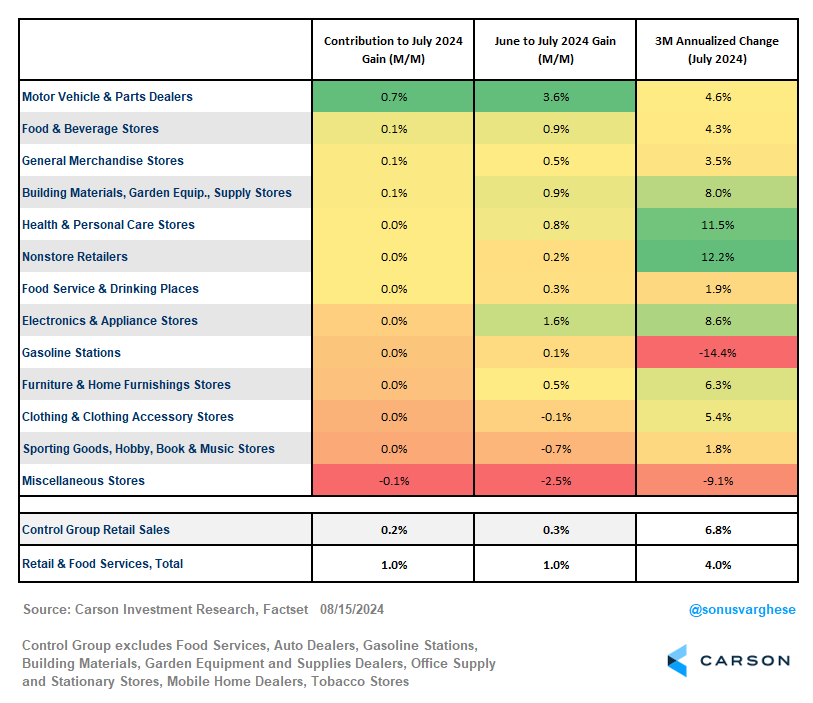

As long as employment is strong, consumer spending will be strong. Yes, job gains slowed in July but prime age (25-54) participation in the labor market remains near record levels, layoffs remain low, and aggregate income growth has been solid. Those numbers were the underpinning of a large upside surprise in July retail sales. Headline retail sales surprised meaningfully to the upside, coming in at 1.0% for the month versus expectations of 0.3%. Core readings also surprised to the upside, with retail sales ex-autos climbing 0.4% versus a 0.2% consensus expectation and the “control group,” which best captures the consumer spending category in GDP, climbed 0.35% versus a 0.1% consensus expectation.

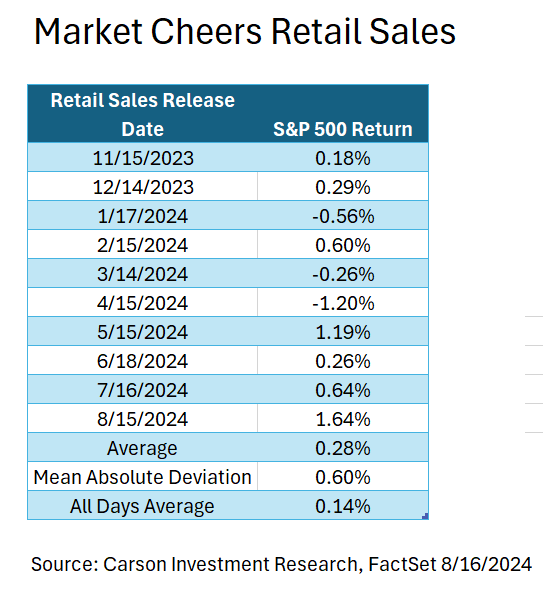

Given the somewhat gloomy economic expectations still baked into the market following the weaker-than-expected August 2 jobs report, the market response was decisively positive. Prior to yesterday, market gains on retails sales day had generally been in line with average returns—this hasn’t been a market moving report unlike the CPI inflation report and monthly jobs report. In fact, yesterday’s reaction was the strongest in the last 10 months independent of direction.

S&P 500 Index gains weren’t the only sign that the retail sales report shifted the market picture of the economic outlook. The market-implied odds of a 0.50%-point hike at the Fed’s next policy meeting dropped another 10 percentage points, from 37.5% to 27.5% according to CME calculations. After three days of declines, the 10-year Treasury yield popped from 3.82% to 3.92%. And small cap stocks caught a bid, the Russell 2000 Index of small cap stocks climbing 2.5% versus the S&P 500’s 1.6% gain. When yields rise but small caps outperform, it’s likely a strong signal that a change in growth expectations is the main driver.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

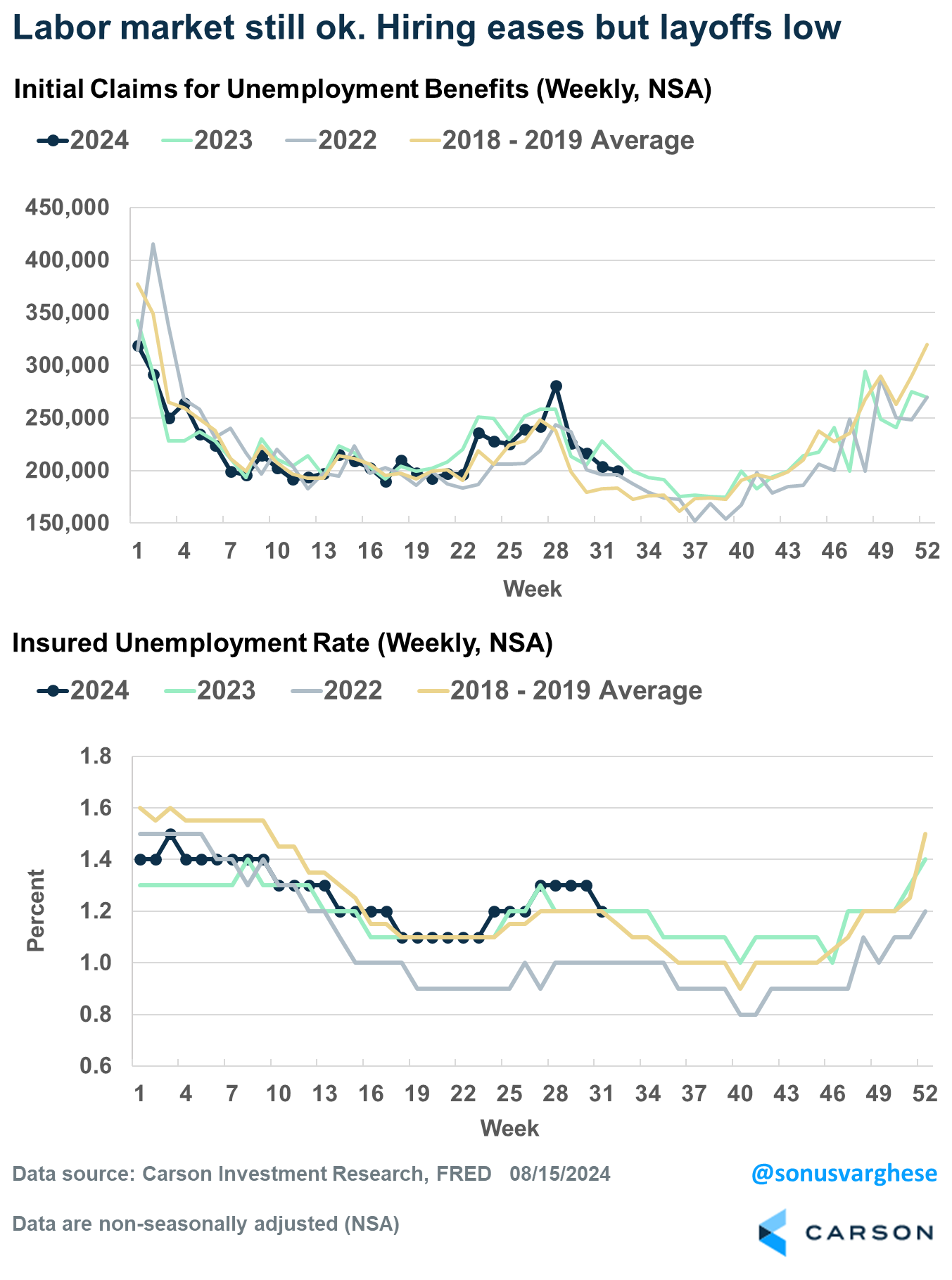

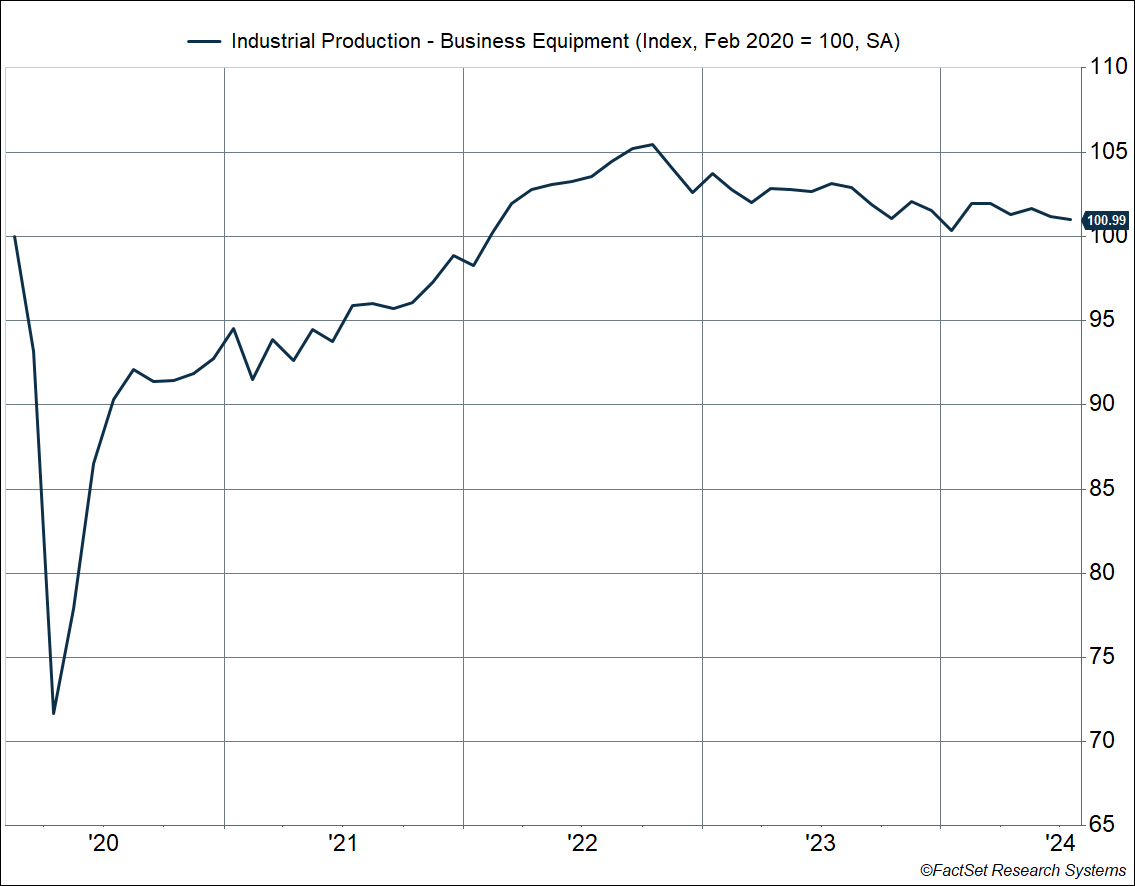

While retail sales drew the most interest, there was a flood of economic data yesterday and there were some signs that the Fed’s tight policy continues to weigh on the economy. While the weekly jobs data on unemployment insurance claims continued to allay some concerns of a weakening job market, industrial production pulled back and has been easing since 2022 despite supportive fiscal policy.

Household spending is the engine of economic growth in the US, but industrial production, which includes manufacturing, mining and drilling activity, and utilities, remains an important secondary gauge the economy’s health. In fact, despite the upside surprise in retail sales the Atlanta Fed’s “Nowcast” of third quarter economic growth fell from 2.9% to 2.4% following yesterday’s data dump, primarily on a shift in expected inventory activity, which is part of the gross private domestic investment category. Expectations for final sales, which excludes inventory, held steady at 2.7%.

Looking at the report itself, the big driver of the upside surprise in the headline number was auto sales, not surprising given falling auto prices (which we took a closer look at in our blog on the CPI inflation data). Control group gains have been supported by electronics, online shopping (“nonstore retailers”), and health and personal care stores. That may be an indicator that while households have curtailed spending on some items, back to school spending, including higher education, remains a priority. Or that may just be the author’s prejudice as he prepares to drop his child off at college for the first time. (Hail to Pitt!)

Overall, the day’s data dump and market reaction were a sign that the market is coming back to our analysis following the pop in market volatility in late July and early August. (See Ryan’s 10 Talking Points About the Recent Volatility.) The economy’s underlying fundamentals are sound but there are segments where tight Fed policy is having a bite. You can see that in the industrial production data, but also the jump in mortgage activity after rates moderated even a little. Better data is moving market expectations towards just one hike in September, which we think is more aligned with the Fed’s comfort level. That would likely be enough, although it would be important that forward guidance signal the Fed is aware of the risk of falling further behind the curve.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02370275-0824-A