“I refuse to join any club that would have me as a member.” -Groucho Marx

Have you tried to fly this week? My oh my, what a mess out there. On both Sunday and Monday nights I was stuck at airports until well past midnight. I made it to Minnesota this week for some client events, but not before I got home around 2 am only to go back two hours later for a 6 am flight. I know this was all because of an ‘upgrade’ but it sure feels like anything but that. Heck, at my hotel they gave me two keys and said not to lose them, as they can’t make anymore due to the IT issues.

Ok, now that I got that off my chest, let’s talk about some upgrades that are actually positive. As I discussed in 7 Reasons the Times Are A-Changin’ for Small Caps, the blast of strength we saw out of small caps recently likely suggested continued strong performance from this widely underinvested group. Today I’m going to share more reasons to expect small caps and large caps to do well, but also the overall stock market bull market to continue.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Why This Is Bullish Small Caps

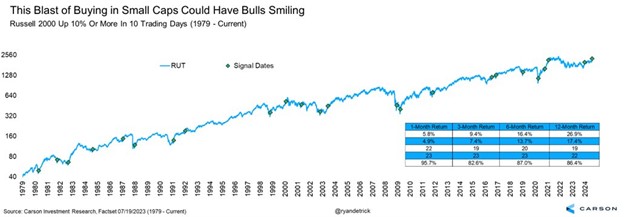

The Russell 2000 (R2k) is comprised of small cap names and it soared after the much better than expected inflation data two weeks ago. How much did it rally? The R2k gained 11.5% in 10 trading days, for one of the best 10-day rallies ever and best since after the election in November 2020.

I found 23 other times the R2k gained at least 10% in 10 trading days (taking the first signal in a cluster) and the returns going forward were extremely strong. The R2k was higher a year later more than 86% of the time and up nearly 27% on average, which should have many long suffering small cap bulls smiling. That’s a club many of us would want to be part of, to build on the quote from Groucho at the top of this blog.

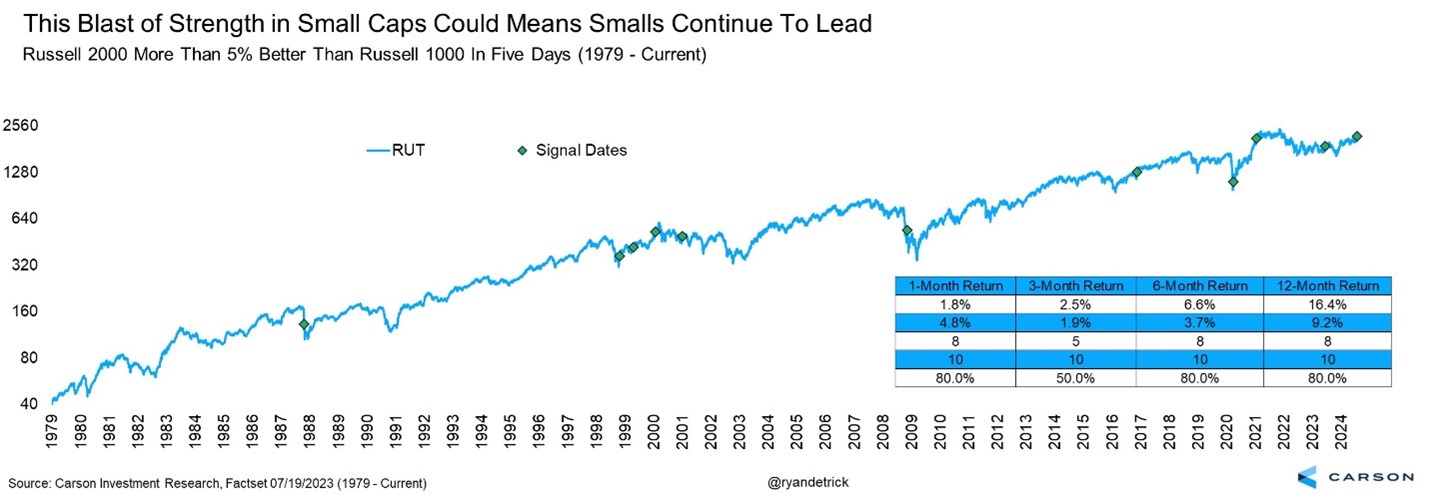

We saw small caps (R2k) outperform the Russell 1000 Index of large caps (R1k) by more than 5% in a five-day period recently. This is another not so subtle clue that small caps could continue to lead, as when this has happened in the past the R2k was higher a year later eight out of 10 times and up an average of more than 16%.

We’ve been bullish and remain bullish on small and midcaps. I was honored to join BNNBloomberg on Monday to discuss this and more in a fun five-minute interview. More discussion on why large caps should also continue to do well below.

To watch the interview click here.

Why This is Bullish for Large Caps

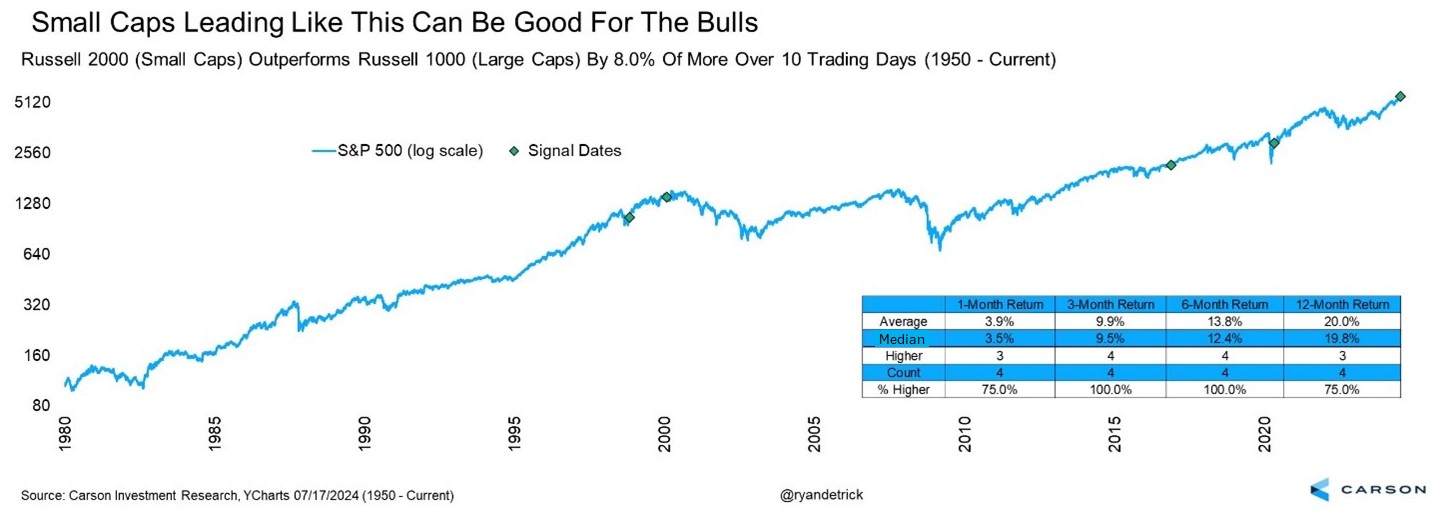

Yes, we think small caps will outperform large caps the rest of this year, but that doesn’t mean large caps can’t have some more fun. In fact, it is quite likely. The R2k outperformed the R1k by more than 8% in a 10-day period recently which is extremely rare. I found only four other instances and the S&P 500 was up 20% on average a year later and higher three times. The one time that didn’t work? March 2000 and the peak of the tech bubble. Still, this combined with the other studies in this blog continues to suggests a solid second half of the year when all is said and done.

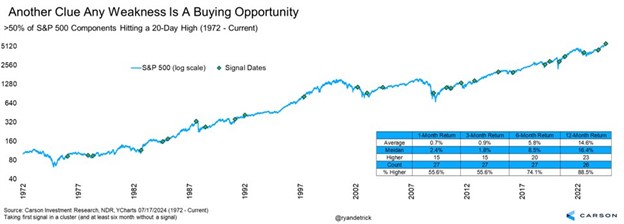

Recently more than half of the components in the S&P 500 hit a new 20-day high, which is a buying thrust and shows there is broad participation in this bull market. Once again, futures returns are strong, with the S&P 500 up close to 15% a year later on average and higher nearly 89% of the time.

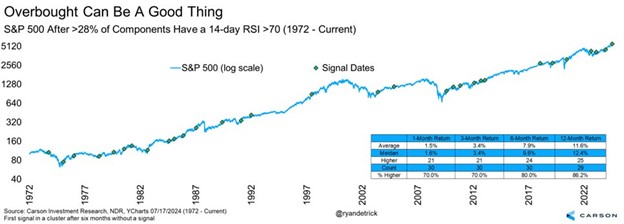

Lastly, overbought can be a good thing. When you hear overbought you might think that it’s bad, but it turns out overbought is how nearly all major bull market start and it can be good plenty of other times too. More than 28% of all the components in the S&P 500 were recently overbought (14-day RSI above 70). This tends to happen in bullish trends and rarely has major trouble been right around the corner. When we’ve seen this level of overbought stocks, the S&P 500 has been higher 25 out of 28 times a year later and up nearly 12% on average.

Let’s be honest though, September and October are historically poor months in an election year and I think we could see some rocky times once again this year. We’ve been quite spoiled with such a strong start to ’24 and this was on the heels of the huge year last year. Buckle up, as we likely will see some scary headlines and red days ahead of the election.

For all of our latest views on markets and the disaster that was traveling this week, be sure to listen to (or watch below) out latest Facts vs Feelings podcast.

For more content by Ryan Detrick, Chief Market Strategist click here.

02335049-0724-A