Inflation is on everyone’s mind these days, but as we wrote last week, the good news is that inflation is on a relatively strong downtrend. As of March, CPI was up 5% over the past year, but well below the peak of 9.1% we saw last June. However, even 5% inflation is really elevated.

No surprise that a popular question we get is “what is a good inflation hedge?”

Over the short-run asset classes like commodities can provide a hedge against inflation, as they did last year. Not to mention they act as a diversifier, which is useful when stocks and bonds are faltering. CPI inflation was up 6.4% in 2022, while here are the returns for 3 main asset classes:

- Stocks (S&P 500): -18.1%

- Bonds (Bloomberg U.S. Aggregate Index): -13.0%

- Commodities (Bloomberg Commodity Index): 16.1%

Another question we get: “what’s the best way to reduce portfolio volatility?”

The simple, and common, answer is related to what I just mentioned above. Diversify your portfolio, with some assets that zig when others zag. Usually, bonds are the diversifier of choice but obviously that doesn’t work always, especially when interest rates rise like in 2022 when the Federal Reserve responded aggressively to tame inflation. So, you need other diversifiers, like commodities.

However, my colleague Ryan Detrick had a wonderful blog yesterday where he quoted Burt White, our Managing Director and Chief Strategy Officer, who likes to say:

“Volatility is the toll that we pay for longer-term returns”

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

You can diversify away from stocks, and while that is a good idea to reduce volatility, the reality is that it does reduce long-term returns. Across asset classes, the maxim “more reward means taking more risk” holds true.

But here’s something that is interesting: time diversifies risk.

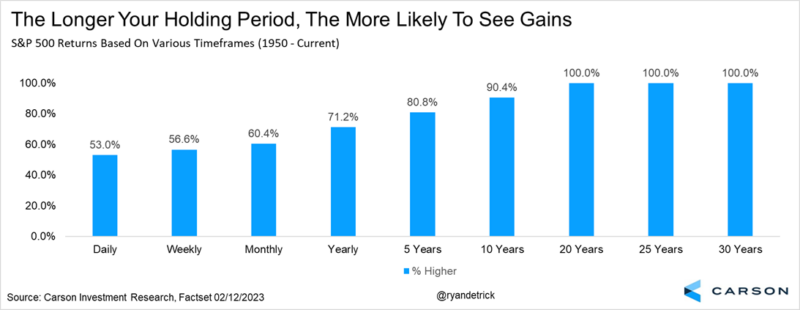

Ryan shared the following chart in a piece titled “Time is your BFF when it comes to investing”, showing that it really pays to have patience when investing in stocks. Looking at rolling 5-year periods over the past 70+ years he found that returns for the S&P 500 were positive 81% of the time. However, returns were positive 100% of the time when looking at rolling 25- and 30-year periods.

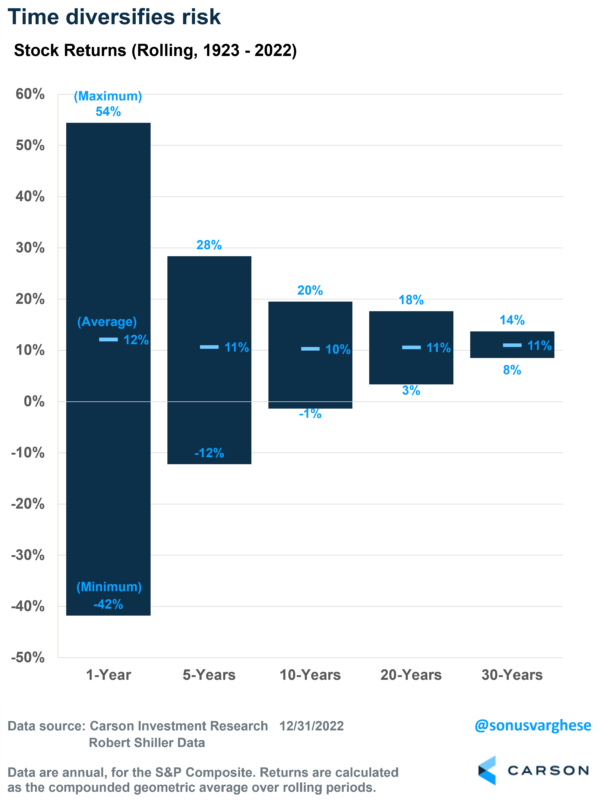

Using S&P Composite data over the past 100 years, I calculated returns for stocks over rolling 1, 5, 10, 20 and 30-year rolling periods. As you can see below, the 1-year horizon has a lot of variability in annual returns, with a maximum return of 54% (1932) and a minimum return of -42% (1930). However, that variability reduces as you expand the time horizon. Over 10-year rolling periods, the worst return was -1%, while the average was 10%. Expand the time horizon to 30 years, and the lowest return over any 30-year period over the last 100 years was +8%!

But there’s even better news.

The story holds even after adjusting for inflation

In a prior piece, I discussed how stocks are real assets whose prices rise with inflation. Also, corporate earnings move higher with inflation since companies can pass along rising input costs over time to customers (and don’t we know it, given what happened last year!). As Jeremy Schwartz at WisdomTree points out, this pricing power is evidenced by the fact that long-term earnings and dividend growth has outpaced inflation (even during the 1970s and 1980s when inflation was high).

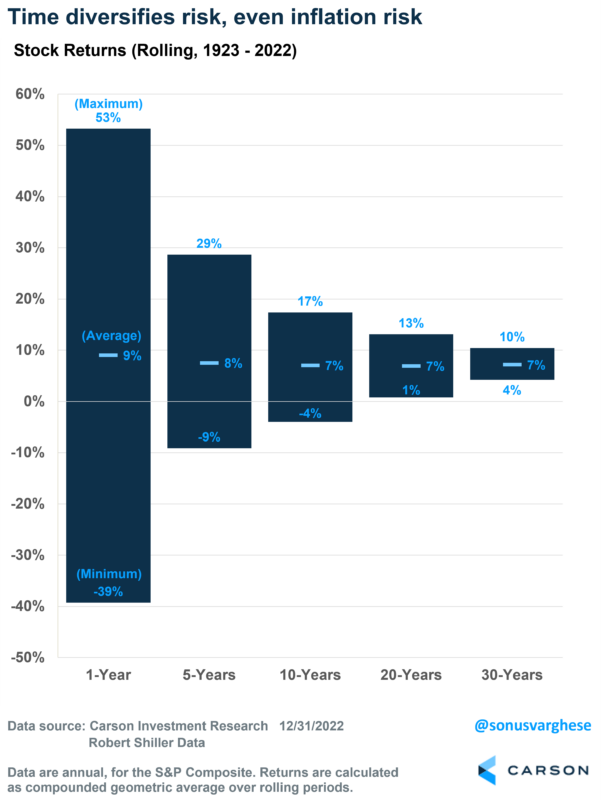

Here’s the thing: over time stocks have a high likelihood of generating positive returns, even after adjusting for inflation. I reproduced the previous chart, but this time the returns are adjusted for inflation, i.e. it shows “real” returns.

As you can see, real returns are highly variable over short time horizons, especially 1- and 5-years. However, when you expand the time horizon to 20- and 30-years, there isn’t a single period over which real returns were negative. Turns out stocks work well for long-term inflation protection.

In case you are curious, here are the stats for the most recent 30-year period, 1993-2022

- Nominal return: 9.7%

- CPI Inflation: 2.5%

- Real return: 7.0%

By the way, this is a period in which we saw 3 massive bear markets, including the Tech bubble crash, the Great Financial Crisis, and Covid.

Ryan and I had Professor Jeremy Siegel on our podcast recently, who literally wrote the book “Stocks for the Long Run”. He first wrote the book in 1994 and showed that real returns on stocks from 1802-1992 was nearly 7%. He just wrapped up the 6th edition of the book (congratulations to our friend, Jeremy Schwartz, for co-authorship on that one). They updated the book with 30 more years of data and incredibly, the last 30 years had more or less the exact same return!

I’ll give him the last word, which is apt:

“It really is quite remarkable and shows the long-term persistence and stability of long-term stock returns!”

Take a listen.