“Be fearful when others are greedy, and be greedy when others are fearful.” Warren Buffett

Warren Buffett opened his annual letter with a heartfelt tribute to his late friend and investment partner, Charlie Munger. Charlie passed just before his 100th birthday but, as Buffett writes, “should be forever credited with being the architect” of Berkshire Hathaway. Charlie famously advised Warren to buy wonderful businesses at fair prices, rather than fair businesses at wonderful prices. Buffett abandoned everything learned from his hero, Benjamin Graham, and with Charlie at his side, built Berkshire into the behemoth it is today.

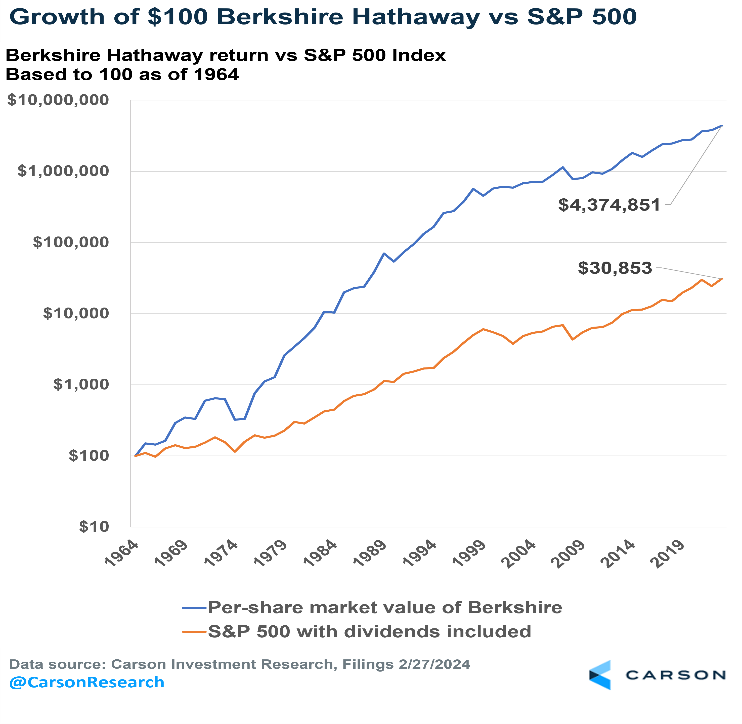

Often hailed as the G.O.A.T. (Greatest of All Time) of investing, Buffett has studied the intricate complexities of investing for more than half a century. Over the past 58 years, Berkshire Hathaway shares compounded at a rate of 19.8%. Consider this: an investment of $100 made in 1965 would now be valued at over $4.3 million, a stunning feat compared to the approximately $31,000 from the S&P 500 over the same period. Given the size of the business, a nearly $900 billion market cap, Buffett remains pragmatic about its future performance, acknowledging there is “no possibility of eye-popping performance” going forward..

Buffett often opines on the virtues of a long-term ownership mentality when it comes to investing, while likening people who buy “hot stocks” to those who purchase “lottery tickets.” It’s interesting, therefore, that shares of Berkshire should reach all-time highs in the midst of an AI-fueled tech rally. The culprit, record earnings driven by its insurance division.

The reason for the swelling insurance profitability, and the rationale behind our House Views overweight on the Financial Sector, is primarily higher yields. Berkshire’s insurance arm holds the premiums paid up front (float) in conservative investments, mostly US T-bills, where yields have risen to roughly 5%. Not only are insurance companies earning more on the float, but the cost to satisfy claims is also declining while premium prices remain strong. In short, there is a trifecta of factors coming together all at the right time, and the trend should continue for a while.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Growth in operating earnings for the insurance division more than offset weakness in Berkshire’s railroad and utilities businesses. BNSF, which operates the largest railroad in North America, saw profits decline by 15% as lower volumes and higher employee wages weighed. The railroad industry is plagued by workforce issues as few people want a job that requires isolation over long hauls. That said, it remains the most cost-effective way to transport heavy materials over long distances and Warren expects it will continue to play a major role in the US economy 100 years from now. He was more downbeat on the utility business, blaming the regulatory environment and the increasing frequency of natural disasters. Berkshire Hathaway Energy (BHE) saw its profits decline by 40%. But the diversified collection of business models in Berkshire overall shined though, with strong segments more than absorbing the weakness in two of its largest divisions.

Berkshire Hathaway has been built to survive, which has proven useful many times over the past 65 years. While it’s true that the company has reached a size that makes eye-popping performance unlikely, it is in times when “others are fearful” that Berkshire shines brightest. With its $163.3 billion and growing cash pile, the company is well positioned for the next opportunity to arise, whenever it may come.

For more of Jake’s thoughts click here.

02138893-0324-A