“There are no gains without pains.” – Benjamin Franklin

Hard to believe it, but one year ago today the vicious bear market ended. I remember it well, as the bear market saw the S&P 500 down 25.5% from the early January lows at the close on October 12, 2022. The very next day we saw the hotter-than-expected CPI print and futures tanked on the news. It felt like all hope was lost. Then a funny thing happened. Stocks soared and closed up 2.60% on that day, more than 5% off their intraday low. That was the ultimate capitulation that was necessary to end the bear market. As Mr. Franklin said above, there were a lot of pains, so some gains were due.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In fact, I joined Yahoo! Finance right after this huge reversal and talked about why October was a bear market killer and we were likely near a major low.

If this sounds somewhat familiar it is because we saw stocks tank last Friday on the hotter-than-expected employment report. That’s right, our economy creating 336,000 jobs was somehow a bad thing. This number was way more than any economist expected and to us, it put an end to the silly talk about an imminent recession. Although futures tanked on Friday, by the end of the day stocks were firmly in the green, which was followed up by more gains on Monday and Tuesday. Could we have just had another major low in October? We think the odds do favor it.

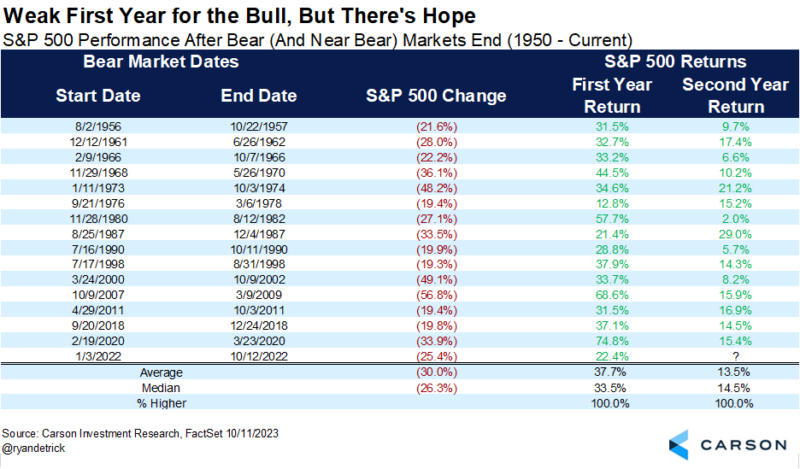

So, let’s talk about bull markets. At the one-year mark this time the S&P 500 is up more than 21%, which would put it at one of the weakest first years of a new bull market ever. In fact, the average first year has seen stocks gain nearly 39%. What is going on this time? For starters, as we’ve said repeatedly, we don’t see a recession on the horizon, as the economy is on much better footing than most economists claim. If we can avoid a recession next year (no small feat for an election year), then there’s a good chance for more solid gains in 2024. In fact, this was the worst first year to start a bull market since after the 1987 bear market, gaining ”only” 21.4% that first year. The good news? The second year of that bull market was the strongest on record, up 29.0%. Could we see another outsized gain after modest gains this first year? We wouldn’t want to bet against it.

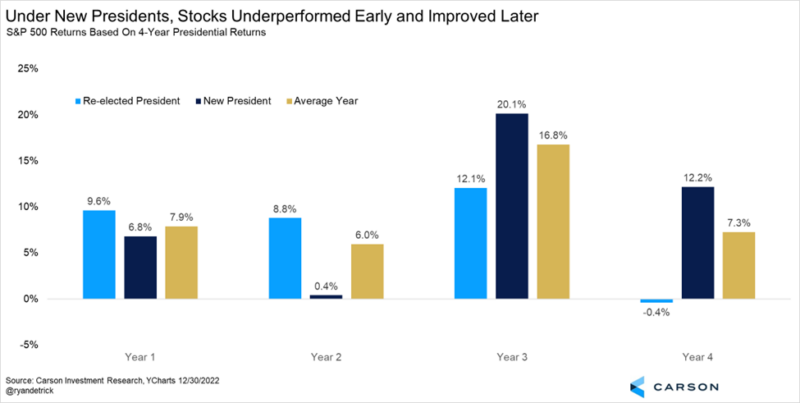

One more interesting note about next year—it’s the fourth year of the Presidential cycle, otherwise known as an election year. Historically, stocks gain 7.3% during election years, better than only the mid-term year in the four-year cycle, which averages 6.0%. (The first year of a Presidential term tends to be the best for stocks.) But what you need to know about an election year is the returns are much better when there’s a first-term President in office, up 12.2% on average and higher 10 out of 10 times since 1950. In fact, returns are actually slightly negative under a second term President in an election year, thanks to the 10.1% drop the lame duck year of President Clinton (2000) and the 38.5% drop the lame duck year of President George W. Bush (2008).

Buckle up, as we head into the election year there could be many new worries and concerns, but we remain optimistic that this bull market has plenty of life left supported by an economy showing no real signs of breaking down.

We welcome you to listen to our latest Facts vs Feelings podcast, as Sonu and I were honored to be joined by Cliff Asness, Founder of AQR Capital Management. This was a true honor, as Cliff is a legend in our industry. Enjoy!

1933872-1023-A