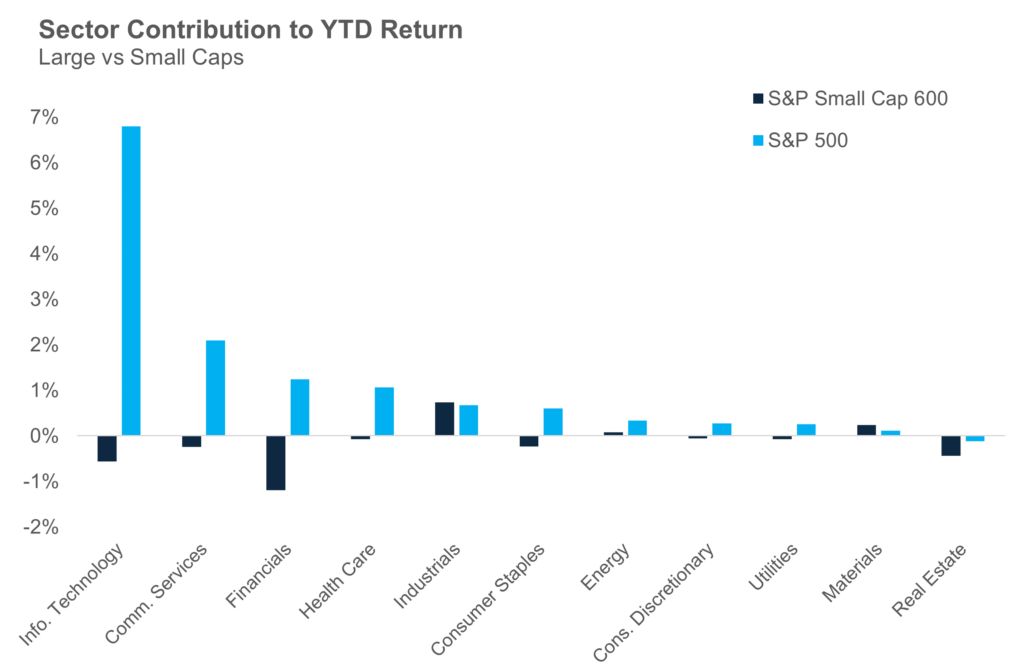

Small cap stocks have been left in the dust by their larger-cap cousins since early 2023, with a few fits and starts along the way. Small caps showed strength coming out of the 2022 lows but were unable to build on their momentum as the Fed continued to raise interest rates until the summer of last year. While small cap stocks have had a few positive sectors this year, any strength pales in comparison to large cap technology. Large cap tech stocks – led by Nvidia and Microsoft – have propelled the S&P 500 higher on the year, contributing more than half of the year-to-date gain on the index. While this is likely not news to many, when seen visually compared to the rest of the sectors in the index, and especially the small cap index, the outperformance is striking. To make matters worse for small caps, ultra-highfliers like Super Micro Computer (SMCI) and MicroStrategy (MSTR) have been ineligible for small cap index inclusion, either because they don’t meet earnings criteria or they have simply grown too large too fast to be considered small caps.

Sources: Factset, Carson Investment Research 6/11/2024

With recent performance working against small caps, why do we continue to lean into the position, and suggest it as an important part of a portfolio for our clients? There are several economic, fundamental, and quantitative reasons not to give up on small caps just yet.

First off, the soft landing – or maybe no landing – scenario continues to play out. Growth remains strong, labor market dynamics healthy, and inflation appears to have stabilized. This combination of a strong domestic economy, where small caps derive a large portion of their earnings (significantly more than large caps), and the likelihood of lower interest rates is a recipe for small cap strength.

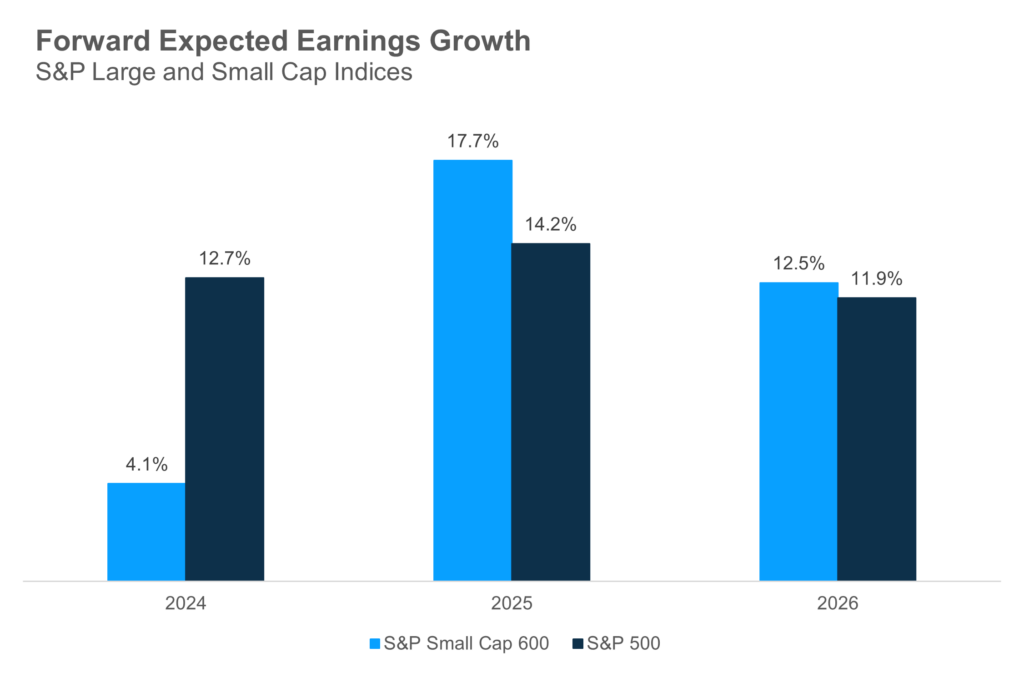

We have written many times before on how over the long term, fundamentals – particularly earnings – drive stock prices. This is of course true for large caps as much as it is for small caps. Small company earnings growth appears to have been troughed over the past year, setting up future year expectations in a big way. In fact, as it stands today, analysts see small cap earnings growth in 2025 and 2026 above that of S&P 500 companies. While these are just estimates, we know that the market is a forward-looking discounting mechanism and begins to apply these expectations in advance.

Sources: Factset, Carson Investment Research 6/11/2024

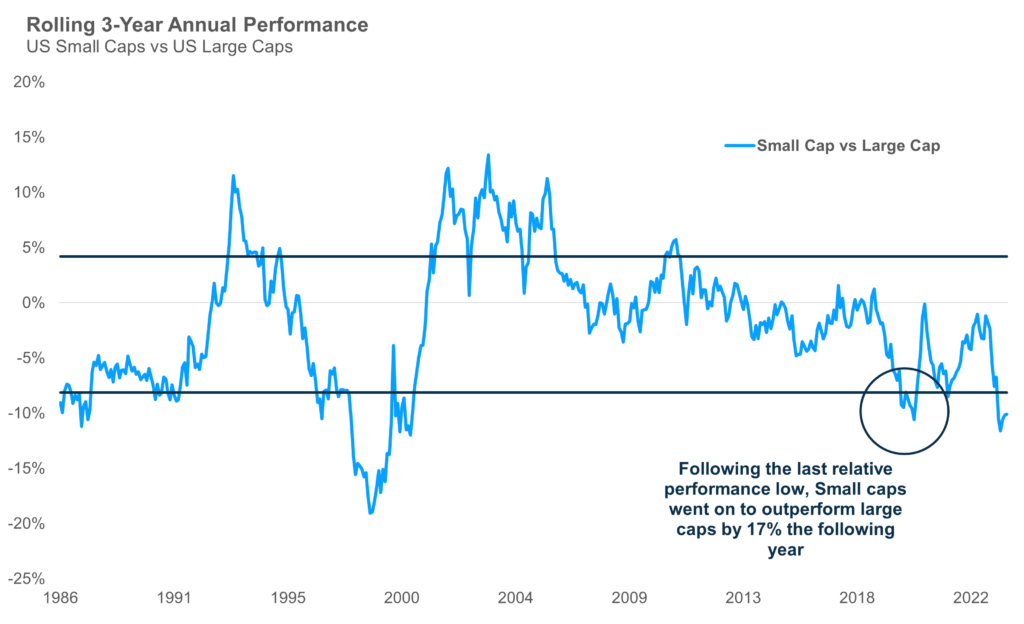

We have also mentioned a number of times before how small caps stocks are historically cheap versus just about every other equity asset class. While this large valuation discount does not provide any sense of timing, it is still a tailwind for the asset class. Valuation re-adjustments can happen quickly, which is one reason for the importance of diversification. Looking at valuations in a differently light, in what can be referred to as long-term reversal, small caps are at a relative performance low versus large caps (probably not a surprise). The magnitude of that relative low, however, is beyond one standard deviation to history, and at a level that has preceded strong small cap rallies in the recent past.

Sources: Morningstar, Carson Investment Research 5/31/2024

We recognize that small cap stocks have not met the performance of their large cap counterparts — particularly large cap growth. Diversification, by definition, means that not everything in your portfolio moves in the same direction at the same time. We believe small and mid-cap stocks offer an attractive opportunity for investors that wish to limit market concentration and position themselves for a change in recent trends that may be getting overextended.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Grant Engelbart, VP, Investment Strategist click here.

02282480-0624-A