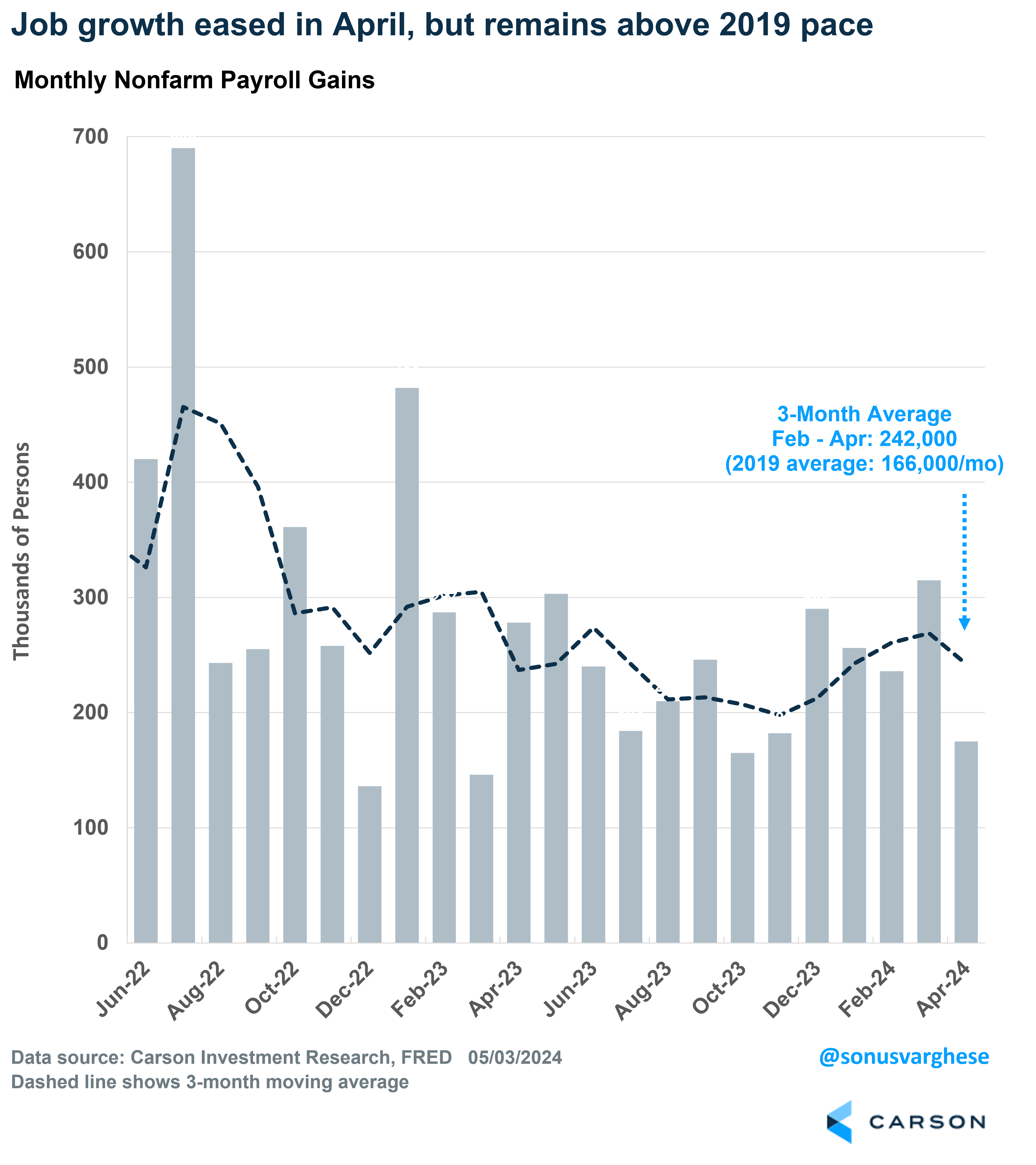

The April employment report was the first one in months that went well against market expectations. Three blockbuster payroll reports in Q1 had conditioned sentiment towards expecting more of the same, but instead we got something less blockbuster(y). Payrolls grew 175,000 in April — below expectations of 240,000 and lower than the red hot Q1 monthly average of 269,000. This does shift the narrative from a “no-landing” scenario to “soft-landing,” i.e. a steady economy with inflation heading lower, which would allow the Federal Reserve to cut interest rates.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

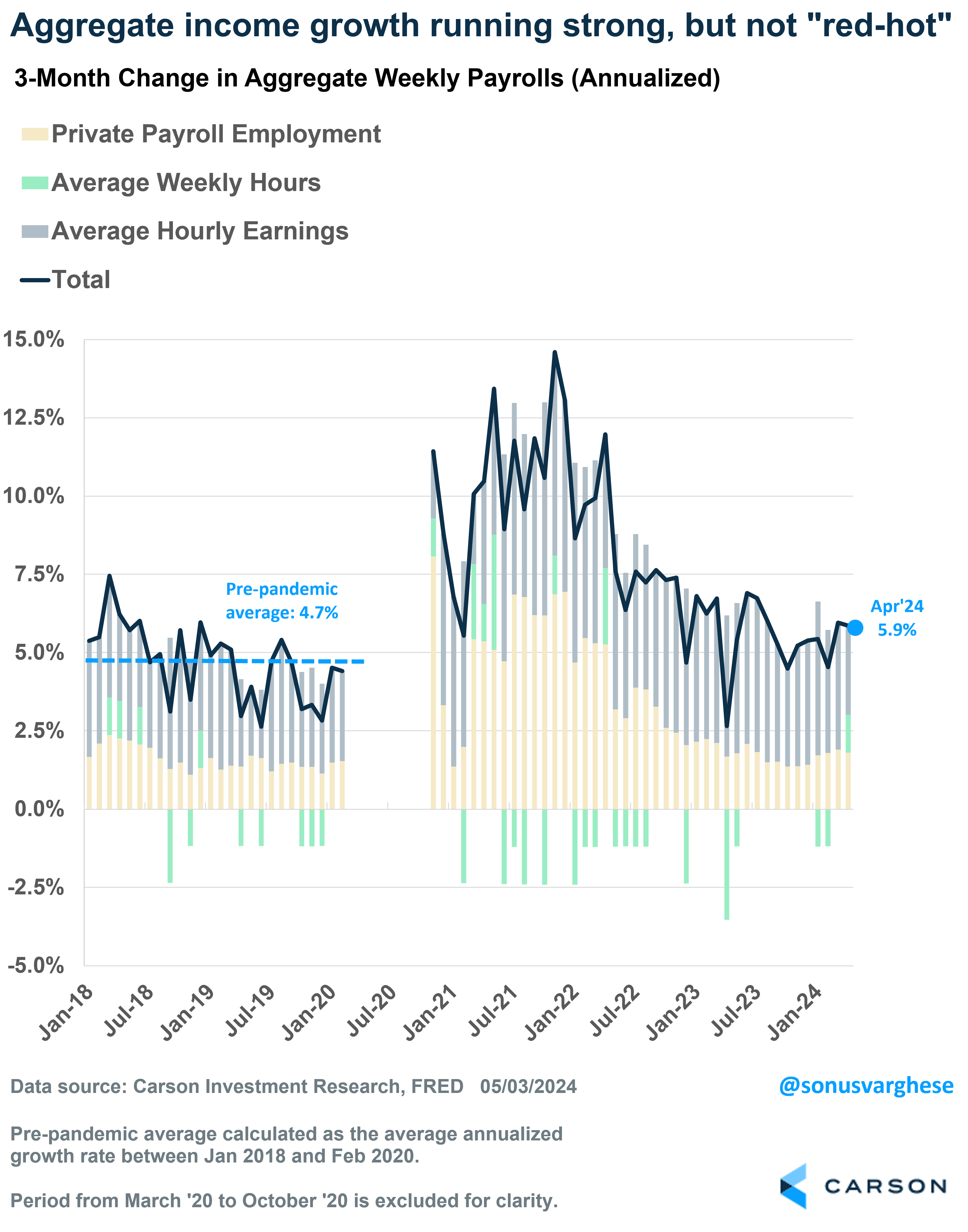

Perhaps the best evidence here is aggregate income growth across all workers in the economy. Ultimately, income growth drives consumption, and aggregate income growth is the sum of employment growth, wage growth, and the change in hours worked. Over the last three months (through April), overall income growth grew at an annualized pace of 5.9%. That’s strong and above the pre-pandemic pace of 4.7%, but it’s far from “red-hot.”

In short, there’s nothing in the employment data that suggests an overheating economy that will keep inflation persistently high and push the Federal Reserve to maintain policy rates as high as they are now (5.25-5.50%). If nothing else, this report makes the prospect of further rate increases even more unlikely, underlying what Fed Chair Jerome Powell said earlier this week. As discussed in my previous blog, Powell stated there’s not much risk of the dreaded “stagflation,” since unemployment is low and inflation has eased a lot.

Make No Mistake, This Economy Is Good for Stocks

Aggregate incomes running close to a 6% annual pace suggests nominal GDP is also running at 5-6%. That’s an environment that’s good for profit growth, which in turn is positive for stocks.

Yes, payrolls did come in well below expectations, but 175,000 is above the 2019 monthly average of 166,000. You always want to be a little careful with monthly job numbers, because they can be revised, but over the last three months payroll growth has averaged 242,000. The corresponding number exactly a year ago was 237,000. In other words, the labor market has remained strong, with not much acceleration or deceleration.

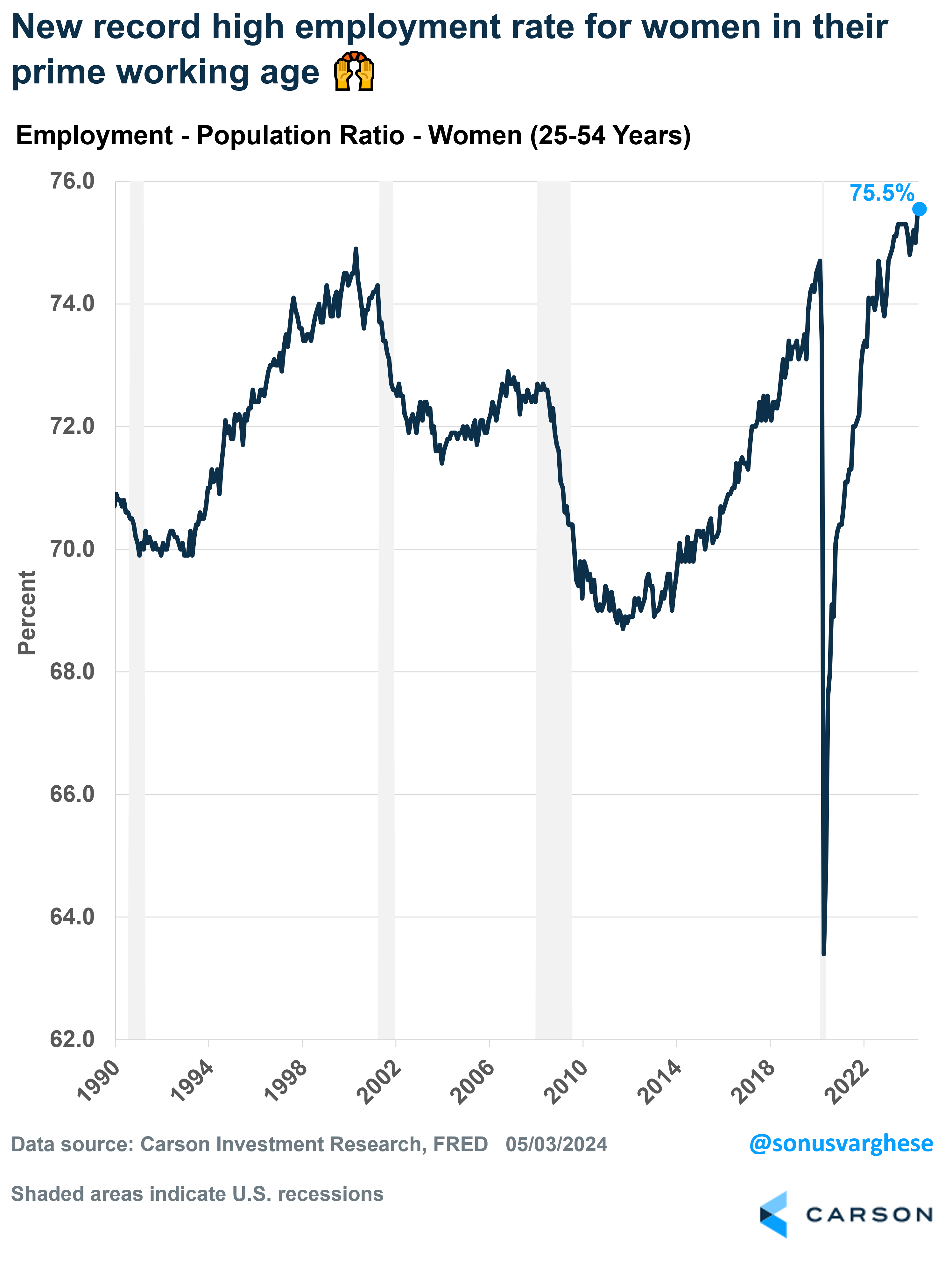

The unemployment rate did tick up from 3.8% to 3.9%, but April is the 27th month in a row in which the unemployment rate has clocked in below 4%. That’s the longest streak since the 1960s. I’ve mentioned in previous blogs how I prefer looking at the “prime-age” (25-54 years) employment-population ratio, since it gets around definitional issues that crop up with the unemployment rate (someone is counted as being “unemployed” only if they’re “actively looking for a job”) or demographics (an aging population with more people retiring and leaving the labor force every day). The prime-age employment population ratio rose in April to 80.8% — that’s only slightly below the high from last summer, and above anything we saw between 2001 and 2019 (when it peaked at 80.4%). In fact, the prime-age employment population ratio for women just hit an all-time record high of 75.5%. This by itself should tell you the labor market is strong, with more people participating in it.

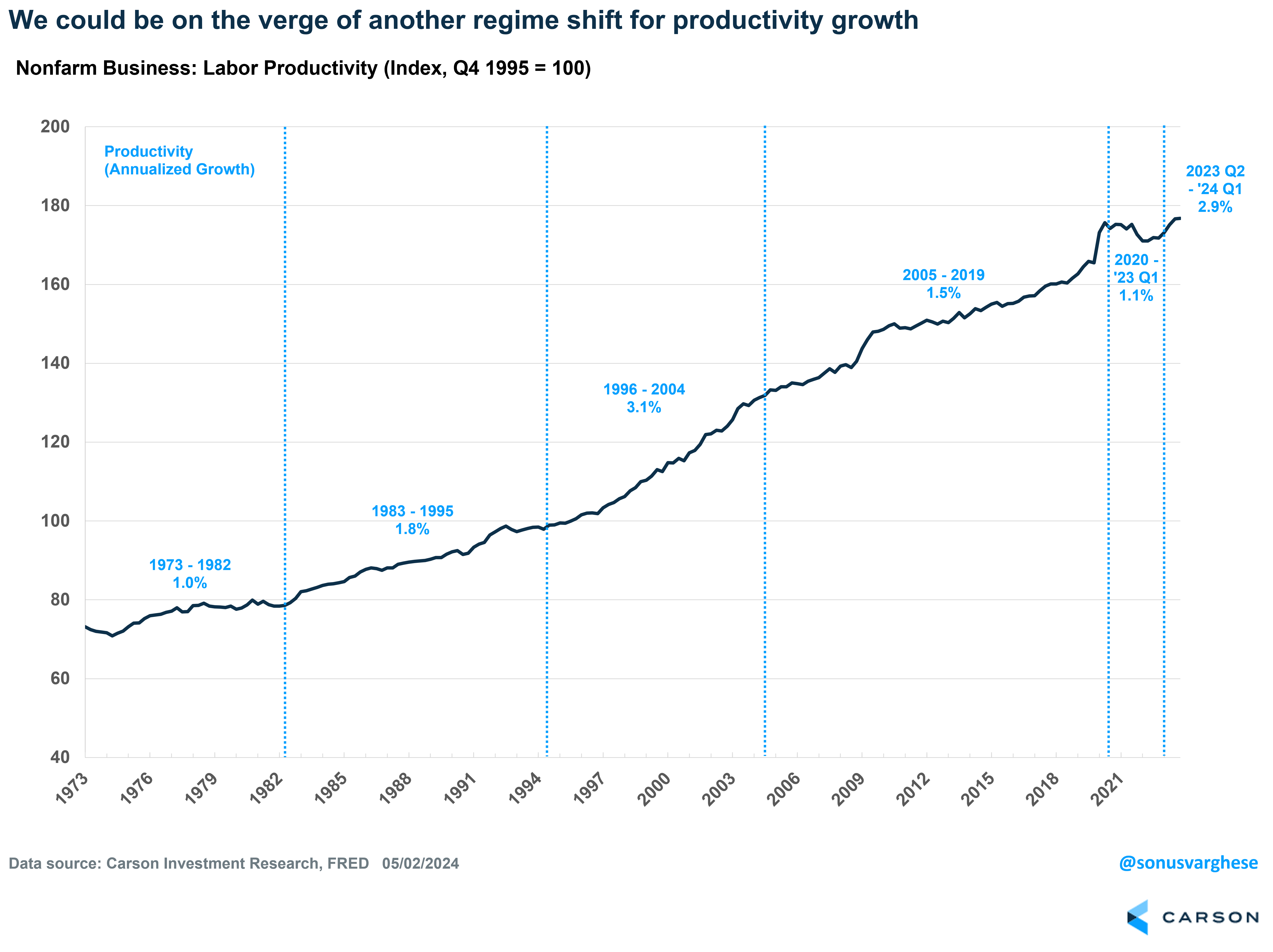

A Strong Labor Market Is Good for Productivity Growth

A theme of our 2024 Outlook was that we may be seeing a resurgence in productivity growth. Over the last year, productivity grew 2.9%. That is well above the 1.1% annualized pace between the first quarter of 2020 and the first quarter of 2023, or the 1.5% annual pace between 2005 and 2019.

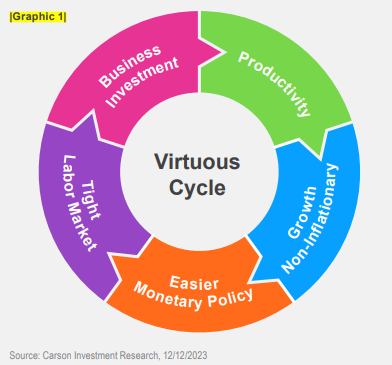

A key piece of this is a strong labor market, which incentivizes businesses to invest more, and that’s what you need for productivity growth. Importantly, with productivity growth, workers can see strong wage growth without necessarily pushing up inflation. Falling inflationary pressures can allow the Fed to ease interest rates. Even if rates are shifted lower by a relatively small degree, that can further boost investment and keep the productivity growth engine running. This is something we saw in the mid-to-late 1990s. A similar situation bodes well for the economy and stocks.

Ryan Detrick, Chief Market Strategist, and I discussed the market expectations for monetary policy and how that impacts stocks and bonds in our latest Facts vs Feelings podcast. Take a listen below.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02227095-0524-A