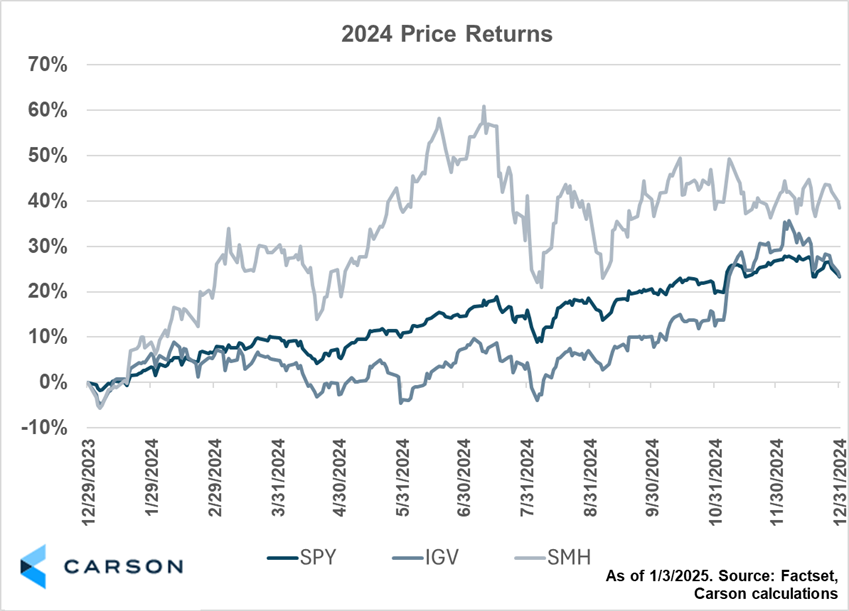

The age-old debate between technology investors was on prime display in 2024. While both the semiconductor and software industries had stellar performance in 2024 relative to broader market-cap weighted indices, it was a tale of two halves. I’m reminded, often, how debates, such as ‘software or semis,’ surface throughout markets, but may often be distracting. Investors may be better served to think about how the two can live in harmony.

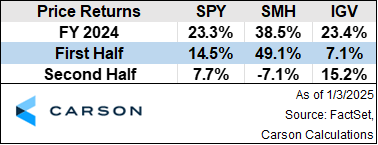

Technology stocks continued to outperform in 2024. Semiconductor stocks, as proxied by the VanEck Semiconductor ETF SMH, delivered a strong 38.5% return for the full year (FactSet data). Semi’s close cousin, Software stocks, as proxied by the iShares Expanded Technology Software ETF IGV, delivered a 23.4% gain in 2024 (FactSet). Both industries beat the broader S&P 500 which delivered a 23.3% return (FactSet). The ‘Technology Trade’ in 2024 was broad.

But as the table above shows, it was certainly a tale of two halves. Semiconductors boomed during the first half, and slumped in the second half. Software had a more consistent performance. I wrote about Software’s Surge which details some of the earnings highlights of holdings in the IGV. With software companies just now releasing AI-based products that used advanced semiconductors to train their algorithms, it should be clear to see why both industries can thrive.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

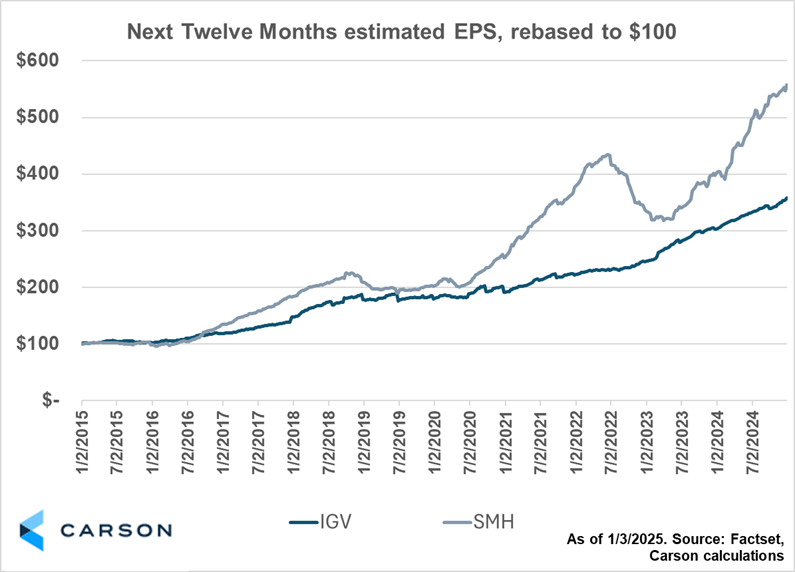

"*" indicates required fields

Investors may be well served to zoom out of the day-to-day debate of “Software or Semi’s” and ask themselves ‘what about software AND semi’s’? NZS Capital (short for Non-Zero Sum), a boutique technology investing firm, talks extensively about the origin and practicality of their namesake. Mainly, that a dollar of earnings for a software company isn’t a dollar less of earnings for a semiconductor firm; in fact, the two are closely intertwined and can often benefit together. And history shows the same. Next twelve months earnings per share estimates for both the SMH and IGV have trended higher over time.

Granted, semiconductors have shown considerably more cyclicality compared to software. But the big picture shows us that investors may be well served to reframe the discussion from “or” to “and.”

For more content by Blake Anderson, Senior Analyst, Investment click here.

02580122-0125-A