“We have two kinds of forecasters, the ones who don’t know and the ones who don’t know they don’t know” – John Kenneth Galbraith

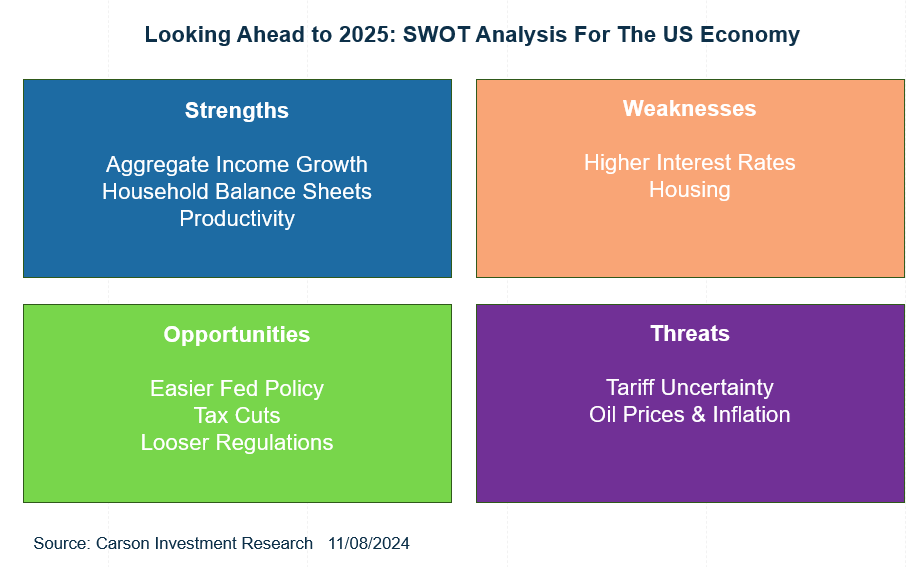

In Part 1 of this blog, I discussed a framework for thinking about the economic outlook in 2025. There’s clearly a lot of policy uncertainty ahead. As the incoming Trump administration and Congress fully work out the details. It’s going to take time for it all to play out, and it would be foolhardy to predict what’s coming down the pike, let alone predict the precise impact. That said, even before we start thinking of what may be coming ahead, it’s useful to take stock of where we are right now. I used a SWOT analysis (strengths, weaknesses, opportunities, and threats) to assess the economy as it stands today (strengths and weaknesses) and external factors that could impact it going forward (opportunities and threats). This allows us to think about the odds of each of these factors, and position portfolios accordingly.

To recap Part 1: The economy is on solid footing right now — thanks to strong income growth, solid household balance sheets, and productivity growth. That does not mean there are no potential risks. Elevated interest rates, even in the face of Federal Reserve cuts, are a big risk to the economy. Higher rates are a function of stronger growth expectations, but it’s hurting sectors like housing, manufacturing, and investment spending. Loan demand is also weak due to elevated rates.

In terms of external forces, we have potential monetary and fiscal policy opportunities that could provide a steady tailwind for markets and the economy. At the same time, threats that could upend the outlook include tariffs and resurgent inflation. Let’s walk through all of these.

Opportunities – Don’t Fight the Fed, or Congress

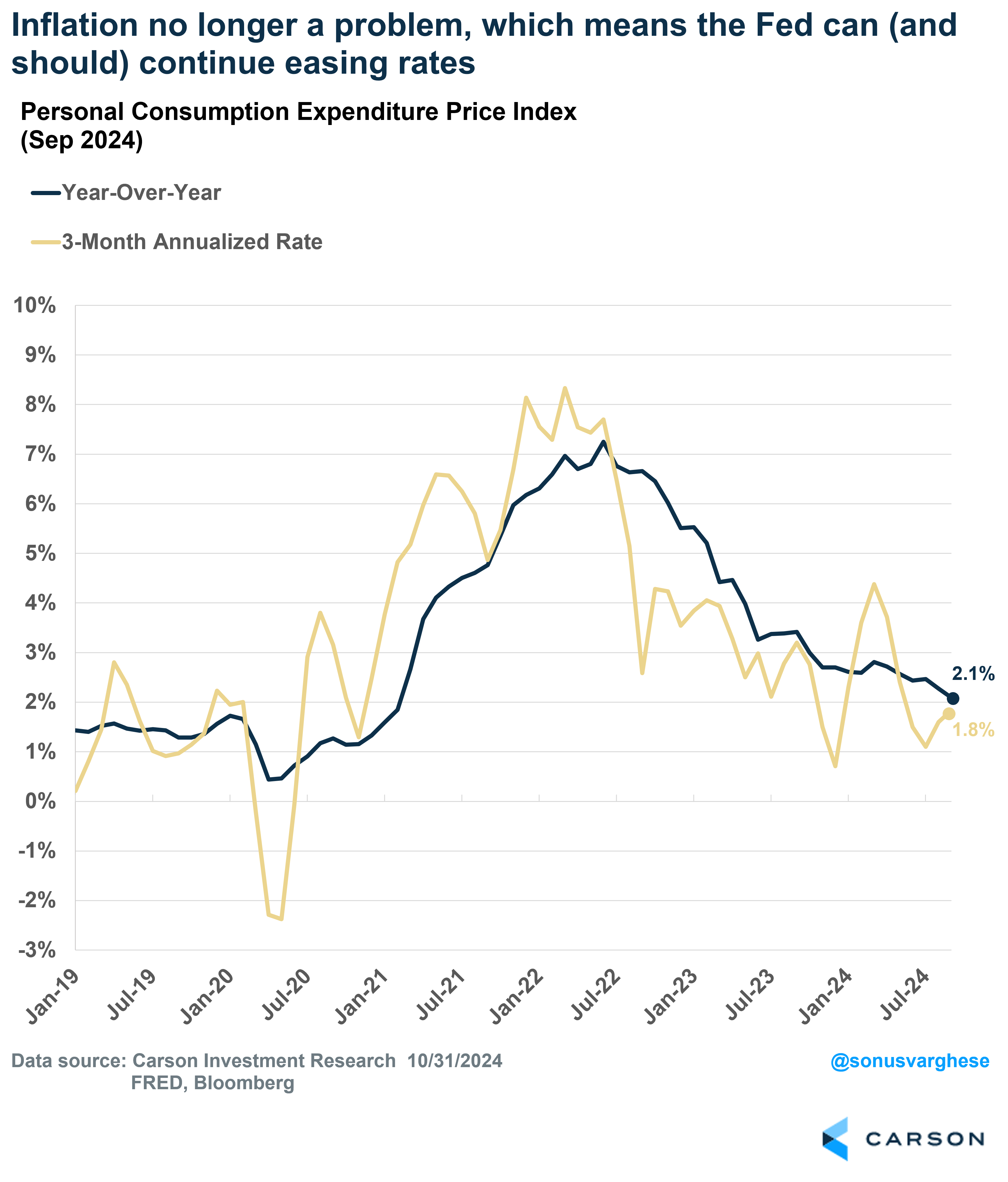

There’re questions about whether the Fed should even be easing rates when GDP growth is running at 2.5–3.0%. However, as I wrote in the previous blog, the Fed does not have a GDP target. They have an inflation target and a maximum employment mandate. The inflation outlook looks good going into 2025. Headline inflation, as measured by the Fed’s preferred personal consumption expenditure (PCE) metric, is running at a 2.1% year over year (the lowest since February 2021), and is up just 1.8% annualized over the past three months.

The Fed does focus on core inflation (excluding food and energy), but it’s good to recall they actually target headline inflation. To that end, oil prices remaining around $70/barrel (WTI) is a big positive — it’s hard to worry about inflation when energy prices are muted. It matters even for core inflation, since energy feeds into items like restaurant prices and airfares. On the core inflation front, most of the excess inflation (above the Fed’s 2% target) is coming from lagging shelter data. The good news is there’s likely more shelter disinflation coming through in 2025. The relatively benign inflation picture will allow the Fed to focus on the employment side of their mandate. Even after their November meeting, Powell noted that the labor market is solid, but they don’t want it to cool further. In other words, they’re putting a cap on the unemployment rate (or a floor under the economy), to the degree that it’s under their control. This implies policy is likely biased towards the dovish side in 2025, and that’s a big positive. Markets are currently pricing in another 0.75%-points of cuts through 2025.

Fiscal policy could provide another tailwind in 2025. The 2017 Tax Cut and Jobs Act (TCJA) had several provisions that “sunset” at the end of 2025, mostly on the individual side but also a few on the business side. But the odds of the economy going over a fiscal cliff from automatic tax increases on January 1, 2026, has been reduced close to zero amid Republicans capturing all three branches of government. There’s a good chance that most, if not all, of the expiring provisions will be renewed, and then some. The corporate tax rate, which was permanently reduced from 35% to 21% in 2017, may be further reduced to 15%, which would boost S&P 500 earnings per share (EPS) by about 4%.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Now, there is caution warranted given the slim 4- to 5-seat majority Republicans will have in the House, the narrowest Republican majority ever. Even in 2017, writing a tax bill took the better part of a year despite Republicans commanding a 20-25 seat majority in the House. The narrow house majority this time around, combined with a 53-47 majority in the Senate, means that serious spending cuts are not going to be on the table (as in 2017). Keep in mind that if defense, Medicare, and Social Security are off the table, it’s going to be hard to find serious savings. The path of least resistance will likely be more deficit spending. The only question is, How much? Republicans in Congress will actually have to settle on a deficit number before proceeding to write the tax bills. Note that permanent renewal of all expiring provisions of TCJA could cost up to $4 trillion. There are also some big differences between now and 2017: deficits are already high and the government’s interest costs are much higher too (thanks to higher rates).

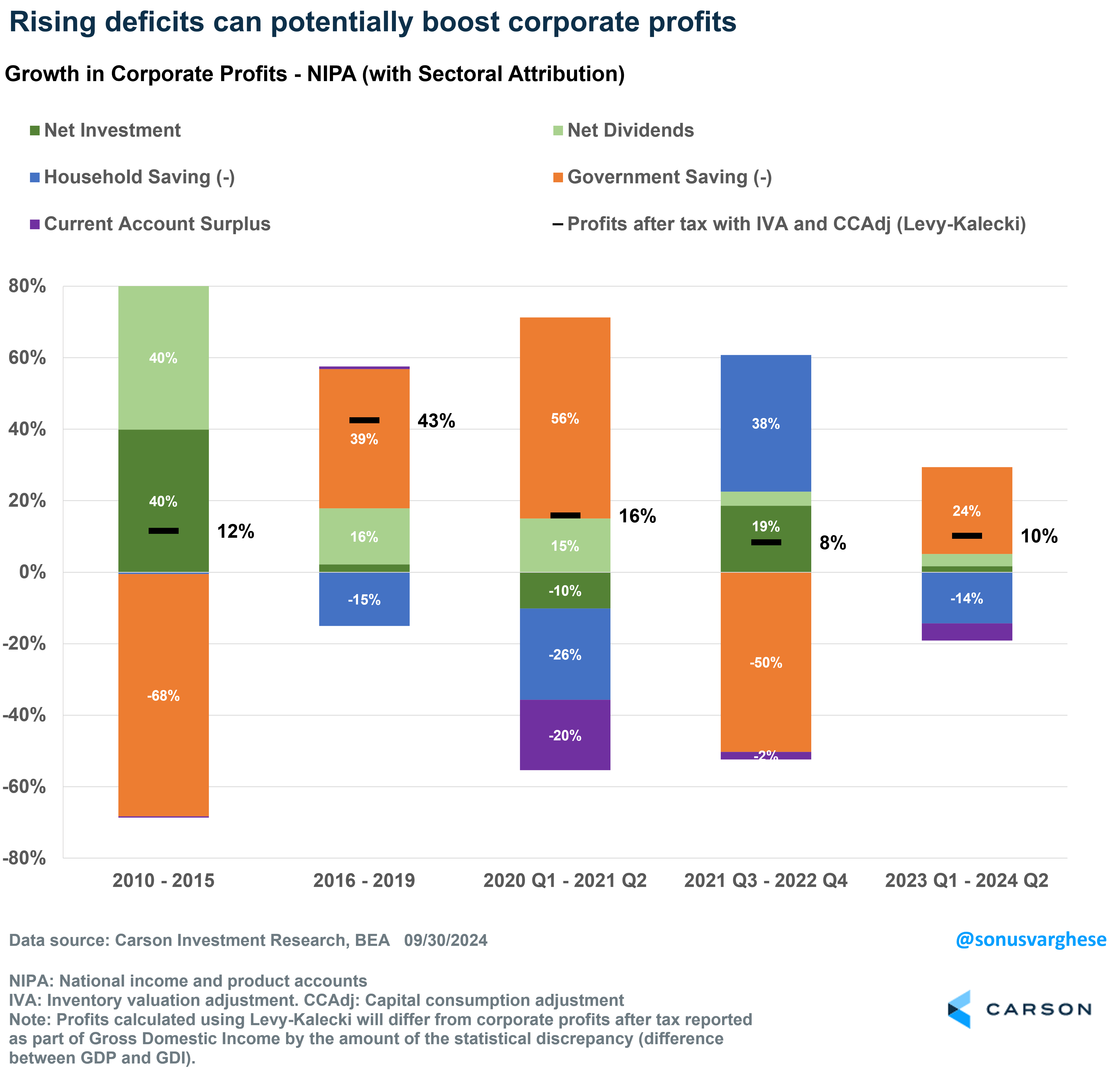

From a market perspective, deficits are not a bad thing as it can potentially boost corporate profits, assuming it doesn’t crowd out consumer spending or private sector investment. And profits are what matter for stocks. At the national aggregate level, corporate profits are the result of net saving versus consumption (the opposite of savings) by the four major sectors of the economy: households, businesses, government, and the rest of the world (via trade). Rising household savings and rising government savings (budget surpluses) drag from profits, and vice versa. More business investment and dividends paid out add to profits. A rising current account surplus means the rest of the world is buying more US-made goods and services than Americans buy from foreigners, and that increases business revenues and profits, whereas an expanding current account deficit (which is typically what the US has) means Americans buy relatively more from abroad, and that’s a drag on profits. Note that this aggregate picture doesn’t tell us which companies are growing profits, or how it’s distributed across industries.

Profit growth surged over the 2016-2019 period on the back of higher fiscal deficits (from TCJA). Even over the last six quarters, households have started saving more (relatively) but corporate profits rose because fiscal deficits started growing again.

Another potential positive is deregulation, though it’s always hard to pinpoint precisely how this impacts markets. An easier stance from agencies like the SEC, FTC, CFTC, and even Department of Justice, could lead to a rise in “animal spirits,” likely manifesting in things like increased M&A activity and IPOs (which have fallen a lot over the last two years, partly due to higher rates depressing valuations). Deregulation could see more supply-side activity, including in areas like energy production. That will also be positive for the inflation outlook.

Tariffs and Potential Inflation Resurgence Pose a Threat

The threat of tariffs, and a retaliatory trade war, is clearly on everyone’s mind. All else equal, tariffs will raise the price of imported goods (though it’s a one-time price level increase). But things don’t work as neatly as that. For one thing, it’s hard to predict what tariffs will actually be implemented, let alone their impact. The Biden administration kept in place most of Trump’s tariffs from his first go-around, and even implemented a few more. President-elect Trump has discussed implementing 60% tariffs on Chinese goods and up to 20% tariffs on other imports. It’s highly unlikely we see anything close to this. For one thing, the market reaction would be extremely negative, perhaps prompting a tempering of any extreme proposals. More targeted tariffs are the likely reality.

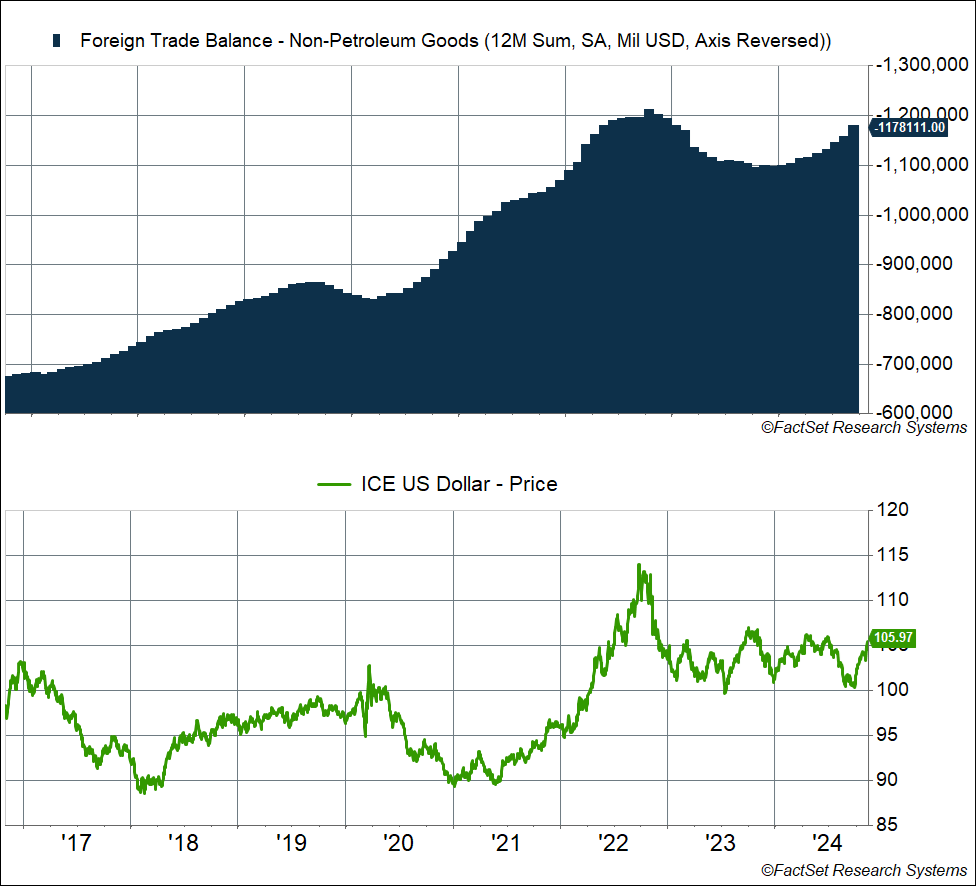

Also, bilateral tariffs may simply shift trade to other countries. The share of U.S. imports coming from China is now just 14%, versus 22% in 2018. Yet, the share of imports from countries like Mexico, Canada, and Vietnam has risen. In fact, the overall non-petroleum goods deficit rose by 14% between 2018 and 2019, thanks to surging goods imports. Another factor here is the dollar. The dollar appreciated soon after Trump’s 2016 election, but then pulled back in 2017 as the focus shifted from tariffs to tax cuts. But it resumed its increase in 2018-2019, making imports cheaper even as the trade war was raging. The dollar has appreciated by about 5% since September 2024, thanks to expectations of stronger economic growth (and higher rates) in the US relative to other countries. But part of this dollar surge occurred post-election. A stronger dollar could offset some of the price increases associated with tariffs.

All in all, we’re skeptical about an inflation surge in 2025 on the back of tariffs. As I noted above, there are disinflationary trends in the pipeline that will likely keep a lid on inflation in 2025 (including shelter). If anything, a potentially higher probability inflation threat remains an unexpected energy price shock (like in 2022) arising from major disruptions in the Middle East. Still, the absolute odds of this are relatively low. Strong oil production increases in the US and Canada will help mitigate this (keeping supply strong), along with continued weakness in China (keeping a lid on demand).

Overall, economic strengths clearly outweigh areas of weakness, and the opportunities likely have a higher probability of coming to fruition than the threats. The balance favors continued strength for equities, which is why we’re maintaining our overweight to stocks, especially US stocks. Equities do have strong momentum going into 2025, but it may not be smooth sailing while Congress and the new administration fully work out policy changes. Combine this with potential risks on the horizon, and we see good reason to maintain a robust array of diversifiers in our portfolios, including bonds, gold, and managed futures.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02506938-1124-A