It seems like there’s always one shoe or another ready to drop on the economy. There were fears over a government shutdown (punted for now) which Ryan wrote about, along with the restart of student loan payments and strikes. Other issues that have investors worried are another bank crisis (like Silicon Valley Bank), or a commercial real estate crash. I don’t want to minimize these issues but often, it’s things that most people are not talking about that could potentially have a greater impact.

One thing that could upset the economic apple cart is an energy price shock. Falling energy prices have been the main force driving inflation from 9.1% in June 2022 to 3.7% as of August, as measured by the Consumer Price Index (CPI). However, oil prices have been rising since July, and a month ago I wrote about an energy price shock being my biggest concern.

The problem with rising energy prices is that they can adversely impact the economy in several different ways. The most immediate impact is via higher pump prices, especially if that forces consumers to cut back elsewhere. Then you have the impact of higher diesel prices on freight and even food prices. Higher jet fuel prices can raise airfares. All of which could lead the Fed to tighten policy a lot more. We saw this happen last year when inflation-adjusted incomes fell while energy prices surged.

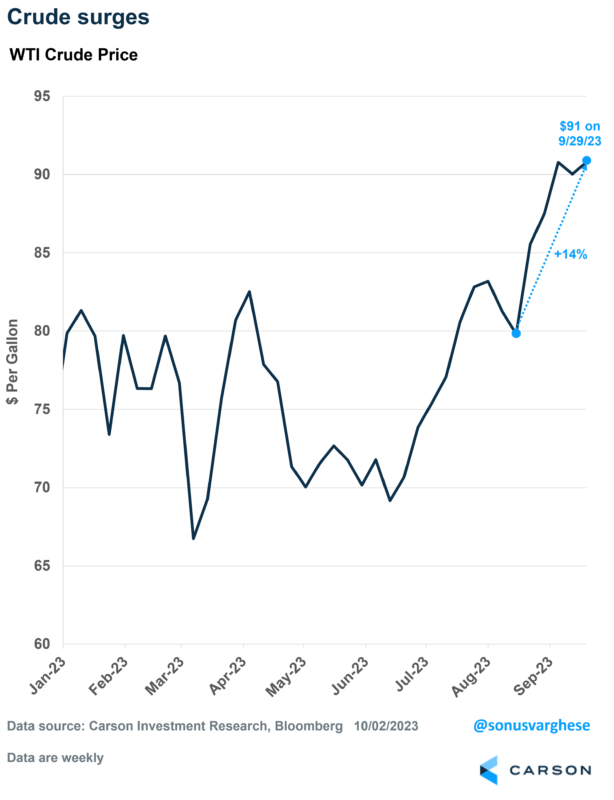

The bad news is that oil prices have surged about 14% since I wrote that piece, taking West Texas Intermediate crude (WTI) to above $90 a barrel. That’s the highest level since last November.

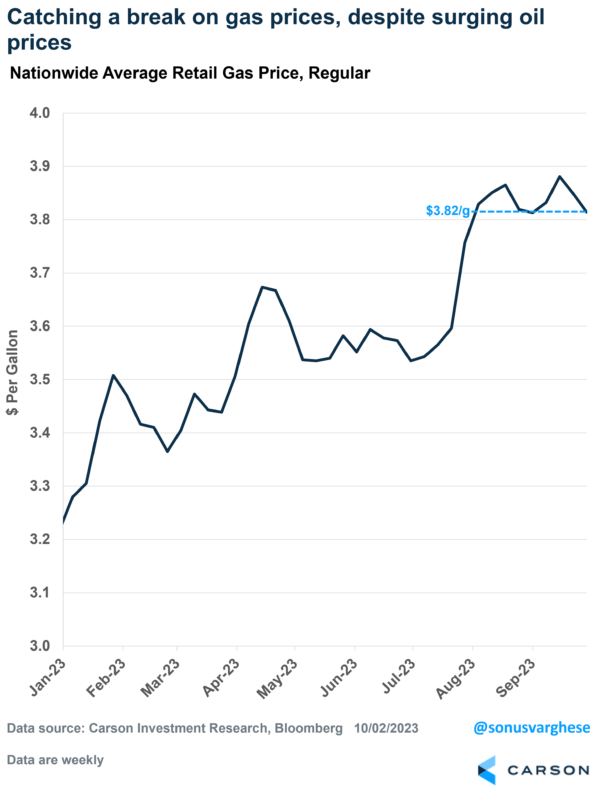

However, we’ve caught a lucky break. Nationwide average gas prices at the pump have more or less remained flat over the last couple of months.

This has surprised a lot of people, but there’s a good reason why gas prices haven’t surged.

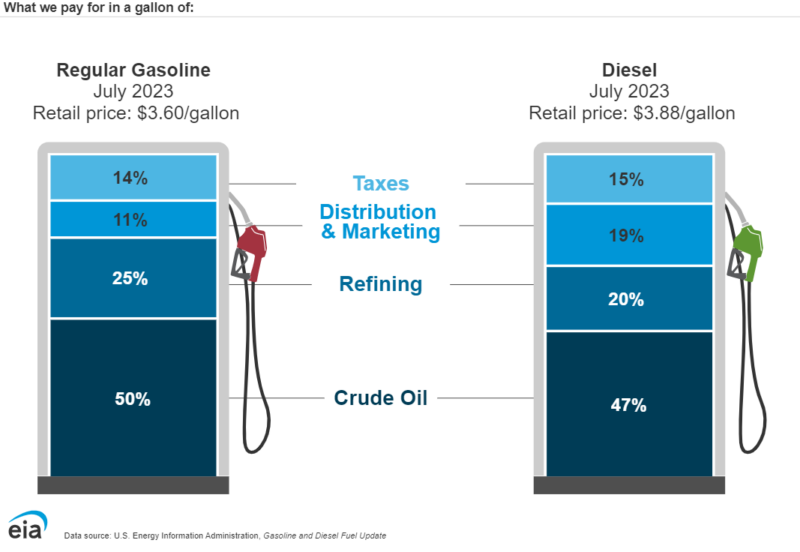

Oil prices are not the only thing that determine gas prices, or even diesel prices. Another major factor (and a volatile one) is refining spreads, which is directly tied to refiners’ margins. Refining or “crack” spreads are the price difference between crude oil and refined product. Here’s a schematic from the Energy Information Administration (EIA) showing what makes up prices at the pump. Oil prices account for just about 50%, while refining spreads make up 20-25% of the rest.

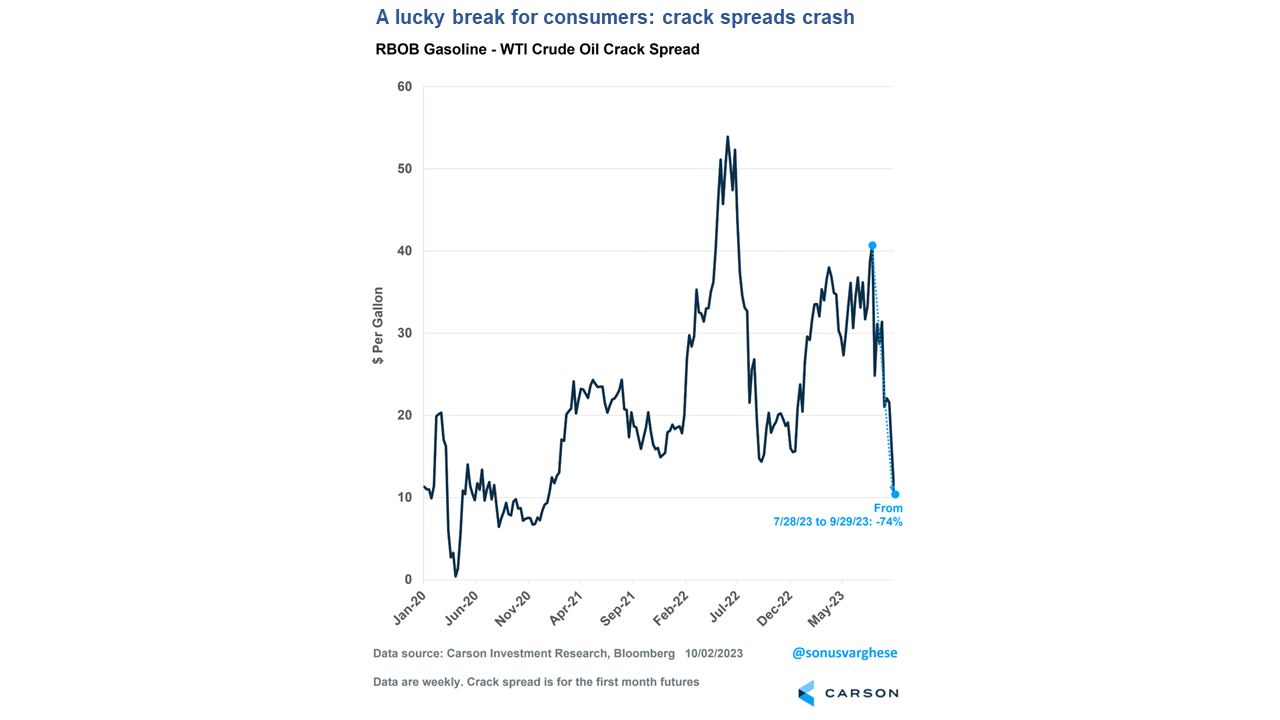

The chart below shows crack spreads for gasoline, and a few things stand out. Spreads spiked last summer, contributing to high inflation. They pulled back soon after that but started to rise again over the first seven months of this year. Which is part of the reason gas prices at the pump also climbed over the same period. However, crack spreads have crashed 74% since the end of July, falling all the way down to pre-pandemic levels. This has offset the recent surge in crude oil prices.

In fact, signs suggest that there may be more relief coming at the pump, with gasoline futures falling 15% over the past month. That’s going to be a tailwind for households.

Of course, gas prices can just as easily go up again, especially if oil prices continue to climb and crack spreads reverse. This is something I’m keeping an eye on because it matters to the economy. For now, we continue to overweight the energy sector in our portfolios, and hold energy commodities as well, which works as a hedge in the event of an energy shock.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more on the economy, and both the short- and long-term outlook, check out the latest Facts vs Feelings episode below. Ryan and I chatted with NDR’s Chief Economist, Alejandra Grindal, who is one of the best in the business at piecing together all the different data out there.

1922013-1023-A