On today’s episode of Framework, Jamie Hopkins talks with Anthony Stich, COO of Advicent, a Milwaukee-based financial services firm.

Anthony’s journey into financial planning is a bit unusual. Starting out in the graphic design and marketing world, he found himself working for AIG right before the recession in 2008. While there, he saw the instability of the market and ended up moving on before eventually finding his way to Advicent.

Anthony is from a large family, seven sisters and two brothers. He calls his childhood “rich”, but not with money. The financial struggles that his family went through shaped how he viewed money from an early age.

Today, Anthony carries all of this with him as he aims to make the financial services industry a job that doesn’t feel like a job. He’s driven by a mission to enable everyone to understand and impact their financial future.

In today’s episode, we talk about roboadvisor disruption, the role of technology for financial professionals in a COVID-19 and post-COVID-19 world, and the significance of the #MrPurple hashtag. We also talk tacos and the importance of eating fast when you come from a big family!

“Financial advisors have such a noble profession. Their goal is simply to make someone successful financially and to protect them and their family and to make sure that they are making the right decisions. How awesome a job is that and how awesome that I can help provide technology to make their jobs easier and their lives better.” ~ @advicentcoo

Main Takeaways

- The advisor is still, and always will be, at the core of the relationship. The technology just plays a complementary role and helps you be a better advisor.

- Advisors aren’t technologists, but you have to embrace a changing world, otherwise, it will pass you by and you will struggle to keep up. Pick technology you need and really learn to use it in the day-to-day.

- COVID-19 is presenting an inflection point for the industry, forcing people to ask how they can be even more efficient with their technology.

- Roboadvisors have not put the dent in the industry that was predicted. People will always want the physical presence and someone to reach out to regarding their finances. Technology will just make in-person advisors better.

- As technology and companies start to consolidate in the wake of the global pandemic, ask yourself if they are going to continue doing what is best for you. As technologies get acquired, the innovation tends to disappear, so make sure to take a fresh look at what you’re using.

Links and Important Mentions

- Advicent

- Anthony Stich on Twitter

- Joe Duran

- Liz Ann Sonders

- Serrano’s Tacos

- Ironside Fish and Oyster

Get Your Free Blueprinting Guide

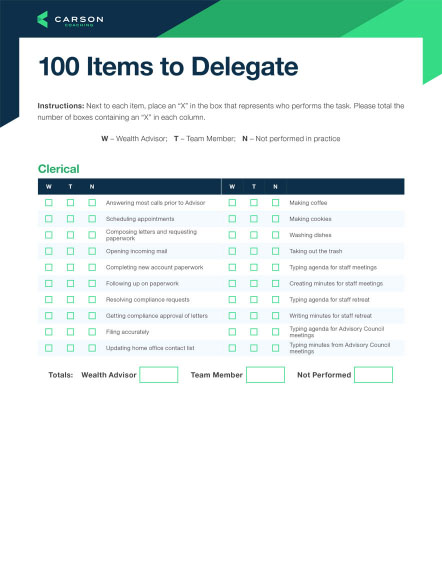

The first step to setting up the framework of your business is to have the right blueprint. But knowing what goes into that blueprint is half of the battle. We put together a free resource that you can use to set your firm down the right path.

Go to CarsonGroupCoaching.com to get your free blueprinting guide.