“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” -Winston Churchill

Yes, stocks have had an incredible run this year (and last year), but there are some reasons to expect the good times to continue. No, we aren’t looking for another 20% next year, but better than average returns in 2025 is still quite possible.

Today I want to share some reasons to continue having a “glass half full” mentality as we head into the election and look ahead to 2025.

Up Six Weeks in a Row

Well, it was bound to happen eventually, but stocks finally fell last week, with the S&P down about 1.0%. Remember though, it has been higher the past six weeks for the longest weekly win streak this entire year, so some red on the screen is perfectly normal. The election is also right around the corner and some type of well-deserved jitters ahead of a potentially volatile event is also perfectly normal. And of course, stocks not going up every week is perfectly normal.

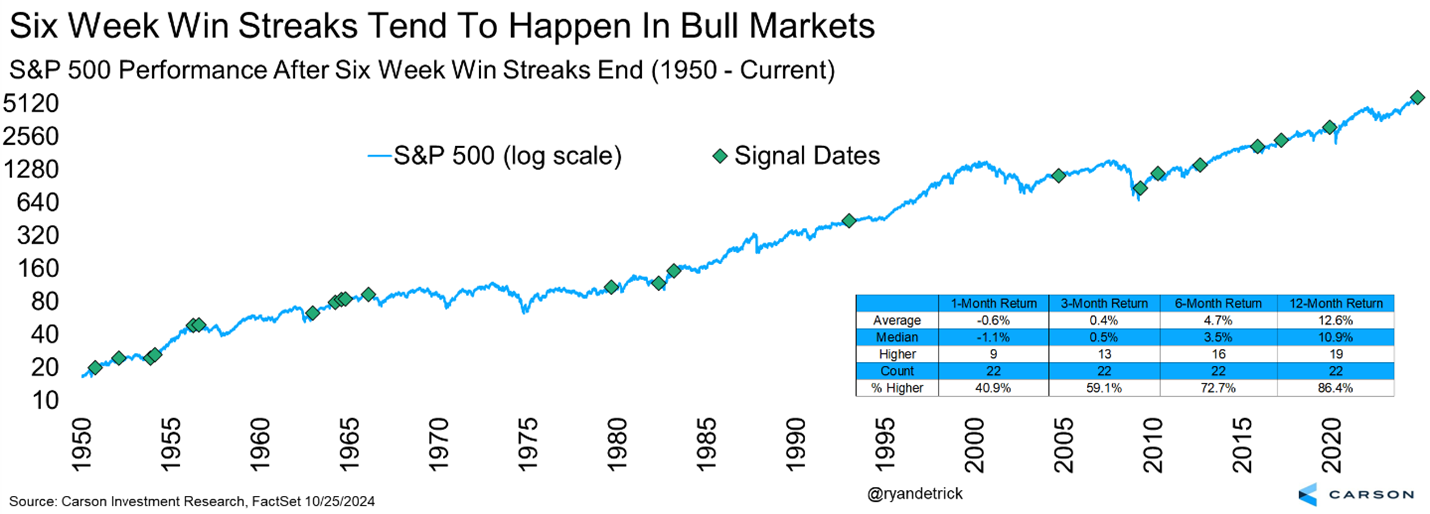

Still, the S&P 500 is up nearly 22% on the year. If the year ended right now that would be the best election year return since a 25% gain way back in 1980. Even if there were some election volatility, long weekly win streaks tend to happen in bull markets, which is another reason we would not panic should more near-term pain take place. Since 1950, we found there were 22 other times the S&P 500 had a six-week win streak (meaning stocks were lower the seventh week) and it was higher a year later 19 times and up a solid 12.6% on average. Yes, the returns over the next month were negative, but after long winning streaks this shouldn’t be very surprising.

The Best Six Months Are Here

We hear all the time about how the worst six months of the year are May through October, also known as the “Sell in May” time of year. We pushed back against this bearish narrative many times this year and all we’ve seen is stocks gain five months in a row during this usually bearish time of year.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

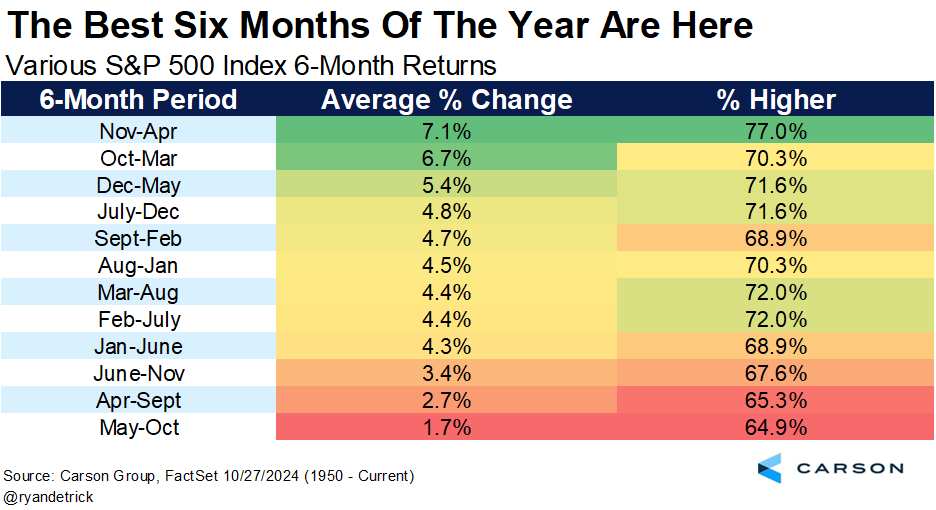

Well, now we are entering the best six months of the year, where the S&P 500 has gained 7.1% on average and been higher 77.0% of the time. This indeed could have the bulls smiling.

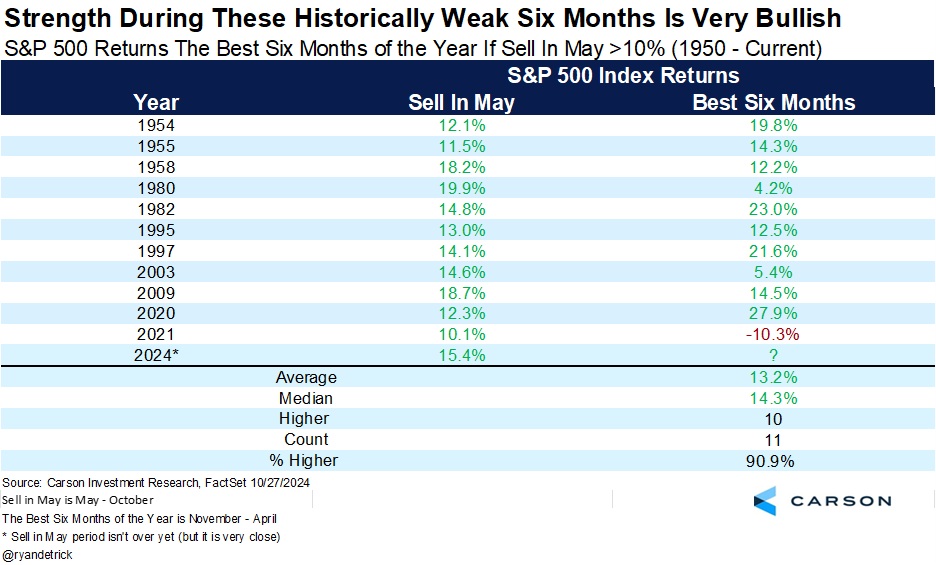

But what happens when the ‘Sell in May’ period is strong? After all, this time around stocks have gained more than 15% during this usually weak six-month stretch, one of the best gains over this period ever. We found 11 other times stocks gained double digits from May through October and the next six months did even better, gaining 10 times and up 13.2% on average, well above the 7.1% average seen in all years.

The Best Three Months

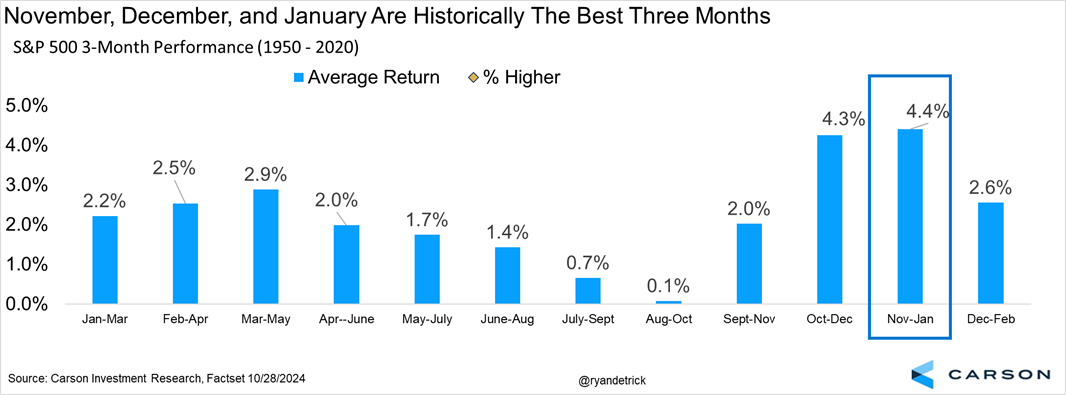

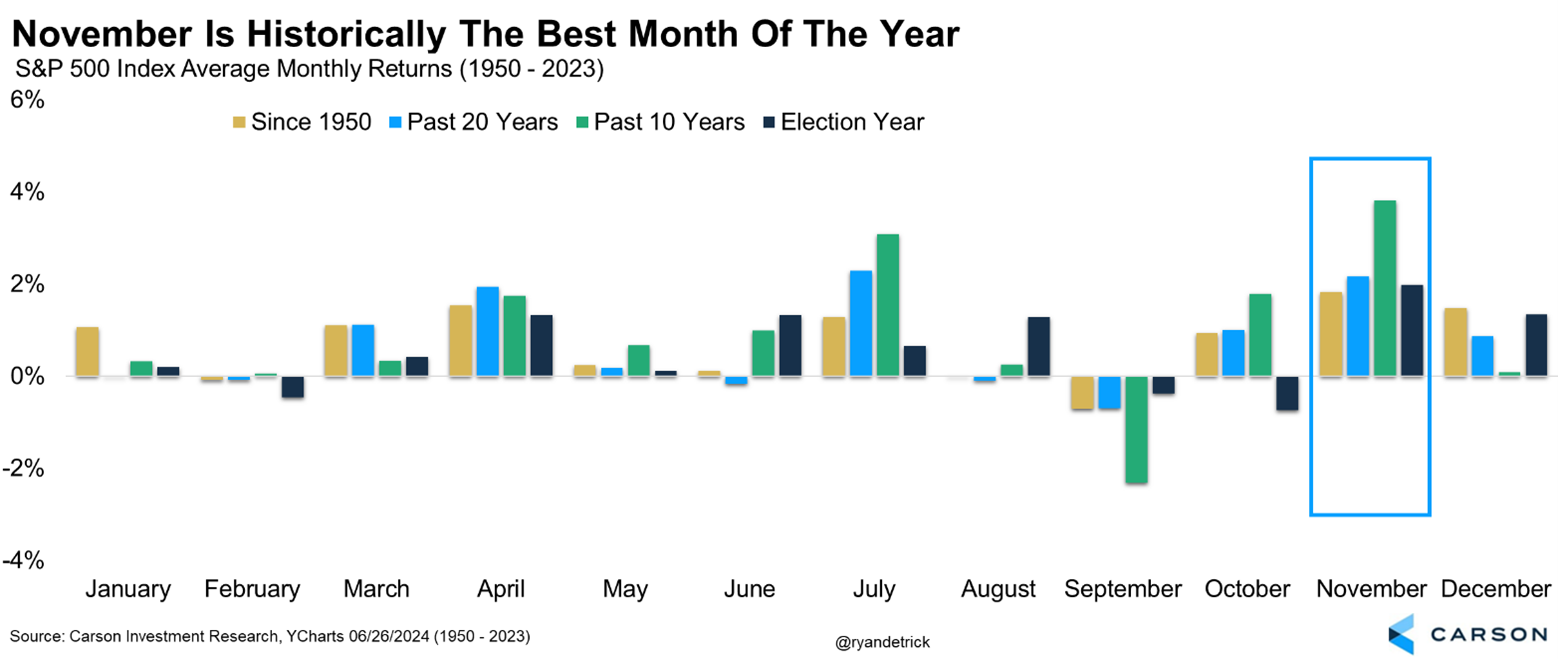

Another reason to remain bullish is November, December, and January are historically the best consecutive three months of the year, up 4.4% on average.

November Is the Best Month of the Year

November is historically a very strong month for stocks. The last time it fell more than 1% was in 2008, and it has been higher 11 of the past 12 years. Not to be outdone, it is the best month since 1950, in the past decade, and in election years, while it ranks as the second-best month the past 20 years (only July is better).

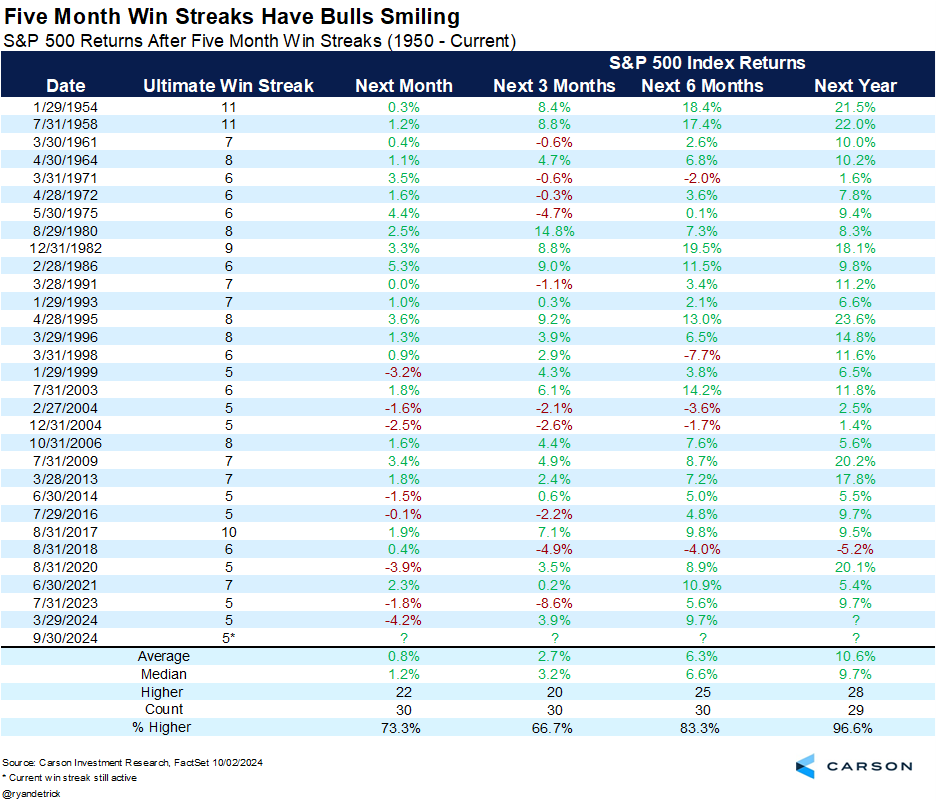

Up Five Months in a Row

The S&P 500 might be up six months in a row soon, but October still has a few more days. But it is already officially up five months in a row. Historically, the year after a five-month win streak the S&P 500 has been higher 28 out of 29 times and up more than 10% on average. Whoa.

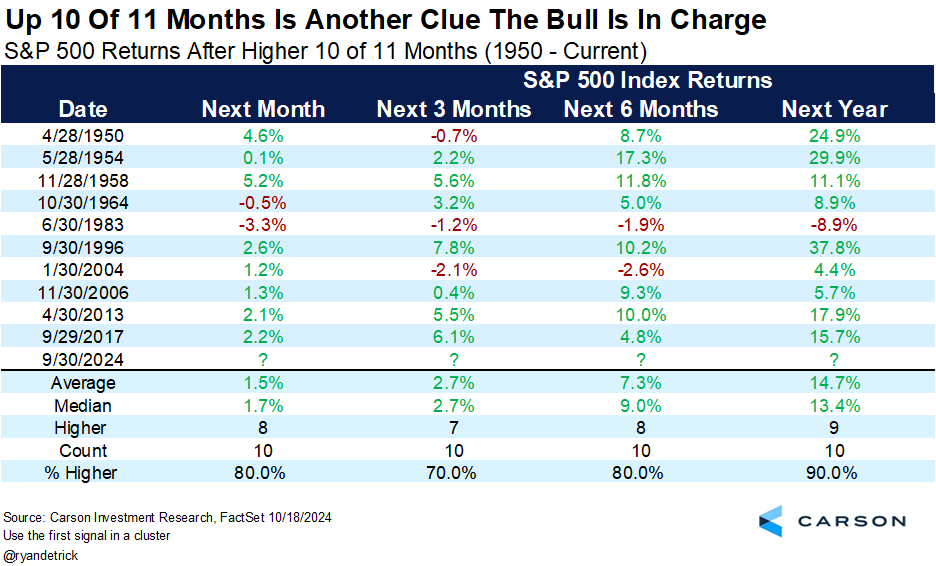

Up 10 of 11 Months Is Also Bullish

The fun doesn’t stop just yet, as when stocks gain ten of eleven months (like now) they are higher a year later nine out of ten times and up nearly 15% on average. In other words, this blast of strength we’ve seen isn’t a reason to turn bearish. In fact, it might be a reason to remain in the glass half full camp as we head into 2025.

This Isn’t an Old Bull Market

Data shows that once someone hits 65 years old, the odds of making it to 85 are quite high. It turns out bull markets are like this, as we found that once a bull makes it into its third year (like this one has) the potential for many more years of gains is actually quite high. Go take another look at the Churchill quote above, as I think it fits this bull market quite well. We might be past the beginning of the bull market, but by no means does that mean it is done.

Going back 50 years, we found there were five other bull markets that made it past their second birthday. Wouldn’t you know it, the worst any of them did was lasting another three years (which happened twice). Meanwhile, the average bull lasted eight years and gained 288% when all was said and done.

No one knows how long this bull will last, but the bottom line is history says be open to this bull market lasting much longer than probably most expect.

Lastly, I joined Paul Bagnell on BNN Bloomberg on Friday to discuss many of these concepts, which you can watch here.

For more content by Ryan Detrick, Chief Market Strategist click here.

02481622-1024-A