“Sometimes the questions are complicated and the answers are simple.”

-Dr. Seuss

2024 came out swinging, with the S&P 500 up more than 10% in the first quarter on the heels of adding more than 11% in the fourth quarter of ’23. Back-to-back double-digit quarters are quite rare, but the good news is they tend to happen in bull markets, something we’ve been saying we are in for a long time.

April is usually a bullish month, but it saw the S&P 500 fall 4.2%, which included a well-deserved 5.5% mild correction mid-month. The economy remains on firm footing, but there are potential cracks forming. What could be next for stocks? We’ve been overweight equities since December ’22 and remain there today, as we expect to see stocks move to new highs this summer and the bull market to continue.

Here are six reasons we think the bull market is alive and well.

Big Starts to a Year Are Bullish

Listen, after a five-month win streak we were probably due for at least a pause. We also saw some of the same bears who mocked us last year for being bullish turn into bulls themselves. With that kind of setup, it makes sense that some type of volatility was necessary to shake the tree. Even though the S&P 500 pulled back just over 5%, many of the former highfliers saw much larger corrections.

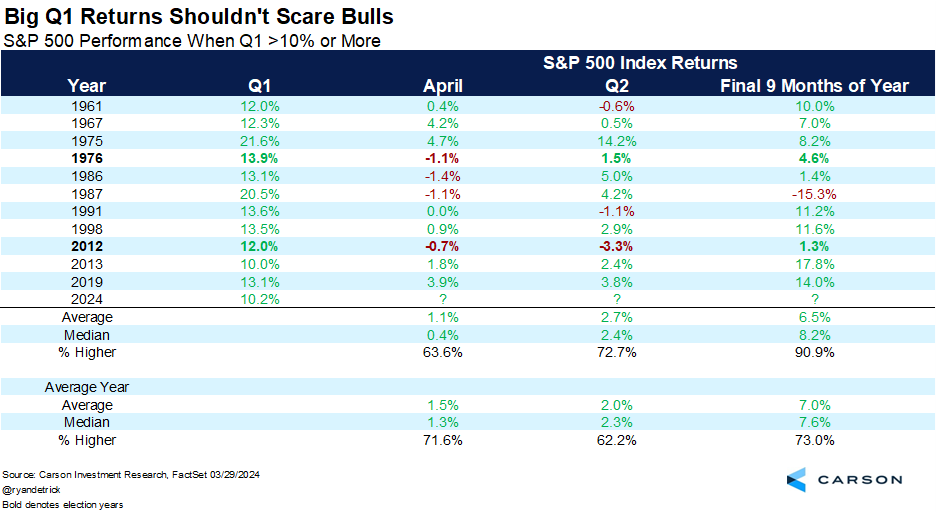

As for the big start, we looked at other years that gained double digits in the first quarter and stocks were higher the rest of the year (so the final nine months) 10 out of 11 years. Yes, 1987 was the one year it was negative, but stocks were up 40% for the year in August back then, so we don’t see that repeating. The average return is skewed due to 1987, but the median return the rest of the year is a solid 8.2%, better than the median return for all years. Bottom line, a big start to a year shouldn’t be a reason to become bearish. In fact, historically it signals likely additional strength.

This Bull Market Is Still Young

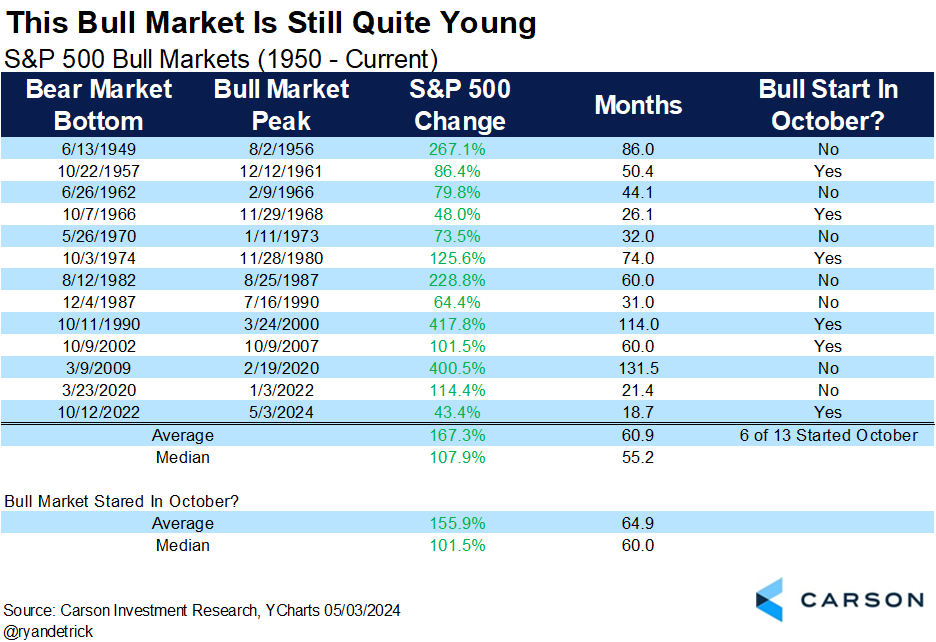

The current bull market started in October ’22, which means it is now just under 19 months old. Would you believe that if the bull ended here and now this would make it the shortest bull market ever? That’s right, most bull markets last much longer, with the past 12 bull markets averaging more than five years in total. Taking this a step further, many bull markets started in the “bear market killer” month of October (this one included), and we found that those bull markets lasted even longer.

The current bull market is up more than 40%, which might feel like a lot, but looking at the four bull markets since 1990 shows they all at least doubled. The bottom line is history tells us to be open to a much longer bull market and potentially large gains along the way.

Stocks Like a President Up for Re-election

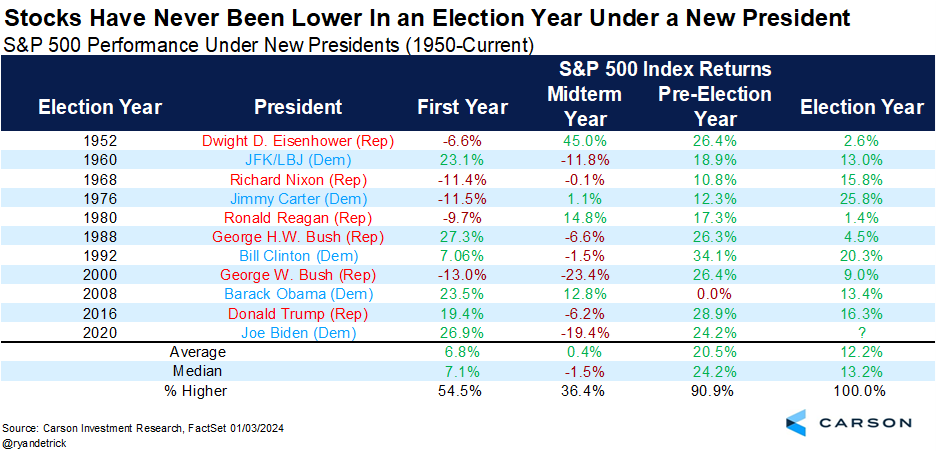

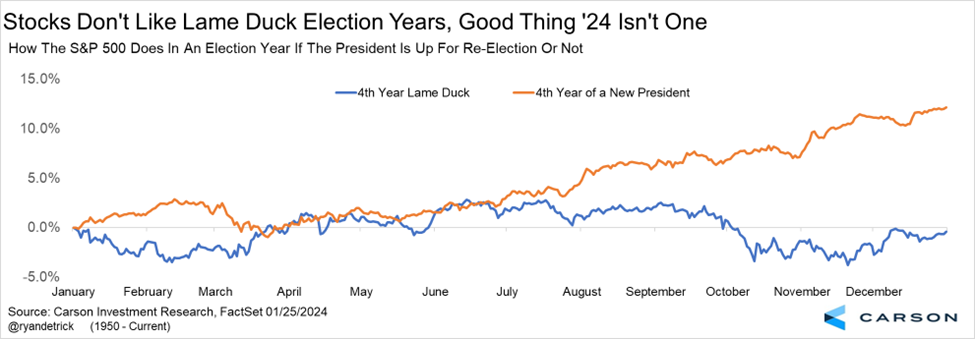

We noted in our Outlook 2024 that the past 10 times a President was up for re-election stocks finished the year higher. It was election years with a lame duck President where things didn’t go as well.

Taking this a step further, a surprise summer rally is normal when the President is up for re-election. This chart does a nice job of showing how strength the rest of this year is likely with a president up for re-election, while trouble brews when the President is a lame duck.

It’s All About Earnings

What drives long-term stock gains? It is earnings and the backdrop continues to look quite strong. The still healthy consumer, strong labor market, potentially lower rates helping housing, and improving manufacturing all suggest an economy that could surprise to the upside the rest of ‘24. Nominal GDP came in near 6% last year for one of the best years in recent memory, but the stage is set for similar growth this year. Remember, nominal GDP growth leads to profit growth and profits matter.

S&P 500 first quarter earnings are up more than 5.0% currently, from 3.2% expected at the start of the quarter, according to FactSet. This would be the best earnings growth in nearly two years, while revenue is higher for the 14th quarter in a row as well.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Corporate profits for the S&P 500 are expected to hit an all-time high this year, with a gain in ’24 of close to 11%. We’ve found that periods that have strong productivity (like we are seeing now) tend to come in even better than expected and we think 11% could be a tad low as a result. The mid-to-late ‘90s saw strong productivity, and also saw earnings and GDP consistently come in much better than was expected. It was the last decade, when productivity was low, that GDP disappointed consistently in the 2% range. Look at the quote at the top one more time, the easiest answer is earnings are strong and that is likely why stocks have been strong!

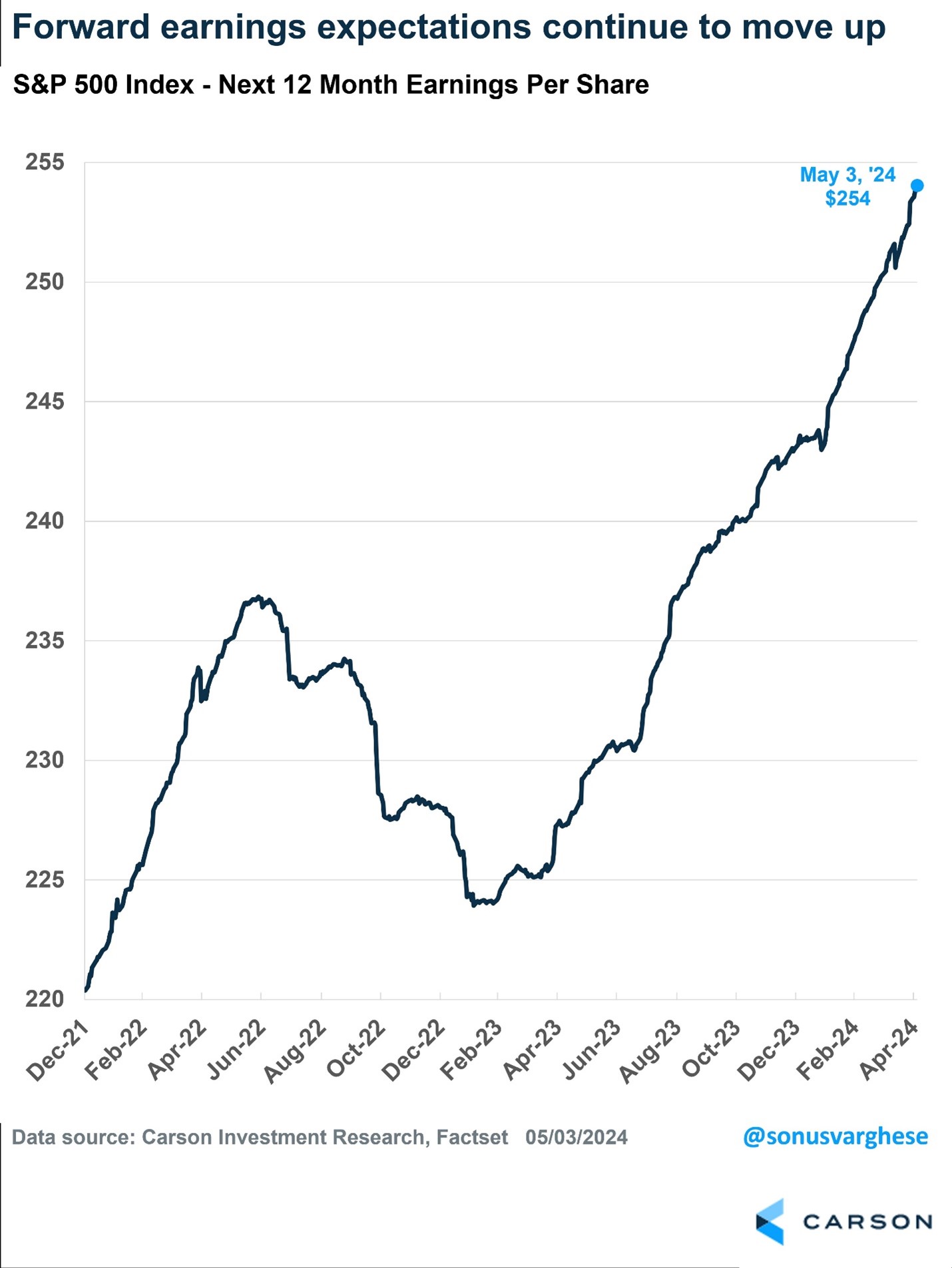

The other thing we’ve seen lately is analysts coming in too low with earnings estimates, as they are still too skeptical of this recovery. Looking out a year, forward 12-month S&P 500 earnings have soared from $243 at the start of the year to $254 currently. When companies post record profits you tend to see stock prices follow suit and we don’t think this time will be any different.

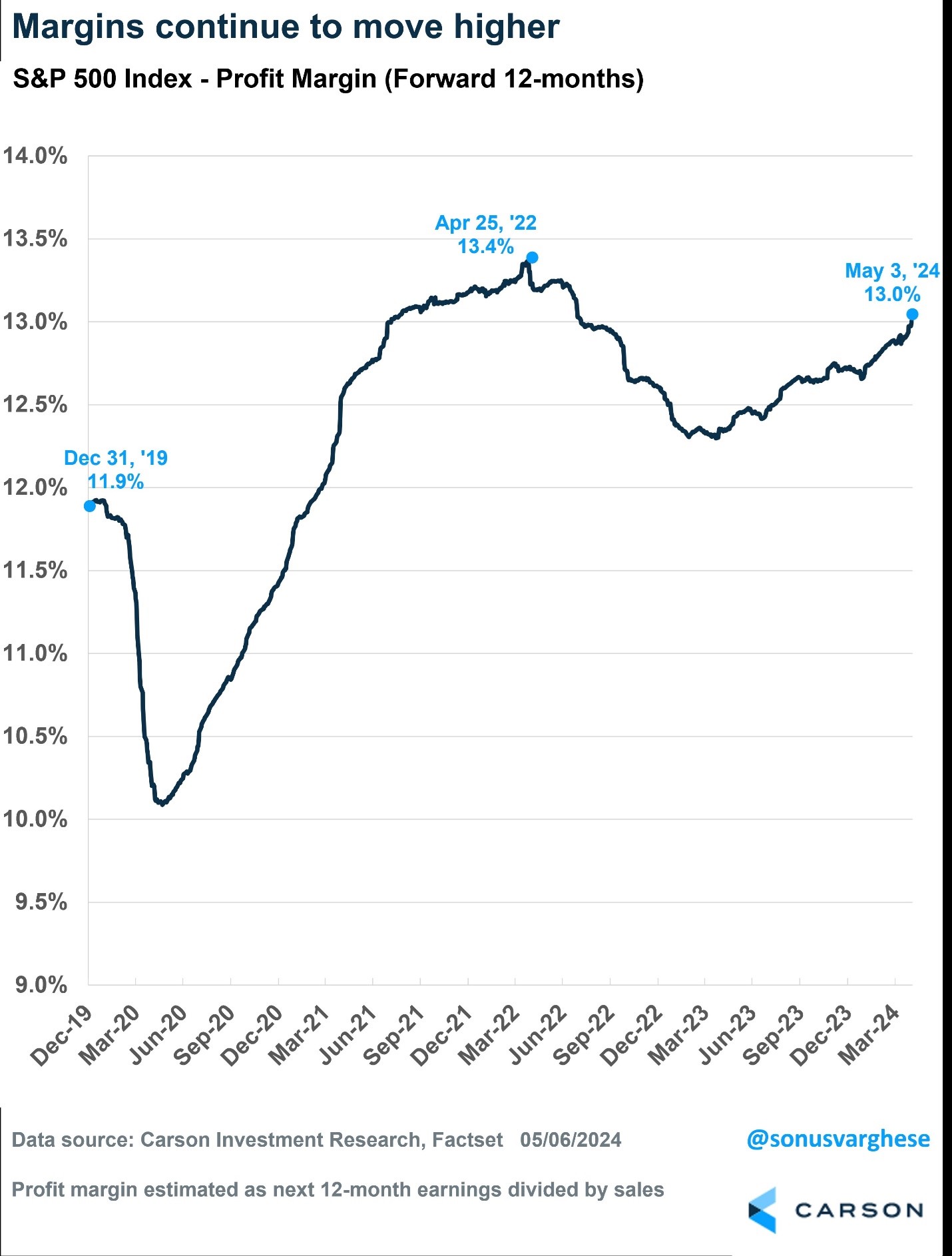

Profit margins and CAPEX Continue to Improve

A cousin to earnings is profit margins and stronger profit margins could be another reason to expect a stronger economy and bull market. Yes, profit margins are improving due to cost-cutting, but this will likely create a leaner and more agile corporate America the second half of this year.

We’ve been told for what feels like years now that profit margins have only one way to go and that is lower, but the opposite continues to happen. Improving profits and profit margins supported by continued economic growth next year would provide a strong tailwind for equities.

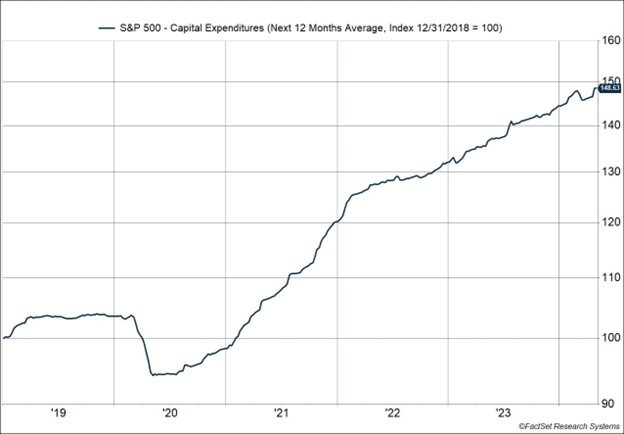

Higher capital expenditures (CAPEX) is another positive. In fact, forward 12-month CAPEX is at an all-time high as well. Companies investing in themselves should lead to continued stronger productivity growth, which will help economic growth likely exceed expectations.

Improvement on the Inflation Front

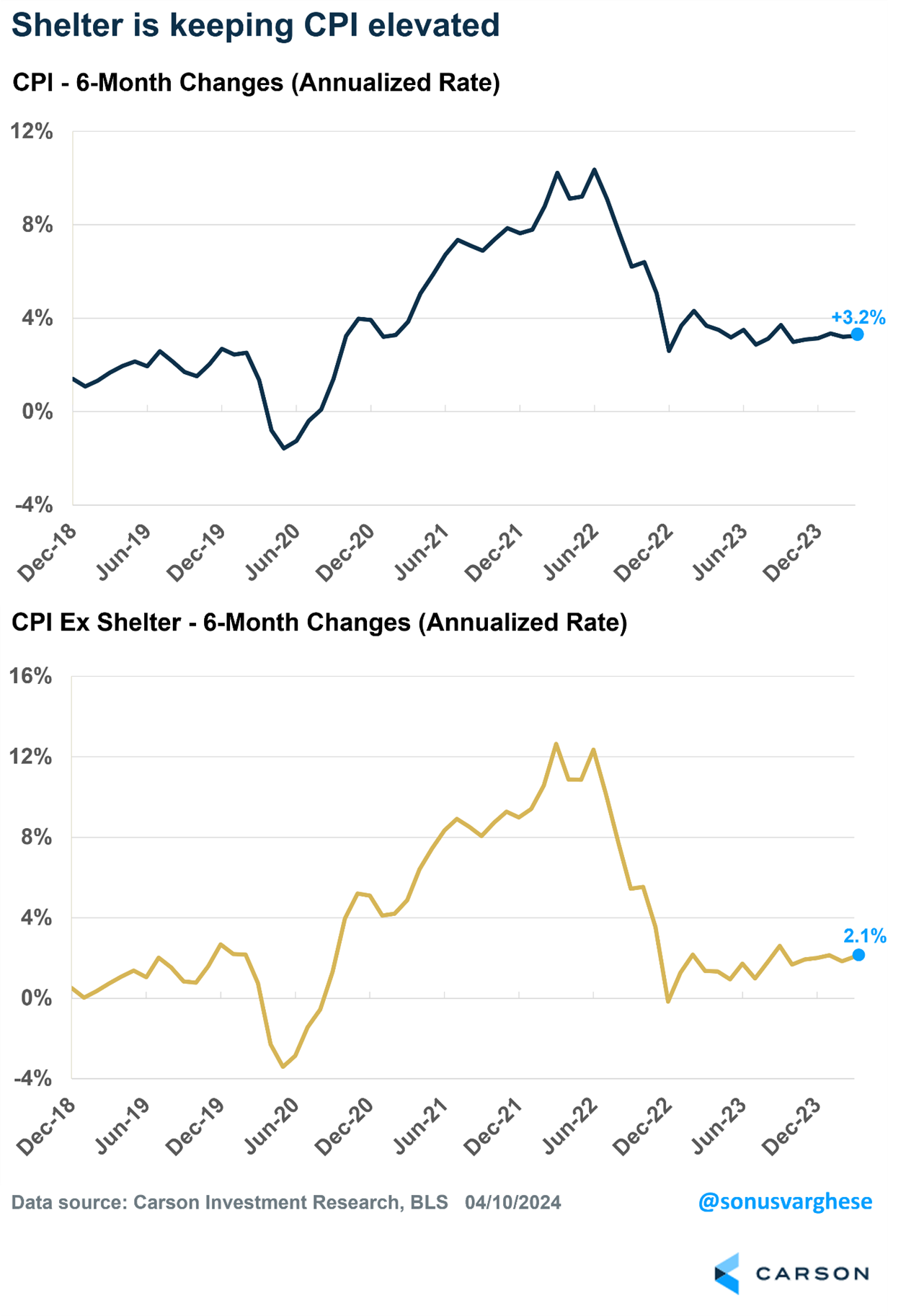

Lastly, and maybe most importantly, we’ve seen overall improvement on the inflation front over the past year, but the past few months have shown that the path lower won’t come without some bumps. We remain in the camp that inflation will continue to improve and the blip we’ve seen early this year is more seasonal quirks and outliers that are unlikely to persist (higher auto insurance and higher financial services fees for example).

We know that rents are falling in the private data, which gives a good estimate of prices for new or renewed leases. The rental price for a lease today is likely less than a similar lease over the last couple of years, but that has yet to flow to the government’s data, which includes all rents and shelter, even rent “attributed” to homeowners. Remember, shelter makes up more than 40% of the core Consumer Price Index (CPI), so any improvement here will quickly influence CPI data. But while we’re waiting for overall rents to catch up with changes in asking prices seen in private data like Apartment List and Zillow, keep in mind that if you remove shelter from CPI, inflation is actually running quite close to that 2% level the Fed targets.

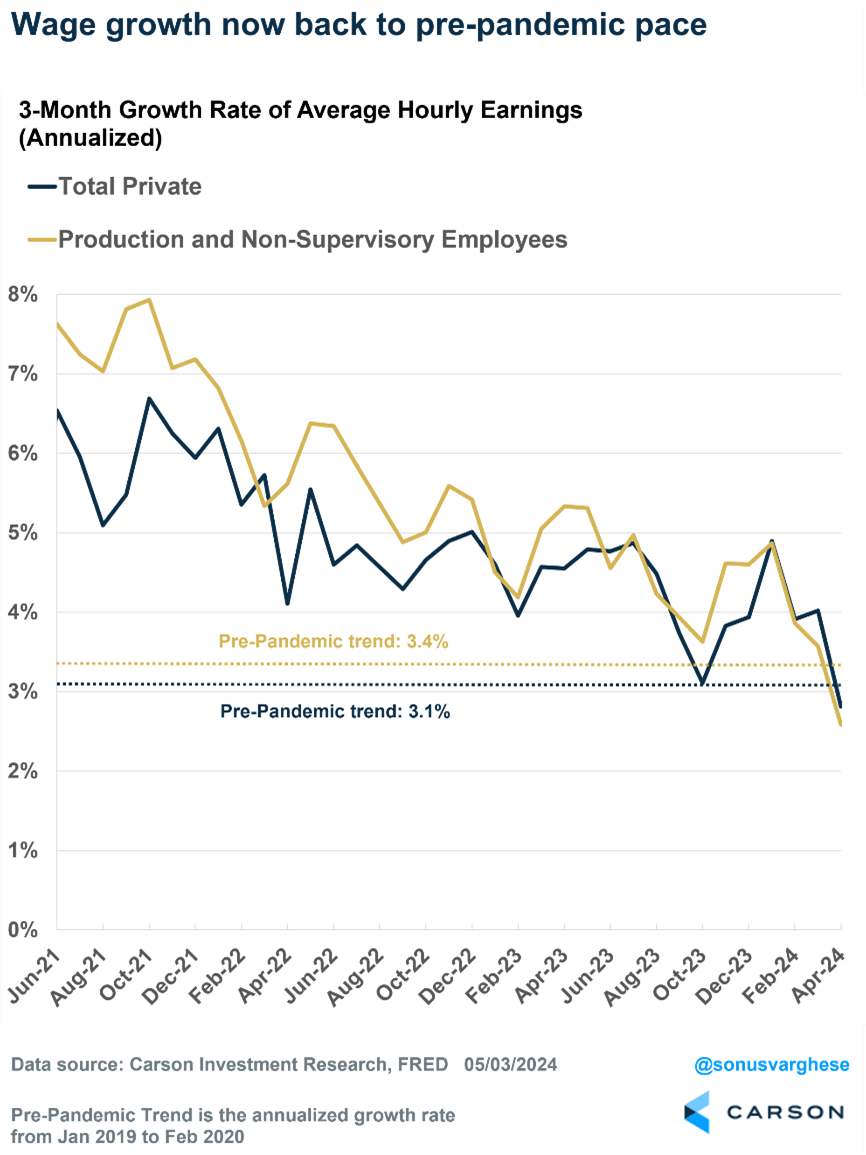

There has also been concern over higher wages impacting inflation, but we expect improvements there as well over the coming months and quarters. The recent JOLTS data showed a healthy but normalizing labor market as wage growth slows. The Indeed Wage Tracker similarly showed slowing wage growth. Remember the 1970s saw wage growth up around 9%, which did flow through to overall inflation. Wages are still solid right now, but more in the range of what we saw pre-pandemic.

All of this matters, as it sets the stage for the Fed to cut rates this year, likely two times. We started the year with markets looking for 6-7 cuts, but it then fell to only one cut (with some vocally calling for a hike recently). Just as the pendulum had swung too far toward many cuts to start the year, we feel it has swung too far the other way now. With improving inflation data expected, the Fed should have the ammo to cut rates, likely starting in September, or at the very least to push back on the hawkish rhetoric. Either could be a nice tailwind for equities.

I joined Scott Wapner on CNBC’s Closing Bell yesterday to discuss many of these concepts, along with why we see a surprise summer rally in stocks.

For more content by Ryan Detrick, Chief Market Strategist click here.

02230177-0524-A