“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” -Mark Twain

September to Remember

Stocks had a rough start to September, but the bull market continued and it is looking like the S&P 500 will be higher this year in the usually weak month of September. (The S&P 500 was up 1.7% on a total return basis as of Friday, September 27, with one trading day left in the month.) Assuming September holds up, stocks would be up eight of the first nine months of the year (with only the usually bullish month of April in the red) and up 10 of 11 months going back to last November.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

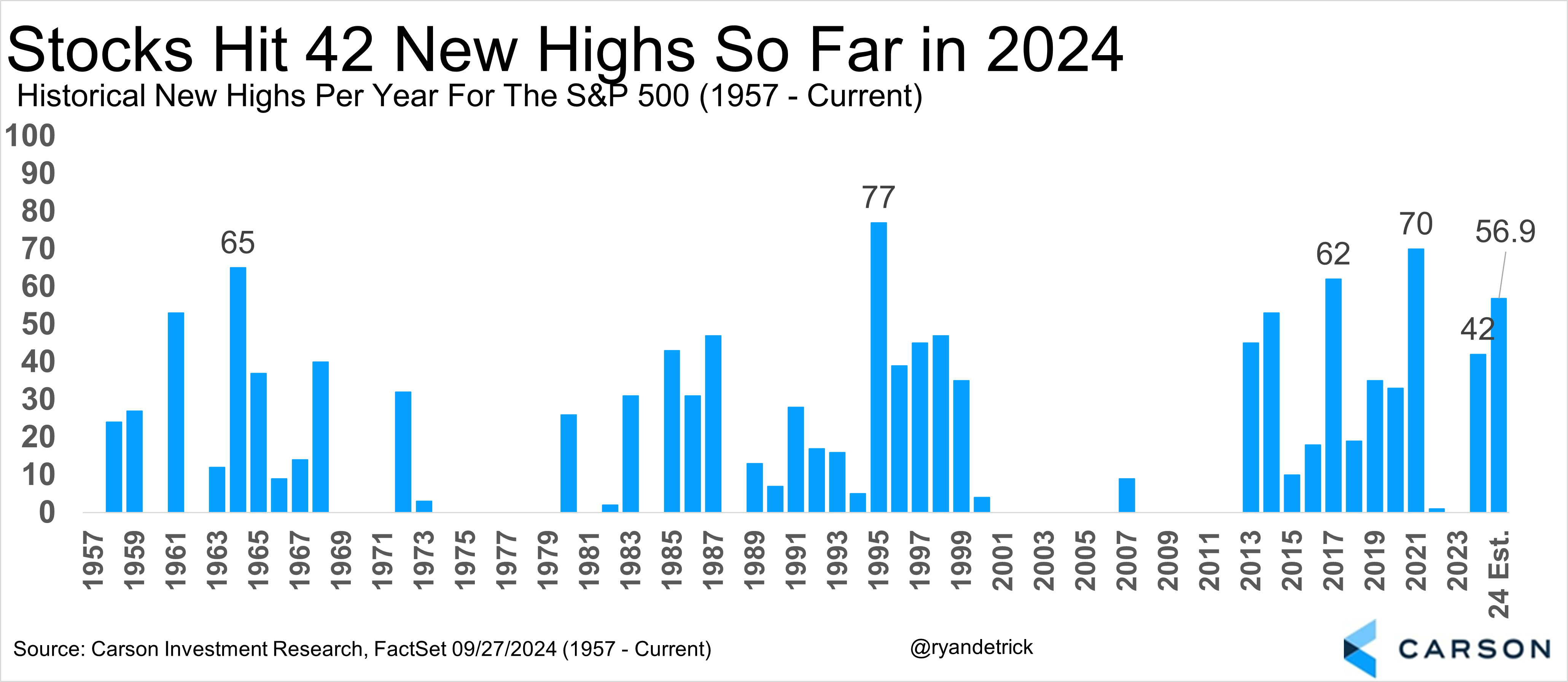

The S&P 500 has made 1,415 new all-time highs and no month has made less than September, making the new highs we’ve seen in 2024 all the more special.

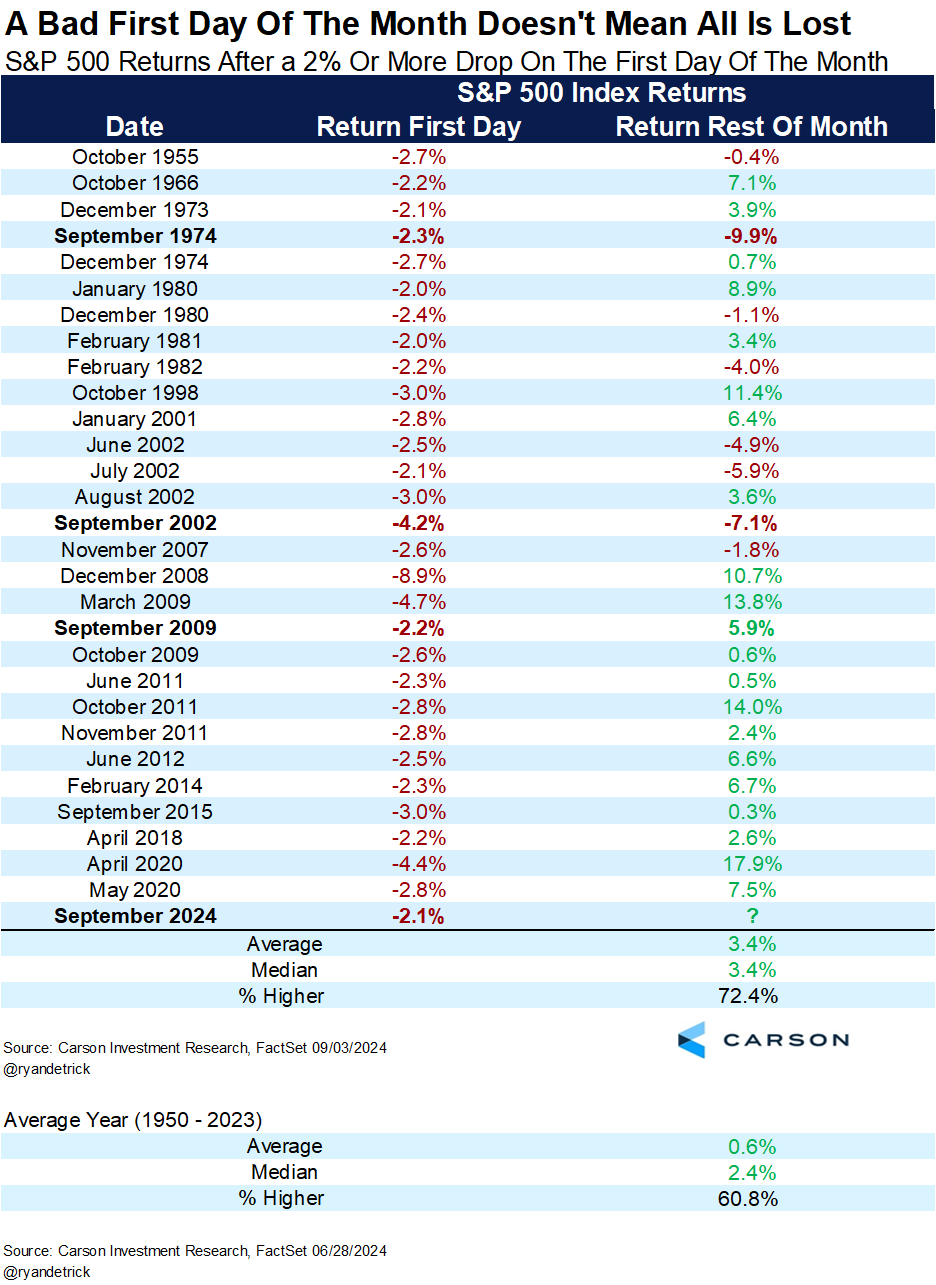

Were new highs this month really a surprise? Maybe it shouldn’t have been as past months that started off with a big down day more often than not tended to have strong rallies.

The reason for the rally? The economy continues to surprise to the upside, with forward earnings hitting another new high. The Federal Reserve Bank (Fed) cutting rates is also a tailwind. But let’s not lose sight of the big picture. With earnings hitting new highs and the economy continuing to expand, it’s no wonder stocks have hit 42 new all-time highs in 2024.

Where do those 42 new all-time highs rank? As you can see here this is one of the most ever and it extrapolates out to nearly 57, which would put 2024 in the top five for the most new highs ever.

An October Surprise?

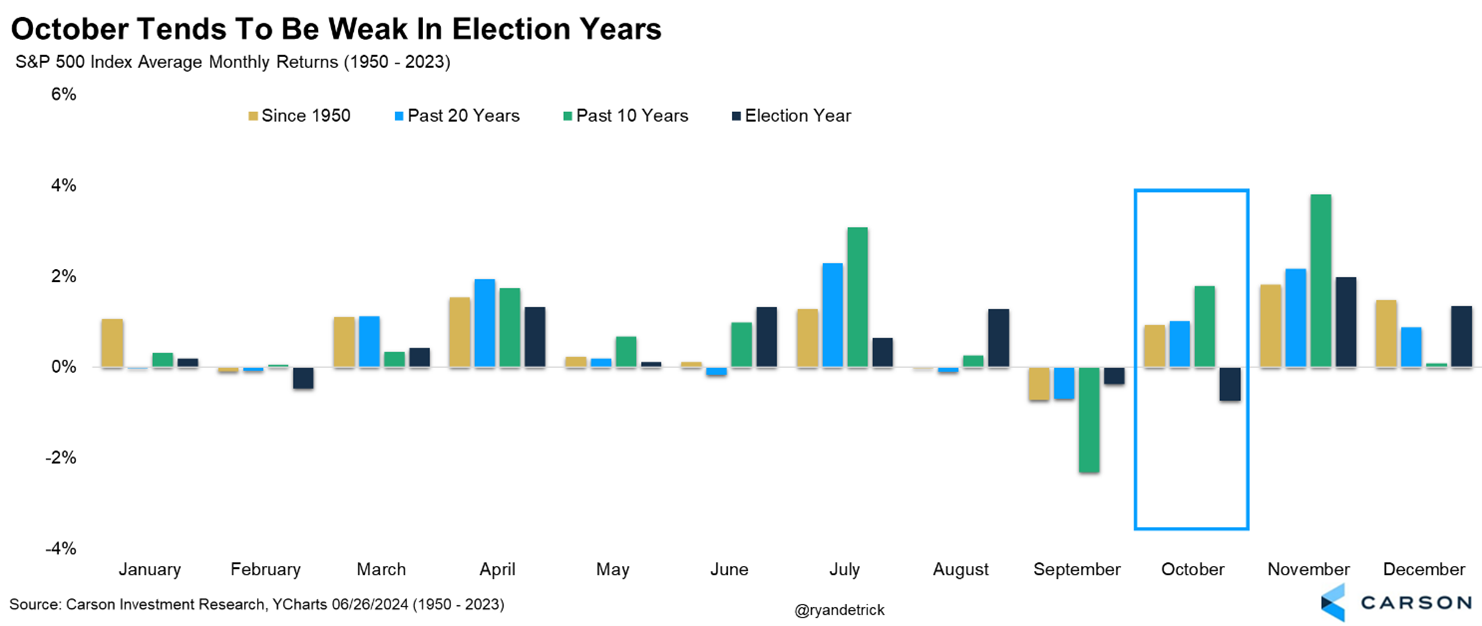

You may be hearing a lot about how October is a month known for high market volatility and large drawdowns. This is true, as 1929, 1987, and 2008 all saw spectacular meltdowns in this spooky month historically. But it is worth noting that overall October is really about an average month, up 0.9% on average, making it the 7th best month of the year. The past 10 years it has gained a very respectable 1.8%, making it the third best month of the year. It was down last year, but hasn’t declined two years in a row for 15 years. October is the worst month during an election year and after the incredible run stocks have seen so far this year, we wouldn’t be surprised at all if we saw some usual October volatility in 2024.

One potential worry for October is stocks have done so well in 2024. With one day to go in September, the S&P 500 was up more than 20% for the year and October has done quite poorly in years that were up nicely heading into the spooky month. In fact, seven of the nine times the S&P 500 was up more than 20% YTD heading into October saw stocks fall the 10th month of the year with an average decline of 3.0%.

That’s the bad news. The good news is things are skewed greatly by 1987 and more often than not the fourth quarter still manages to finish higher, with solid gains the remainder of the final quarter of the year.

The Fourth Quarter Is Here

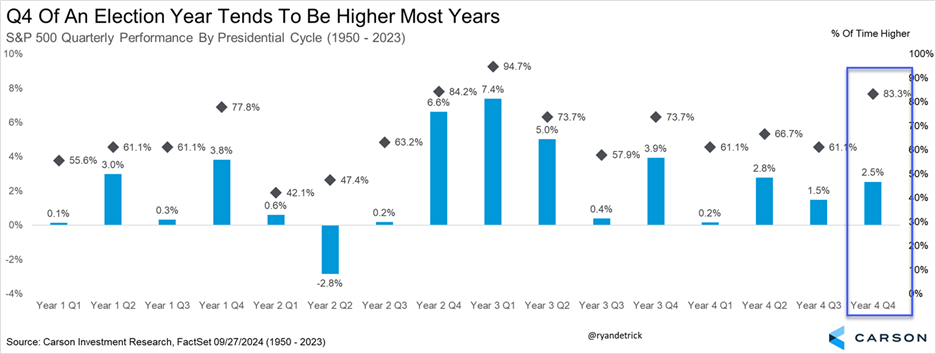

Let’s say we have some usual October volatility, which wouldn’t be abnormal. Planning for this now would be a wise decision. The good news is November and December historically do quite well in election years, as the uncertainty of the election is removed. Take another look at the chart above to see what we mean.

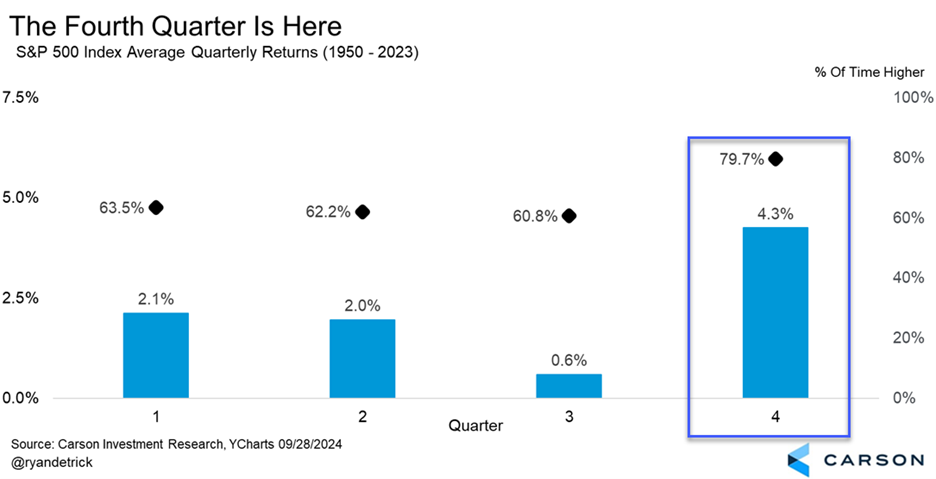

Looking past possible October volatility, the fourth quarter overall is higher nearly 80% of the time and up 4.3% on average, making it far and away the best quarter of the year.

Breaking things down by the four-year Presidential cycle shows this quarter is up more than 83% of the time, making it one of the most likely quarters out of all 16 to be higher. Of course, a 22% drop in the fourth quarter of 2008 pulled back the average return by a good deal, but to say stocks will be lower three months from now is probably a low probability event.

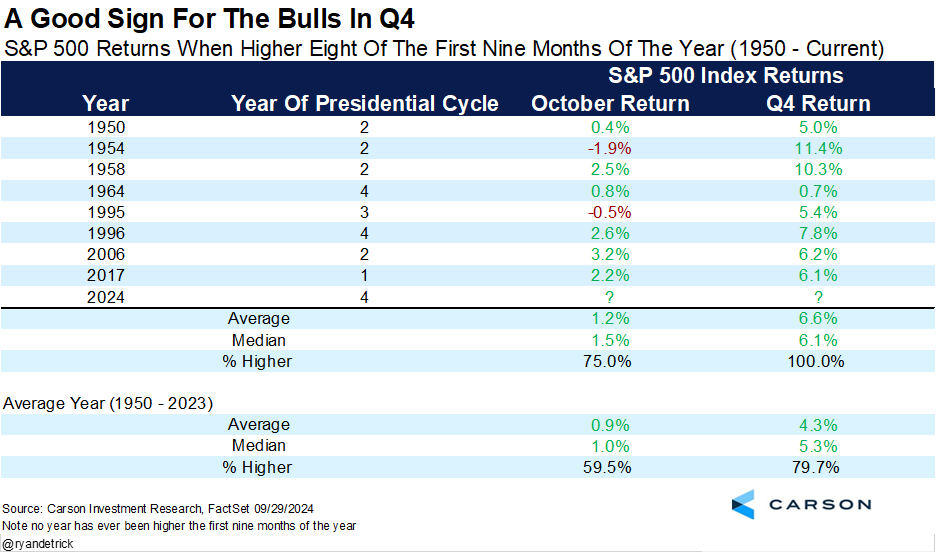

No year has ever seen the S&P 500 higher the first nine months of the year, but we found eight times that eight of the first nine months were higher. And wouldn’t you know it, the future returns were even better than average. October alone was better than average, and the fourth quarter overall has never been lower and is up a very impressive 6.6% on average.

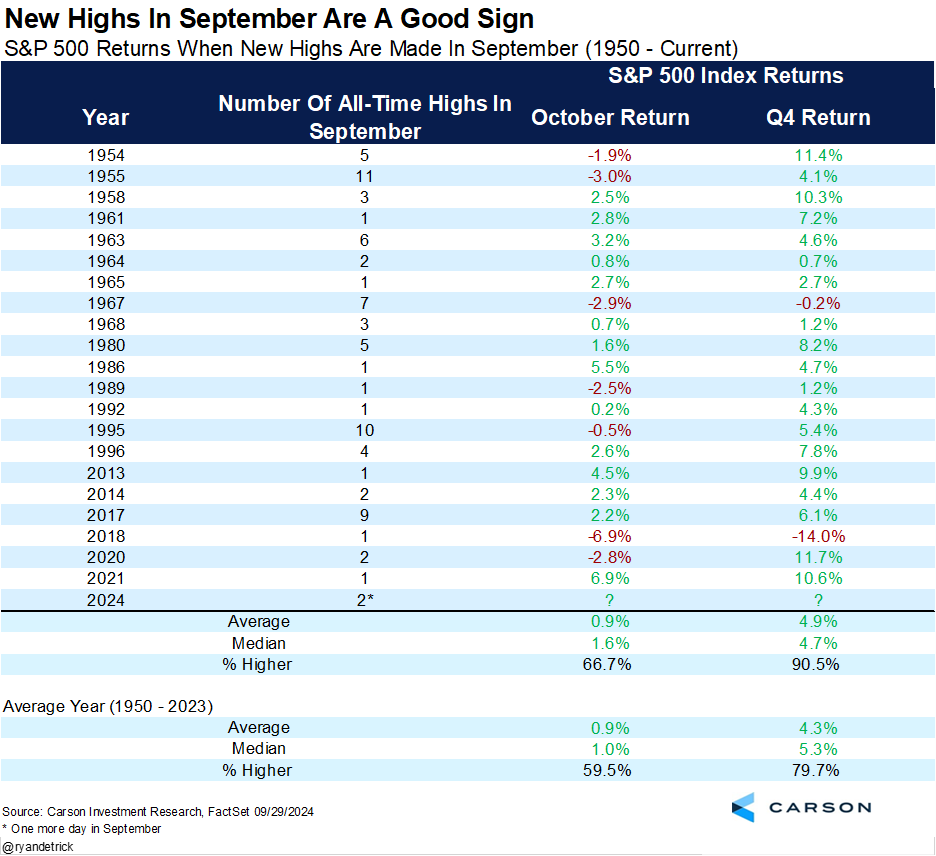

Lastly, stocks made a new high in September, which could be a signal all by itself the bulls will do well the rest of 2024. We found 21 other times stocks hit a new high this month and the fourth-quarter was higher 19 times and up nearly 5% on average.

The bottom line is this is the best start to any year as of the end of September since 1997. Investors have been rewarded by sticking with a glass half full mentality amid the incessant negativity. Could we see a negative October surprise? Absolutely, but we would use that as an opportunity to benefit from potentially higher prices before 2024 is done.

In our latest Take Five video, Sonu Varghese, VP Global Macro Strategist, and I discussed a potential October surprise.

For more content by Ryan Detrick, Chief Market Strategist click here.

02434728-0924-A