“If everybody is thinking alike, somebody isn’t thinking.” -General George S. Patton

Last week, we discussed how the S&P 500 officially moved into a correction, which is down 10% from the February 19th peak. We noted then that most years (even some of the best years) see volatility and scary headlines, with many of those years seeing a 10% correction at some point in the year.

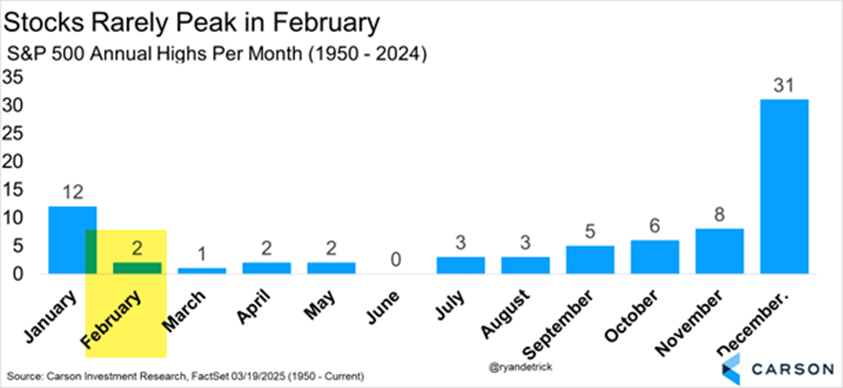

So did stocks officially peak for the year on February 19th? We don’t think so and we still expect stocks to come back to new highs at some point during this year. To back this up, only twice over the past 75 years did stocks peak for the year in February. Yes, most years peak in January or December, but for many reasons we’ve noted lately (and more below), we don’t think this will be the third year stocks peak in February.

Two Reasons to Expect New Highs Later This year

We’ve pointed these two things out recently, but wanted to share them again as they are important.

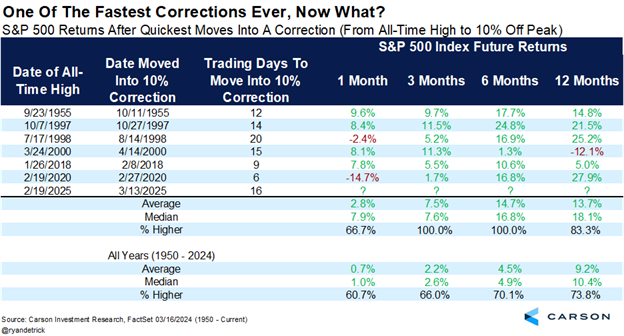

If your head is spinning from being at an all-time high to down more than 10%, then you aren’t alone, as this was one of the quickest trips ever to do just that. In fact, it took only 16 trading days to achieve this dubious feat, but it turns out this isn’t really bad news.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

We found six other corrections off an all-time high that took place in less than one calendar month (or about 21 trading days) and the good news is quick snapbacks are quite common. In fact, the S&P 500 has never been lower three and six months later, with an average return six months later of an extremely impressive 14.7%. Who said roller coasters weren’t fun?

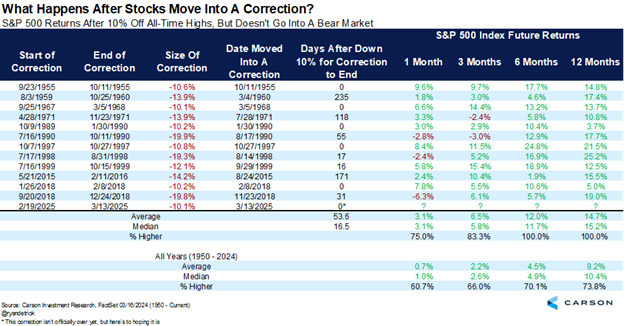

We are on record that we don’t believe this one will turn into a full-fledged bear market, which means stocks won’t be down 20% or more. That right there is a reason not to sell, but assuming that is the case, we found 12 other times stocks moved from an all-time high into a correction, but didn’t fall into a bear market. Looking into this showed stocks were higher six and 12 months later every single time, with much better than average returns as well.

What I found incredible is that five of those 12 times saw stocks bottom the day they moved into a correction (which in the current case would have been Thursday, March 13th). That is way more than I would have ever expected. Will we do it again? After the rare bullish clue we recently saw (more on this below) we think there’s a chance.

Some More Good News

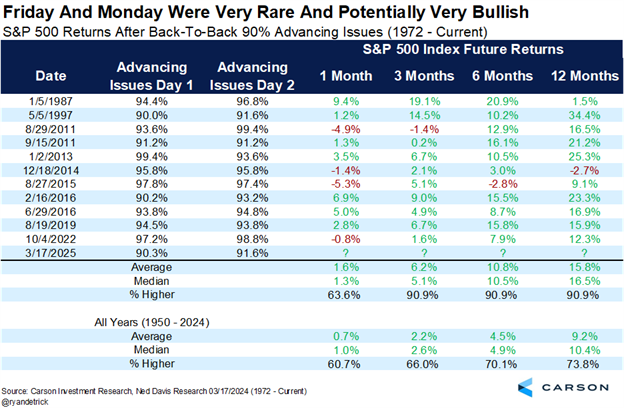

Some more good news and why you shouldn’t sell right now is we saw a potential buying thrust, consistent with higher prices coming. How do weak markets end? I like to say when the selling stops. Kind of obvious, but with all the negativity we’ve seen anyone who wanted to sell likely has done so, leaving only buyers. Well, the buyers showed up Friday, March 14 and Monday, March 17 as both days saw more than 90% of the components of the S&P 500 higher, a very impressive back-to-back feat. This is extremely rare but could be a clue a major low is in place or trying to form.

The last time we saw this was in early October 2022, right as that bear market was ending. You can see on the table below we’ve seen strong returns after previous buying thrusts, with the S&P 500 higher six months later 10 out of 11 times and up nearly 11% on average. This coupled with the data from above suggests the potential for better-than-expected returns over the next six months, which might surprise many investors who are positioned for the worst.

Not All Corrections Become Bear Markets

We found 13 official bear markets (down 20% from recent highs) going back to World War II, with many asking whether this could be number 14. We don’t think so, but a nice way to show this is to highlight that most corrections don’t become bear markets.

We found only 13 of the previous 39 corrections eventually turned into bear markets. Or as we like to say, all bear markets started as a correction, but not all corrections turn into a bear market.

Panic Is in the Air

We’ve noted many times the past few weeks that fear is in the air and from a contrarian point of view this could be very bullish, as nearly anyone who wanted to sell has probably sold by now. One example of this is the American Association of Individual Investors (AAII) Sentiment Survey has had bears above 55% for four weeks in a row, besting the previous record of three weeks in a row that ended the week the Great Financial Crisis ended in March 2009. Yes, investors are potentially more worried now than after a generational crash and recession.

Purely anecdotal, but many investors are scared and want nothing to do with stocks. I know I’ve heard from many friends and family who share this same sentiment, as all they’ve heard in the media is how bad everything is out there.

Shoutout to Ben Carson for this find, but a recent Wall Street Journal article interviewed regular investors and the sentiment was quite negative. Below caught my attention:

For years, Yoram Ariely hadn’t touched most of his investments, preferring to ride the stock market’s ups and downs. Last Tuesday, he decided he had enough.

The 82-year-old unloaded almost half of his stock investments, fearful of the effects of President Trump’s economic agenda, and tariffs in particular. He may get rid of more still

“The decisions are changing daily,” said Ariely, a retired business owner in Longboat Key, Fla.

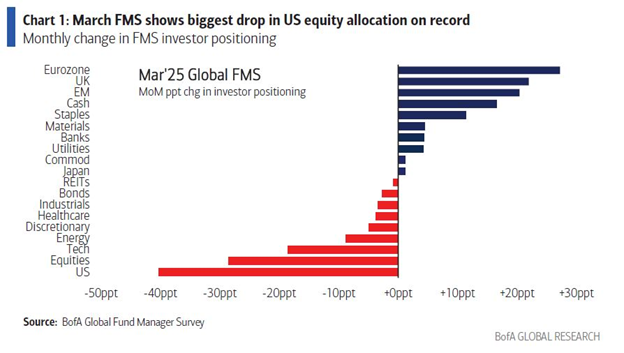

So we have surveys and anecdotal sentiment at extremes, but what about people who manage real money? The recent Bank of America Global Fund Manager Survey showed the largest drop ever in US equity allocations last month. That’s in the chart below, but the recent monthly survey also saw the second largest decrease in global growth expectations ever, the largest increase in allocations to cash since March 2009, and the lowest allocation to US equities since June 2023.

Why a Big Drop This Year Is Still Not Likely

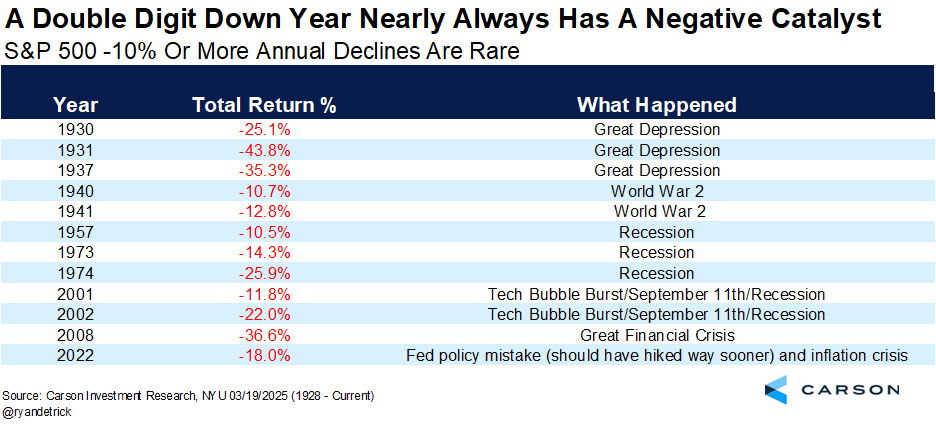

The last thing that’s caught my attention lately is how rare it is to see stocks down 10% for an entire calendar year. Given many investors are expecting a big down year, could it really happen? Going back the past 100 years, stocks were lower by more than 10% for the full year only 12 times (on a total return basis) and as you can see, big drops usually happen for a reason. In other words, something bad has to happen. Could something bad happen this year? Of course, but for now, we still don’t see any compelling reason to expect a major recession or any reason for something very bad to happen.

Thanks for reading and if you are going on Spring Break this year, safe travels and enjoy! For more of our thoughts on much of this and more, be sure to watch our latest Facts vs Feelings podcast below.

For more content by Ryan Detrick, Chief Market Strategist click here.

7774723-0325-A