“I am an optimist because I don’t see the point in being anything else.” Abraham Lincoln

What a start to 2025, nearly picking up where 2024 left off. Yes, stocks fell in December and during the historically bullish Santa Claus Rally period, but the S&P 500 just made another new all-time high and is up nearly 4% in January already.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Here are two bits of good news for the bulls as we all freeze across this great country.

The First Five Days Were Positive

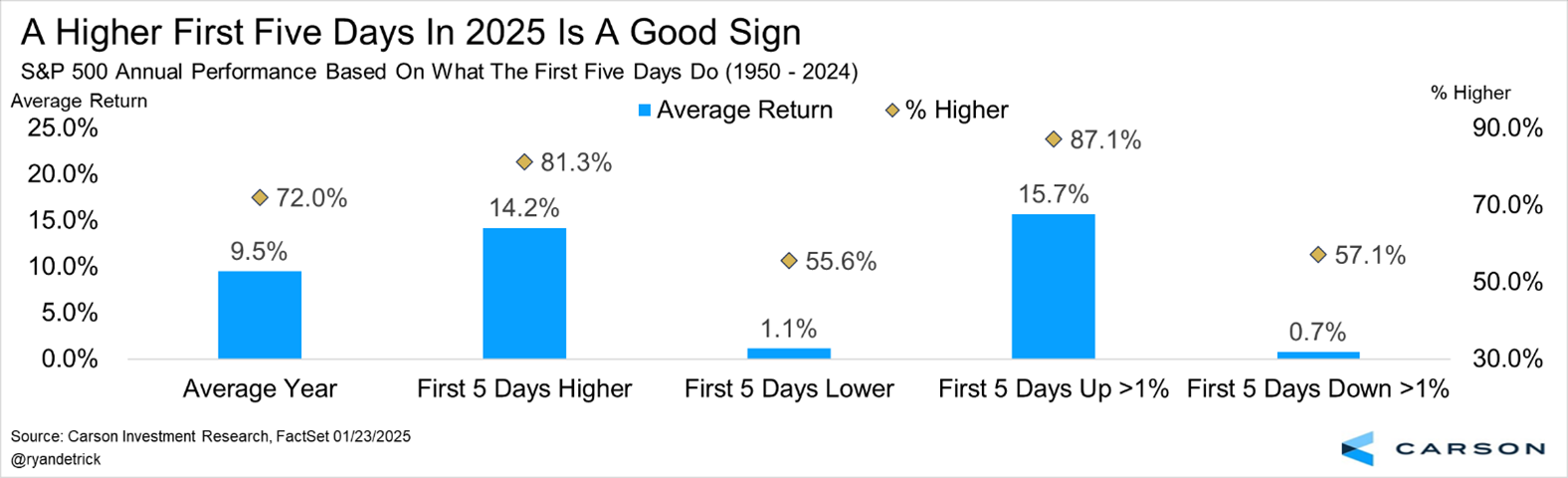

Although you wouldn’t expect there to be much correlation here, the first five days of a new year can sometimes foreshadow how the rest of the year might go.

Since 1950, the first five days were in the green 48 times and the full year was higher 81.3% of the time and up 14.2% on average, both better than the average year gain of 9.5% and up 72.0% of the time. Digging in a little bit more, a negative first five days suggests virtually a flat year on average and higher only 55.6% of the time. This matters, as the first five days in 2025 were up 0.62%, suggesting some potential good news for the bulls.

Post-Election Years Have Been Strong Lately

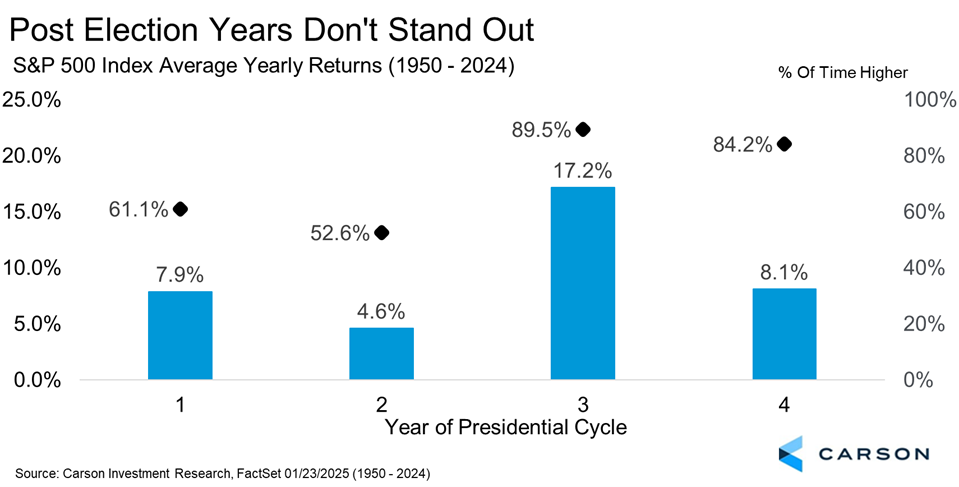

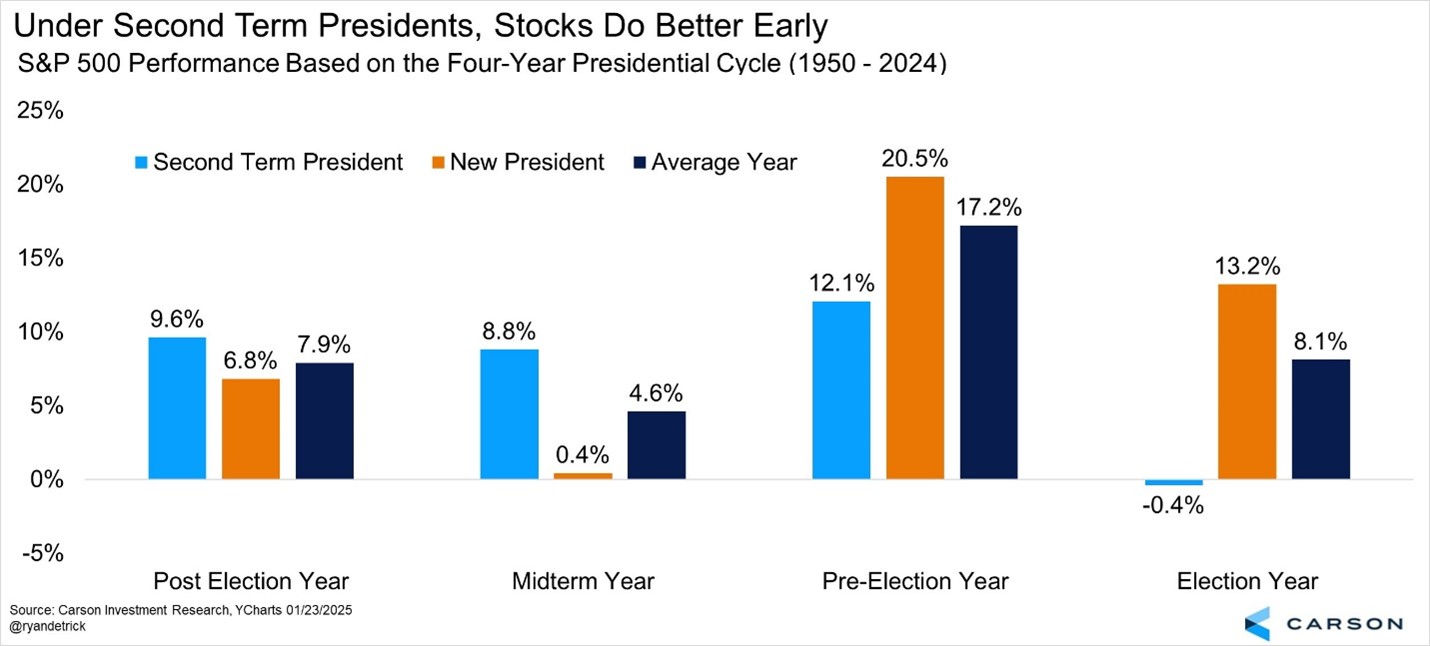

Did you hear we had an election last year? That of course means this is a post-election year, a year that historically has just been kind of average. As you can see below, since 1950, most of the big gains took place in pre-election years, while midterms years could be trouble. So this means election and post-election years tended to be more along an average type of year.

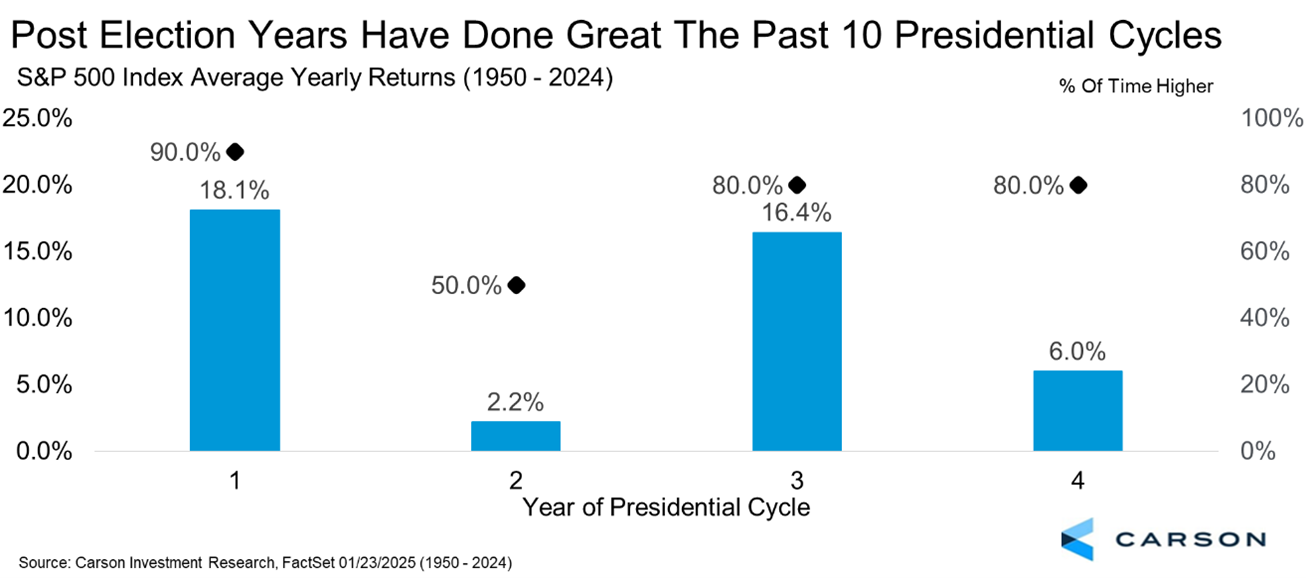

Here’s where things get interesting though. In more recent times, post-election years have been very strong. Going back 40 years (to 1985) post-election years have gained more than 18% on average and have been higher nine out of ten times!

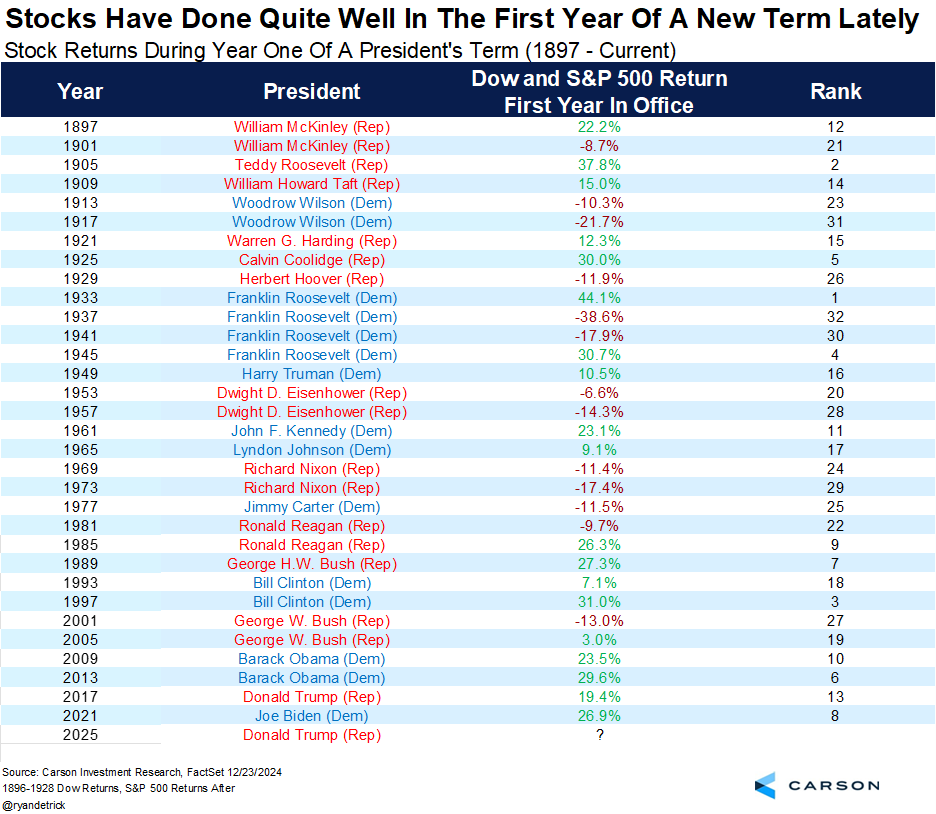

Here we broke it down by all post-election years going all the way back to 1897 and as you can see, only Bush in 2001 saw a negative return during this year in the cycle in more recent times.

To put a bow on this discussion, here are the returns for the four-year Presidential cycle since 1950 compared with the past 10 cycles. Post-election years are far and away the best performing year more recently.

What about taking the extra step and breaking it down by whether there was a new president versus a president in their second term? Here we found that stocks once again do much better in post-election years under a second term president, yet another positive for 2025.

For more of thoughts on this bull market, be sure to listen to or watch our latest Facts vs Feelings podcast. Thanks for reading!

For more content by Ryan Detrick, Chief Market Strategist click here.

7564478-0125-A