“Stocks take the escalator up, but the elevator down.” Old investing axiom

It’s New Year’s Eve today and 2025 is just around the corner. We know 2025 will bring with it new worries, concerns, and fears, but also new opportunities. But it is also important to take a step back sometimes and realize there are some things about markets that all investors should know that are timeless. As 2024 winds down, here are seven things we think all investors should know as we move into 2025.

Go Into the New Year Expecting a Double-Digit Decline

Remember August 2024? It might be hard to recall now, but global markets crashed on fears over the yen carry trade unwinding. We pushed back against the sell-off at the time, but still, knowing that Japan was having its worst day since the 1987 crash and US futures were down massively overnight made for a sleepless night for your dear authors on that first Sunday in early August.

In the end, the S&P 500 pulled back 8.5% from peak to trough, the largest drawdown of the year. Take note though that since 1980 the largest drawdown of the year has averaged 14.2%. If most investors went into each year expecting a double-digit correction as uncomfortable but perfectly normal, they probably wouldn’t get so worried when it happens. If it doesn’t happen at all in a year then all the better, but the odds of it happening the next year increase. In the end, 23 of the previous 44 years saw a double-digit correction, with 13 of those 23 years still finishing positive.

What Matters Is Time in the Market, Not Timing the Market

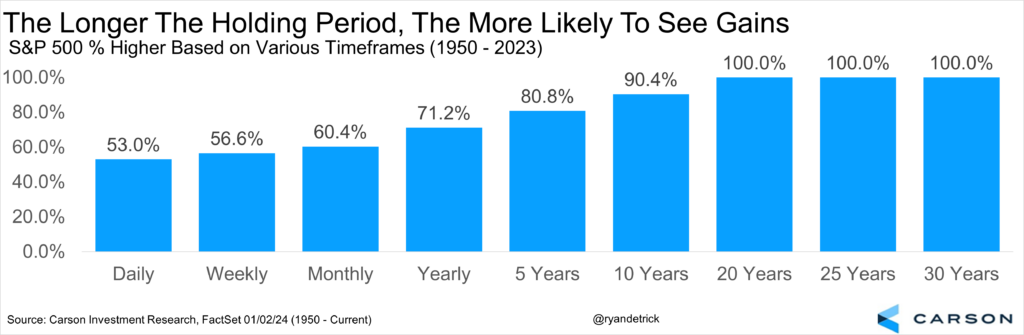

Time can be an investor’s best friend. Each year will have scary headlines and reasons to sell, but that doesn’t mean you should. In fact, the longer you are willing to hold, the more likely you’ll make money. On any random day the odds of stocks being higher is about a coin flip at 53%. A full week? 56.6%. A full month? 60.4%. A year? 71.2%. Five years? 80.8%. 10 years? 90.4%. And over 20 years stocks have never been lower.

Sure, no one wants to buy something and wait 20 years to feel really secure about gains, but imagine what the returns could be if you buy when stocks were in a correction or bear market? They get much, much better. There’s an old saying that it is all about time in the market, not timing the market, and this is something all investors need to remember.

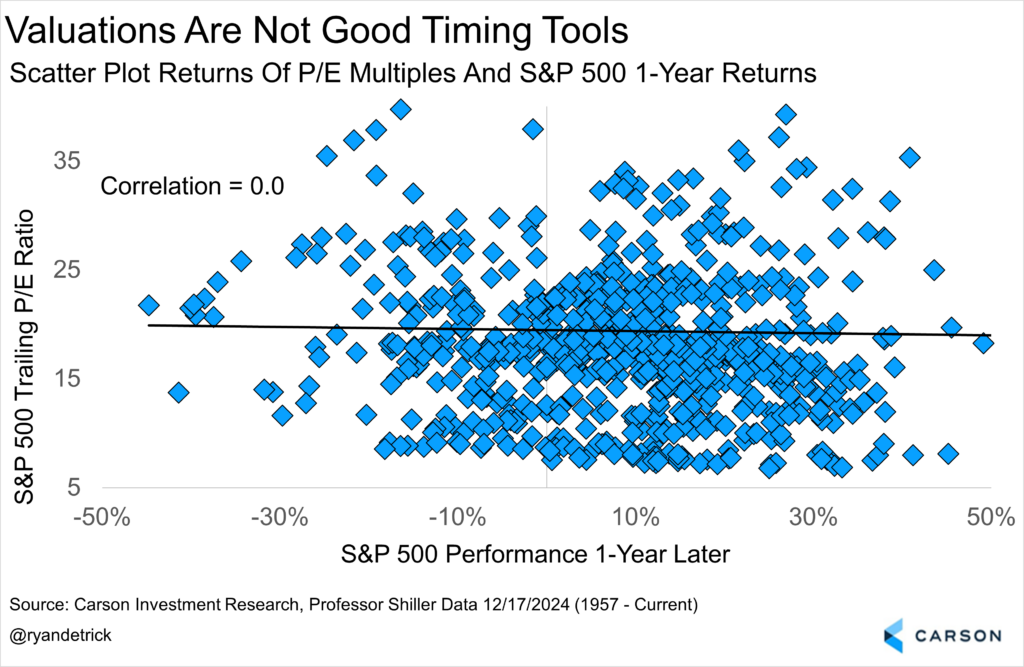

Valuations Aren’t Always a Good Timing Tool

Do you like buying things when they are pricey? Of course not, and investors feel the same way. Here’s the catch though. There is virtually no proof that high (or low) valuations can predict what stocks might do the following year. Going out many years there can be some advantage, but don’t get sucked into avoiding the stock market because a talking head on TV tells you stocks are overvalued. We heard the same thing this time a year ago and stocks have added another 20%. If you want to lighten up on overvalued parts of the market that is fine, but to blindly go to cash could be a very bad mistake.

I looked at forward S&P 500 price/earnings multiples and S&P 500 returns the following 12 months and found the correlation was about zero. Without getting too geeky here, the correlation tells you how much two variables tend to move together. When the correlation is near 0, there’s no statistical tendency to move together at all, and that’s basically where we are. Rather than making investing decisions based on valuations, you are better off investing in days that end in ‘y’ if you ask me. 😉

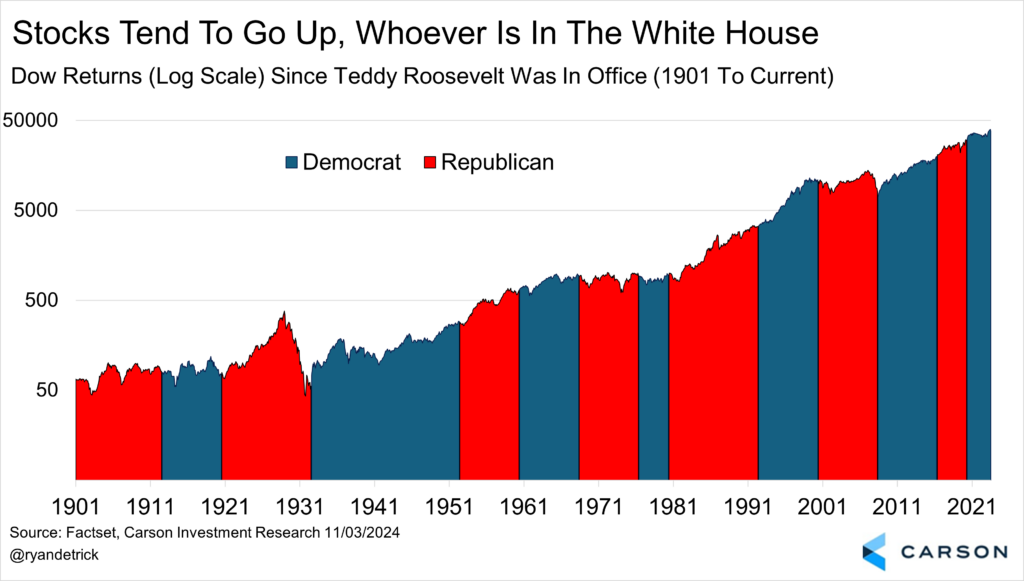

Don’t Mix Politics and Investing

I can’t tell you how many investors I’ve met over the years that didn’t invest in the stock market because of who is in the White House. A lot of people didn’t like President Obama and stocks did great. A lot of people didn’t like President Trump and stocks did really well. A lot of people didn’t like President Biden and stocks started slowly, but soared the past two years. This is obviously a bigger deal in election years and mid-term years, but it is still important to remember every year. I’ll say it one final time, don’t mix your political beliefs with your investing views.

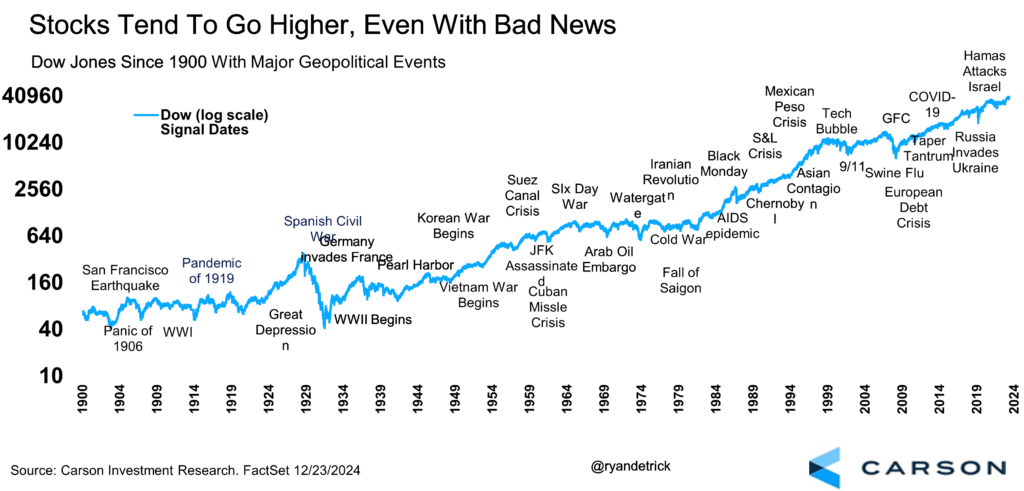

Ignore the Scary Headlines; All Years Have Them

A cousin to the lesson above is remembering that every single year will have scary headlines. I’m old enough to remember back in 2013 when everyone freaked out because the island of Cypress was having financial issues. I’m serious, it was a very big deal for about a week and had many investors on edge. Then you look back and the S&P 500 gained over 30% in 2013 and you wonder what in the world we were thinking!

Here’s a great chart that shares some of the worst headlines we’ve ever seen, yet over time stocks still gained.

Average Isn’t So Average When It Comes to Investing

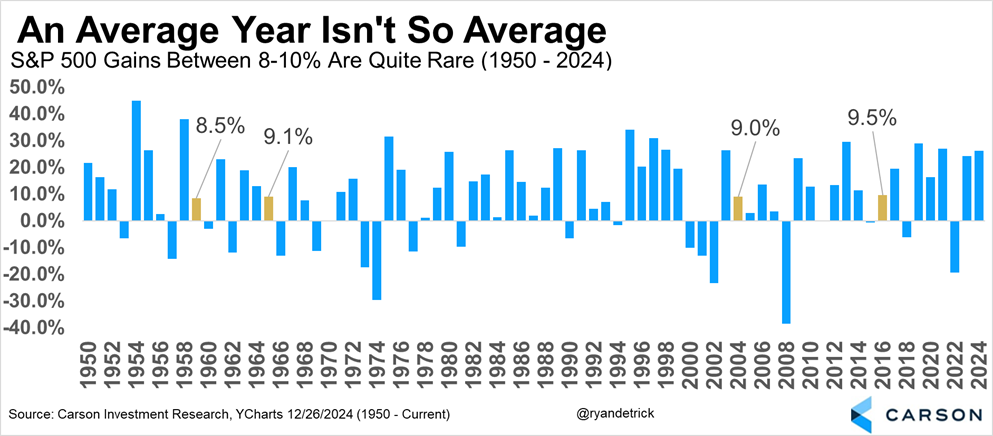

Historically, stocks gain about 9% on average, but a little known secret is that something near the average return rarely ever happens, in fact, much larger moves, both higher and lower, are quite common. Incredibly, going back to 1950 stocks had ‘about an average year,’ with a return between 8% and 10%, only four times, and the average return in an up year is 17.6%.

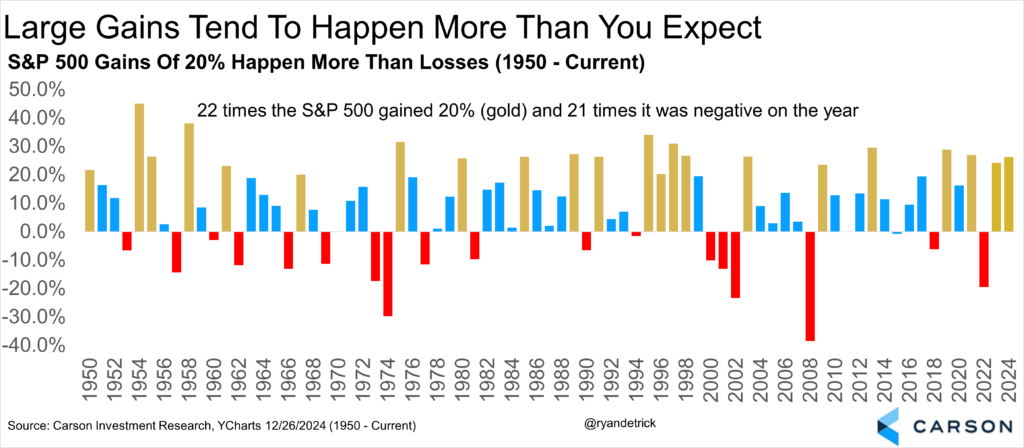

Another angle — after this year the S&P 500 will have gained more than 20% 22 times compared with an annual outright loss 21 times. In other words, the historical odds of a 20% gain are greater than a down year! Most investors aren’t prepared for this type of annual volatility, but it’ll help them if they indeed are.

Volatility Is the Toll We Pay to Invest

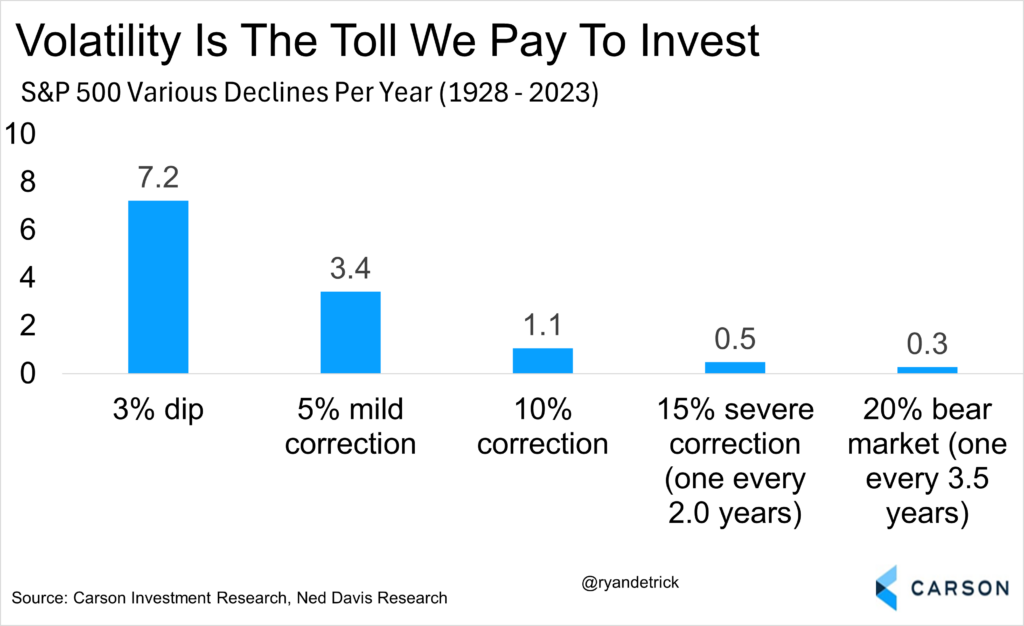

We will finish with probably one of the most important lessons for investors. While stocks have a strong economically based tendency to go up in the long run, it’s still perfectly normal for them to go down in the short run. As the quote at the beginning noted, the declines always seem to happen way quicker than the advances.

With thanks to our friends at Ned Davis Research, historically the average year sees more than seven 3% dips and more than three mild corrections of 5% or more a year. In fact, it is perfectly normal to see a 10% correction as well, as one happens on average once a year. Print this off and stick it to your desk, as investors could do themselves a big favor by remembering that each year will see volatility and it is the toll we pay to invest.

That’s seven important things to remember in 2025 and in every year. We wish everyone a Happy New Year and many happy returns in 2025.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Ryan Detrick, Chief Market Strategist click here.

02574347-1224-A