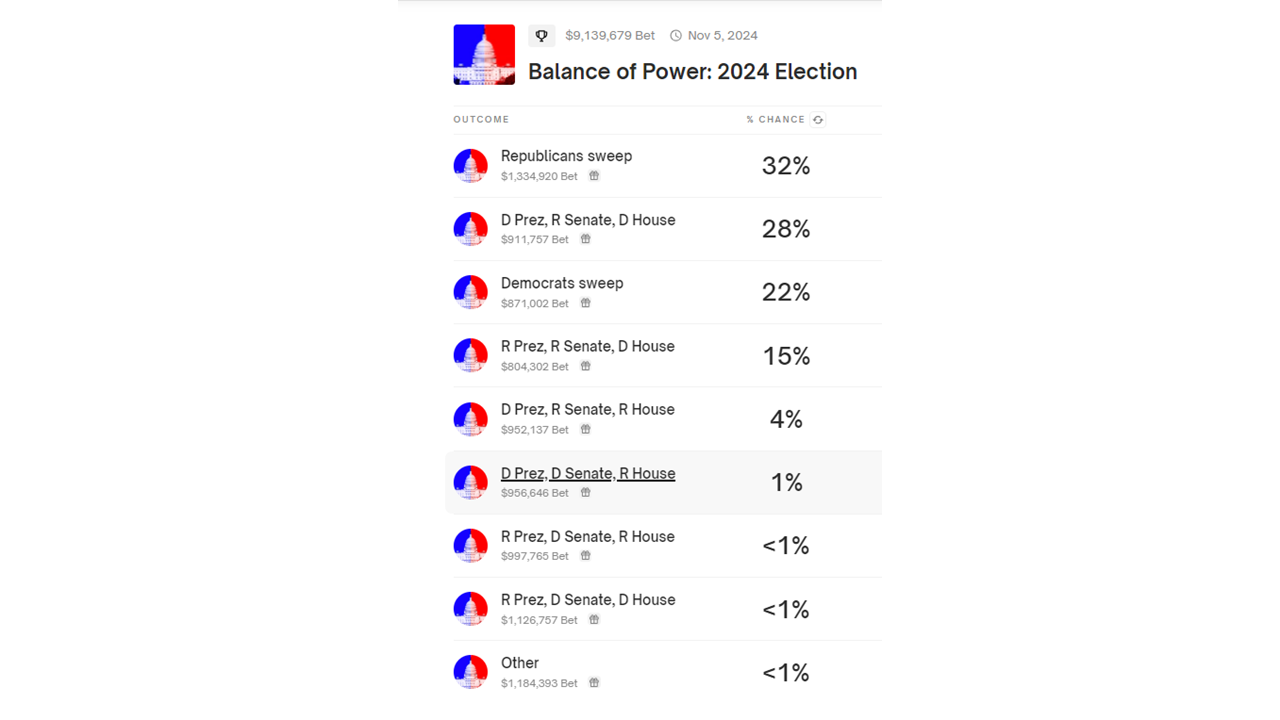

Lost amid a lot of analysis of the above proposals is that they aren’t likely to move far in Congress. In addition to the Presidential election, we also have the House up for re-election, alongside a third of Senate seats. Looking at the prediction market site Polymarket, the Presidential election looks to be a toss-up, but things go in opposite directions for control of Congress:

- Democrats have a 63% chance of winning the House

- Republicans have a 70% chance of taking the Senate

- Republicans have a 30% chance of a full sweep (Presidency, House, Senate) while Democrats have a 23% chance

There’s a reasonable chance we’re looking at split party control of Washington D.C. post-election, but even if not a lot of policies will require a two-third majority in the Senate to prevent a filibuster and a closely divided Senate or House gives the centrists of the majority party a lot of power. (Remember the influence Senators Manchen, Sinema, and Tester have had the last four years, and that Senators Collins, Murkowski, Romney, and McCain had during the Trump administration.) However, it’s really tax policy that is going to be the single-biggest issue next year, and that can potentially pass through the Senate under something called “reconciliation,” which needs only a simple majority of 51.

2025: A Big Year for Tax Policy

The Tax Cut and Jobs Act of 2017, which former President Trump signed into law, contained both corporate and individual tax cuts. The corporate tax cuts (including dropping the corporate tax rate from 35% to 21%) were permanent, but the individual tax cuts were all set to “sunset” at the end of 2025. Unless these tax cuts are pro-actively renewed, Americans could see taxes go up starting in 2026. At the same time, renewing them will increase the deficit by $4.6 trillion over ten years. Keep in mind that 2026 is a mid-term election year, and that’s going to crystallize Congress’s focus on getting something done. But it also gives various players in Washington enormous leverage, as everyone seeks to keep their pet proposals.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The contours of tax policy are going to matter for investors as well, and so it’s worth walking through the broad areas.

Starting with a potential Harris administration, the biggest risk for markets is an increase in the corporate tax rate. However, given how close the House and Senate will be, an increase is unlikely, in my opinion, with a probability near zero if Republicans control even one chamber. Even if Democrats sweep, moderate senators are unlikely to agree to an increase in the corporate tax rate. At the same time, tax cuts for more wealthy households will probably not be renewed, though any deficit reduction from that side may likely be eaten up by expansion of the child tax credit.

With a potential Trump administration, the biggest risk is not tax policy—he’s said his administration would renew all the tax cuts, and perhaps even drop the corporate tax rate to 15% (music to investors’ ears). Instead, the big risk will be an expansion of the tariff regime (which a President can impose without Congress). We may see renewed trade wars, which could adversely impact capital expenditures and the production side of the economy (as it did in 2018).

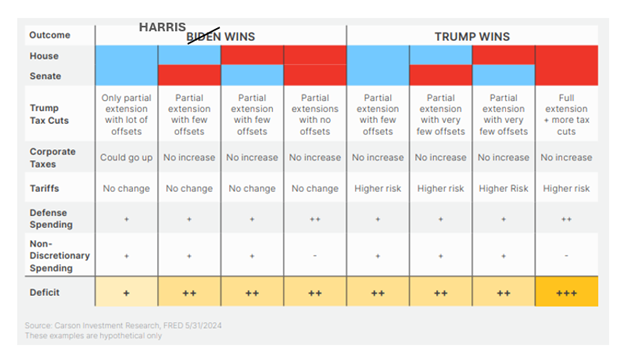

The table below, from our MidYear Outlook 2024, illustrates the various major policy changes and their likelihood under different scenarios of congressional control. The big takeaway is really at the bottom of the table, which shows the deficit increasing under all scenarios—it’s just a question of how much.

Populism and Deficits Are Here to Stay

The one through-line across all the proposals floating out there now, and what’s actually likely to be passed, is larger deficit spending, a sign that both candidates are leaning into populism. Campaigns always make a lot of promises during election season, but the populist rhetoric from both candidates is actually quite unusual, especially given where we are in the economic cycle.

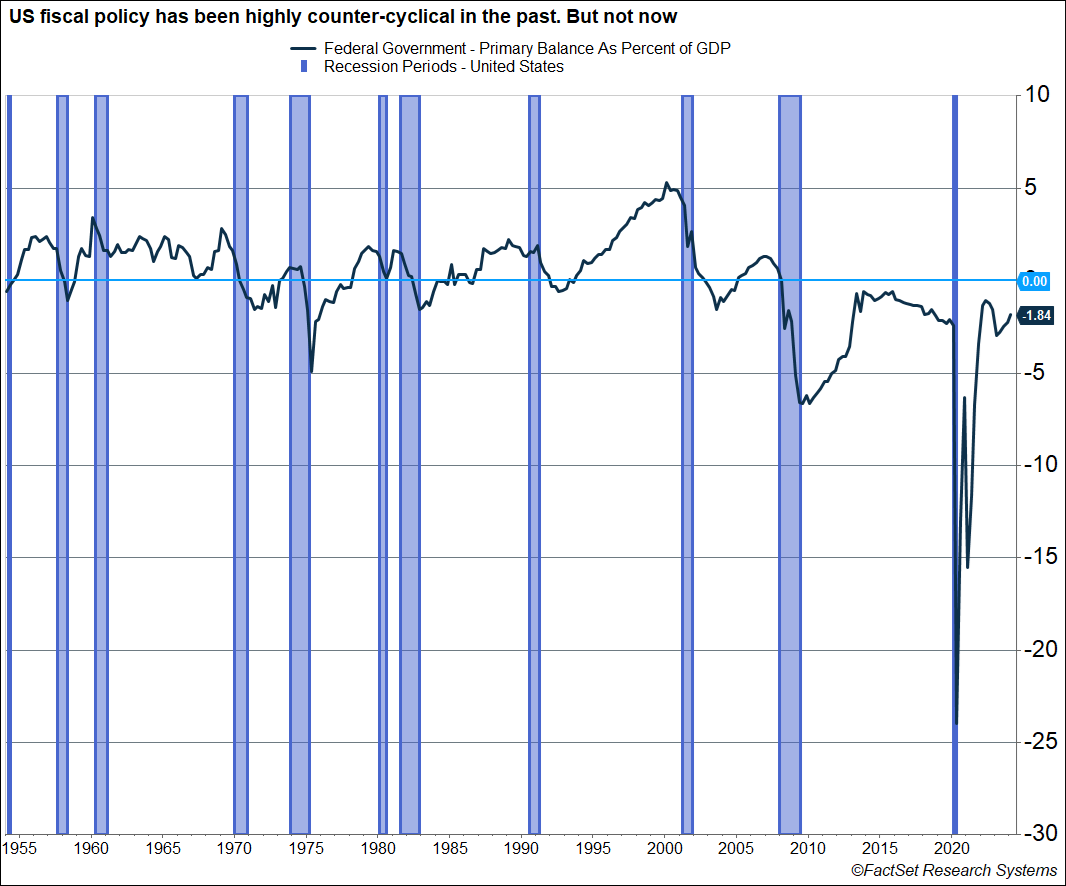

The Federal government’s “primary balance,” which is revenue minus spending excluding interest payments on Treasury debt, is one way to measure how much net spending is happening at the Federal level. The chart below shows the primary balance as a percent of GDP. As you can see, prior to the 2010s, the primary balance was always in positive territory as economic expansions wore on. It fell into deficit only during recessions, which isn’t surprising because that’s when economic stabilizers (like unemployment benefits) kick in, and revenue collection drops (as there’s less income). In short, US fiscal policy has historically been counter-cyclical, which is generally what it should be.

But the late 2010s was markedly different, as the primary balance remained in deficit territory, hitting -2% of GDP by the end of 2019. We’re well removed from the pandemic right now, but the primary balance is still historically low, at -1.8% of GDP (something we’ve seen only in recessions prior to 2010). Given what the candidates are proposing, it’s fairly certain that the primary balance remains in deficit territory well into the second half of the 2020s.

As we wrote in our outlook, deficit-financed spending can boost corporate profits if it doesn’t crowd out consumer spending or private sector investment. That’s positive for markets as well, since profits are what matter. In fact, this is something we saw as recently as 2016-2019, when profit growth surged on the back of higher fiscal deficits (due to the 2017 tax cuts). Even more recently, we’re seeing federal spending “crowd in” private investments on the manufacturing construction side—construction of computer, electrical, and electronic manufacturing facilities has jumped more than 1,100% since the end of 2020 in real terms. Over the last two years, profit growth was boosted by rising fiscal deficits, which more than offset rising household savings. At the same time, we saw a rise in productivity growth.

The main concern with deficit-fueled spending is whether it leads to inflation. It’s quite likely that a US economy that is near its productive capacity sees bouts of higher inflation as well, leading to higher interest rates. The good news is that inflation has been falling recently, and the Fed is poised to cut rates. Combine that with profit growth driven by more fiscal spending, and we have two positive tailwinds for equities over the next year.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02384431-0824-A